Suzee Quanta

News: Top Atlanta Realtor Debra Johnston Offers a Rare Luxury New York Style 18,537 square-foot Estate

Mortgage and Finance News: (ATLANTA, Ga.) Atlanta's leading luxury agent, Debra Johnston, lists the ultimate secluded sanctuary and one of the most exquisite examples of Art Deco mastery in the exclusive Winterthur Estates, nestled at the end of a cul-de-sac and ensconced in the grounds of a lush 7-acre domain.

News: MCT’s CMO Ian Miller Designated a 2019 ‘Top 40 Most Influential Mortgage Professionals Under 40’ by NMP Magazine

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT) a leading mortgage hedge advisory and secondary marketing software firm, announced that its Chief Marketing Officer, Ian Miller, was recognized by National Mortgage Professional Magazine's (NMP) for his industry accomplishments, landing him on the 2019 'Top 40 Most Influential Mortgage Professionals Under 40' list.

News: MQMR’s Britt Haven Receives Achievement Certification from the MBA’s Certified Mortgage Compliance Professional Program

Mortgage and Finance News: (LOS ANGELES, Calif.) Mortgage Quality Management and Research, LLC (MQMR) announced today that its National Account Executive Britt Haven has completed Level I of the Certified Mortgage Compliance Professional (CMCP) Certification and Designation program offered by the Mortgage Bankers Association (MBA).

News: OpenClose LOS Platform, POS System and PPE Receives the Highest Overall Satisfaction and Lender Loyalty Score in STRATMOR’s New ‘Technology...

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose(R), an industry-leading multi-channel loan origination system (LOS) and digital mortgage fintech provider, announced that STRATMOR Group's most recent Technology Insight Survey ranked the company's LOS platform, point-of-sale (POS) system, and product and pricing engine (PPE) as having the highest Overall Satisfaction and Lender Loyalty Score(TM) out of any vendor surveyed in the mortgage industry.

News: Conte Wealth Advisors Opens Office in Tampa, Florida

Mortgage and Finance News: (TAMPA, Fla.) Camp Hill, Pennsylvania based independent financial services firm, Conte Wealth Advisors, LLC (CWA), has welcomed its first Tampa, Florida advisor, Robert Seaman, to its advisory team.

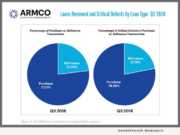

News: ARMCO Q3 2018 QC Trends Report: Defect Trends Reflect Lower Volume, Hyper-Competitive Market

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report covers the third quarter (Q3) of 2018, and provides loan quality findings for mortgages reviewed by ACES Audit Technology(TM).

News: The Mortgage Collaborative Adds Three New Board Members, 45 Lender Members and Grows Attendance at 2019 Winter Conference

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative, a fast-growing independent mortgage cooperative of banks, credit unions and mortgage bankers, continues growth initiatives by adding three new mortgage executives to its Board of Directors. The new board members were voted in at their bi-annual member conference held in Austin, Texas.

News: seriesOne Acquires Dynamo Development to Accelerate its Global Expansion Efforts and Bring Software Development In-House

Mortgage and Finance News: (NEW YORK, N.Y.) seriesOne Inc., a leading global digital security fundraising platform led by leaders with over 20 years of traditional investment banking, venture capital and technology experience, today announced its acquisition of Dynamo Development, a custom software development company with a mature engineering team based in the Ukraine.

News: Totle Launches Equity Crowdfunding Campaign on Republic

Mortgage and Finance News: (DETROIT, Mich.) Totle, the startup powering rapid growth in the world of decentralized finance (DeFi) by providing optimized exchange functionality, today announced their partnership with Republic - a leading crypto and equity investment platform backed by Binance and AngelList that enables anyone to be an angel investor.

News: Sean M. Clayton Named Rising Star by Super Lawyers

Mortgage and Finance News: (CHARLOTTE, N.C.) Sean M. Clayton of The Karney Law Firm has been selected to the 2019 North Carolina Rising Stars list, The Karney Law Firm announced today. Each year, no more than 2.5 percent of the lawyers in the state are selected by the research team at Super Lawyers to receive this honor.

