Tag: AP

News: Class Valuation appoints Chris Flynn as chief data officer to accelerate innovation and data strategy

Mortgage and Finance News: (TROY, Mich.) Class Valuation, a leading real estate appraisal management company (AMC), announced today that Chris Flynn has joined its leadership team as chief data officer effective April 1. In his new role, Flynn will lead Class Valuation's enterprise data strategy, overseeing the development of scalable analytics, AI capabilities and automation to improve valuation accuracy, speed and transparency.

News: Tidewater Mortgage Services Replaces Legacy POS with LiteSpeed from LenderLogix

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced Tidewater Mortgage Services (Tidewater), a retail mortgage lending company, has replaced its legacy point-of-sale (POS) technology with LiteSpeed, thus expanding its partnership with the company. In addition to Fee Chaser™, Tidewater will now use LiteSpeed as the point-of-sale to automate mortgage processes and provide borrowers with a digital-first experience.

News: Veteran Financial Educator Reveals Revolutionary Approach to Teaching Children About Wealth and Impact in Groundbreaking New Book

Mortgage and Finance News: (PHOENIX, Ariz.) Financial expert Walter Clarke's groundbreaking work in "401Kid: A Guide to Teaching You and Your Children How to Master Money" (ISBN: 978-1964377643 [ebook]; 978-1964377605 [paperback]; 978-1964377599 [hardcover]; Legacy Launch Pad Publishing) emphasizes the profound impact of early financial education and the consequences of neglecting it. He has identified a critical gap-virtually no one is actively addressing this need.

News: Click n’ Close Expands Correspondent Lending Sales Team with Mortgage Industry Veteran Kim Schenck

Mortgage and Finance News: (ADDISON, Texas) Click n' Close (CNC), a multi-state mortgage lender, announced today that Kim Schenck has joined its Correspondent Lending Sales team as Correspondent Manager. In her new role, Schenck will lead the expansion of the company's proprietary down payment assistance (DPA) program, which plays a key role in helping more borrowers achieve homeownership.

News: Class Valuation expands private lending capabilities with acquisition of Appraisal Nation

Mortgage and Finance News: (TROY, Mich.) Class Valuation, a leading national real estate appraisal management company (AMC), today announced the strategic acquisition of Appraisal Nation, a Cary, North Carolina-based AMC specializing in comprehensive valuation solutions for the private lending market.

News: Cooler Interest Rates Heat Up Refinances and Spark Early Signs of Purchase Demand

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today released its March 2025 Market Advantage mortgage data report, showing a 24% surge in rate lock volume as early spring buyers returned to the market and homeowners jumped at the chance to refinance into lower rates. While still down 2% on a year-over-year (YoY) basis, purchase volumes were up 21% month-over-month (MoM). Rate-and-term and cash-out refinances jumped 52% and 20% MoM, respectively, together representing 25% of all lock activity.

News: The Mortgage Collaborative Welcomes New Lender Members and Preferred Partners to Its Expanding Network

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, proudly announces the addition of several new lender members and preferred partners to its growing community. These organizations join TMC's network of industry leaders committed to collaboration, innovation, and operational excellence.

News: Scrubblade Joins Walmart: 17-Year Entrepreneurial Journey Hits the Fast Lane

Mortgage and Finance News: (TEMECULA, Calif.) Scrubblade, a leader in advanced windshield wiper technology, announced a nationwide partnership with Walmart, bringing their highly anticipated Black Edition silicone wiper blades to shelves across the U.S. This monumental milestone reflects the culmination of a 17-year journey marked by persistence, ingenuity, and grit, driven by founder Billy Westbrook's vision to revolutionize driver safety.

News: Digital-First Self-Storage Platform Annexx Transforms French Market with Tech-Driven Expansion

Mortgage and Finance News: (TOULOUSE, France) Annexx is pioneering a digital revolution that's redefining France's rapidly growing self-storage sector in a market traditionally dominated by padlocks and metal doors. Based in Toulouse, the company has implemented an AI-powered platform that has reduced customer service response times by 40% and generated a significant 35% increase in mobile bookings since rolling out in late 2024.

News: Dovenmuehle Receives New Subordinate Lien Servicer Ranking, Maintains Above Average Primary Servicer Ranking from S&P Global Ratings

Mortgage and Finance News: (LAKE ZURICH, Ill.) Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading mortgage subservicing company, today announced that S&P Global Ratings has assigned the company an Above Average ranking as a residential mortgage loan subordinate lien servicer, in addition to reaffirming its Above Average ranking as a residential mortgage loan primary servicer with a stable outlook.

