News: ACES Quality Management Partners with Digilytics, Provider of AI-Powered Document Indexing, Categorization for QC Reviews

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced a new partnership with Digilytics to provide ACES users access to Revel, an advanced optical character recognition (OCR) technology powered by artificial intelligence (AI) and machine learning (ML).

News: Dark Matter Technologies enhances the Empower LOS with native support for mortgage assumptions

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative leader in mortgage technology backed by time-tested loan origination software and leadership, today announced enhancements to the Loan Assumptions feature in the Empower® loan origination system (LOS) that make it easier for mortgage lenders and servicers to transfer assumable mortgages to new homebuyers. The Empower LOS is the first mortgage loan origination system to announce native support for loan assumptions.

News: Denver Post Names ACES Quality Management a Recipient of Colorado Top Workplaces 2024 Award

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced it has been awarded a Top Workplaces 2024 honor by Denver Post Top Workplaces. The Top Workplaces list is based solely on employee feedback gathered through a third-party survey.

News: Truity Credit Union inks deal to implement the Empower LOS from Dark Matter Technologies

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today welcomed Truity Credit Union (Truity) as the latest financial institution to select the Empower® loan origination system. A member-owned credit union with locations in Oklahoma, Kansas and Texas, Truity will leverage the Empower LOS to provide loan officers and members a modern, mobile-friendly experience.

News: Optimal Blue Announces ‘Optimize Your Advantage’ to Showcase How Its Capital Markets Platform Puts Lenders in Control of Their Margins

Mortgage and Finance News: (PLANO, Texas) Optimal Blue announced the launch of its Optimize Your Advantage campaign in advance of the MBA Secondary and Capital Markets Conference. This comprehensive brand initiative highlights the value and innovation the company delivers to clients. Through Optimal Blue's position as the housing industry's only end-to-end capital markets platform, lenders and other market participants have greater control of their profit margins, giving them distinct advantages, regardless of market conditions.

News: OneTrust Home Loans Selects LenderLogix’s Fee Chaser to Eliminate Manual Processes

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced OneTrust Home Loans as its newest Fee Chaser client. Using Fee Chaser, OneTrust Home Loans can streamline its operations and compliantly collect upfront fees from its borrowers.

News: Dark Matter Technologies appoints former Ellie Mae executive as deputy chief product officer

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter) today announced the appointment of Vikas Rao as deputy chief product officer. Reporting directly to Chief Product Officer Stephanie Durflinger, Rao is charged with overseeing enhancements to the Empower® loan origination system (LOS) and establishing Dark Matter's developer community, which will help lenders embed automation deeper in their origination workflows and more tightly integrate their systems using open application programming interfaces (APIs) and widgets.

News: 23-year industry veteran Jason Mapes joins Floify as head of sales

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced the appointment of Jason Mapes as head of sales. Mapes, who previously served as director of sales for nCino's Mortgage Suite, brings a wealth of experience to spearhead Floify's national sales initiatives.

News: ACES Quality Management Named 2024 Best Places to Work in Financial Technology

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has been named one of the 2024 Best Places to Work in Financial Technology. The awards program was created in 2017 and is an Arizent and Best Companies Group project.

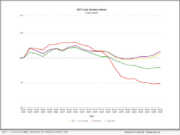

News: Mortgage Purchase Lock Counts See First YoY Gain Since Fed Rate Hikes Began Two Years Ago

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today released its April 2024 Originations Market Monitor report, which reveals the first year-over-year increase in purchase mortgage lock counts since the Federal Reserve initiated rate hikes in March 2022.

News: Down Payment Resource integration with ICE Mortgage Technology embeds down payment assistance program support into core mortgage origination software

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, today announced a new integration using the latest API framework from Intercontinental Exchange (ICE) for mortgage technology. Available via the Encompass Partner Connect™ API Platform, the integration makes it easier for lenders to support homebuyers with the nation's 2,300-plus down payment assistance (DPA) programs.

News: New Solution Connects API-Driven Back-End Execution to Front-End Pricing with Industry-First Features

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of the Base Rate Generator, an industry-changing solution that allows mortgage lenders to directly inform their front-end rate sheet pricing with their back-end capital markets executions. By combining live agency API connections, co-issue executions, aggregator pricing, and custom TBA indications, the MCT Base Rate Generator allows mortgage lenders to improve margin management and competitive performance.

News: ACES Quality Management Partners with Infrrd to Provide AI-Powered Intelligent Mortgage Document Processing

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced a new partnership with Infrrd to provide ACES users access to intelligent document processing. When used in conjunction with ACES Quality Management & Control software, Infrrd's technology helps lenders improve the efficiency of their quality control (QC) reviews by indexing, categorizing and reviewing the accuracy of loan file documents prior to review.

News: MCT Reports A 2% Lock Volume Increase Despite Rising Rates

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today reported a 1.87% increase in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

News: MMI Webinar with MBA Focuses on Using Data, Technology to Reach ‘Mortgage-Ready’ Millennials

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announced its Vice President of Strategic Partnerships, Heidi Iverson, will be participating in the Mortgage Bankers Association's upcoming webinar "Using Data and Technology to Connect with Today's Buyers to Increase Homeownership," on May 14 at 3 p.m. ET.

