Tag: Washington State Business

News: Friday Harbor introduces dynamic pre-underwriting to help LOs structure deals that qualify and close

Mortgage and Finance News: (SEATTLE, Wash.) Friday Harbor, an AI pre-underwriting platform that helps loan officers assemble complete and compliant loan files in real time, today announced the launch of Income and Asset Sandbox, a new set of capabilities that allows lending teams to structure income and asset decisions in real time without committing changes prematurely or stepping outside program guidelines. The capabilities are designed to help loan officers structure deals that qualify and close earlier in the origination process.

News: Friday Harbor adds Fannie Mae’s Income Calculator to its AI Originator Assistant

Mortgage and Finance News: (SEATTLE, Wash.) Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced the integration of its AI Originator Assistant with Fannie Mae's Income Calculator. The new connection enables lenders to instantly calculate qualifying income for borrowers with self-employment or rental income and gain enforcement relief from representations and warranties on the income calculation for conventional loans.

News: Friday Harbor adds appraisal underwriting to its AI Originator Assistant

Mortgage and Finance News: (SEATTLE, Wash.) Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced that its AI Originator Assistant now performs collateral analysis alongside credit, income and asset reviews. The enhancement enables lenders to underwrite appraisals and appraisal-related documents with the same precision and consistency the platform already delivers for other loan file components.

News: Friday Harbor puts lenders in control with underwriting overlays in its AI Originator Assistant

Mortgage and Finance News: (SEATTLE, Wash.) Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced that its AI Originator Assistant can now evaluate loan files against not only baseline program guidelines, but also the lender and investor overlays that ultimately shape salability and risk. By embedding these requirements directly into the workflow of frontline originators, the platform gives lenders greater control over credit quality and secondary market execution.

News: Friday Harbor joins Community Home Lenders of America as affiliate member

Mortgage and Finance News: (SEATTLE, Wash.) Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, has joined the Community Home Lenders of America (CHLA) as an affiliate member. Friday Harbor will serve as an expert adviser to CHLA's lender members on the use of artificial intelligence in housing finance.

News: Friday Harbor announces integration with ICE Mortgage Technology’s Encompass

Mortgage and Finance News: (SEATTLE, Wash.) Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced its new integration with the Encompass® loan origination system (LOS) from ICE Mortgage Technology, part of Intercontinental Exchange, Inc. (NYSE: ICE), a leading global provider of data, technology and market infrastructure. Built using ICE's latest Developer Connect API framework for mortgage technology, the integration enables seamless use of Friday Harbor within the Encompass environment.

News: Friday Harbor adds Chris Simms, Gregory Buehler to leadership team to accelerate AI-powered mortgage origination

Mortgage and Finance News: (SEATTLE, Wash.) Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, announced two strategic hires today: Chris Simms has joined as head of strategic partnerships, and Gregory Buehler has joined as founding product manager. They bring over 35 years of combined experience in mortgage lending, product strategy and technology innovation.

News: Friday Harbor launches open APIs to give mortgage lenders and vendors more integration flexibility

Mortgage and Finance News: (SEATTLE, Wash.) Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced the availability of open APIs, giving lenders and vendors a new level of flexibility in how they integrate Friday Harbor into their mortgage tech stack.

News: Free Book Available July 11 – 13 on Amazon/Kindle on How to Get Rid of the Income Tax and Abolish...

Mortgage and Finance News: (SEATTLE, Wash.) How would you like to take home 100% of your paycheck and never pay income tax again? To learn more, get a free copy of the new book by Rich Germaine, "Tax Revolution 2.0, Let's Get Rid of the Income Tax."

News: New Book Explores Public Support for the Replacement of the Current Income Tax System

Mortgage and Finance News: (SEATTLE, Wash.) It's been 250 years since the first tax revolution. Media Arts Institute, a Seattle-based media company, has just released a new book, "Tax Revolution 2.0, Let's Get Rid of the Income Tax" (ISBN: 979-8288643385; paper) by media consultant and researcher Rich Germaine.

News: Friday Harbor unveils AI-powered condition engine to deliver faster, cleaner, audit-ready mortgage files

Mortgage and Finance News: (SEATTLE, Wash.) Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced the launch of a retooled condition engine that automatically generates actionable underwriting conditions based on borrower source documents and loan guidelines.

News: Friday Harbor raises $6M to help community mortgage lenders match the speed and efficiency of industry giants

Mortgage and Finance News: (SEATTLE, Wash.) Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced the completion of a $6 million seed round. The round was led by Abstract Ventures, a San Francisco-based venture firm with $1.5 billion in assets under management and a track record of backing breakout companies including Rippling, xAI, Hebbia, Brigit and Hippo (NYSE: HIPO) and Mischief, an early-stage VC fund co-founded by Plaid CEO Zach Perret.

