Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q2 2024 Homeownership Program Index (HPI) report. The Q2 report saw the national homebuyer assistance programs increase by 42 to 2,415 – the highest count on record. Much of this quarter’s increase in program count was due to local agencies pulling more heavily from federal funding to support homebuyer assistance.

DPR’s Q2 2024 HPI Report finds 42 more U.S. homebuyer assistance programs and 29 more program providers than the previous quarter

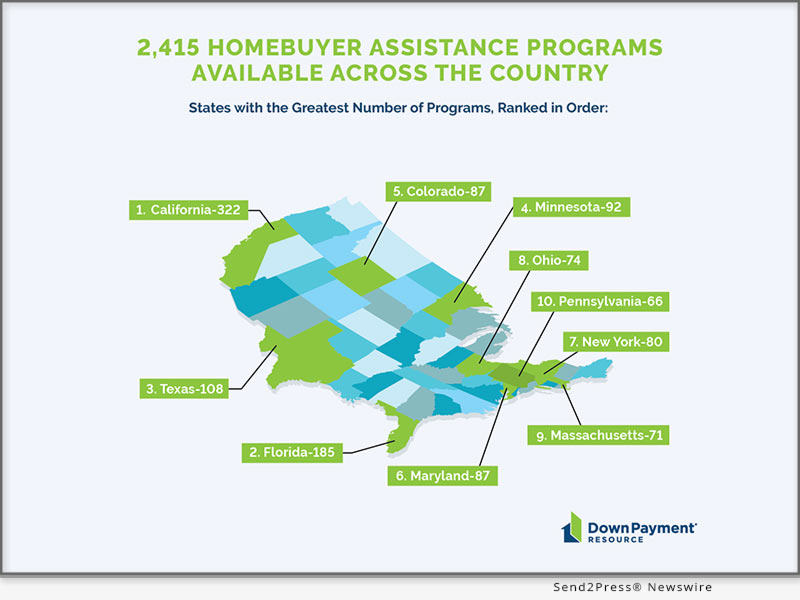

ATLANTA, Ga. /Mortgage and Finance News/ — Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q2 2024 Homeownership Program Index (HPI) report. The Q2 report saw the national homebuyer assistance programs increase by 42 to 2,415 – the highest count on record. Much of this quarter’s increase in program count was due to local agencies pulling more heavily from federal funding to support homebuyer assistance.

“It’s very encouraging to see more state HFAs allocating American Rescue Plan Act (ARPA) and US Department of Health and Human Services (HHS) funds to support homeownership. We think this indicates that local municipalities are increasingly viewing affordable homeownership as a stabilizing force that fosters prosperity within communities,” said Rob Chrane, founder and CEO of DPR. “We are also particularly encouraged by the rise in programs targeting first-generation homebuyers to ensure more Americans can achieve the dream of homeownership.”

Key HPI Report Findings

An examination of the existing 2,415 homebuyer assistance programs on July 1, 2024, resulted in the following key findings:

* The number of U.S. homebuyer assistance programs increased by 42 quarterly. This represents a 2% increase over the previous quarter and 213 more programs than in Q2 2023.

* 29 more program providers supported homebuyer assistance in Q2 2024 than the previous quarter.

* Federally-funded programs are on the rise.

o 24 programs are now funded by the ARPA, a 26% increase from the previous quarter and a 200% increase year-over-year (YoY). The ARPA authorized $350 billion in 2021 to help state, local, and tribal governments respond to and recover from the COVID-19 pandemic. APRA-funded homebuyer assistance programs are on the rise because governments must return funds to the Treasury Department if they are not allocated by December 31, 2024, and spent by December 31, 2026.

o The number of programs funded by HHS increased by 19% quarterly and 121% annually to 31 programs. Many studies have shown that stable housing positively impacts the health of individuals and families. This understanding is likely why HHS is increasingly supporting affordable housing.

* 21 programs target first-generation buyers, a 133% increase from 9 in Q1 2024. First-generation homebuyers are less likely to receive financial assistance from their parents for a downpayment and other upfront home-buying costs. “This is a recent trend we are seeing in the past year or so that started with a few pilot programs and is now being replicated by agencies throughout the country,” said Chrane.

* 970 programs allow for repeat buyers, while 1,445 are restricted to first-time buyers. “While the majority of programs are for first-time buyers, we’ve seen a steady uptick in the number of programs that allow for repeat buyers,” said Chrane, noting that the YoY change is 11%.

A more detailed analysis of the Q2 2024 HPI findings, including infographics and examples of the programs described in this release, can be found on DPR’s website at https://downpaymentresource.com/professional-resource/the-down-payment-resource-q2-2024-homeownership-program-index-report.

For a complete list of homebuyer assistance programs by state, visit https://downpaymentresource.com/wp-content/uploads/2024/07/HPI-state-by-state-data.Q22024.pdf.

Methodology

Published quarterly, DPR’s HPI surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits and other housing organizations. DPR communicates with over 1,300 program providers throughout the year to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates (MCCs) and affordable first mortgages, in the DOWN PAYMENT RESOURCE® database.

About Down Payment Resource:

Down Payment Resource (DPR) is the housing industry authority on homebuyer assistance program data and solutions. With a database that tracks more than 2,400 programs and toolsets for mortgage lenders, multiple listing services (MLSs) and API users, DPR helps housing professionals connect homebuyers with the assistance they need. DPR frequently lends its expertise to nonprofits, housing finance agencies, policymakers, government-sponsored enterprises and trade organizations seeking to improve housing affordability. Its technology is used by seven of the top 25 mortgage lenders, the three largest real estate listing websites and 600,000 real estate agents. For more information, visit https://downpaymentresource.com/.

X: @DwnPmtResource #downpaymentassistance #affordabilitycrisis #housingaffordability #mortgage #housingequity #downpayment

Learn More: https://www.downpaymentresource.com/

This version of news story was published on and is Copr. © 2024 Mortgage & Finance News™ (MortgageAndFinanceNews.com) – part of the Neotrope® News Network, USA – all rights reserved.

Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.

STORY ID: 119906