News: Top of Mind Lead Project Manager Maggie Mae Named 2020 HousingWire Rising Stars Award Honoree

Mortgage and Finance News: (ATLANTA, Ga.) Top of Mind Networks (Top of Mind), a leader in customer relationship management (CRM) and marketing automation software for the mortgage lending industry, today announced that Lead Project Manager Maggie Mae has been named a recipient of HousingWire's 2020 Rising Stars award. Now in its seventh year, the HW Rising Stars award program honors the housing industry's most influential professionals aged 40 and under.

News: Evaluations and Defense Testimony Expert, Dr. Jeffrey Freiden, Currently Offering a No-Fee Phone Consultation for Attorneys

Mortgage and Finance News: (MEMPHIS, Tenn.) For more than 20 Years, Dr. Jeffrey Freiden has provided pre-sentence and post-sentence evaluations for defense attorneys and their clients. Dr. Freiden is also an expert in courtroom testimony and has been engaged by numerous law firms in multiple states.

News: Amid Ongoing Work-From-Home Requirements, DocMagic Provides its eSign Technology at Zero Cost to Boost Employee Productivity

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced it has made an agnostic version of its eSign technology available for free in order to help organizations increase productivity, efficiency and compliance among work-from-home employees during COVID-19 stay-at-home orders as well as after they are lifted.

News: The 2020 Black Hole Recession – COVID-19 Effect on Metro Denver Home Values

Mortgage and Finance News: (DENVER, Colo.) Clear Realty and their real estate technology division Sell-Star released today an in-depth report on how the economic freefall triggered by fear of death from COVID-19 instantly formed the 2020 Black Hole Recession and now affects Metro Denver home values and the safety of 250,000 or so families and individuals wishing to sell or buy a home over the next two-and-a-half years.

News: AutoAccident.com: As Lawsuits Mount, Johnson & Johnson Ends Sales of Talc-Based Baby Powder in the U.S.

Mortgage and Finance News: (SACRAMENTO, Calif.) AutoAccident.com: After a century of selling baby powder, Johnson & Johnson has decided to pull the plug on further sales of its talc-based product. Sales will officially end in the U.S. and Canada after supplies already on the shelf run out.

News: COVID-19 and the Increasing Number of Uninsured Drivers – How to Protect Yourself by AutoAccident.com

Mortgage and Finance News: (SACRAMENTO, Calif.) AutoAccident.com: With the unemployment rate at sky-high levels since the pandemic hit, many families are faced with difficult economic choices. For some that may mean having to choose between paying rent or continuing to pay for car insurance.

News: TeamSnap Raises $5.5 Million in Funding as Sports Activities Begin to Resume

Mortgage and Finance News: (BOULDER, Colo.) TeamSnap, the leader in sport management technology, announced today a $5.5 million convertible notes financing led by Foundry Group and Bolt Ventures. The funding comes as TeamSnap prepares for sports activities to return after the global shutdown.

News: ARMCO Launches QC NOW Web Series to Support QC Professionals

Mortgage and Finance News: (DENVER, Colo.) ACES Risk Management (ARMCO), the leading provider of enterprise quality management and control software for the lending industry, announced the launch of QC NOW, a web series covering current regulatory and operational changes related to quality control, compliance and risk for independent mortgage lenders, banks and credit unions.

News: NotaryCam Offers Free RON Services for Current, Retired Military Members over Memorial Day for Its ‘Help a Hero’ Initiative

Mortgage and Finance News: (NEWPORT BEACH, Calif.) NotaryCam, the pioneering leader in online notarization and original provider of mortgage eClosing solutions, today announced that it would once again offer free remote online notarization (RON) sessions to United States veterans and current service members over the Memorial Day holiday weekend as part of its semi-annual "Help a Hero" initiative.

News: Structured Settlement Factoring Company Launches New Website to Better Serve Customers

Mortgage and Finance News: (NEW YORK, N.Y.) Strategic Capital has launched a new website. With this newly revamped web presence, they give people the opportunity to learn more about how they can maximize payout options for structured settlements, lottery winnings, casino winnings, and more.

