News: Click n’ Close Chief Operations Officer Kara Lamphere Selected in Mortgage Women Magazine’s Annual Mortgage Star Award Program

Mortgage and Finance News: (ADDISON, Texas) Click n' Close, a multi-state mortgage lender serving consumers and mortgage originators through its wholesale and correspondent channels, today announced Kara Lamphere has been named a Mortgage Star in Mortgage Women Magazine's annual awards program.

News: MMI’s VP of Strategic Partnerships Heidi Iverson Named a Mortgage Star in Mortgage Women Magazine’s Annual Award Program

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced Heidi Iverson, vice president of strategic partnerships, has been named a Mortgage Star by Mortgage Women Magazine.

News: Falling Home Prices and Purchase Mortgage Locks Reveal a Stagnant Late-Spring Housing Market

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today released its June 2024 Market Advantage mortgage data report, which revealed a stagnant late-spring housing market as home prices dropped for the first time in 2024 and purchase lock counts fell 8% over the previous year. All mortgage lock figures in this news release have been controlled for fewer market days in June.

News: Informative Research Adds Brandon Hall as New EVP of Operations

Mortgage and Finance News: (GARDEN GROVE, Calif.) Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, has named Brandon Hall as its new executive vice president (EVP) of operations. Hall brings over 20 years of experience driving operational excellence within the financial services sector and is known for implementing innovative process improvements, fostering cross-functional collaboration and leading through change.

News: Dovenmuehle’s Bernadette McDonnell named 2024 Mortgage Star Award Winner by Mortgage Women Magazine

Mortgage and Finance News: (LAKE ZURICH, Ill.) Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading mortgage subservicing company, announced today that Vice President Bernadette McDonnell has been selected by Mortgage Women Magazine for its 2024 Mortgage Star Award. McDonnell was chosen for her significant contributions to the industry and dedication to Dovenmuehle over the past four decades.

News: Vice Capital Markets Launches Integration with Fannie Mae Mission Score API

Mortgage and Finance News: (NOVI, Mich.) Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today it has integrated the Fannie Mae® Mission Score application programming interface (API) into its trading portal, allowing current clients to take advantage of pricing and best execution decisions to improve gain-on-sale.

News: Eighteen homebuyer assistance programs offering up to $117,000 are available to help people with disabilities and family caregivers purchase or...

Mortgage and Finance News: (ATLANTA, Ga.) In celebration of Disability Pride Month in July, Down Payment Resource (DPR) is highlighting 18 U.S. homebuyer assistance programs that are specifically designed to support people with disabilities and their family caregivers on their journey toward homeownership. While people with disabilities may be eligible for any of the 2,300-plus U.S. homebuyer assistance programs in DPR's database, 18 are specifically developed to promote accessibility and inclusivity for aspiring homeowners with disabilities.

News: Floify’s President and General Manager Sofia Rossato named to 2024 HousingWire Women of Influence and Inman Best in Finance lists

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that Sofia Rossato, its president and general manager, has received two new honors, being named to HousingWire's Women of Influence and Inman's Best in Finance list. The Inman award is the second in a row for Rossato.

News: Down Payment Resource expands team to keep pace with a rising number of DPA programs and increasing demand

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, today announced the addition of three new team members to support growing demand

News: The Mortgage Collaborative Advocates for Lender Concerns at Federal Housing Agencies During June DC Visits

Mortgage and Finance News: (WASHINGTON, D.C.) The Mortgage Collaborative (TMC) hosted its second Advocacy Committee trip to Washington, DC June 4-6, 2024, with 13 of its IMB and depository Lender Members meeting with key federal agencies, including the Consumer Financial Protection Bureau (CFPB), the U.S. Department of Housing and Urban Development (HUD), Ginnie Mae, Federal Housing Finance Agency (FHFA), Fannie Mae, and Freddie Mac to discuss the impact of recent and upcoming policy changes on small to mid-size lenders.