News: iEmergent confronts the DEI debate with bold webinar on the business case for diverse lending

Mortgage and Finance News: (DES MOINES, Iowa) iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced a provocative new webinar that dares to reframe the diversity conversation through a business lens. Amid growing pushback on diversity, equity and inclusion (DEI) initiatives, iEmergent is doubling down on the importance of inclusive lending to lenders' long-term success. Titled "Not Sold on Diversity? Fine. Let's Talk About Your Bottom Line," the roundtable session will take place Wednesday, April 30, from 1 to 3 pm ET.

News: MMI Strengthens Mortgage Tech Leadership in Q1 2025 with MonitorBase Acquisition and Major Platform Enhancements

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mobility Market Intelligence (MMI), the industry's leading mortgage and real estate data solutions provider, announces major Q1 2025 platform enhancements alongside its strategic acquisition of borrower monitoring and predictive analytics leader, MonitorBase. These initiatives solidify MMI's position as The Ultimate Lead-to-Loan Growth Platform(tm), providing mortgage professionals with unparalleled data intelligence, automation, and borrower engagement tools.

News: Floify’s Maggie Zielinski Swanson named to HousingWire’s 2025 Rising Stars list

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that Enterprise Account Executive/Sales Engineer Maggie Zielinski Swanson has been named to HousingWire's prestigious Rising Stars list for 2025. Swanson, 29, joined Floify in 2021 as a skilled sales professional and has quickly become an indispensable force in the company's collaborative culture and growth.

News: The Mortgage Collaborative Helps Lender Member Resolve VA Loan Issue, Restoring Lender Authority

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC) has once again demonstrated the power of its network by swiftly assisting lenders to resolve a critical VA lending issue that had stalled loan processing nationwide. Through rapid collaboration, direct engagement with the Department of Veterans Affairs (VA), and the persistence of key TMC members, impacted lenders regained their VA underwriting and insurance authority in just one week-ensuring veterans could move forward with their home purchases.

News: Optimal Blue Establishes Alliance with Cotality to Expand the Reach of Its Mortgage Origination and Pricing Data

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today announced a strategic alliance with Cotality™ (formerly CoreLogic®) that expands access to its mortgage origination and pricing data. Through this collaboration, Cotality will offer Optimal Blue's data to a broader audience, including hedge funds, capital markets participants, and investment firms seeking insights into the mortgage markets.

News: StallPlus+ Restroom Privacy Gap Guards Eliminate Sizable Gaps at Stall Doors and Corners

Mortgage and Finance News: (ST. LOUIS, Mo.) The "Return to Office" movement means more employees are reporting to work. This means businesses and workplaces are addressing common restroom concerns, such as restroom privacy, which is an issue that 70% of restroom users view as important. And since 83% of employees view workplace restrooms as an indicator of how a company values its employees, companies nationwide are using StallPlus+ Restroom Privacy Gap Guards from Restroom Specialties.

News: Secured Signing Integrates with NetDocuments to Revolutionize Legal Documents Signing

Mortgage and Finance News: (MOUNTAIN VIEW, Calif.) Secured Signing, a global leader in digital signatures and Remote Online Notarization (RON) solutions, proudly announces its seamless integration with NetDocuments, the premier cloud-based document management system (DMS) tailored for legal, financial, and professional services firms. This collaboration empowers users to efficiently handle eSignatures and online notarizations without leaving the NetDocuments platform, revolutionizing workflows while bolstering security and ensuring compliance.

News: The Woodlands at Furman Announces Groundbreaking Ceremony Set for April 4 to Launch 22 New Luxury Apartments and Enhanced Amenities

Mortgage and Finance News: (GREENVILLE, S.C.) The Woodlands at Furman, Greenville's premier Life Plan Community, is proud to announce a transformative expansion project that will further elevate its residents' living experience. The highly anticipated development, set to begin construction in April 2025, includes 22 brand-new apartments, a modern library and expanded dining facilities. This expansion underscores The Woodlands at Furman's commitment to providing upscale amenities, lifelong learning opportunities and unmatched peace of mind to its residents.