News: Monterra Credit Union elevates the member experience with the Empower LOS from Dark Matter Technologies

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced that Monterra Credit Union (Monterra CU), a full-service financial institution serving members throughout San Mateo County, California, the City of Palo Alto and the San Francisco Bay Area, has selected the Empower® loan origination system (LOS) for mortgage loan, home-equity loan and home-equity line of credit (HELOC) originations.

News: MMI adds Ron Ross as CFO to fuel the growth of its mortgage data intelligence platform

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announced today that Ron Ross, an established senior executive, will fill the role of chief financial officer.

News: Down Payment Resource brings its award-winning homebuyer assistance software to The Mortgage Collaborative as a preferred partner

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, today announced that it has joined The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry. As a member of TMC's Preferred Partner Network, DPR will provide its software, which provides operational support for utilizing its database of more than 2,300 down payment assistance (DPA) programs, at a discounted rate to TMC members.

News: Informative Research’s Ryan Kaufman Named HousingWire’s 2024 Rising Star

Mortgage and Finance News: (IRVINE, Calif.) Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced today that Ryan Kaufman, IT Manager - Integrations, has been selected by HousingWire magazine for its annual Rising Stars award.

News: Agile Introduces Competitive Electronic Bidding on Fourth Month TBA Mortgage-Backed Securities

Mortgage and Finance News: (PHILADELPHIA, Pa.) Agile, a groundbreaking fintech bringing mortgage lenders and broker-dealers onto a single electronic platform, announced today the launch of electronic bidding for the fourth month in the To-Be-Announced mortgage-backed securities (TBA) market. This marks a significant leap forward in the trading landscape of off-screen securities.

News: Dark Matter Technologies’ Rich Gagliano honored as one of Jacksonville’s top 25 CEOs by Key Executives

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter) today announced that its CEO Rich Gagliano has been recognized by Key Executives, a periodical publication providing news and information on today's leading corporate executives, as one of 2024's Top 25 CEOs of Florida's largest city, Jacksonville. The award recognizes CEOs from diverse sectors and industries whose trailblazing ideas and strategic leadership have contributed to Jacksonville's economic significance.

News: Sydney Barber, Floify’s head of product, named to HousingWire’s 2024 Rising Stars List

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that its Head of Product Sydney Barber, has been honored by HousingWire with its 2024 Rising Stars award. Since Barber joined Floify in 2019, she's spearheaded dozens of product enhancements to help its customers operate more efficiently in a volatile market.

News: Argyle’s Anaid Chacón honored as HousingWire Rising Star

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, today announced its Senior Vice President of Product Anaid Chacón has been recognized as a HousingWire Rising Star. The award recognizes leaders in real estate and mortgage under the age of 40 who have achieved remarkable milestones.

News: Optimal Blue Director of Data Solutions Brennan O’Connell Named a 2024 HousingWire Rising Star

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today announced that Brennan O'Connell, director of data solutions, has been honored with the 2024 HousingWire Rising Stars award. The award program celebrates emerging leaders in real estate and mortgage who have demonstrated rapid career growth and an ability to lead, achieving remarkable milestones before the age of 40.

News: Down Payment Resource reports highest annual down payment assistance program count growth on record

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q1 2024 Homeownership Program Index (HPI) report. In a quarter where year-over-year (YoY) home prices jumped 6%, the YoY national down payment assistance count increased by 204, the largest annual jump since DPR began reporting on this data in Q3 2020.

News: Dark Matter and Total Expert partner to boost lender revenue through best-in-class mortgage automation and customer engagement

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter) today announced a new strategic partnership with Total Expert, the customer engagement platform purpose-built for modern financial institutions. A forthcoming bi-directional integration between Total Expert and the Empower® loan origination system (LOS) from Dark Matter will empower mortgage lenders to generate more leads, improve sales productivity and close more loans by intelligently automating and personalizing the homebuyer journey.

News: Informative Research Adds Mortgage Finance Expert Kurt Raymond, CMB as Senior Vice President

Mortgage and Finance News: (GARDEN GROVE, Calif.) Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced it has expanded its team to add mortgage industry veteran Kurt Raymond, CMB as Senior Vice President and Borrower Journey Engineer. The move reflects Informative Research's commitment to helping lenders streamline origination costs and enhance the borrower experience.

News: MCT Launches Complete Best Execution, Now Including Fully Integrated Retain vs. Release MSR Decisioning

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, proudly introduces a game-changing advancement: a Best Ex for Released and Retained all in one platform!

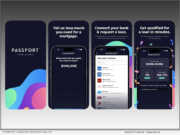

News: FormFree upgrades Passport Wallet with simpler UI, VantageScore integration and streamlined asset validation

Mortgage and Finance News: (ATHENS, Ga.) FormFree®, a leader in financial technology since 2007, today announced significant enhancements to Passport Wallet®, an innovative app that transforms how everyday people access loans. Available now in the Apple App Store and Google Play, the latest version of Passport Wallet is designed to make it easier than ever for consumers to understand their ability to pay and match with lenders.

News: Patelco Credit Union selects the Empower LOS to streamline and bolster home loan and home-equity origination

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the implementation of the Empower® loan origination system (LOS) by Patelco Credit Union (Patelco), a Bay Area-based credit union dedicated to the financial wellness of its team, members and communities.