News Topic: Product Launches

News: MCT Launches BAMCO: Co-issue Loan Sale Marketplace for Shadow Pricing and Unique Executions

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced the release of BAMCO, a new marketplace for co-issue loan sales. Co-issue loan sales, also known as flow-based mortgage servicing rights (MSR) sales, are a three-way transaction involving the sale of loans to one of the agencies with a simultaneous sale of the MSRs to a separate third party.

News: Click n’ Close launches proprietary SmartBuy loan suite to provide low- and moderate-income homebuyers with more affordable mortgage options

Mortgage and Finance News: (ADDISON, Texas) Click n' Close, a multi-state mortgage lender serving consumers and mortgage originators through its wholesale and correspondent channels, announces it has launched SmartBuy, a suite of loan programs designed to give low and moderate-income (LMI) homebuyers an advantage in today's heightened mortgage interest rate environment.

News: New ‘Ready Now’ Podcast Features Survivors, Experts

Mortgage and Finance News: (JACKSONVILLE, Fla.) The Peace of Mind Estate Organization, Inc., today introduced a new podcast that features thought-provoking conversations with survivors of a range of emergencies and end-of-life scenarios-from major hurricanes to Alzheimer's Disease. "Ready Now" explores the ways everyday consumers can take charge of becoming ready, now, for life's most difficult scenarios.

News: FormFree releases Residual Income Knowledge Index, an intelligent new system for assessing borrowers’ Ability to Pay, to lenders nationwide

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced the general availability of its Residual Income Knowledge Index, or RIKI. RIKI is an innovative method for measuring consumers' Ability-to-Pay (ATP) for mortgages and other loans based on monthly income and spending. When paired with traditional credit scoring models, RIKI offers lenders a more complete understanding of consumers' creditworthiness and creates homeownership opportunities for those with little to no credit history.

News: After, Inc. Announces the Launch of QuickClaim® – Its Best-in-Class Claims and Returns Management System

Mortgage and Finance News: (NORWALK, Conn.) After, Inc., a global leader in post-sale customer experience technology, just announced the launch of QuickClaim®, a cloud-based, claims and returns management system. QuickClaim is one of five post-sale customer experience platforms that After, Inc. calls its QuickSuite.

News: After, Inc. Announces the Launch of QuickInsight® – Its Powerful Post-Sale Customer Data Enrichment Platform

Mortgage and Finance News: (NORWALK, Conn.) After, Inc., a global leader in post-sale technology and services, just announced the launch of its QuickInsight® customer data enrichment platform. QuickInsight is one of five post-sale customer experience platforms that After, Inc. calls its QuickSuite®, which just won The SAMMY Award from Business Intelligence Group for "Product of the Year."

News: LegalStream, LLC Launches The Largest Online Directory Of Personal Injury Attorneys and Healthcare Providers In America

Mortgage and Finance News: (SAN ANTONIO, Texas) First established in 2019, LegalStream, a U.S. based SaaS company, today announced their brand new APP to help streamline your personal injury case, and they did it right here in San Antonio, Texas. LegalStream has stepped up, filled the communication gap plaguing the personal injury business, and has developed an online directory of the largest networks of personal injury attorneys and healthcare providers across the nation.

News: Lender Price Launches Marketplace 2.0, Providing Wholesale Brokers and Lenders with Enhanced Pricing Capabilities and Deal Intelligence

Mortgage and Finance News: (PASADENA, Calif.) Lender Price, a leading provider of product, pricing and eligibility technology, announced today they have released Marketplace 2.0, a major enhancement to their Broker Marketplace platform, one of the largest communities of wholesale brokers in the mortgage industry.

News: Mid America Mortgage rebrands to Click n’ Close

Mortgage and Finance News: (ADDISON, Texas) Mid America Mortgage, Inc. (Mid America) today announced it has rebranded as Click n' Close following the sale of the majority of its retail lending operations to Houston-based Legend Lending. Click n' Close will retain retail operations related to its reverse mortgage and Native American lending business and focus on delivering innovative down payment assistance (DPA) and adjustable-rate mortgage (ARM) products through its third-party originator (TPO) channels.

