Tag: Reports and Studies

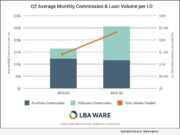

News: LBA Ware Issues Q3 2020 Mortgage Loan Originator Compensation Report, Enhances Analysis with Addition of Loan Processor Compensation Data

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of incentive compensation management (ICM) and business intelligence software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry compensation in the third quarter of 2020.

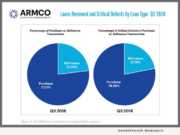

News: ACES Quality Management Q1 2020 Mortgage QC Trends Report: EPDs Rising, Critical Defect Rate Hits Three-Year Low

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management (ACES), formerly known as ARMCO and the leading provider of enterprise quality management and control software for the financial services industry, announced the release of the quarterly ACES Mortgage QC Trends Report.

News: A New Measure of Home Condition Without Inspections – Pomar Lane Completes Condition Scores for 90,000 Homes

Mortgage and Finance News: (SANTA BARBARA, Calif.) Pomar Lane, a data analytics firm specializing in real estate modeling, today completed a demonstration project that estimated condition scores for over 90 thousand homes. Home condition is represented by the Pomar Condition Score, the first measure of home condition based on advanced analytics rather than expensive inspections or appraisals.

News: Uncertainty Due to Short-Notice FHFA Directive Amplifies Harm to Borrowers

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory firm, analyzed the potential effect of Wednesday's fifty basis points worsening in prices paid by Fannie Mae and Freddie Mac for most mortgage refinances.

News: LBA Ware Issues Q2 2020 Mortgage Loan Originator Compensation Report

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of incentive compensation management (ICM) and business intelligence software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry compensation in the second quarter of 2020.

News: Patent Bots LLC Releases New Legal Rankings for Tracking Patent Quality

Mortgage and Finance News: (SOMERVILLE, Mass.) Patent Bots today announced its Patent Law Firm Quality Scores, a new ranking of 802 U.S. patent law firms with at least 50 issued patents for the year ending March 31, 2020. Patent Bots downloaded 310,842 publicly available patents from the United States Patent and Trademark Office and then used the company's AI-powered, automated patent proofreading tool to count the number of errors in each issued patent.

News: 2019 ARMCO QC Trends Report Indicates Overall Marked Improvement in Critical Defect Rate over 2018

Mortgage and Finance News: (DENVER, Colo.) ACES Risk Management (ARMCO), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report, which provides nationwide loan quality findings based on data derived from ACES Audit Technology covers both the fourth quarter (Q4) and the 2019 calendar year (CY).

News: The 2020 Black Hole Recession – COVID-19 Effect on Metro Denver Home Values

Mortgage and Finance News: (DENVER, Colo.) Clear Realty and their real estate technology division Sell-Star released today an in-depth report on how the economic freefall triggered by fear of death from COVID-19 instantly formed the 2020 Black Hole Recession and now affects Metro Denver home values and the safety of 250,000 or so families and individuals wishing to sell or buy a home over the next two-and-a-half years.

News: LBA Ware Publishes Findings of Top-10 Lender’s Compensation Automation Cost-Benefit Analysis

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of incentive compensation management (ICM) and business intelligence software solutions for the mortgage industry, today released the findings of a cost-benefit analysis quantifying one mortgage lender's expected return on investment after implementing CompenSafe.

News: Certain Lending Launches Major Survey of Real Estate Investors

Mortgage and Finance News: (SAN FRANCISCO, Calif.) Certain Lending released a national survey of real estate investors. A majority of real estate investors expect COVID-19 will cause home prices to decline up to 20%. The survey of 569 real estate investors across the U.S., conducted between April 20 and 24, is the first of its kind.

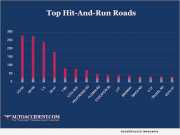

News: New Sacramento Accident Study Identifies and Maps Roads with Highest Hit-and-Run Rates

Mortgage and Finance News: (SACRAMENTO, Calif.) AUTOACCIDENT.COM - According to the AAA Foundation for Traffic safety, a hit-and run-accident occurs about 60 times per minute. 36% of hit-and-run accidents in Sacramento between 2017-2018 have resulted in injury or death.

News: Vanbridge Releases Second Comprehensive Review of US Representations and Warranties Insurance Market

Mortgage and Finance News: (NEW YORK, N.Y.) Vanbridge, an EPIC company, an insurance intermediary and program management firm, published its second edition of its U.S. Representations and Warranties Insurance (R&W) Market Review today. This edition evaluates and summarizes domestic R&W data for the years 2017, 2018 and 2019.

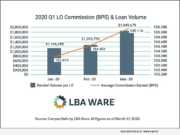

News: LBA Ware Issues Q1 2020 LO Compensation Report

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of incentive compensation management (ICM) and business intelligence software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry compensation in the first quarter of 2020.

News: Refinance Spike Drives Continued Decrease in Critical Defect Rate, According to Q3 2019 ARMCO Mortgage QC Trends Report

Mortgage and Finance News: (DENVER, Colo.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk mitigation solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report covers third quarter (Q3) 2019 and provides loan quality findings for mortgages reviewed by ACES Audit Technology™.

News: After, Inc. just launched its latest whitepaper on Warranty Marketing and Predictive Analytics

Mortgage and Finance News: (NORWALK, Conn.) After, Inc., the global leader in Warranty Services since 2005, just announced the launch of its latest whitepaper on Warranty Marketing. The whitepaper, entitled "Optimizing Warranty Marketing with Predictive Analytics" offers readers a playbook of the most effective predictive models and marketing strategies to employ in order to increase revenue and profits in their Warranty Marketing programs.