News: CapitalW Collective Collaborates with Citizens to Advance Women in Mortgage Capital Markets

Mortgage and Finance News: (SAN DIEGO, Calif.) CapitalW Collective, a leading non-profit dedicated to increasing the representation of women and their allies in mortgage capital markets, proudly announces Citizens as a Diamond-level corporate sponsor. This partnership reflects a shared commitment to fostering a more inclusive and dynamic mortgage capital markets industry by providing education, mentorship, and leadership opportunities, particularly for underrepresented professionals.

News: Secured Signing Teams Up with Microsoft Azure for its Multi-Region Data Centers

Mortgage and Finance News: (MOUNTAIN VIEW, Calif.) Secured Signing, a global leader in Digital Signatures and Remote Online Notarization (RON) solutions, proudly announces its migration to Microsoft Azure multi-region data center. This strategic move marks a major step forward, reinforcing Secured Signing's reputation as a top global provider of secure, and trusted eSignatures solutions.

News: Dark Matter Technologies completes migration to AWS to enhance computing speed, performance and scalability

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology, today announced the successful completion of its IT infrastructure migration to Amazon Web Services (AWS). This strategic move enhances Dark Matter's ability to deliver superior performance, scalability and reliability to mortgage industry clients

News: Collaboration Between MCT and Fannie Mae Improves Pricing for Mortgage Sellers on Select Loans

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced their integration with Fannie Mae's new Loan Pricing API. By combining various price factors and utilizing a broader set of data found in bid tapes, the new API provides greater price transparency on certain loans. This is the latest in a series of recent collaborations between MCT and Fannie Mae intended to provide additional benefit and value to mortgage secondary market participants.

News: Vice Capital Markets Integrates with Fannie Mae’s New Loan Pricing API to Streamline Mortgage Loan Pricing and Commitment

Mortgage and Finance News: (NOVI, Mich.) Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today it is the first to integrate Fannie Mae's new Loan Pricing application programming interface (API) into its trading portal. The API consolidates multiple APIs into one, simplifying the loan pricing process and enhancing pricing and commitments.

News: Alliance Group Announces Key Promotions and New Hires

Mortgage and Finance News: (LAWRENCEVILLE, Ga.) Alliance Group is proud to announce four significant promotions within its leadership team, reinforcing the company's commitment to excellence and growth. Additionally, two talented new team members have joined the organization, bringing valuable expertise to support Alliance Group's expanding initiatives.

News: MCT Reports 28% Increase in Mortgage Lock Volume Heading into Spring Season

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced a 27.91% increase in mortgage lock volume compared to the previous month. Industry professionals and stakeholders are encouraged to download the full report for a detailed analysis.

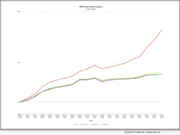

News: 40% Jump in Rate-and-Term Refis Drives Overall Lock Growth as Purchase Activity Stalls

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today released its February 2025 Market Advantage mortgage data report, showing a 7% month-over-month increase in mortgage lock volume driven primarily by a surge in refinance activity. Rate-and-term refinances saw the biggest jump, rising nearly 40% as homeowners seized the opportunity to lower their monthly payments. Cash-out refinances also edged higher, while purchase lock activity remained subdued for the second consecutive month.

News: The Mortgage Collaborative 3.16.25 Mortgage Tech Day Presents Five Startups to Compete in Dallas Pitch Event

Mortgage and Finance News: (DALLAS, Texas) The future of mortgage technology is set to take the spotlight in Dallas as The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, and the TMC Emerging Technology Fund LP present the seventh Mortgage Tech Day (MTD).

News: IRS Solutions® Named as American Society of Tax Problem Solvers (ASTPS) Partner

Mortgage and Finance News: (VALENCIA, Calif.) IRS Solutions®, a company offering innovative tax resolution software explicitly designed for tax professionals, announces that it has been named an industry partner by the prestigious American Society of Tax Problem Solvers (ASTPS).

News: Floify taps Sol Klein as head of client experience and business operations

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced the appointment of Sol Klein as head of client experience and business operations. Klein, a seasoned mortgage technology executive with extensive experience in customer success and implementation, will lead initiatives to help clients maximize the value of their investment in Floify's platform.

News: MMI Names Kortney Lane-Schafers as Its New Vice President of Growth & Client Advocacy

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, is pleased to announce the promotion of Kortney Lane-Schafers to Vice President of Growth & Client Advocacy.