News: Asset Defense Team and Vast Solutions Group Announce a New Joint Venture for Asset Protection and Tax Strategy

Mortgage and Finance News: (SEATTLE, Wash.) Asset Defense Team and Vast Solutions Group (VastSolutionsGroup.com) are pleased to announce their joint venture, VastAssetDefense.com. This partnership brings together two leading companies in the asset protection and tax strategy industry, combining their expertise and resources to provide top-quality services to clients around the globe. The alliance is introducing an advanced AI platform called "Einstein" and is currently in Beta 4.0 and is also introducing a community called Vast Vault.

News: iEmergent CEO Laird Nossuli to present at Seattle’s inaugural Black Homeownership Symposium on January 26

Mortgage and Finance News: (SEATTLE, Wash.) iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced that its CEO Laird Nossuli will present at Seattle's inaugural Black Homeownership Symposium on January 26. Dr. Courtney Johnson Rose, president of the National Association of Real Estate Brokers (NAREB), one of the oldest minority trade associations in the nation and its foremost network of Black real estate professionals, will unveil the findings of the first-ever Washington state edition of the State of Housing in Black America (SHIBA) report.

News: Timber Ridge at Talus, a thriving senior living community in the Cascade Mountain foothills, makes living a quality 100-year life...

Mortgage and Finance News: (ISSAQUAH, Wash.) Timber Ridge at Talus, a thriving 62+ community, announced that despite the life expectancy decline in the U.S. during the last several years, largely due to COVID, the number of centenarians is increasing at the same time, which means many will be planning for the 100-year life in 2023.

News: Asset Defense Team and Vast Solutions Group Do Joint Venture

Mortgage and Finance News: (SEATTLE, Wash.) Asset Defense Team and Vast Solutions Group, Inc. are pleased to announce their joint venture, AssetDefenseAdv.com. This partnership brings together two leading companies in the asset protection and tax strategy industry, combining their expertise and resources to provide top-quality services to clients around the globe. The advanced platform is called "Einstein" and is currently in Beta 1.0.

News: Spokane Association of REALTORS® rolls out Down Payment Resource to help subscribers connect homebuyers with down payment assistance

Mortgage and Finance News: (SPOKANE, Wash.) The Spokane Association of REALTORS (SAR) today announced that it has partnered with Down Payment Resource (DPR) to provide its 2,500 MLS subscribers with access to DPR's toolset that helps real estate agents connect clients with programs that can help save on down payments and closing costs.

News: Knowledge Coop Appoints Brian Paine as Director of Technology

Mortgage and Finance News: (VANCOUVER, Wash.) Knowledge Coop, the industry's top online compliance training and virtual work platform, today announced it has hired Brian Paine as Director of Technology. His responsibilities at Knowledge Coop include maintaining a stable working environment for all of Knowledge Coop's technical operations.

News: Report: Over One Quarter of All Mileage Reimbursement Claims Are Overreported

Mortgage and Finance News: (ISSAQUAH, Wash.) According to internal data gathered by TripLog, a leading enterprise mileage and expense tracking solution, over 1/4 (nearly 30%) of all mileage is overreported, which could potentially cost businesses millions of dollars per year in fraudulent reimbursements.

News: Agent Review Announces Technology Awareness Series for Insurance Agents – Leonardo247 Leads Launch

Mortgage and Finance News: (BELLEVUE, Wash.) Agent Review which serves insurance agents and those needing insurance, announces the creation of the Technology Awareness series. These informational alerts can make agents significantly more valuable to their clients, according to Bryan Foos, Agent Review's Operations Manager.

News: MyKabin Officially Completes Its First Backyard Cottage as Seattle Detached ADU (DADU) Landscape Shifts

Mortgage and Finance News: (SEATTLE, Wash.) MyKabin, a Seattle construction firm specializing in making it easier, faster and less expensive for homeowners to build a personalized and sustainable detached accessory dwelling unit, just completed its first backyard cottage build at a Madison Valley home.

News: MyKabin Launches in Seattle – Brings Affordable Backyard Cottages to Western Washington

Mortgage and Finance News: (SEATTLE, Wash.) Now residents of Western Washington have access to affordable backyard living space with the launch of MyKabin, a new construction firm specializing in backyard cottages. MyKabin has reimagined the construction process by focusing on creating a beautiful, prefabricated cottage with a minimally disruptive installation process that saves homeowners time, money, and the hassle of a lengthy construction project.

News: VLP Law Group Continues Its Growth with the Addition of Patent Attorney Jim White

Mortgage and Finance News: (PALO ALTO, Calif.) VLP Law Group LLP ('VLP') is pleased to announce that patent attorney Jim White has joined the firm's Intellectual Property Practice Group as a partner based in Seattle, Washington. Prior to becoming a software patent attorney, Mr. White worked as a software engineer in Silicon Valley for over six years.