News: Commercial and Industrial Lighting Industry Leader, Convergence, Introduces Tech Consulting Division to Educate Luxury Homeowners

Mortgage and Finance News: (NORTH KANSAS CITY, Mo.) Convergence Partners, Inc., a leader in the commercial and industrial lighting industry, introduces technology consulting division to bridge the knowledge gap for luxury homeowners. The Bespoke team consists of highly-experienced individuals with decades of experience in the luxury residential market.

News: Agile Launches Agile Chat for Lenders and Broker Dealers

Mortgage and Finance News: (PHILADELPHIA, Pa.) Agile, a groundbreaking fintech bringing mortgage lenders and broker dealers onto a single electronic platform, today announced the launch of Agile Chat, a new chat feature designed to increase transparency and efficiency between lenders and broker dealers.

News: Stack Sports Partners with NEAR Foundation to Make NFTs more Accessible to Sports

Mortgage and Finance News: (PLANO, Texas) Stack Sports - the global technology leader in sports software announced today that it will be partnering with the NEAR Foundation, a Swiss non-profit that oversees the NEAR blockchain ecosystem, to launch an athlete-focused NFT platform. The new Stack NFT platform will give all athletes an opportunity to create and mint their own NFTs on NEAR's blockchain.

News: Apocalyptic Apes Launches: Bringing Web 2.0 to Web 3.0 One NFT at a Time

Mortgage and Finance News: (LOS ANGELES, Calif.) The non-fungible token (NFT) market is changing the way some big companies and major products get exposure. And, Apocalyptic Apes is a unique collection of 8,800 post-apocalypse themed chimp NFTs on the Ethereum platform. They're available on the company's website, and OpenSea, the world's first and largest NFT marketplace.

News: All That Glitters is Not Gold: Attorney Debuts Shocking Legal Thriller ‘The Golden Prison’ – Blows the Lid off Secret...

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Attorney Paul Alexander Sangillo announces the debut of his first novel, "Golden Prison" (ISBN: 978-1941015469). This novel is the first of its kind, offering a never-before-seen look into the hi-stakes, impossibly stressful world of law students and young lawyers.

News: Neuro Diverse Living Announces the Launch of Their New Brand Name, Front Porch Cohousing: A Neuro-Inclusive Community by NDL

Mortgage and Finance News: (LEHIGH VALLEY, Pa.) Front Porch Cohousing is excited to announce the launch of their new brand and the inspiration behind that change. As a cohousing community of private homes clustered around shared space, Front Porch Cohousing will intentionally design spaces to create opportunities for those with and without neuro or cognitive disabilities to build meaningful and lasting relationships.

News: DocMagic Officially Launches eDecision™, Fully Automating and Perfecting Digital Closing Eligibility

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of fully compliant loan document preparation, automated regulatory compliance, and comprehensive eMortgage services, announced the rollout of eDecision™, a robust solution that significantly expands the level of analysis applied to e-eligibility determination for eClosings.

News: After Inc. Will Premiere its Award-Winning QuickSuite Technology at CES 2022

Mortgage and Finance News: (NORWALK, Conn.) After, Inc., the leader in post-sale customer experience technology and services since 2005, just announced that its senior team will be at CES in Las Vegas on January 5 - 7, 2022 to unveil its new QuickSuite. Each year, CES brings together the most innovative technology companies to share their latest developments and this will be no different.

News: MCT Launches Dynamic Learning Center to Empower Lender Growth and Profitability

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a recognized industry leader in mortgage risk management providing pipeline hedging, best execution loan sales and centralized lock desk services, announced the debut of its new Learning Center, a one-stop educational content database for each stage of growth of a mortgage lender in the secondary market.

News: OpenClose Launches Mobile Assist™ Native Mobile App Platform

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose®, the leading fintech provider of mortgage software solutions for banks, credit unions and mortgage lenders, today announced the launch of its native mobile app platform, Mobile Assist™. Mobile Assist adds features and functionality to make originators more successful with a real-time omnichannel device platform.

News: SimpleNexus helps lenders better serve Spanish-speaking borrowers with launch of Nexus Bilingual

Mortgage and Finance News: (LEHI, Utah) SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced the release of Nexus Bilingual(tm), a new feature that makes the loan process more accessible to prospective homebuyers who prefer to communicate in Spanish by gathering initial loan information in Spanish.

