News: Mid America Mortgage Hires Kerry Webb as Director of Business Development

Mortgage and Finance News: (ADDISON, Texas) Mid America Mortgage, Inc. (Mid America) announced today that it has hired Kerry Webb as Executive Managing Director of Business Development. In this role, Webb will be responsible for recruiting, managing and motivating teams of mortgage professionals to meet and exceed productions goals that align with the overall company's strategic volume growth and profitability goals.

News: Simplifile Promotes Mark Moats to VP of National Accounts

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents and counties, today announced it has promoted Mark Moats to Vice President of National Accounts. Moats previously served as a Regional Sales Director for Simplifile and has been with the company for nearly 13 years.

News: National Lending Industry Leaders, Residential Capital Partners and 2020 REI Group, Join Forces

Mortgage and Finance News: (DALLAS, Texas) Residential Capital Partners is pleased to announce the acquisition of 3L Finance. As a part of the acquisition, Residential Capital Partners is pleased to be the national hard money and rental finance lending partner to 2020 REI Group.

News: Matic Makes HousingWire’s List of Top Mortgage Tech Companies for Second Year in a Row

Mortgage and Finance News: (COLUMBUS, Ohio) Digital insurance agency Matic has been named to HousingWire's HW TECH100(TM) list of the top housing technology companies in the United States. The annual awards program, now in its sixth year, recognizes the most innovative tech firms in the real estate and mortgage finance sector.

News: Anow advances to final round of Mortgage Professional America’s Power Originator Summit Awards

Mortgage and Finance News: (RED DEER, Alberta) Anow, developer of appraisal firm management software that simplifies the way real estate appraisers manage their businesses, has been named a finalist for Mortgage Professional America's Power Originator Summit Award for Best Technology.

News: FormFree and Board Member Faith Schwartz Named Finalists for Mortgage Professional America Power Originator Summit Awards

Mortgage and Finance News: (ATHENS, Ga.) Both FormFree(R) and Faith Schwartz, a member of FormFree's board of directors, were named finalists for Mortgage Professional America's Power Originator Summit Awards. As nominees for the Best Rate Referrals Award for Best Technology and the RCN Capital Award for Woman of Distinction, FormFree and Schwartz were recognized at the inaugural Power Originator Summit at the Anaheim Convention Centre on April 4.

News: ARMCO Wins HousingWire HW Tech100 Award for Fifth Consecutive Year

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of financial risk mitigation and compliance solutions, announced that it has won HousingWire's sixth annual HW Tech100(tm) award, which recognizes the 100 most innovative technology companies in the U.S. housing economy. This is the fifth consecutive year that ARMCO has achieved this prestigious designation.

News: NEXT and Housing Finance Strategies Form Strategic Alliance

Mortgage and Finance News: (WASHINGTON, D.C.) NEXT Mortgage Events, creator of NEXT women's mortgage technology summit, today announced it has engaged in a strategic alliance with Housing Finance Strategies, a Washington, DC-based advisory firm led by renowned industry veteran and award winner Faith Schwartz, former executive director of HOPE NOW.

News: FormFree Named to HousingWire’s 2019 TECH100 List of Top Digital Mortgage Technology Companies

Mortgage and Finance News: (ATHENS, Ga.) FormFree(R) today announced that it has been named to HousingWire's list of the top 100 innovators in housing technology. Now in its sixth year, the HW TECH100(TM) awards program honors leading technology companies in all sectors of the U.S. housing economy, including residential mortgage lending, servicing and investments.

News: Texas Mortgage Bankers Association Releases Details for the 103rd Annual Convention

Mortgage and Finance News: (AUSTIN, Texas) The Texas Mortgage Bankers Association (TMBA) announced the agenda for its annual convention to be held on April 28 - 30, 2019 in San Antonio at the Marriott Rivercenter hotel. More than 1,000 industry participants are expected to at attend, which consists of comedian Dennis Miller as the keynote address, a list of preeminent speakers, educational tracks, networking opportunities, trending insights and a diverse mix of exhibitors.

News: LBA Ware Named a HousingWire TECH100 Company for 5th Straight Year

Mortgage and Finance News: (MACON, Ga.) LBA Ware(TM), provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that it has been named to HousingWire's 2019 TECH100(TM) list of the housing industry's most impactful technologies. This marks the fifth consecutive year LBA Ware has been named to the list.

News: Simplifile Recognized as HW Tech100 Winner for Fourth Consecutive Year

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, announced that it has been included on the sixth annual HW Tech100(TM) list published by housing and mortgage industry trade magazine HousingWire.

News: IDS Makes Fifth Appearance on HW TECH100

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has been named to the 2019 HW TECH100(TM) list published by mortgage industry trade magazine HousingWire. IDS was part of the inaugural TECH100 list, and 2019 marks the fifth year IDS has made the list.

News: ReverseVision Named to HousingWire Magazine’s Tech100 List of Top Housing Technology Companies for a Fourth Year

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, today announced it has been named to HousingWire (HW) Magazine's Tech100 list of innovative housing technology companies for a fourth time. ReverseVision was previously named a HW Tech100 honoree in 2015, 2017 and 2018.

News: DocMagic Earns a Spot on the HW TECH100 For the Sixth Straight Year

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of dynamic loan document preparation, automated regulatory compliance and comprehensive eMortgage solutions, announced that HousingWire has honored the company with the HW TECH100(tm) award for the sixth year in a row.

News: NEXT Wins PROGRESS in Lending Innovations Award

Mortgage and Finance News: (EDMOND, Okla.) NEXT Mortgage Events LLC, creator of the NEXT women's mortgage tech summit, has announced that it was named a winner of the Innovations Award from PROGRESS in Lending Association.

