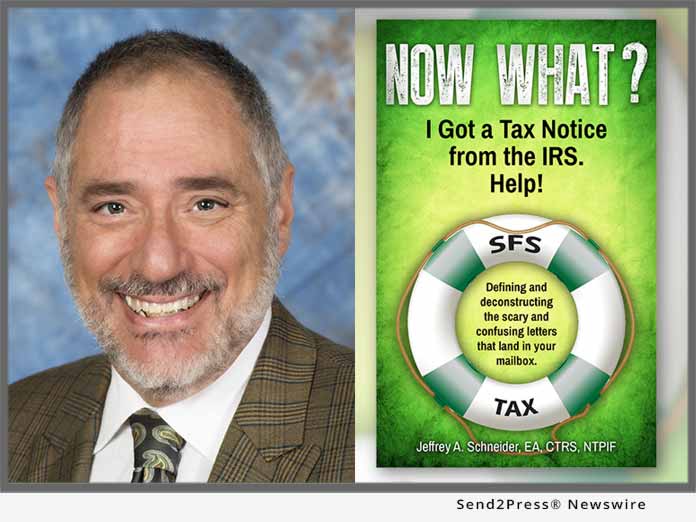

SFS Tax Problem Solutions Press announces the release of “Now What? I Got a Tax Notice from the IRS. Help!” (ISBN: 978-0692997154) by Jeffrey Schneider. “Now What?” is available nationwide today in paperback. It will be published in an eBook edition in March and an audio book edition in June 2018. Schneider defines and deconstructs the scary and confusing letters in a fashion that mixes attention to detail with humor and an intricate clarification of what-is-what in the world of the IRS.

STUART, Fla. /Mortgage and Finance News/ — SFS Tax Problem Solutions Press announces the release of “Now What? I Got a Tax Notice from the IRS. Help!” (ISBN: 978-0692997154) by Jeffrey Schneider. “Now What?” is available nationwide today in paperback. It will be published in an eBook edition in March and an audio book edition in June 2018.

In the new book, “Now What? I Got a Tax Notice from the IRS. Help!” Jeffrey Schneider defines and deconstructs the scary and confusing letters in a fashion that mixes attention to detail with humor and an intricate clarification of what-is-what in the world of the IRS.

“The idea of receiving a letter from the IRS is not a pleasant one for anyone. What makes it worse is the confusion, the fear, the assumptions and the thoughts of all the worst-case scenarios that can make you feel like you have a tidal wave of stress,” says Schneider.

Written by Jeffrey Schneider, an Enrolled Agent, Certified Tax Resolution Specialist and a National Tax Practice Institute Fellow, “Now What? I Got a Tax Notice from the IRS. Help!” defines and deconstructs the scary and confusing letters that land in your mailbox, details how there is life, sanity, and even money after receiving a notice.

“You have choices and you do have some control. The IRS is not always correct! Even if you owe more than you can pay, there are other options,” Schneider explains.

Jeffrey Schneider, EA, CTRS, NTPI Fellow has the knowledge and expertise to help you reach a favorable outcome with the IRS. He is the head honcho at SFS Tax & Accounting Services as well as the Enrolled Agent and Certified Tax Resolution Specialist for SFS Tax Problem Solutions. Schneider was recently appointed to the Internal Revenue Service Advisory Council (IRSAC).

In the book, Jeffrey provides instruction, enlightenment, and answers questions on such topics as: How do I pay the IRS what I don’t have? Can you really start over and get a second chance? as well as What can a tax professional do for you that an online program can’t?

According to Schneider, “With life preserving tips and sanity maintaining directions, this guide is your life preserver to hold on to while you read those notices that give you that sinking feeling. So, when you get that notice, you don’t have to panic, you don’t have to drown in stress or worry and you will have a brief understanding of the best steps to achieve the best results as you head toward dry land.”

From the common to the not so common notices, to what you can do about them and the different types of professionals as well as the different types of credentials that make the difference in correcting or resolving your specific situation.

“The all-encompassing advice: Tax debt is not something to ignore. The IRS has a long memory. They will not forget. And the longer you wait to take care of the problem, the harder and more costly it will be,” says Schneider.

For more information about Jeffrey Schneider, visit: https://sfstaxproblemsolutions.com/ or http://sfstaxacct.com/.

BOOK SUMMARY:

– Title: “Now What? I Got a Tax Notice from the IRS. Help!”?

– Author: Jeffrey Schneider.

– Publisher: SFS Tax Problem Solutions Press.

– ISBN: 978-0692997154; paperback, 6×9; 216pp; $9.97.

– eBook: March 2018

– Audio book: June 2018.

VIDEO (YouTube):

https://youtu.be/cxHj9P9G2FQ

Learn More: https://sfstaxproblemsolutions.com/

This version of news story was published on and is Copr. © 2018 Mortgage & Finance News™ (MortgageAndFinanceNews.com) – part of the Neotrope® News Network, USA – all rights reserved.

Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.