A Prime Time to Plan for Long-Term Care for Yourself Is After Arranging It for A Loved One, says ACSIA Partners

Mortgage and Finance News: (KIRKLAND, Wash.) Have you been called upon to arrange care for an aging parent or other loved one? If so, "it can be a blessing in disguise," says Denise Gott, CEO of ACSIA Partners, one of the nation's largest long-term care insurance agencies. "It can inspire you to plan ahead for your own care, without delay."

TrumpCare Won’t Help: As America Ages, Long-Term Care Costs Could Overwhelm Families

Mortgage and Finance News: (KIRKLAND, Wash.) The number of Americans age 65 and older is on track to double -- from 46 million now to over 98 million in 2060, when today's 20-somethings will be turning 65. At that time the 65-plus age group's share of the population will have jumped to 24-percent from 15-percent today. "Think of it," says Denise Gott, CEO of ACSIA Partners, "one in four of us will be in the older group, at high risk of needing long-term care."

It Can Be Easier to Plan for Long-Term Care if We Face Our Personal Concerns Up Front, says ACSIA

Mortgage and Finance News: (KIRKLAND, Wash.) Last year the U.S. Department of Health & Human Services issued a report about Americans' concerns and actions related to long-term care (LTC), also referred to as long-term services and supports (LTSS). "The main takeaway was not the particulars of the responses, in our view," says Denise Gott, CEO of ACSIA Partners. "It was the fact that participants considered and faced the issues."

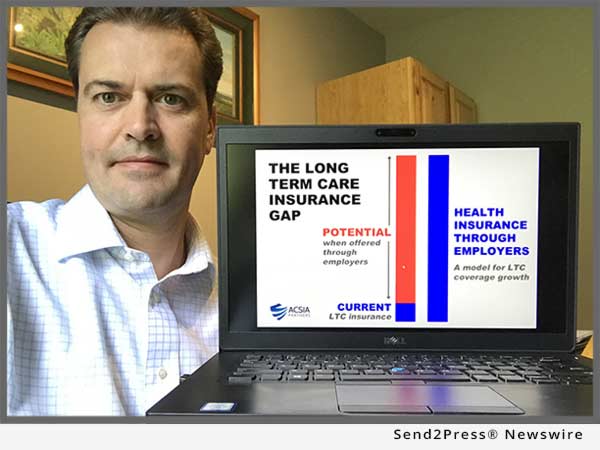

James Dettman, a veteran of the insurance and employee benefits industries, has joined ACSIA Partners LLC

Mortgage and Finance News: (KIRKLAND, Wash.) James Dettman, a veteran of the insurance and employee benefits industries, has joined ACSIA Partners, one of America's largest long-term care insurance agencies. He will serve as one of four Worksite Sales Directors.

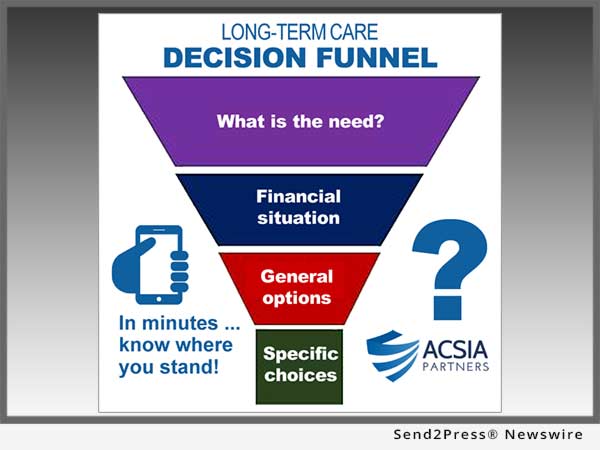

Quick and Easy Long-Term Care Choices: ACSIA Partners Offers Decision Funnel

Mortgage and Finance News: (KIRKLAND, Wash.) Many Americans spend hours investigating long-term care options online, only to come away confused and dispirited. Now there's another way to go. It's a by-phone Decision Funnel designed to cut through the complexity. Offered by ACSIA Partners, the service will be delivered by real human specialists, not phone robots.

It’s Tax Time, and Millions Could Miss Sizeable Deductions for Long-Term Care Insurance, ACSIA Partners Says

Mortgage and Finance News: (KIRKLAND, Wash.) If you're considering long-term care insurance, or already have a policy, "Tax time is a good time to look for help from Uncle Sam," says Denise Gott, CEO of ACSIA Partners, one of the nation's largest long-term care insurance agencies. "And the help you get could be more than negligible."

Five Reasons to Give Yourself the Holiday Gift of Long-Term Care Insurance

Mortgage and Finance News: (KIRKLAND, Wash.) If you're 50-plus, Denise Gott has some holiday advice for you. 'Consider giving yourself the gift of long-term care insurance,' she says. 'It just might lift your spirits during the gift-giving season.' Gott is CEO of ACSIA Partners, a leader in long-term care planning.