Suzee Quanta

News: Mark Maher and David Nielsen Assume Leadership Roles at JenCap Holdings LLC

Mortgage and Finance News: (NEW YORK, N.Y.) JenCap Holdings LLC (JCH), a specialty insurance business, announced that Mark P. Maher has been promoted to Chief Operating Officer and that David Nielsen had recently joined the firm as Corporate Chief Financial Officer.

News: Business Association of Real Estate Appraisers (BAREA) partners with Anow to empower appraisal firms in Canada with transformative tech

Mortgage and Finance News: (RED DEER, Alberta) Anow, the appraisal firm management software developer that simplifies the way real estate appraisers manage their businesses, today announced a partnership that makes its powerful appraisal technology platform available to members of the Business Association of Real Estate Appraisers (BAREA).

News: FormFree Builds on Its Success in 2018 with Addition of New Products and Industry Partnerships, Including Freddie Mac

Mortgage and Finance News: (ATHENS, Ga.) After a banner 2018 that included new partnerships, a product launch and several industry accolades, automated verification provider FormFree(R) anticipates continued growth and innovation in 2019 thanks in part to an expanded focus on serving the needs of independent mortgage brokers.

News: Transformational Mortgage Solutions Appoints Michael Barrett as Mortgage Executive Consultant

Mortgage and Finance News: (AUSTIN, Texas) Leading mortgage industry management consulting firm Austin, Texas-based Transformational Mortgage Solutions (TMS), today announced that it has brought on Michael Barrett as mortgage executive consultant. In this role, Barrett will apply his more than 17-years of mortgage business and product development expertise to helping TMS clients improve process efficiencies, execute digital mortgage transformation strategies and expand profit margins.

News: Continuing Its Growth, VLP Law Group Welcomes Partner Jim O’Hare to the Firm’s Corporate Practice Group

Mortgage and Finance News: (BOSTON, Mass.) VLP Law Group LLP ('VLP') is pleased to announce that Jim O'Hare has joined the firm's Corporate Practice Group as a partner based in the Boston area. Mr. O'Hare brings over 30 years of experience as a trusted adviser to companies, investors, management teams and boards of directors.

News: LenderCity Chooses FinKube’s ELSA AI-Powered Virtual Assistant

Mortgage and Finance News: (DALLAS, Texas) FinKube, a company that provides AI-powered Platform-as-a-Service solutions for a range of industries, announced today that St. Louis-based LenderCity has successfully deployed ELSA, FinKube's Electronic Loan Services Assistant. The mortgage industry's first chatbot is already interacting with prospective borrowers on the LenderCity website.

News: Simplifile Adds 46 Midwest, West Jurisdictions to E-recording Network

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents and counties, today announced that 46 additional recording jurisdictions located in 13 states throughout the Midwest and Western U.S. have joined Simplifile's e-recording network.

News: Report from EraNova Institute: Making Buildings Smart for a Green Future

Mortgage and Finance News: (MOUNTAIN LAKES, N.J.) The EraNova Institute today announced a special report, "In the Cloud, Our Buildings and We Can Fly - Toward a Smart, Green Life." Dick Samson, Director of EraNova and author of the report, says "Buildings need to get smart if society is to get green."

News: EPIC Insurance Brokers adds Brandon Rich in Houston Texas

Mortgage and Finance News: (HOUSTON, Texas) EPIC Insurance Brokers and Consultants ('EPIC')announced today that Brandon Rich has joined the firm's Property & Casualty practice as a Client Advocate, reporting to EPIC Managing Principal and Director of the Southwest Region, KJ Wagner.

News: Strategic Benefits Advisors Promotes Three Consultants to Director Level

Mortgage and Finance News: (ATLANTA, Ga.) Independent, full-service employee benefits consulting firm Strategic Benefits Advisors (SBA) today announced the advancement of retirement plan consultants Kim Shumate, David Runsick and Harry Souder to the role of director. Shumate, Runsick and Souder were promoted in recognition of their sustained contributions to SBA, including their proven success leading complex projects to high-value outcomes and fostering strong client relationships.