News: MCT Integrates with Fannie Mae’s Mission Score API and New Product Grids to Empower Originators to Take Advantage of Market...

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced the launch of new integrations with Fannie Mae's Mission Score application programming interface (API) and Mission Score 2 and 3 product grids that provide better transparency and pricing for mortgages aligned with Fannie Mae's mission objectives.

News: Optimal Blue Launches Competitive Data License to Help Lenders Optimize Margins With Competitive Loan Pricing Data

Mortgage and Finance News: (PLANO, Texas) Optimal Blue announced the release of Competitive Data License, a collection of key national mortgage pricing data that enables lenders to price products competitively, operate more profitably, and react swiftly to changing market conditions. Competitive Data License draws upon direct-source loan data from the Optimal Blue PPE, which is used to price and lock over 35% of loans in the United States.

News: Dark Matter Technologies’ Richard Gagliano honored with the 2024 Inman Best of Finance award

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative leader in mortgage technology backed by time-tested loan origination software and leadership, today announced that Inman has recognized its CEO Richard Gagliano with the 2024 Best of Finance award. Now in its second year, the award celebrates 150 innovative professionals demonstrating exceptional leadership and impact in the real estate, mortgage and finance sectors. Honorees are hand-selected by Inman's editorial team.

News: Floify brings its industry-leading point-of-sale technology to The Mortgage Collaborative as a preferred partner

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that it has joined The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry. As a member of TMC's Preferred Partner Network, Floify will provide its intuitive lending platform for mortgage lenders at a discounted rate to TMC members.

News: Critical Defect Rate Declines Five Straight Quarters, Ending 2023 at 1.53%, Per ACES Mortgage QC Industry Trends Report

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) and calendar year (CY) of 2023. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

News: Argyle’s Shmulik Fishman named an Inman Best of Finance award honoree

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Shmulik Fishman, CEO of Argyle, a platform providing real-time income and employment verifications for some of the largest lenders in the United States, has been named to Inman's 2024 Best in Finance list. Now in its second year, the award honors professionals hand-selected by Inman's editorial team for their role in shaping the mortgage and financial services industries through leadership and commitment to innovation.

News: Secured Signing Scales Up with Strategic Leadership and Global Expansion

Mortgage and Finance News: (MOUNTAIN VIEW, Calif.) Secured Signing, a leading provider of secure Digital Signatures and Remote Online Notarization platform, today announced a significant growth, fueled by a visionary leadership change and strategic team expansion.

News: Dovenmuehle’s Above Average Residential Mortgage Loan Primary Servicer Ranking Affirmed by S&P Global Rankings

Mortgage and Finance News: (LAKE ZURICH, Ill.) Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading mortgage subservicing company, announced today that Standard & Poor's Global Ratings (S&P) has affirmed its Above Average ranking of Dovenmuehle as a residential mortgage loan primary servicer with a stable outlook. For 13 consecutive years, Dovenmuehle has consistently received an Above Average ranking from S&P.

News: MCT and Lender Price Join Forces to Improve Mortgage Pricing with Loan-Level MSR Values

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading (MCT®), the de facto leader in innovative mortgage capital markets technology, and Lender Price, the first cloud-native provider of mortgage pricing technology, have partnered to provide mortgage lenders using the Lender Price product and pricing engine (PPE) with loan-level MCT MSR values. MCT's industry-leading mortgage servicing rights (MSR) grids allow Lender Price PPE clients to be more granular, profitable, and efficient when generating their front-end borrower pricing and managing their MSR portfolio.

News: Mortgage Interest Rate Sensitivity Triggers 25% Spike in May Rate-and-Term Refinance Activity

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today released its May 2024 Market Advantage mortgage data report, which revealed a 25.6% month-over-month (MoM) spike in rate-and-term mortgage refinances. The spike was a response to a modest drop in the Optimal Blue Mortgage Market Indices (OBMMI) 30-year conforming rate, which ended the month at 7.02%.

