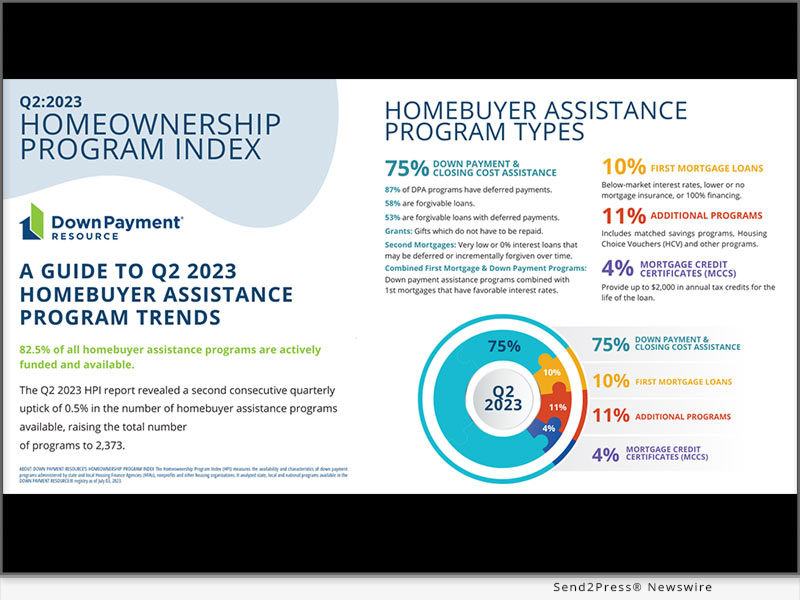

Down Payment Resource (DPR), the housing industry’s leading technology for connecting homebuyers with homebuyer assistance programs, issued its Q2 2023 Homeownership Program Index (HPI). The firm’s analysis revealed a second consecutive quarterly uptick of 0.5% in the number of homebuyer assistance programs available to help people finance homes, raising the number of programs to 2,373.

Report shows increased program acceptance of multifamily and manufactured homes as agencies seek to expand inventory options for LMI homebuyers

ATLANTA, Ga. /Mortgage and Finance News/ — Down Payment Resource (DPR), the housing industry’s leading technology for connecting homebuyers with homebuyer assistance programs, issued its Q2 2023 Homeownership Program Index (HPI). The firm’s analysis revealed a second consecutive quarterly uptick of 0.5% in the number of homebuyer assistance programs available to help people finance homes, raising the number of programs to 2,373.

Key Findings

An examination of the 2,373 homebuyer assistance programs that were active as of July 3, 2023, resulted in the following key findings:

* Growth in programs that expand inventory options. In response to the dearth of affordable inventory, agencies continue to introduce programs that expand housing options for low-to-moderate income (LMI) home buyers. Last quarter, 24 more programs introduced support for manufactured housing, an increase of 3.4%. Additionally, three programs that support multi-family purchases were introduced, bringing the number of programs that support two- to four-unit residential properties to 650.

* Growth in the number of agencies administering programs. As affordability continues to challenge LMI home buyers, 45 more agencies have stepped up to administer homebuyer assistance programs, a 3.9% increase over the previous quarter. Now 1,323 agencies provide assistance to aspiring homeowners across the country.

* Municipalities administer the lion’s share of homebuyer assistance programs. Municipalities support 42.2% of homebuyer assistance programs, roughly double the 21.8% of programs supported by state housing finance authorities (HFAs) and 21.0% of programs supported by nonprofits – the second and third largest source of homebuyer assistance, respectively.

“Marked growth in the number of agencies administering homebuyer assistance programs reflects how affordability challenges are driving demand for affordable pathways to homeownership,” said DPR Founder and CEO Rob Chrane. “These emerging community champions play a vital role in making home homeownership more accessible to LMI households and marginalized demographics who have lower rates of homeownership.”

“At the same time, agencies are responding to near historic low new listing figures by opening program support of manufactured and multifamily housing,” continued Chrane. “This effectively expands inventory options for homebuyers that rely on these programs.”

A more detailed analysis of the Q2 2023 HPI findings, including infographics and examples of many of the programs described in this release, can be found on DPR’s website at: https://downpaymentresource.com/professional-resource/a-guide-to-q2-2023-homebuyer-assistance-program-trends/.

For a complete list of homebuyer assistance programs by state, visit: https://downpaymentresource.com/wp-content/uploads/2023/07/HPI-state-by-state-data.Q22023.pdf.

Methodology

Published quarterly, DPR’s HPI surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits and other housing organizations. DPR communicates with over 1,300 program providers throughout the year to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates (MCCs) and affordable first mortgages, in the DOWN PAYMENT RESOURCE(r) database.

About Down Payment Resource:

Down Payment Resource (DPR) is an award-winning technology provider helping the housing industry connect homebuyers with the homebuyer assistance they need. With toolsets tailored for real estate agents, multiple listing services and mortgage lenders, DPR’s technology empowers housing professionals to make affordable home financing opportunities more accessible while growing business and forging referral partnerships. The only organization to track the details of every U.S. homebuyer assistance program, DPR frequently lends its expertise to nonprofits, housing finance agencies, policymakers, government-sponsored enterprises, think tanks and trade organizations seeking to improve housing affordability. Its technology is used by five of the top 10 retail mortgage lenders by volume, three of the four largest real estate listing websites and 500,000 real estate agents.

For more information, visit: https://downpaymentresource.com/.

Learn More: https://www.downpaymentresource.com/

This version of news story was published on and is Copr. © 2023 Mortgage & Finance News™ (MortgageAndFinanceNews.com) – part of the Neotrope® News Network, USA – all rights reserved.

Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.

STORY ID: 92219