Tag: Mortgage QC

News: ACES Quality Management Launches ACES Intelligence™, Redefining Mortgage and Financial Services Quality Control with AI

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, today announced the launch of ACES Intelligence, the industry's first and only AI-powered features for quality control (QC). ACES Intelligence helps ACES customers improve quality, speed and efficiency by enhancing loan reviews, selection and compliance.

News: ACES Increases Financial Services QC Audit Volume by 15% in 2024, Expands New Client Acquisition by 66%

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has sought to support its customers through turbulent market conditions by providing critical technology innovations to its quality control audit suite.

News: ACES Quality Management Executive Vice President of Compliance, Amanda Phillips, Selected to Speak at 2024 ACUMA Annual Conference

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced its Executive Vice President of Compliance Amanda Phillips will be speaking at the American Credit Union Mortgage Association (ACUMA) Annual Conference taking place September 29 through October 2, 2024 at the Bellagio Hotel & Casino in Las Vegas.

News: ACES Quality Management Partners with Digilytics, Provider of AI-Powered Document Indexing, Categorization for QC Reviews

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced a new partnership with Digilytics to provide ACES users access to Revel, an advanced optical character recognition (OCR) technology powered by artificial intelligence (AI) and machine learning (ML).

News: ACES Quality Management Partners with Infrrd to Provide AI-Powered Intelligent Mortgage Document Processing

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced a new partnership with Infrrd to provide ACES users access to intelligent document processing. When used in conjunction with ACES Quality Management & Control software, Infrrd's technology helps lenders improve the efficiency of their quality control (QC) reviews by indexing, categorizing and reviewing the accuracy of loan file documents prior to review.

News: ACES Audit Volume Increases 24%, Hits Record High in 2023

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that, despite challenging mortgage market conditions, the company maintained a record growth path achieved over the last few years by adding more than a dozen of the leading lenders in the U.S. to its client roster in 2023.

News: ACES Quality Management unveils ACES PROTECT® mortgage compliance testing module

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announces the addition of ACES PROTECT, a suite of automated regulatory compliance tests, to its flagship ACES Quality Management & Control® quality control (QC) auditing platform.

News: ACES Quality Management Upgrades ACES CONNECT® to Enhance Communication, Collaboration on Quality Control Findings

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced it has enhanced its proprietary ACES CONNECT portal to extend its flexibility and user control capabilities. This enhancement allows ACES administrators to create custom user roles and assign permissions for those roles to fit the needs of their organization.

News: Mortgage Servicing Start-Up Valon Selects ACES Quality Management & Control to Drive QC Operations

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that mortgage lending and servicing start-up Valon has selected ACES' flagship audit platform ACES Quality Management & Control® Software to support the company's mortgage servicing quality control (QC) audits, completing implementation within 28 business days.

News: MCTlive! Lock Volume Indices: August 2022 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for August 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

News: MCTlive! Lock Volume Indices: July 2022 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for July 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

News: Loan Quality Expert Duane Gilkison to Speak at ACES ENGAGE

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has added Duane Gilkison, senior director of loan quality at Fannie Mae, to its speaker line-up for the upcoming ACES ENGAGE conference, taking place at the historic Broadmoor Hotel in Colorado Springs, May 23 - 25, 2022.

News: Maxwell Announces Launch of MaxDiligence, a Tech-Powered Due Diligence and Quality Control Service for Lenders

Mortgage and Finance News: (DENVER, Colo.) Today, leading digital mortgage platform Maxwell released MaxDiligence, a new offering that provides Due Diligence and Quality Control services for its clients. The latest feature in Maxwell's suite of tools designed for community lenders, MaxDiligence is a new scalable way to gain efficiency and generate reliable results.

News: ARMCO Launches QC NOW Web Series to Support QC Professionals

Mortgage and Finance News: (DENVER, Colo.) ACES Risk Management (ARMCO), the leading provider of enterprise quality management and control software for the lending industry, announced the launch of QC NOW, a web series covering current regulatory and operational changes related to quality control, compliance and risk for independent mortgage lenders, banks and credit unions.

News: MQMR Promotes Mabel Lee to Head of Warehouse Due Diligence, Adds Scott Weintraub to Lead Internal Audit Department

Mortgage and Finance News: (LOS ANGELES, Calif.) Mortgage Quality Management and Research, LLC (MQMR) announced today that it has promoted Mabel Lee to Warehouse Due Diligence Manager and hired Scott Weintraub as Internal Audit Manager.

News: ARMCO Reduces QC Turn Times with ACES’ New Parallel Workflow Capability

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk mitigation solutions, has announced several product enhancements to its auditing platform, ACES Audit Technology. This upgrade introduces a new parallel workflow capability that saves time and reduces turn times while maintaining the quality of staff output. The ultimate result of this feature is faster loan delivery.

News: MQMR: FNMA Updates to Selling Guide Compels Lenders to Conduct Independent Audit Reviews of QC Process Before Year’s End

Mortgage and Finance News: (LOS ANGELES, Calif.) Mortgage Quality Management and Research, LLC (MQMR) President Michael Steer reminded lenders to conduct an independent audit review of their quality control (QC) process immediately in deference to updates to "Subpart D1, Lender QC Process" of the Fannie Mae Selling Guide.

News: ARMCO’s Sharon Reichhardt Wins HW Tech Trendsetters Award

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, today announced that Sharon Reichhardt, the company's vice president of client success, has been named a winner of HousingWire's inaugural Tech Trendsetters award.

News: ARMCO Names Trevor Gauthier Chief Executive Officer

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, today announced that Trevor Gauthier has been appointed as CEO and board member of ARMCO. Avi Naider, who led ARMCO for the past 10 years as CEO, will transition to the board of directors.

News: MQMR Bolsters Executive Team with Addition of Mortgage Industry Veteran Stephen Sherman as COO

Mortgage and Finance News: (LOS ANGELES, Calif.) Mortgage Quality Management and Research, LLC (MQMR) announced today that seasoned mortgage and real estate professional Stephen Sherman has joined the firm as Chief Operating Officer. Sherman brings more than 30 years of experience in mortgage servicing, secondary marketing, warehouse lending, commercial real estate sales, corporate consulting and REO management services to his new role at MQMR, where he will be responsible for overseeing MQMR's day-to-day operations and managing the firm's long-term growth strategy.

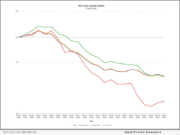

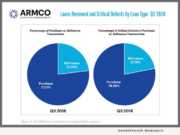

News: ARMCO Q3 2018 QC Trends Report: Defect Trends Reflect Lower Volume, Hyper-Competitive Market

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report covers the third quarter (Q3) of 2018, and provides loan quality findings for mortgages reviewed by ACES Audit Technology(TM).

News: Paladin Advisory Services Adds Mortgage Loan Quality Expert John Gray to Lead Forensic Loan File Reviews, Enhance Strategic Guidance and...

Mortgage and Finance News: (ATLANTA, Ga.) Paladin Advisory Services, LLC, is pleased to announce that mortgage loan quality subject matter expert John Gray, CFE, CAMS, has joined its team. Gray will drive Paladin's forensic loan file review programs and enhance its offerings in strategic guidance and training for mortgage lenders.

News: Waterstone Mortgage to Manage QC Audits Using TRK’s Insight RDM

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection, a leading provider of mortgage quality control and origination management solutions, announced today that Wisconsin-based Waterstone Mortgage Corporation has chosen the Insight Risk and Defect Management (RDM) platform to conduct its internal quality control (QC) audits.