News Topic: FormFree

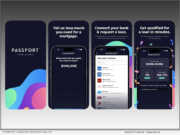

News: FormFree upgrades Passport Wallet with simpler UI, VantageScore integration and streamlined asset validation

Mortgage and Finance News: (ATHENS, Ga.) FormFree®, a leader in financial technology since 2007, today announced significant enhancements to Passport Wallet®, an innovative app that transforms how everyday people access loans. Available now in the Apple App Store and Google Play, the latest version of Passport Wallet is designed to make it easier than ever for consumers to understand their ability to pay and match with lenders.

News: FormFree celebrates its 10th appearance on the HousingWire Tech100

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced it has been honored as a HousingWire Tech100 Mortgage award winner for a tenth year. The fintech was recognized for the launch of its Residual Knowledge Income Index(tm) (RIKI(tm)), an innovative method for measuring consumers' ability to pay for mortgages and other loans based on cash-flow analysis.

News: FormFree president Eric Lapin to speak on artificial intelligence at MISMO Winter Summit

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced its President Eric Lapin has been selected to speak at the MISMO Winter Summit taking place January 8-11, 2024, at The Woodlands Resort just outside of Houston, Texas. Lapin will speak on a panel titled "Demystifying Artificial Intelligence, Digital Identity and Blockchain" during a brown-bag lunch session on January 9 from 12:30 pm-1:25 pm CT. He will be joined by fellow panelists Devin Caster, principal, product solutions at CoreLogic; Rishi Godse, principal technical architect at USAA; and Shawn Jobe, vice president and head of business development at Informative Research.

News: FormFree appoints Solvent CEO DIVINE as head of culture

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced the appointment of former hip-hop/rap recording artist-turned-techpreneur Victor D. Lombard, professionally known as DIVINE, as head of culture. DIVINE is the CEO and founder of Solvent, a fintech focused on financial empowerment for marginalized groups.

News: FormFree welcomes MX Founder and Executive Chair Ryan Caldwell to its board of directors

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced the appointment of MX Technologies, Inc. (MX) Founder and Executive Chair Ryan Caldwell to its board of directors. Caldwell brings more than 20 years of experience in financial services and fintech, helping organizations around the world harness the power of financial data to improve business and consumer outcomes.

News: Jenny Moss joins fintech FormFree as director of marketing

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced the appointment of Jenny Moss as its new director of marketing. The timing of the move comes just as the company is launching its Passport® portable financial ID on October 20 and the FormFree Exchange (FFX), an online marketplace where lenders compete for the business of Passport users, later this year.

News: MEDIA ADVISORY: Original ‘Shark Tank’ shark comes to MBA Annual

Mortgage and Finance News: (PHILADELPHIA, Pa.) Kevin Harrington of "Shark Tank" fame will host a meet-and-greet with attending mortgage professionals and trade press before taking the stage during the Mortgage Bankers Association (MBA) Annual Convention & Expo to introduce Passport®, FormFree's portable financial ID for consumers launching October 20, and the FormFree Exchange (FFX®), the online marketplace where lenders compete for the business of Passport users.

News: FormFree announces first-of-a-kind exchange to connect lenders with qualified borrowers

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced the fourth quarter debut of FormFree Exchange (FFX®), a dynamic online marketplace that matches lenders with qualified borrowers for a faster, better and fairer lending experience. FFX has been meticulously designed to address the challenges facing lenders and borrowers in the modern financial landscape.

News: FormFree partners with original ‘Shark’ and iconic entrepreneur Kevin Harrington to launch Passport portable financial ID

Mortgage and Finance News: (ATHENS, Ga.) FormFree has partnered with serial entrepreneur Kevin Harrington of "Shark Tank" fame to promote Passport, a free service that makes it easy for consumers to quantify their borrowing power and share their verified assets, employment, annual and residual income and rent payment history with their preferred lender in just minutes from any web-enabled device.