News: Home Point Financial Partners with Matic to Offer Customers Lowest Market Rates on Homeowners Insurance

Mortgage and Finance News: (COLUMBUS, Ohio) Digital insurance agency Matic announced today that it has partnered with Home Point Financial Corporation ("Home Point"), a national, mortgage originator and servicer, to help its mortgage servicing customers find competitively priced homeowners insurance.

News: FormFree Joins Financial Data Exchange (FDX)

Mortgage and Finance News: (ATHENS, Ga.) FormFree(R) announced today that it has joined the Financial Data Exchange (FDX), a non-profit group that promotes information sharing and security standards for the financial sector. A leading provider of digital asset, income and employment verification, FormFree brings over a decade of experience in protecting the safety and integrity of sensitive consumer data.

News: Mid America COO Kara Lamphere Honored as ‘Tech All-Star’ by Mortgage Bankers Association

Mortgage and Finance News: (ADDISON, Texas) Mid America Mortgage, Inc. (Mid America) announced today that Mid America Chief Operating Officer Kara Lamphere was one of four mortgage technology innovators honored by the Mortgage Bankers Association (MBA) as a 2019 MBA Insights Tech All-Star. The award, now in its 18th year, recognizes "industry leaders who have made outstanding contributions in mortgage technology."

News: LBA Ware Founder and CEO Lori Brewer Selected as 2019 Tech All-Star by Mortgage Bankers Association

Mortgage and Finance News: (MACON, Ga.) LBA Ware(TM), provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that company Founder and CEO Lori Brewer has been named a winner of the 2019 MBA Insights Tech All-Star award. Brewer accepted her award today during the opening session of the Mortgage Bankers Association's Technology Solutions Conference & Expo 2019 in Dallas.

News: Global DMS Launches SnapVal to Provide Instant, Accurate, Guaranteed Appraisal Pricing Early on in the Origination Process

Mortgage and Finance News: (DALLAS, Texas) MBA's Technology Solutions Conference & Expo: Global DMS, a leading provider of cloud-based valuation management software, today announced the official rollout of SnapVal(TM), an automated solution that utilizes the property address to return a guaranteed price on any residential appraisal in the U.S.

News: IDS Adds Full Mortgage eClosing Capabilities with Release of ClickToClose

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has augmented its flagship doc prep platform idsDoc to include full eClosing capabilities through a new service called ClickToClose.

News: NotaryCam-DocMagic Integration Delivers Remote Online Notarization, eClosing Capabilities for Mid America Mortgage

Mortgage and Finance News: (NEWPORT BEACH, Calif.) NotaryCam, the leader in online notarization solutions, today announced that eMortgage pioneer Mid America Mortgage is now using the firm's integration with DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, to conduct remote online notarizations (RONs) through DocMagic's Total eClose platform.

News: OpenClose Extends its Digital Mortgage Ecosystem with New POS Offering – ConsumerAssist Digital POS

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose(R), an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that it is has scheduled a May release for the official rollout of its much anticipated digital mortgage point-of-sale (POS) solution, ConsumerAssist(TM) Digital POS.

News: NEXT Mortgage Conference Announces Summer Dates: Aug. 26-27, 2019

Mortgage and Finance News: (EDMOND, Okla.) NEXT Mortgage Events LLC, creator of the NEXT women's mortgage tech summit, has announced its summer 2019 event dates. The event, hashtagged #NEXTSummer19, will take place Aug. 26-27, 2019 at The Gwen Hotel in Chicago. Registration will open to the public in April 2019.

News: National Association of Appraisers (NAA) and Anow forge partnership to bring cutting edge appraisal software to real property appraisers members

Mortgage and Finance News: (SAN ANTONIO, Texas) Anow, creator of the leading software for real estate appraisal offices, today announced it has forged a partnership with the National Association of Appraisers (NAA) to make Anow's appraisal office management platform more readily accessible to members of the professional organization.

News: MCT’s CMO Ian Miller Designated a 2019 ‘Top 40 Most Influential Mortgage Professionals Under 40’ by NMP Magazine

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT) a leading mortgage hedge advisory and secondary marketing software firm, announced that its Chief Marketing Officer, Ian Miller, was recognized by National Mortgage Professional Magazine's (NMP) for his industry accomplishments, landing him on the 2019 'Top 40 Most Influential Mortgage Professionals Under 40' list.

News: MQMR’s Britt Haven Receives Achievement Certification from the MBA’s Certified Mortgage Compliance Professional Program

Mortgage and Finance News: (LOS ANGELES, Calif.) Mortgage Quality Management and Research, LLC (MQMR) announced today that its National Account Executive Britt Haven has completed Level I of the Certified Mortgage Compliance Professional (CMCP) Certification and Designation program offered by the Mortgage Bankers Association (MBA).

News: OpenClose LOS Platform, POS System and PPE Receives the Highest Overall Satisfaction and Lender Loyalty Score in STRATMOR’s New ‘Technology...

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose(R), an industry-leading multi-channel loan origination system (LOS) and digital mortgage fintech provider, announced that STRATMOR Group's most recent Technology Insight Survey ranked the company's LOS platform, point-of-sale (POS) system, and product and pricing engine (PPE) as having the highest Overall Satisfaction and Lender Loyalty Score(TM) out of any vendor surveyed in the mortgage industry.

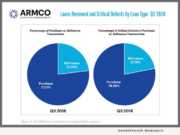

News: ARMCO Q3 2018 QC Trends Report: Defect Trends Reflect Lower Volume, Hyper-Competitive Market

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report covers the third quarter (Q3) of 2018, and provides loan quality findings for mortgages reviewed by ACES Audit Technology(TM).