News: LBA Ware CEO to Discuss Loan Originator Compensation Trends in Today’s Market at MBA Independent Mortgage Bankers Conference

Mortgage and Finance News: (MACON, Ga.) LBA Ware(TM), provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that its Founder and CEO Lori Brewer will be a panelist at the Mortgage Bankers Association's (MBA) 2019 Independent Mortgage Bankers (IMB) Conference, which will be held January 28-31 at the Hyatt Regency San Francisco.

News: Anow Closes 2018 with 110-percent Year-over-Year Increase in Orders Processed Through Its Digital Appraisal Office Management Technology

Mortgage and Finance News: (RED DEER, Alberta) Digital appraisal management software developer Anow reported a record 110 percent year-over-year increase in appraisal orders processed through its core appraisal office management platform in 2018 despite an industry-wide, market-driven drop in orders per customer.

News: SafeChain Digitizes Property Deed Transfer and Conveyance for Perry County, Ohio

Mortgage and Finance News: (COLUMBUS, Ohio) SafeChain, the industry leader in wire fraud prevention software and blockchain implementation for land title, announced today it has completed the digital conversion of Perry County, Ohio's deed transfer and conveyance process between the engineer and auditor. Beginning January 7, the Perry County Engineer's office will be able to digitize property deeds before the inspection and mapping process.

News: Bank of Southern California, N.A. Names Bill Lamison Vice President, Underwriter

Mortgage and Finance News: (SAN DIEGO, Calif.) Bank of Southern California, N.A. (OTC Pink: BCAL), a community business bank headquartered in San Diego, has announced the appointment of Bill Lamison as Vice President, Underwriter. He will join the company's established business banking team and will be responsible for structuring, analyzing and underwriting commercial credit for new clients as well as managing an existing portfolio of customers.

News: EPIC Insurance Brokers and HR Hotlink Partner for the Benefit of California New Car Dealers

Mortgage and Finance News: (SAN FRANCISCO, Calif.) EPIC Insurance Brokers and Consultants, a retail property, casualty insurance brokerage and employee benefits consultant, announced today a marketing and distribution agreement with HR Hotlink. Both firms are longtime valued partners of the California New Car Dealers Association (CNCDA).

News: Caregivers Will Be Honored as ‘Saints’ in New Orleans ‘Gift Bag Assembly’ Event, Organized by ACSIA Partners

Mortgage and Finance News: (NEW ORLEANS, La.) While the New Orleans Saints give their all on the football field, caregivers give their all in sickrooms, bedrooms, and care centers. They are also "saints." They will be honored for their devotion in a "Caregiver Gift Bag Assembly & Giveaway" event, 4 to 5 p.m. on Saturday, January 19, at Sheraton New Orleans Hotel, New Orleans. Organized by ACSIA Partners, the event will include representatives from a dozen care-related organizations.

News: ARMCO Launches ARMCO CARES Employee Donation Matching Program

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the launch of ARMCO CARES, the company's employee matching gift program.

News: EPIC Insurance Brokers adds Judith Paredes in Dallas, Texas

Mortgage and Finance News: (DALLAS, Texas) EPIC Insurance Brokers and Consultants announced today that Judith Paredes has joined the firm's Property & Casualty practice as an Account Executive, reporting to EPIC Managing Principal and Director of the Southwest Region, KJ Wagner.

News: EPIC Insurance Brokers adds Krista Aburrow in Dallas TX

Mortgage and Finance News: (DALLAS, Texas) EPIC Insurance Brokers and Consultants announced today that Krista Aburrow has joined the firm's Property & Casualty practice as a Client Advocate, reporting to EPIC Managing Principal and Director of the Southwest Region, KJ Wagner.

News: Former FNF/Black Knight executive joins Cloudvirga as chief revenue officer

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga(TM), a leading provider of digital mortgage software, today announced the appointments of Dan Sogorka as chief revenue officer and Kelly Kucera as senior vice president of marketing. Sogorka, a seasoned mortgage technology executive, will drive Cloudvirga's continued revenue growth and oversee the firm's sales and marketing strategy with the help of veteran cloud technology marketer Kucera.

