Tag: Long Term Care

News: At Commencement, The Woodlands at Furman Graduates to ‘Certified University Based Retirement Community (UBRC)’ Status

Mortgage and Finance News: (GREENVILLE, S.C.) The Woodlands at Furman, a 350+ resident senior living community in partnership with Furman University, has met criteria to be recognized as a "Certified University Based Retirement Community (UBRC)," the highest category among more than 85 University Retirement Communities (URCs) nationwide.

News: LTC News Introduces New Comprehensive National Long-Term Care Provider Directory

Mortgage and Finance News: (LA GRANGE, Ill.) LTC News, a premier online destination for news and information on aging, caregiving, health, long-term care and retirement planning, announces the launch of an extensive online long-term care directory. This new resource connects individuals and families to a host of quality long-term care providers across the country.

News: LTC NEWS Acquisition Anticipates Growth and Expansion

Mortgage and Finance News: (CHICAGO, Ill.) Matt McCann, a nationally-known veteran of the long-term care (LTC) insurance industry, announces the formation of LTC NEWS, LLC after acquiring the online asset - ltcnews.com.

News: Caregivers Will Be Honored as ‘Saints’ in New Orleans ‘Gift Bag Assembly’ Event, Organized by ACSIA Partners

Mortgage and Finance News: (NEW ORLEANS, La.) While the New Orleans Saints give their all on the football field, caregivers give their all in sickrooms, bedrooms, and care centers. They are also "saints." They will be honored for their devotion in a "Caregiver Gift Bag Assembly & Giveaway" event, 4 to 5 p.m. on Saturday, January 19, at Sheraton New Orleans Hotel, New Orleans. Organized by ACSIA Partners, the event will include representatives from a dozen care-related organizations.

A Prime Time to Plan for Long-Term Care for Yourself Is After Arranging It for A Loved One, says ACSIA Partners

Mortgage and Finance News: (KIRKLAND, Wash.) Have you been called upon to arrange care for an aging parent or other loved one? If so, "it can be a blessing in disguise," says Denise Gott, CEO of ACSIA Partners, one of the nation's largest long-term care insurance agencies. "It can inspire you to plan ahead for your own care, without delay."

More Than Two Thirds of Americans Not Prepared for Disability says American Fidelity Assurance Company

Mortgage and Finance News: (OKLAHOMA CITY, Okla.) The average American Fidelity Assurance Company long-term disability is nearly three years. Even though one in five adults experiences a long-term disability, most Americans are ill-prepared to cover expenses if they are unable to work (note 1). The average American could not cover a $400 emergency without selling some of their possessions and 69 percent have less than $1,000 in savings (notes 2, 3).

Tax Tip from ACSIA Partners: 2016 Deductions Make Long-Term Care Insurance More Affordable for Many

Mortgage and Finance News: (KIRKLAND, Wash.) If you're in the market for long-term care insurance, you may be suffering from sticker shock. 'The cost may seem out of reach,' says Denise Gott. 'Many people feel this way, so they put off protecting themselves. That's a shame, because in their case, Uncle Sam may pick up part of the tab.' Gott is CEO of ACSIA Partners, one of the nation's largest long-term care insurance agencies.

Tax Puzzle: Millions Expected to Forego Deductions as High as $4,750 for Long-Term Care Insurance

Mortgage and Finance News: (KIRKLAND, Wash.) Every year tens of millions pass up a few hundred to a few thousand dollars - tax deductions for owning long-term care insurance. How come? Four sales leaders with ACSIA Partners point to psychological obstacles and suggest ways around them. ACSIA Partners is one of America's largest long-term care insurance agencies.

MasterCare, a National LTC Network Member Firm, Recommends Consumers Work with Long Term Care Insurance Specialists

Mortgage and Finance News: (OVERLAND PARK, Kan.) The National LTC Network announces its immediate past Chairman, Mike Skiens, is featured in an article on long term care planning in Kiplinger's Retirement Report (March 2014). 'Options for Covering Long-Term-Care Costs' shares strategies that can help people cover long term care costs while also keeping premiums manageable.

Evolving Tax Benefits Make Long-Term Care Planning More Attractive – Multiple Incentives Now Moderate the Cost

Mortgage and Finance News: (KIRKLAND, Wash.) LTC (Long-term care) services, which are generally not covered by Medicare or regular health insurance, can be expensive. 'Sticker shock keeps many from thinking about it,' says Ken Dehn, General Counsel for LTC Financial Partners LLC, one of the nation's most experienced long term care insurance solutions agencies.

Industry Leader Broadens Focus from Long-Term Care Insurance to Long-Term Care Solutions, Responding to Changing Consumer and Business Needs

Mortgage and Finance News: (KIRKLAND, Wash.) LTC Financial Partners, LLC (LTCFP), one of America's largest and most experienced long-term care insurance agencies announces a bold shift from its traditional focus on LTC insurance to a broad, balanced focus on multiple ways to pay for care.

ClaimJockey Increases the Likelihood of Collecting Long-Term Care Insurance Benefits by Helping Families Submit Clean Claims

Mortgage and Finance News: (KANSAS CITY, Mo.) FCF Holding today announced the results of the market test of ClaimJockey, their new long-term care insurance claims assistance service, the first of its kind in America. 'It's proving more successful than when families tackle the claims process alone,' says Wendy Rinehart, President.

Credentials and Experience are Key When Seeking Help in a Retirement Crisis

Mortgage and Finance News: (LOS ANGELES, Calif.) Retirement Planning Advisors, Inc.'s Karl Kim CFP, CLTC, is a Medi-Cal specialist who is quickly gaining a reputation for being California's 'go-to-guy' in the retirement crisis planning arena. In fact, RPA is California's first firm completely dedicated to retirement crisis planning and pre-planning.

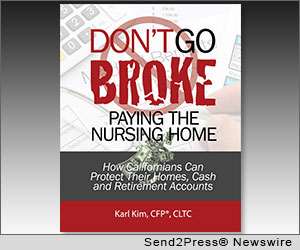

California’s Retirement Crisis Planner Offers Long-Term Care and Medi-Cal Solutions in New Book

Mortgage and Finance News: (LOS ANGELES, Calif.) According to retirement crisis expert. and author of 'Don't Go Broke Paying the Nursing Home' (ISBN: 978-0988902619), Karl Kim, CFP, CLTC; each year thousands of people are thrust into a 'care crisis' when a family member or loved one needs long-term care.