News: FormFree joins ACUMA as an affiliate member

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced it has joined the American Credit Union Mortgage Association (ACUMA) as an affiliate member. Through its membership, FormFree aims to help credit unions provide more inclusive pathways to homeownership by introducing them to residual income analytics, a methodology for gaining enhanced insight into borrowers' ability to repay loans.

News: Jonathan Nahil joins FormFree as chief technology officer

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that it has brought on Jonathan Nahil as chief technology officer (CTO). Nahil possesses more than 20 years of experience as a software architect and leader of development teams at renowned technology organizations.

News: FormFree’s Brent Chandler named an Inman Best of Finance award honoree

Mortgage and Finance News: (ATHENS, Ga.) FormFree(R) today announced that its founder and CEO Brent Chandler was named to Inman's 2023 Best of Finance award program, which recognizes the leaders who are reshaping the mortgage and finance industries for both professionals and consumers. The inaugural class of Inman's Best of Finance winners were honored for their unwavering commitment to innovation and service in the residential mortgage space.

News: IndiSoft partners with FormFree to streamline the delivery of housing counseling services to underserved consumers

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that developer of collaborative solutions for the housing finance industry, IndiSoft, is leveraging FormFree's Passport® to enable HUD-approved housing counseling agencies (HCAs) to provide more effective and expeditious consumer counseling.

News: GreenLyne adopts FormFree’s Residual Income Knowledge Index to unlock greater inclusivity in mortgage lending

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that Inclusive-Finance-as-a-Service platform GreenLyne has enhanced its ability to help lenders identify home financing opportunities for underserved consumers with its adoption of FormFree's Residual Income Knowledge Index™ (RIKI™).

News: FormFree selected to HousingWire Tech100 for the ninth year

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced its inclusion in HousingWire's (HW's) annual Tech100 list for the ninth year. The HW Tech100 Mortgage Awards recognize the U.S. housing economy's most innovative and influential fintech companies and solutions.

News: FormFree sharpens focus on decentralizing and democratizing consumer access to credit with strategic divestiture of AccountChek

Mortgage and Finance News: (ATHENS, Ga.,) Founder and CEO Brent Chandler today heralded a new era for FormFree® following its strategic divestiture of asset-verification service AccountChek®. Moving forward, the fintech will focus on products that advance its mission to decentralize and democratize the way consumers understand their financial data and access credit opportunities. Eric Lapin, who joined FormFree in 2022 as chief strategy officer, will guide the company's next chapter as president.

News: FormFree’s Brent Chandler named a 2023 Industry Titan by National Mortgage Professional

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that its founder and CEO Brent Chandler was featured in National Mortgage Professional's list of 2023 Industry Titans. The inaugural Industry Titans awards program recognized 24 of the most notable leaders in mortgage lending.

News: FormFree expands its verification of income and employment network through partnership with Truv

Mortgage and Finance News: (ATHENS, Ga.) FormFree® announced that it has partnered with Truv to enhance AccountChek®'s verification of income and employment (VOI/E) reporting capabilities with Truv's payroll provider network, expanding the modern convenience of electronically sharing payroll data with mortgage lenders to 120 million workers.

News: FormFree supports Freddie Mac’s launch of innovative underwriting enhancement that uses cash flow analysis to help increase home financing access

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that mortgage lenders will be able to use AccountChek® to help more lenders qualify more borrowers for home financing as a result of a recently announced Freddie Mac initiative that analyzes loan applicants' account transaction data as part of its automated underwriting system, Loan Product Advisor® (LPA℠).

News: FormFree’s AccountChek can now be used by mortgage lenders to satisfy Freddie Mac’s assessment of income requirement for loan applicants...

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that mortgage lenders can now use AccountChek® to automate income assessment using Freddie Mac Loan Product Advisor® (LPA℠) asset and income modeler (AIM) for borrowers who are paid through ADP.