News: Taylor Wilshire Receives the 2019 International Business Excellence Award

Mortgage and Finance News: (NEW YORK, N.Y.) Taylor Wilshire, President and CEO of Wilshire Financial and Wilshire Foundation was presented with the International Business Excellence Award in February 2019 in New York, New York, for constructing innovative programs and investments that address chronic environmental, social, and economic challenges in unique and transformative ways.

News: ReverseVision Voted ‘Best in Show’ by Attendees of NEXT Women’s Mortgage Event in February

Mortgage and Finance News: (EDMOND, Okla.) NEXT Mortgage Events LLC, a creator of events for women mortgage executives, has announced that ReverseVision has been voted Best in Show for the live technology showcase at its February 2019 technology conference. This distinction is awarded to the technology showcase participant that presented the most compelling solution, as determined by attendee vote.

News: Leslie Kavanaugh Lists Best Home in Malibu’s Desirable Point Dume Neighborhood

Mortgage and Finance News: (BEVERLY HILLS, Calif.) Luxury Estate REALTOR, Leslie Kavanaugh, has announced an exceptional property located in Malibu's most coveted neighborhood offered for $8,888,888. This exquisite property and estate at 6950 Dume Drive offer an unparalleled combination of superior finishes, high tech services, and gorgeous coastlines views.

News: Valentis International Engages OGGI EQUITY, Europe

Mortgage and Finance News: (PITTSBURGH, Pa.) Valentis recently engaged OGGI EQUITY, the European private equity consultancy and financial firm, to consult, advise, and guide Valentis on strategic planning in equity, corporate compliance, stock market goals, European development, and other expansion or focus areas.

News: Mg O’Hare Law Releases White Paper on New York State’s Industrial Equipment Rental Industry for Owners and Operators

Mortgage and Finance News: (NEW YORK, N.Y.) Mg O'Hare Law, a New York Law Firm, releases white paper on New York State's Industrial Equipment Rental Market for Owners and Operators. The industrial equipment rental market is forecast to grow over the next five years to 2023. New York State is expected to outpace the rate of growth of the U.S. industry. A focus on customer retention can give operators an edge over the competition.

News: Mid America Mortgage Earns Multiple Top Mortgage Workplace Honors

Mortgage and Finance News: (ADDISON, Texas) Mid America Mortgage, Inc. (Mid America) announced today that the company has been named a top mortgage workplace by two industry trade publications. In addition to garnering Top Mortgage Workplace honors by Mortgage Professional America (MPA), Mid America was also named a Top Mortgage Employer by National Mortgage Professional (NMP) in the magazine's January issue.

News: TRK Connection Named Ellie Mae Experience 2019 Sponsor and Exhibitor

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection (TRK), a leading provider of mortgage quality control (QC) and origination management solutions, announced today it is a sponsor and exhibitor at Ellie Mae Experience 2019. The annual conference will be held March 10-13, 2019 at Moscone West in San Francisco, California.

News: Anow integrates Veros PATHWAY and VeroSELECT, adds VeroSCORE QC to appraisals submitted by mortgage lenders

Mortgage and Finance News: (RED DEER, Alberta) Anow, developer of appraisal firm management software that simplifies the way real estate appraisers manage their businesses, today announced appraiser productivity and appraisal quality integrations with Veros Real Estate Solutions (Veros(r)), a leading developer of enterprise risk management, collateral valuation and predictive analytics services.

News: Simplifile Now E-recording in 1,900 Counties Nationwide

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents and counties, today announced that Logan County, Illinois, is the 1,900th jurisdiction to join Simplifile's e-recording network.

News: Paragon Insurance Holdings Improves and Enhances Public Entity Program with Transition to a New Underwriter / Insurance Carrier

Mortgage and Finance News: (AVON, Conn.) Paragon Insurance Holdings LLC ("Paragon"), a national multi-line specialty Program Manager based in Avon, Conn., today announced a definitive agreement to move their public entity program to a new A+ XV insurance carrier.