News: MCT Reports A 7% Mortgage Lock Volume Increase In Latest Indices Report

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an increase of 6.78% in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

News: Optimal Blue Names Joe Tyrrell Chief Executive Officer

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today announced the appointment of Joe Tyrrell as CEO. Tyrrell succeeds interim CEO Scott Smith of Optimal Blue's parent company, Constellation Software Inc. Tyrrell brings over 25 years of experience in the mortgage, finance, and technology industries to Optimal Blue.

News: CapitalW Collective: Educating, Elevating, and Empowering Women in Mortgage Capital Markets

Mortgage and Finance News: (SAN DIEGO, Calif.) CapitalW Collective (CapitalW), the glass shattering non-profit benefiting women and their allies in mortgage capital markets, today announced its successful debut within the mortgage industry. Officially launched on May 1, 2024, CapitalW made its first appearance at the Mortgage Bankers Association Secondary and Capital Markets Conference in New York May 19-21.

News: Argyle CEO Shmulik Fishman honored as a 2024 Tech All-Star by Mortgage Bankers Association

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing real-time income and employment verifications for some of the largest lenders in the United States, today announced its CEO Shmulik Fishman has been named a 2024 Tech All-Star by MBA NewsLink, a publication of the Mortgage Bankers Association (MBA). The award celebrates mortgage industry leaders who have made outstanding contributions to mortgage technology.

News: Click n’ Close to Receive Top Lender Award at USDA’s Single Family Housing Guaranteed Loan Program Ceremony

Mortgage and Finance News: (ADDISON, Texas) Click n' Close, a multi-state mortgage lender, today announced that it will be honored with a top lender award at the United States Department of Agriculture's Single Family Housing Guaranteed Loan Program ceremony. This recognition underscores Click n' Close's commitment to fostering homeownership and supporting community development through innovative loan programs.

News: American Pacific Mortgage Picks Fee Chaser by LenderLogix to Collect Upfront Borrower Fees

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, recently announced the addition of American Pacific Mortgage to its roster of clients utilizing Fee Chaser. Employing Fee Chaser enables American Pacific Mortgage to efficiently and compliantly collect initial mortgage-related fees from borrowers.

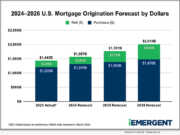

News: iEmergent’s 2024-2026 U.S. Mortgage Origination Forecast is now available in Mortgage MarketSmart

Mortgage and Finance News: (DES MOINES, Iowa) iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the availability of its 2024-2026 U.S. Mortgage Origination Forecast. Updated to reflect preliminary 2023 Home Mortgage Disclosure Act (HMDA) data released by the Federal Financial Institutions Examination Council in March, iEmergent's latest projections call for modest growth in purchase originations and a gradual increase in refinance loan units and dollars as a percentage of total originations.

News: Floify’s head of marketing Courtney Dodd named to HousingWire’s 2024 Marketing Leaders list

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that its Head of Marketing, industry veteran Courtney Dodd, has been named to HousingWire's 2024 Marketing Leaders list. The award celebrates the industry's most creative and influential marketing minds who have demonstrated a track record of transforming brands, leading teams and driving business results.

News: Dark Matter Technologies VP of Marketing Wes Horbatuck honored as HousingWire Marketing Leader

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative leader in mortgage technology backed by time-tested loan origination software and leadership, today announced that its vice president of marketing, Wes Horbatuck, has been honored by HousingWire as one of its 2024 Marketing Leaders.

News: Dovenmuehle announces strategic business development promotions to support demand for its mortgage subservicing offerings

Mortgage and Finance News: (LAKE ZURICH, Ill.) Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading residential mortgage subservicer, announced two promotions within its business development team - Anna Krogh to Senior Vice President and Director of Business Development and Chris Torres to Vice President of Business Development and Manager of the Western Region.