News: MPI REPORT: Wide Range of Private Market Fund Returns Could Explain Ivy Endowments’ Lackluster Fiscal 2019 Performance

Mortgage and Finance News: (SUMMIT, N.J.) Markov Processes International (MPI), a leading provider of investment research, analysis and reporting solutions for the global wealth and asset management industry, today announced the publication of its annual Ivy League endowment performance analysis for the latest fiscal year, "Measuring the Ivy 2019: Decoding the Performance Gap."

News: New Fresno Pedestrian Injury Study Maps Most Fatal Roads

Mortgage and Finance News: (VISALIA, Calif.) According to a 2018 police report, a staggering 64 percent of fatal crashes in Fresno involved a vehicle and a pedestrian. In an effort to raise awareness and reduce pedestrian fatalities, Maison Law of Visalia, California conducted a study of Fresno's most dangerous roads and intersections for pedestrians.

News: LBA Ware Releases 2019 LO Compensation Report

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of incentive compensation management (ICM) and business intelligence software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry compensation in 2019. The firm's analysis of year-over-year data from its CompenSafe ICM platform reveals compelling trends about how mortgage lenders nationwide are managing commissions for loan originators (LOs).

News: HexGn Study: Startup Investors Shun Asia in 2019 and Flock to Americas and Europe

Mortgage and Finance News: (NEW YORK, N.Y.) HexGn released a study of the funding trends in the global startup ecosystem in 2019; the team analyzed over 60,000 deals and one million data points for the report.

News: Latest ARMCO QC Trends Report Draws Correlation Between Lenders’ Profitability and Adaptability to Market

Mortgage and Finance News: (DENVER, Colo.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report covers second quarter (Q2) 2019 and provides loan quality findings for mortgages reviewed by ACES Audit Technology.

News: STRATMOR Group’s 2019 Technology Insight Study Again Scores MCT Highest for Overall Satisfaction, Lender Loyalty, and Lender Share

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that the study results from STRATMOR Group's 2019 Technology Insight Study show MCT as the industry leader in lender share, overall satisfaction, and Lender Loyalty Score(r) in the Production Pipeline Hedging category.

News: After, Inc. Publishes Latest Research on California Consumer Protection Act (CCPA) – Effective Jan. 1, 2020 – and Its Implications...

Mortgage and Finance News: (NORWALK, Conn.) After, Inc., a pioneer in the Warranty Services industry, has delivered innovative warranty marketing, analytics and program management services to top-tier manufacturers since 2005. As an industry leader, After, Inc. stays on top of regulations that may affect its manufacturing clients. The California Consumer Protection Act (CCPA) is one of these.

News: ARMCO QC Trends Report: Loan Quality Corrects with Market’s Upturn

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report covers first quarter (Q1) 2019 and provides loan quality findings for mortgages reviewed by ACES Audit Technology(TM).

News: ARMCO QC Trends Report: Defects Related to Loan Package Documentation Doubled from 2017 to 2018

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report covers both the fourth quarter (Q4) and the calendar year (CY) 2018, and provides loan quality findings for mortgages reviewed by ACES Audit Technology.

News: Showbiz Shows a Better Way to Pay: Insurance Industry Alert issued by EraNova Institute

Mortgage and Finance News: (LOS ANGELES, Calif.) Today the EraNova Institute issued a business alert: "Showbiz shows a better way to pay." EraNova's Director and author of the report, Dick Samson, says, "For non-employees in entertainment and insurance, getting the money due you has often been a chore. Now, for the likes of Tom Hanks and Lady Gaga, it's more of a breeze; and soon may be for everyone involved in insurance."

News: After, Inc. Announces Publication of ‘First of its Kind’ Study of Millennials and Extended Service Plans (ESPs)

Mortgage and Finance News: (NORWALK, Conn.) In December 2018, After, Inc. launched its "Millennials and Extended Service Plans" study, to investigate the attitudes and behavior of Millennials regarding manufacturers' product warranties and Extended Service Plans (ESPs).

News: ‘Finding Mold in a New Home’ – New Infographic Demonstrates How to Check for Mold Before It’s Too Late

Mortgage and Finance News: (PORTLAND, Ore.) Mold Inspection Sciences (MIS), one of the state's largest mold inspection and testing companies, has announced the publication of an infographic now available to view and download from the Mold Inspection Sciences website.

News: OpenClose LOS Platform, POS System and PPE Receives the Highest Overall Satisfaction and Lender Loyalty Score in STRATMOR’s New ‘Technology...

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose(R), an industry-leading multi-channel loan origination system (LOS) and digital mortgage fintech provider, announced that STRATMOR Group's most recent Technology Insight Survey ranked the company's LOS platform, point-of-sale (POS) system, and product and pricing engine (PPE) as having the highest Overall Satisfaction and Lender Loyalty Score(TM) out of any vendor surveyed in the mortgage industry.

News: ARMCO Q3 2018 QC Trends Report: Defect Trends Reflect Lower Volume, Hyper-Competitive Market

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report covers the third quarter (Q3) of 2018, and provides loan quality findings for mortgages reviewed by ACES Audit Technology(TM).

News: Mg O’Hare Law Releases White Paper on New York State’s Industrial Equipment Rental Industry for Owners and Operators

Mortgage and Finance News: (NEW YORK, N.Y.) Mg O'Hare Law, a New York Law Firm, releases white paper on New York State's Industrial Equipment Rental Market for Owners and Operators. The industrial equipment rental market is forecast to grow over the next five years to 2023. New York State is expected to outpace the rate of growth of the U.S. industry. A focus on customer retention can give operators an edge over the competition.