News: Lowden Street Capital Announces Acquisition of Southern Air Custom Interiors, Inc.

Mortgage and Finance News: (ALEXANDER CITY, Ala.) Lowden Street Capital, a private equity firm focused on rural market investing, acquired Southern Air Custom Interiors, Inc., an upholstery company out of Haleyville, Ala. that focuses on custom aircraft interiors, on April 30, 2020.

News: SROA Capital Pays Quarterly Distributions – Sees Market Opportunity Ahead

Mortgage and Finance News: (WEST PALM BEACH, Fla.) SROA Capital, LLC ("SROA"), a West Palm Beach-based vertically-integrated real estate investment management firm with $1 billion of assets under management and owner/operator of Storage Rentals of America, announced today that it has paid its first quarter distribution.

News: LBA Ware Publishes Findings of Top-10 Lender’s Compensation Automation Cost-Benefit Analysis

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of incentive compensation management (ICM) and business intelligence software solutions for the mortgage industry, today released the findings of a cost-benefit analysis quantifying one mortgage lender's expected return on investment after implementing CompenSafe.

News: Global DMS offers unique Compliance Guarantee Program for EVO Appraisal Management Software

Mortgage and Finance News: (LANSDALE, Pa.) Global DMS, a leading provider of cloud-based appraisal management software, announced that it has launched a new Compliance Guarantee Program for those that utilize its EVO-Res appraisal management platform, which covers all fines in the event that a client is found out of compliance, but is using the software's Best Practice Configuration.

News: ARMCO Expands Integrated Third-Party Vendor Offerings Within ACES Audit Technology

Mortgage and Finance News: (DENVER, Colo.) ACES Risk Management (ARMCO), the leading provider of enterprise quality management and control software for the lending industry, announced several major enhancements to its ACES Audit Technology platform to aid lenders' loan defect categorization and post-closing quality control efforts.

News: SimpleNexus advances initial release of Closing Portal to help lenders meet urgent consumer demand for mobile mortgage closing solutions

Mortgage and Finance News: (LEHI, Utah) SimpleNexus, developer of the leading digital mortgage platform for loan officers, borrowers and real estate agents, today announced the release of the SimpleNexus Closing Portal, a new feature that enables lenders to securely collaborate with settlement service providers for streamlined closing package delivery and will pave the way for hybrid mortgage closings.

News: Veteran B2B Sales Leader Nick Belenky Joins Top of Mind as EVP of Sales

Mortgage and Finance News: (ATLANTA, Ga.) Top of Mind Networks (Top of Mind), a leader in customer relationship management (CRM) and marketing automation software for the mortgage lending industry, has hired veteran business-to-business sales leader Nick Belenky as executive vice president of sales. In this role, Belenky will direct Top of Mind's sales operations with a focus on client success and new customer acquisition.

News: Digital Mortgage Provider Maxwell Extends Product Offering with New Fulfillment Platform

Mortgage and Finance News: (DENVER, Colo.) Digital mortgage provider Maxwell today announced a new way for small and midsize lenders to scale processing capacity to meet market needs through the launch of the Maxwell Fulfillment Platform.

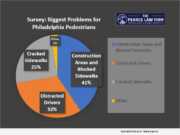

News: New Philadelphia Pedestrian Fatality Study Highlights Accident Statistics and Community Response

Mortgage and Finance News: (PHILADELPHIA, Pa.) The Pearce Law Firm, Personal Injury and Accident Lawyers P.C. has a new pedestrian fatality study which highlights accident statistics and community response. Accidents involving pedestrians resulting in serious injuries or fatalities are on the rise in Philadelphia.

News: VDC Display Systems Selected for MMD Program

Mortgage and Finance News: (COCOA, Fla.) Video Display Corporation (OTC:VIDE) is pleased to announce that its VDC Display Systems subsidiary has been awarded a significant contract by a major US defense contractor for the delivery of its next generation Multi Mission Display (MMD) rugged display line.