News: Inspire Escrow Services Launches as All-New Trusted, Safe and Efficient Escrow Company in the Inland Empire

Mortgage and Finance News: (ONTARIO, Calif.) Inspire Escrow Services has launched as an all-new trusted, safe and efficient escrow business serving the Inland Empire region, the Ontario, California-based company placing high value on security and quality while ensuring all transactions are successful and convenient for every client.

News: After, Inc. will launch its new QuickSuite® of products at the 12th Annual Extended Warranty and Service Contract Innovations Conference

Mortgage and Finance News: (NORWALK, Conn.) After, Inc., a global leader in Warranty Services Solutions since 2005, just announced that it will be a Platinum Sponsor of the 12th Annual Extended Warranty and Service Contract Innovations Conference. The conference, which brings together companies across auto, appliance, mobile, electronics, home, and industrial equipment industries to discuss the latest trends and insights in extended warranty and service contracts, offers the ideal backdrop to unveil After's new QuickSuite® product portfolio.

News: SimpleNexus debuts in-app payments with Nexus Pay at MBA Annual21

Mortgage and Finance News: (LEHI, Utah) SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced the debut of Nexus Pay at the Mortgage Bankers Association's Annual Convention and Expo (MBA Annual21) happening October 17-20 at the San Diego Convention Center.

News: DocMagic Unveils eSign 3.0, Enhancing Remote Notary and eClosing Capabilities

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of fully compliant loan document preparation, automated regulatory compliance, and comprehensive eMortgage services, announced the official launch of its eSign 3.0 platform. The enhancements to the mortgage industry's preeminent eSigning platform introduce new tools and features designed to enable lenders to easily facilitate remote online notarization (RON) for paperless eClosings.

News: Agile Launches MBS Pool Bidding

Mortgage and Finance News: (PHILADELPHIA, Pa.) Agile, a groundbreaking fintech bringing mortgage lenders and broker dealers on to a single electronic platform, today announced the launch of MBS pool bidding, enabling lenders and dealers to gain much-needed efficiencies and data through technology.

News: New MBS Fintech Agile Revolutionizes Trading with the Launch of RFQ Platform

Mortgage and Finance News: (PHILADELPHIA, Pa.) Agile, a new fintech bringing mortgage lenders and broker dealers on to a single electronic platform, has formally announced the launch of its flagship RFQ (request for quote) platform. All MBS market participants can now participate on an electronic platform that expedites the exchange of To-Be-Announced Mortgage-Backed Securities (TBAs).

News: Launch Pad Releases First Book By Real Estate Mogul and Art Impresario Daniel Lebensohn

Mortgage and Finance News: (LOS ANGELES, Calif.) Los Angeles based publishing company Launch Pad Publishing is celebrating the release of "The Art of the Real: Real Life, Real Relationships and Real Estate" (ISBN: 978-1951407629) - the debut memoir from Daniel Lebensohn.

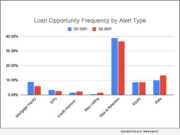

News: Sales Boomerang releases Q2 2021 Mortgage Market Opportunities Report

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the mortgage industry’s top-rated automated borrower intelligence and retention system, today released its inaugural Mortgage Market Opportunities Report. According to the report, refinance opportunities continue to dominate the market, but a promising uptick in new listings was also evident in the Q2 data. Mortgage servicers will need to closely manage their default and foreclosure risk in the coming months, as the second quarter saw nearly two out of five customers trigger a risk-and-retention alert.

News: Maxwell Announces Launch of MaxDiligence, a Tech-Powered Due Diligence and Quality Control Service for Lenders

Mortgage and Finance News: (DENVER, Colo.) Today, leading digital mortgage platform Maxwell released MaxDiligence, a new offering that provides Due Diligence and Quality Control services for its clients. The latest feature in Maxwell's suite of tools designed for community lenders, MaxDiligence is a new scalable way to gain efficiency and generate reliable results.

News: MCT Introduces BAM Marketplace, the First Truly Open Mortgage Loan Exchange

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced the public introduction of BAM Marketplace™. Originally launched to support existing MCT sellers during the 2020 pandemic liquidity crisis, BAM Marketplace now welcomes new buyers and sellers as the world's first truly open loan exchange between unapproved counterparties.