Tag: Business

News: iFOS Managing Consultants Awarded Multi-Year Financial Review Management and Resolution Program Blanket Purchase (BPA) Agreement

Mortgage and Finance News: (COLUMBIA, Md.) Intelligent Fiscal Optimal Solutions (iFOS) received a blanket purchase agreement (BPA) to provide Financial Review Management and Resolution Professional Services to the U.S. Agency for International Development (USAID) Agency.

News: The Mortgage Collaborative Announces Release of TMC Benchmark 2.0

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's only independent mortgage cooperative, today announced the release of its enhanced benchmarking solution for its lender members. In collaboration with TMC Preferred Partner LBA Ware, TMC Benchmark now has an improved user interface, augmented reporting dashboards and peer segmentation.

News: Cloudvirga Adds Digital Mortgage Integration with Leading Mortgage Insurance Provider Radian

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform(R), has partnered with Radian Guaranty, a subsidiary of Radian Group (NYSE: RDN), to deliver instant and accurate mortgage insurance (MI) rate quotes and streamline the ordering of MI certificates for lenders.

News: Express Information Systems Named to Accounting Today VAR 100 for Second Consecutive Year

Mortgage and Finance News: (SAN ANTONIO, Texas) For the second consecutive year, Express Information Systems, a leading provider of business software and consulting for growing businesses in Texas and beyond, has been included in the Accounting Today VAR 100.

News: MCT’s Bid Auction Manager (BAM) Technology Automates Tri-Party Agreement for Investors’ Bid Tape AOT Loan Sale Executions

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced automation of the Tri-Party Agreement required between lenders, investors, and broker dealers during Assignment Of Trade (AOT) transactions in the secondary market. The functionality is built into MCT's Bid Auction Manager(TM) (BAM) bid tape management and best execution platform.

News: PowerGuard Adds Top Warranty and Service Agreement Specialist Dan Cantafi in Connecticut

Mortgage and Finance News: (GLASTONBURY, Conn.) PowerGuard Specialty Insurance Services - a renewable energy program manager based in the United States - announced today the addition of warranty and service agreement specialist Dan Cantafi as the firm's Senior Vice President of Sales and Marketing. He will be based in Glastonbury, Conn. and report to PowerGuard's Co-Founder, Mike McMullen and COO Scott Gunnison.

News: NotaryCam Applauds Treasury Recommendations to Remove Barriers to Remote Online Notarization and ‘Fully Digital Mortgage’

Mortgage and Finance News: (NEWPORT BEACH, Calif.) Rick Triola, founder and CEO of the industry's most popular remote online notarization solution, NotaryCam, calls the Department of Treasury's recommendations in its July 31 report to the President: A Financial System That Creates Economic Opportunities: Nonbank Financials, Fintech, and Innovation "a cure to the persistent drags on real estate transactions that have prevented the consumer from experiencing the benefits now possible with digital technologies."

News: Introducing Aclaro TrueView: The Fintech Solution Set to Revolutionize Lending Risk Analysis

Mortgage and Finance News: (MIAMI, Fla.) Aclaro, the leading provider in blockchain-based open platform solutions, recently released its latest A.I. solution. The new tool, Aclaro TrueView is designed to provide automotive and other lenders with a competitive advantage through robust features that save them time, money, and facilitate better lending decisions.

News: Bank of Southern California NA Completes Acquisition of Americas United Bank

Mortgage and Finance News: (SAN DIEGO, Calif.) Bank of Southern California, N.A., San Diego (OTC Pink: BCAL / OTCMKTS:BCAL) announced today the completion of its acquisition of Americas United Bank (OTC Pink: AUNB), effective July 31, 2018. Americas United Bank had total assets of approximately $231 million as of June 30, 2018.

News: Cloudvirga’s Josephine Yen Named to MPA Magazine’s 2018 Elite Women in Mortgage

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform, today announced that senior vice president of product management Josephine Yen has been named one of Mortgage Professional America magazine's 2018 Elite Women in Mortgage.