News: NEXT™ Team Adds Staff to Expand Digital Footprint

Mortgage and Finance News: (EDMOND, Okla.) NEXT Mortgage Events LLC (NEXT™), creator of NEXT women's executive mortgage summit and NEXTMortgageNews.com, has announced that it has added two key positions to support the expansion of its digital footprint.

News: Dr. Thomas T. Nagle Joins Sturbridge Growth Partners as Advisory Partner

Mortgage and Finance News: (MEDFIELD, Mass.) Sturbridge Growth Partners, a boutique management consulting firm dedicated to driving profitable growth for clients through innovative approaches to pricing and value management, announced today that Tom Nagle has joined the company as an Advisory Partner.

News: The Devil is in the Details: Black-owned BWC Capital Works to Demystify Federal Stimulus PPP Loan Forgiveness

Mortgage and Finance News: (GREENSBORO, N.C.) Black-owned North Carolina-based investment firm, BWC Capital secured a Payroll Protection Program (PPP) forgivable small business loan during the first round of available funds several weeks ago.

News: ARMCO Launches ACESXPRESS for Early Payment Defaults

Mortgage and Finance News: (DENVER, Colo.) ACES Risk Management (ARMCO), the leading provider of enterprise quality management and control software for the lending industry, announced the release of ACESXPRESS for Early Payment Defaults (EPDs) to bolster lenders' existing audit programs in light of the recent increases in required monthly EPD audit volume.

News: Senior Kit Estate Planning: Will, Power of Attorney, Healthcare Agent, Living Will

Mortgage and Finance News: (AVENTURA, Fla.) Elder Solutions Law Firm, PA has released a new service for Seniors in response to COVID-19. The service is called the Senior Kit, and it focuses on basic estate planning for seniors.

News: Top of Mind wins eight international Hermes Awards for SurefireCRM’s creative videos that help mortgage lenders engage prospects and customers

Mortgage and Finance News: (ATLANTA, Ga.) Top of Mind Networks (Top of Mind), a leader in customer relationship management (CRM) and marketing automation software for the mortgage lending industry, was recognized with four platinum and four gold awards for outstanding corporate marketing in the 2020 Hermes Creative Awards.

News: Altavera Founder Brian Simons joins Maxwell executive team

Mortgage and Finance News: (DENVER, Colo.) Digital mortgage leader Maxwell has announced Altavera Mortgage Services founder and former CEO Brian Simons has joined the company as president. Simons comes to Maxwell with 23 years of experience in the mortgage industry, including capital markets, loan origination and default management.

News: Innovation Technology Award Goes to OpenClose Loan Origination System

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose the industry-leading omni-channel loan origination system (LOS) and digital mortgage fintech provider, announced that it received PROGRESS in Lending Association's 2020 Innovation Award for its "truly game-changing solutions in the mortgage space."

News: Bank of Southern California NA Funds More Than $487.8 Million in PPP Loans

Mortgage and Finance News: (SAN DIEGO, Calif.) Bank of Southern California, N.A. (OTC Pink: BCAL), a community business bank headquartered in San Diego, announced today that it has funded more than $487.8 million in Paycheck Protection Program (PPP) loans. These results, as of 9:30 p.m. PDT on May 7, 2020, provided 1,940 local businesses affected by the Coronavirus (COVID-19) with critical financing to retain or restore jobs for 51,523 individuals.

News: KROST CPAs & Consultants Provides Much-Needed Help to Businesses Affected by the Economic Downturn Caused by the COVID-19 Pandemic

Mortgage and Finance News: (LOS ANGELES, Calif.) Los Angeles-based firm, KROST CPAs & Consultants, has launched several programs to assist businesses during the Coronavirus pandemic. Since April 2020, the firm has assisted hundreds of businesses and individuals through the development of COVID-19 resources.