News: FormFree releases Residual Income Knowledge Index, an intelligent new system for assessing borrowers’ Ability to Pay, to lenders nationwide

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced the general availability of its Residual Income Knowledge Index, or RIKI. RIKI is an innovative method for measuring consumers' Ability-to-Pay (ATP) for mortgages and other loans based on monthly income and spending. When paired with traditional credit scoring models, RIKI offers lenders a more complete understanding of consumers' creditworthiness and creates homeownership opportunities for those with little to no credit history.

News: FormFree integrates with Docutech to streamline loan production with VOA and VOI/E capture

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced the integration of AccountChek®, a service that allows lenders to verify borrowers' assets, income, employment and rent payment history, with Solex®, a comprehensive eDelivery, eSign, eClose and eVault platform from Docutech®, a First American company.

News: FormFree and Finastra partnership streamlines borrower verification for improved mortgage loan processing

Mortgage and Finance News: (ATHENS, Ga.) Finastra and FormFree®, a market-leading fintech company that enables lenders to understand people's true ability to pay (ATP®), have partnered to further streamline electronic borrower verification for mortgage lenders.

News: FormFree and HomeScout partner to help lenders identify mortgage-ready borrowers earlier in the home buying journey

Mortgage and Finance News: (ATHENS, Ga.) FormFree® has partnered with HomeScout, a wholly owned subsidiary of FirstClose®, to launch HomeScout Qualified Borrower, a tool that helps lenders generate leads and concentrate borrower conversion efforts on mortgage-ready home buyers.

News: FormFree announces support for new Freddie Mac Loan Product Advisor enhancement aimed at expanding sustainable homeownership for renters

Mortgage and Finance News: (ATHENS, Ga.) FormFree® announced that mortgage lenders using AccountChek® verification of asset (VOA) reports in conjunction with a Freddie Mac Loan Product Advisor® (LPA℠) solution will soon benefit from an enhancement that takes loan applicants' 12-month on-time rent payment history into consideration when assessing eligibility for qualified first-time homebuyers.

News: Mortgage lenders are now able to use FormFree AccountChek to satisfy Freddie Mac’s reverification of employment requirement

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that its AccountChek® digital asset verification service supports a new enhancement to Freddie Mac's Loan Product Advisor® (LPASM) asset and income modeler (AIM) solution that makes assessment of borrower employment easier, faster, less expensive and more fraud-resistant.

News: FormFree opens registration to its third annual Heroes Golf Classic 2022 benefiting the American Red Cross of Northeast Georgia

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced it has opened registration to the organization's third annual Heroes Golf Classic, which will be held on September 9, 2022, at Lanier Islands Legacy Golf Course in Buford, Georgia. All proceeds from the event will be donated to the American Red Cross of Northeast Georgia, a 501(c)(3) nonprofit organization that provides emergency assistance and preparedness education to communities affected by disaster.

News: FormFree’s Christy Moss recognized by the Mortgage Bankers Association for outstanding contributions in mortgage technology

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that the Mortgage Bankers Association (MBA) has named FormFree Chief Customer Officer Christy Moss, CMB, a 2022 Tech All-Star. Since 2002, the Tech All-Star Awards have honored leaders who have made outstanding contributions to mortgage technology.

News: FormFree and Take3Tech integration brings AccountChek asset, income and employment verification to the LoanMAPS mortgage technology platform

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced it has partnered with Take Three Technologies (Take3Tech) to make its AccountChek® automated asset, income, and employment verification solutions available within LoanMAPS™, an all-in-one loan origination platform that encompasses a loan origination system (LOS), point-of-sale system (POS), customer relationship management system (CRM), compliance monitoring and report generation.

News: FormFree grows executive team, appoints Eric Lapin chief strategy officer

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that it has appointed Eric Lapin to the role of chief strategy officer (CSO). In this position, Lapin will leverage his more than 25 years' experience in leadership roles at marquee mortgage technology firms and financial institutions to steer the strategic vision and partnerships driving FormFree's growth.