News: LBA Ware CEO and Founder Lori Brewer Named to MPA’s Elite Women in Mortgage Two Years Running

Mortgage and Finance News: (MACON, Ga.) LBA Ware(TM), a leading provider of automated compensation software and systems integration solutions for mortgage lenders, announced that company CEO and Founder Lori Brewer has been named to Mortgage Professional America (MPA) magazine's list of 2018 Elite Women in Mortgage.

News: Simplifile’s Toni Carroll Receives Mortgage Professional America Award

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that National Settlement Account Manager Toni Carroll was honored by Mortgage Professional America among its list of 2018 Elite Women in Mortgage.

News: TRK Connection CEO Teri Sundh Named to MPA’s 2018 List of Elite Women in Mortgage

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection (TRK), a leading provider of mortgage quality control and origination management solutions, announced today that CEO Teri Sundh has been named to Mortgage Professional America (MPA) magazine's 2018 Elite Women in Mortgage.

News: Mid America Mortgage COO Kara Lamphere Repeats as One of MPA Magazine’s Elite Woman in Mortgage

Mortgage and Finance News: (ADDISON, Texas) Mid America Mortgage, Inc. today announced that Chief Operating Officer Kara Lamphere was named by Mortgage Professional America (MPA) magazine to the publication's list of 2018 Elite Women in Mortgage. This is the second consecutive year that Lamphere has received this recognition.

News: MQMR’s Erin Harris Recognized by Mortgage Professional America as One of Its ‘2018 Elite Women in Mortgage’

Mortgage and Finance News: (LOS ANGELES, Calif.) Mortgage Quality Management and Research, LLC (MQMR), a leader in mortgage risk management and compliance services, today announced that Erin Harris, manager of MQMR's vendor management division HQ Vendor Management, has been named by industry trade magazine Mortgage Professional America (MPA) as a 2018 Elite Women in Mortgage honoree.

News: Beckie Santos of IDS Honored with MPA Magazine’s 2018 Elite Women in Mortgage Award

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced today that New Product Development Manager Beckie Santos has been recognized by Mortgage Professional America (MPA) magazine in its list of 2018 Elite Women in Mortgage.

News: Advalent Partners with Novus Healthcare to Close the Gap in Value-Based Care

Mortgage and Finance News: (WESTBOROUGH, Mass.) Advalent Corporation ('Advalent') signed a partnership in early 2018 with Novus Healthcare to identify patients who could benefit from value-based care and implement that approach using Advalent's Value-Based Care Platform and Novus' population health management programs.

News: EPIC adds Lou D’Agostino as a Principal in New York serving the Financial Services Industry

Mortgage and Finance News: (NEW YORK, N.Y.) EPIC Insurance Brokers & Consultants today announced that risk management and insurance brokerage veteran Lou D'Agostino and his Iron Cove Partners team have joined the firm. D'Agostino has over 17 years of insurance brokerage experience with an expertise in serving the Financial Services industry.

News: Thompson Mackey and EPIC Insurance Host Young Risk Professional Event in Atlanta

Mortgage and Finance News: (ATLANTA, Ga.) EPIC Insurance Brokers and Consultants, a retail property & casualty insurance brokerage and employee benefits consultant, announced today that Atlanta-based Risk Management Consultant Thompson Mackey will be hosting an event with the non-profit he leads locally, Young Risk Professionals, at the rooftop of The Ivy in Buckhead on Wednesday, July 25, 2018 from 5:30 - 8:30 p.m.

News: Simplifile Signs 1800th County to Its E-recording Network, Platform Now Utilized by More Than Half of U.S. Recording Jurisdictions

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that Clallam County, Wash., is the 1800th jurisdiction to join Simplifile's e-recording network.

News: Maxwell Announces New Partnership with HomeServices Lending

Mortgage and Finance News: (DENVER, Colo.) Digital mortgage software provider, Maxwell, today announced a new partnership with HomeServices Lending of Des Moines, Iowa. Maxwell empowers mortgage lenders across the nation with a modern digital workspace that digitizes and automates the home-buying experience.