News: UNiQ Realty Launches a New Virtual Real Estate Brokerage That Brings the Real Estate Industry Into the 21st Century

Mortgage and Finance News: (NEWPORT BEACH, Calif.) With the launch of its new Virtual Real Estate Brokerage, UNiQ Realty brings a solution to the need, giving participating real estate agents full ownership over their real estate businesses and allowing homeowners to receive the best possible service.

News: The Cooksey Team Achieves 35 Percent Increase in Profitability in 2018 Despite Overall Mortgage Market Decline

Mortgage and Finance News: (DALLAS, Texas) The Cooksey Team, a top-producing retail branch of Mid America Mortgage, Inc., announced today it has achieved year-over-year growth in volume and profitability for the sixth year running. In 2018, The Cooksey Team increased its overall volume by 27 percent over the previous year and increased the number of loan units closed by 28 percent.

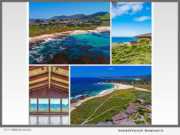

News: Carmel Meadows Unique Home is Available to Own a Piece of Oceanside Paradise

Mortgage and Finance News: (CARMEL, Calif.) Jonathan Spencer Properties has announced a rare opportunity to own an oceanfront slice of heaven in sought-after Carmel Meadows. To live in Carmel Meadows is to live in arguably one of the most gorgeous and glorious places imaginable. At over 4,200 square feet, this 5-bedroom and 3.5 bath property offers a beautiful canvas for the next owner to create a showpiece refuge in an exquisite setting that captures the senses and inspires the mind.

News: Triserv Becomes a Preferred Partner of The Mortgage Collaborative

Mortgage and Finance News: (ROSWELL, Ga.) Triserv, a national appraisal management company (AMC), is proud to announce a strategic partnership with The Mortgage Collaborative to provide appraisal management services to the organization's growing lender member network.

News: EPIC Insurance Brokers Adds Blake Kirk as a Principal in San Francisco

Mortgage and Finance News: (SAN FRANCISCO, Calif.) EPIC Insurance Brokers and Consultants announced today that risk management and insurance professional Blake Kirk has joined the firm's operations in Northern California as a Senior Vice President and Principal.

News: Ohio’s Largest Title Agent Selects SafeWire by SafeChain

Mortgage and Finance News: (COLUMBUS, Ohio) SafeChain, the industry leader in wire fraud prevention software and blockchain implementation for land title, announced today that Ohio Real Title, the largest title agent in the state, has selected its technology solution, SafeWire(TM), to securely facilitate real estate wire transactions for the firm's eight offices throughout Ohio.

News: Randy Pizer Joins EPIC in Orange County, Calif.

Mortgage and Finance News: (IRVINE, Calif.) EPIC Insurance Brokers and Consultants ('EPIC') announced today that risk management and insurance professional Randy Pizer has joined the firm's operations in California as Vice President/Account Executive.

News: MCT’s Danyel Shipley Honored as one of Mortgage Banking’s Most Powerful Women for 2018 by NMP Magazine

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that long-time employee Danyel Shipley was name to National Mortgage Professional Magazine's (NMP) 2018 list of Mortgage Banking's Most Powerful Women.

News: Klingenstein Fields Wealth Advisors: In Memoriam – Frederick A. Klingenstein

Mortgage and Finance News: (NEW YORK, N.Y.) The Members of Klingenstein Fields Wealth Advisors (KFWA) mourn the passing of Fred Klingenstein, a founding member of the firm and Chairman Emeritus. Together with his brother, John Klingenstein, and colleague, Kenneth H. Fields, Fred established the firm in 1989 to provide investment advice and guidance to high-net-worth individuals and families. Prior to KFWA, Fred was CEO of Wertheim & Company and Co-Chairman of Wertheim-Schroder & Company.

News: Paragon Insurance Holdings, LLC Acquires Argo Landscapers Program

Mortgage and Finance News: (AVON, Conn.) Paragon Insurance Holdings, LLC, a national multi-line specialty program manager, today announced it has contracted with Argo Group International Holdings, Ltd. to assume MGA responsibilities for Argo's Landscape Contracting program, effective January 1, 2019.