News: LBA Ware Named Ellie Mae Experience 2019 Exhibitor

Mortgage and Finance News: (MACON, Ga.) LBA Ware, provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that it will exhibit at Ellie Mae Experience 2019, which will be held March 10-13, 2019, at Moscone West in San Francisco, California. This year's conference theme, "Driving Innovation Home," encourages attendees to learn about the latest technologies defining the mortgage industry.

News: FormFree to Help Kick Off Ellie Mae Experience 2019 as Welcome Reception Sponsor and Exhibitor

Mortgage and Finance News: (ATHENS, Ga.) FormFree(R) announced it will help kick off Ellie Mae's (NYSE:ELLI) annual user conference, Ellie Mae Experience 2019, as a sponsor of the event's welcome reception and "wine tasting tour" on Monday, March 11. Ellie Mae Experience 2019 takes place March 10-13 at the Moscone Center in San Francisco.

News: Bank of Southern California NA Continues to Expand Its Business Development Team in Greater Los Angeles Area

Mortgage and Finance News: (SAN DIEGO, Calif.) Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, is pleased to announce the expansion of its business development team in the Los Angeles market with the hiring of two seasoned banking professionals to support the company's continued growth and expansion in the Southern California region.

News: After, Inc. to launch new QuickReg solution at Warranty Chain Management (WCM) Conference on March 12-14, 2019

Mortgage and Finance News: (NORWALK, Conn.) After, Inc., a global leader in the warranty services industry since 2005, announced today that it will launch QuickReg, its next-generation registration tool, at the 2019 Warranty Chain Management Conference.

News: EPIC Insurance Brokers Adds John Sames in the Northeast US

Mortgage and Finance News: (PEARL RIVER, N.Y.) EPIC Insurance Brokers and Consultants, a retail property, casualty insurance brokerage and employee benefits consultant, today announced that John Sames has joined the firm's Northeast Region leadership team in the new position of Director of Operations and Sales.

News: TRK Connection Hires Chris Bruner as Senior Vice President of National Sales

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection (TRK), a leading provider of mortgage quality control (QC) and origination management solutions, announced today it has hired Chris Bruner, CMB, AMP, as Senior Vice President of National Sales.

News: EPIC to Sponsor International Supply Chain Protection Organization (ISCPO) 2019 Annual Conference

Mortgage and Finance News: (HOUSTON, Texas) EPIC Insurance Brokers and Consultants, a retail property, casualty insurance brokerage and employee benefits consultant, announced today that it will sponsor the International Supply Chain Protection Organization (ISCPO) Annual Conference on March 6 and March 7 at the 7-Eleven Store Support Center in Irving, Texas.

News: Steiner Realty, Inc. Launches New Website to Better Serve Renters and Homebuyers in the Greater Pittsburgh Area

Mortgage and Finance News: (PITTSBURGH, Pa.) Steiner Realty, Inc. is excited to announce the launch of a brand new website. This new site with its stunning photography and easy navigation replaces the old site, developed in 2013. Casey Steiner, the company's President, described the new website as keeping with Steiner Realty's focus on total customer satisfaction.

News: NEXT and Global DMS Partner to Raise Funds for Girls Inc. of Tarrant County

Mortgage and Finance News: (EDMOND, Okla.) NEXT Mortgage Events LLC, creator NEXT women's mortgage tech summit and Global DMS, a leading provider of cloud-based valuation management software, have announced that they partnered to create a fundraising event that raised over $2,700 for Girls Inc. of Tarrant County.

News: Matic Obtains SOC 2 Type II Certification

Mortgage and Finance News: (COLUMBUS, Ohio) Matic, the digital homeowners insurance marketplace built for mortgage servicers and lenders, announced that it has successfully completed a Service Organization Control (SOC) 2 Type II audit. Conducted by IS Partners, LLC, a globally recognized certified public accounting firm, the audit verifies that Matic's information security practices.