News: Bank of Southern California NA Names Catherine Puckett VP, Business Development Manager

Mortgage and Finance News: (SAN DIEGO, Calif.) Bank of Southern California, N.A. (OTC Pink: BCAL), a community business bank headquartered in San Diego, is pleased to announce that Catherine Puckett has joined the company as Vice President, Business Development Manager. She will be responsible for expanding Bank of Southern California's business banking client base by actively seeking new business opportunities in the San Diego region.

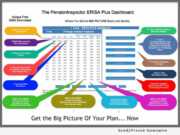

News: The Pension Inspector Launches New SaaS Integrating Prior and Present Form 5500 Filings, to Provide Big Picture of Plan Operations

Mortgage and Finance News: (NEW YORK, N.Y.) National Retirement Programs, Inc. and its wholly owned subsidiary AtPrime Media Services, the creator of PensionInspector.com, introduces "Form 5500 Prestige Vision," an addition to its, super easy to use, replacement for the U.S. Department of Labor's ERISA Form 5500 Download Service "ERISA Plus Dashboard."

News: Express Information Systems Named to Software Industry Guru Bob Scott’s 2018 List of Top 100 VARs

Mortgage and Finance News: (SAN ANTONIO, Texas) Express Information Systems, a leading provider of business software and consulting for growing businesses in Texas and beyond, has announced its inclusion on Bob Scott's Top 100 VARs 2018 published by Progressive Media Group.

News: EPIC Insurance Brokers add Josh Close in Birmingham, Alabama

Mortgage and Finance News: (BIRMINGHAM, Ala.) EPIC Insurance Brokers and Consultants ("EPIC") announced today that Josh Close has joined the firm's Birmingham-based national energy construction practice as a client services coordinator, reporting to EPIC Principal Brian Tanner.

News: Paragon Insurance Holdings Expands Operations in San Diego with addition of Robert Etzler and opening of new offices

Mortgage and Finance News: (SAN DIEGO, Calif.) Paragon Insurance Holdings LLC ("Paragon"), a national multi-line specialty MGA (Managing General Agency) based in Avon, Conn., today announced its expansion in San Diego, Calif. with the opening of new offices at 401 B Street in downtown San Diego and the hiring of top local insurance professional Robert Etzler, under the leadership of Paragon regional president, Andrew Petersen.

News: MorVest Capital Hires Ruth Lee as Executive Vice President for Expansion of Mortgage Liquidity and MSR Advisory Services

Mortgage and Finance News: (SUGAR LAND, Texas) David Fleig, CEO of MorVest Capital, LLC, a financial services advisory firm specializing in mortgage banking liquidity and capital solutions, today announced its addition of Executive Vice President Ruth Lee.

News: OpenClose Launches DecisionAssist Mobile for Originators

Mortgage and Finance News: (SAN FRANCISCO, Calif.) OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced at the California Mortgage Bankers Association (CMBA) 46th Annual Western Secondary Marketing Conference that it unveiled DecisionAssist(TM) Mobile, which provides fingertip access to the company's proprietary web-based product and pricing engine (PPE)

News: Business Development and Relationship Management Specialist Julia Moore Joins EPIC in Sacramento CA

Mortgage and Finance News: (SACRAMENTO, Calif.) EPIC Insurance Brokers & Consultants ('EPIC') announced today that new business sales and relationship management professional Julia Moore has joined the firm's operations in Sacramento as Vice President, New Business Development.

News: LBA Ware Recruits Mortgage Process Improvement Specialist Jessica Henke as Solutions Consultant

Mortgage and Finance News: (MACON, Ga.) LBA Ware(TM), a leading provider of automated compensation software and systems integration solutions for mortgage lenders, announced today that it has hired Jessica Henke as a solutions consultant to support the company's implementation consulting and client success efforts. Henke will leverage her two decades of accounting and business process improvement expertise in mortgage lending to bring LBA Ware clients streamlined business workflow solutions and enhanced operational insights.