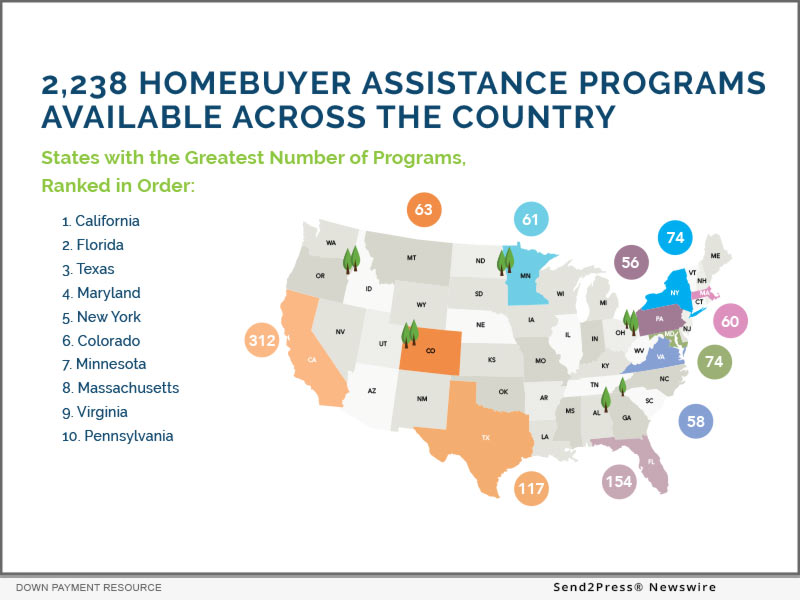

Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced the release of its latest Homeownership Program Index (HPI). The firm’s analysis of 2,238 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 46 from Q4 2021 to Q1 2022.

Quarterly analysis of U.S. homebuyer assistance programs highlights marked increase in number of programs available to help people purchase homes

ATLANTA, Ga. /Mortgage and Finance News/ — Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced the release of its latest Homeownership Program Index (HPI). The firm’s analysis of 2,238 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 46 from Q4 2021 to Q1 2022.

Methodology

Published quarterly, DPR’s HPI surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits and other housing organizations. DPR communicates with over 1,200 program administrators throughout the year to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates and affordable first mortgages, in the DOWN PAYMENT RESOURCE® database.

Key Findings

The Q1 2022 HPI examined a total of 2,238 homebuyer assistance programs that were active as of April 6, 2022. Key findings are as follows.

* Marked increase in number of programs introduced. Programs introduced in Q1 2022 include two first mortgage programs, two combined funding programs, 10 grants and 32 second mortgage programs. This marks a 2.1% increase in the number of homebuyer programs available compared to Q4 2021.

* Largest gains in nonprofit programs. There was a 5.7% increase in nonprofit-sponsored programs introduced in Q1 2022. Additionally, there was a 2.3% increase in programs supporting home purchases in defined locales and a 1.3% increase in statewide programs.

* Support for manufactured housing continues to increase. 31 additional homebuyer programs opened eligibility to manufactured housing in Q4 2021. Now 28.8% of all homebuyer assistance programs support the purchase of manufactured homes.

* More than one third of programs do not have a first-time home buyer requirement. It is a common misconception that homebuyer assistance is only available to first-time homebuyers, however 38% of homebuyer assistance programs in Q1 2022 did not have a first time homebuyer requirement.

“Both the number of homebuyer assistance programs and the volume of available funding increased in Q1 2022, a trend we have observed for several consecutive quarters,” said DPR CEO Rob Chrane. “With affordability on the decline in 79% of U.S. counties and the availability of homebuying assistance on the rise, homebuyers need real estate agents and mortgage lenders to connect them with programs that make homeownership more affordable.”

Further analysis of the Q1 2022 HPI findings, including infographics and examples of many of the programs described in this release, can be found on DPR’s website at https://downpaymentresource.com/professional-resource/more-homebuyer-assistance-programs-introduced-as-affordability-declines-in-most-u-s-counties/.

For a complete, state-by-state list of homebuyer assistance programs, visit https://downpaymentresource.com/wp-content/uploads/2022/04/HPI-state-by-state-data.Q12022.pdf.

About Down Payment Resource:

Down Payment Resource (DPR) is a nationwide database of down payment assistance and affordable lending programs. The company tracks funding status, eligibility rules, benefits and more for approximately 2,200 programs in 11 categories. Its award winning technology helps the housing industry connect more homebuyers to the down payment help they need. DPR has been recognized by Inman News as “Most Innovative New Technology” and the HousingWire Tech100(tm). DPR is licensed to Multiple Listing Services, Realtor Associations, lenders and housing counselors across the country. DPR’s subscription based service, Down Payment Connect, helps agents and loan officers match buyers to available programs. For more information, please visit DownPaymentResource.com and on Twitter at @DwnPmtResource .

Learn More: https://www.downpaymentresource.com/

This version of news story was published on and is Copr. © 2022 Mortgage & Finance News™ (MortgageAndFinanceNews.com) – part of the Neotrope® News Network, USA – all rights reserved.

Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.

STORY ID: 80930