Tag: San Diego Business

News: The Mortgage Collaborative and Mortgage Bankers Association announce partnership agreement

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's largest independent cooperative network for mortgage lenders and the Mortgage Bankers Association (MBA), the national association representing the real estate finance industry, announced today that they have entered into a strategic partnership to expand advocacy, education and engagement opportunities for their members.

News: Mortgage Collaborative releases Pulse of the Network survey results and analysis

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's leading independent cooperative network for mortgage lenders, today released results from the latest Pulse of the Network survey, along with an analysis examining how mortgage lenders are prioritizing technology, operational efficiency, and growth strategies amid continued market pressure.

News: The Mortgage Collaborative Appoints Rich Swerbinsky as Strategic Advisor to CEO & President; Names Heidi Belnay Senior Advisor for Business...

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's only independent, wholly-owned mortgage lending cooperative, today announced the appointment of Rich Swerbinsky as Strategic Advisor to the CEO & President and Heidi Belnay as Senior Advisor for Business Development. These strategic additions to the leadership team position TMC for accelerated growth and continued industry impact in 2026 and beyond.

News: TMC to host inaugural ACT Technology Summit focused on mortgage technology and AI

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's leading independent cooperative network for mortgage lenders, today announced it will host the inaugural ACT Technology Summit, short for Accelerator and Collaborative Transformation, a two-day standalone mortgage technology competition and showcase Aug. 12-13 at The Highlands Hotel in Dallas.

News: TMC launches new individual subscription membership option

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's leading independent cooperative network for mortgage lenders, today announced the launch of an individual subscription membership option that expands access to its network for mortgage professionals seeking connection, insight and peer engagement outside a traditional lender membership.

News: The Mortgage Collaborative Charts 2026 Strategy Focused on Connection, Growth and Industry Resilience

Mortgage and Finance News: (SAN DIEGO, Calif.) As lenders continue to navigate a shifting housing market marked by volatility, margin pressure and rapid technological change, The Mortgage Collaborative (TMC) is doubling down on what it believes is the industry's greatest strength: connection.

News: FICO Joins CapitalW Collective as Corporate Development Partner, Reinforcing Commitment to Industry Education and Innovation

Mortgage and Finance News: (SAN DIEGO, Calif.) CapitalW Collective, a trailblazing non-profit dedicated to advancing women and their allies in mortgage capital markets, proudly announces FICO® (NYSE:FICO), as a Corporate Development Partner - CapitalW Collective's highest support tier. The partnership reinforces a shared mission to educate, elevate, and empower current and future leaders within mortgage.

News: Cheers in Boston: TMC fall conference concludes with collaboration and confidence in the industry’s next chapter

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), wrapped up its 2025 fall conference, "Cheers in Boston: Where Everyone Knows Your Name," held September 14-17 at the Boston Marriott Copley Place. The event drew hundreds of lenders, vendors, and industry leaders to connect, exchange ideas, and refocus on progress as the industry moves into its next phase of growth.

News: The Mortgage Collaborative partners with FICO to deliver exclusive credit intelligence to lenders

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's largest independent cooperative network for mortgage lenders, has added FICO, global analytics software leader, as an educational partner. This partnership gives members additional insights into credit data, market trends and risk modeling. Unlike TMC's traditional partners, FICO will not sell products or services, focusing instead on empowering TMC's lender network with actionable intelligence on credit behavior and market dynamics.

News: The Mortgage Collaborative hosting Mortgage Tech Day at Fall conference in Boston

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's leading independent cooperative network for mortgage lenders, announced today that its Mortgage Tech Day will take place September 14 at the historic Fairmont Copley Plaza in Boston as part of its Fall conference, "CHEERS! Where Everyone Knows Your Name."

News: TMC July 2025 Pulse of the Network survey finds mortgage lenders leaning into automation, leadership development, and product innovation to...

Mortgage and Finance News: (SAN DIEGO, Calif.) Amid one of the mortgage industry's most prolonged stretches of cost pressure and market uncertainty, the latest Pulse of the Network survey from The Mortgage Collaborative (TMC) reports that lenders are responding with creativity and nimble thinking, anchored by a clear commitment to long-term resilience.

News: 25 Mortgage Executives Bridge Local Advocacy and National Innovation Through Dual Roles with TMC and State MBAs

Mortgage and Finance News: (SAN DIEGO, Calif.) Twenty-five executive leaders from The Mortgage Collaborative (TMC) have been identified as holding current leadership positions in their respective state Mortgage Bankers Associations (MBAs), showcasing a growing alignment between grassroots industry advocacy and national operational collaboration.

News: The Mortgage Collaborative’s ‘The Sip’ Podcast Delivers Industry Insights and Peer Collaboration

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced the launch of its new weekly podcast, "The Sip," designed to give mortgage professionals direct access to peers solving the same challenges they face every day. From tech adoption and compliance pressure to margin management, the 30-minute series delivers real-world strategies shared by lenders, for lenders-streamed live every Tuesday on LinkedIn.

News: Deemed Wild and Dangerous – But Fish & Game Can’t Produce a Single Document or Respond to Our Records Request

Mortgage and Finance News: (LA MESA, Calif.) On February 12, 2025, a formal Public Records Act (PRA) request was submitted to the California Fish and Game Commission seeking documentation to justify the classification of domestic ferrets as "not normally domesticated in California" by LegalizeFerrets.org. The request specifically asked for any scientific studies, internal memos, environmental risk assessments, or correspondence used to uphold the ongoing prohibition of domestic ferrets under Title 14, Section 671 of the California Code of Regulations.

News: Mortgage Lenders Lifted by Collaboration During Extended Period of Margin Compression, Regulatory Chaos, and Technology Transformation, reports The Mortgage Collaborative

Mortgage and Finance News: (SAN DIEGO, Calif.) Navigating a prolonged era of complexity marked by compressed margins, fierce recruiting wars, regulatory uncertainty, and rapid technological transformation, mortgage lenders find guidance and support in collaboration, according to The Mortgage Collaborative (TMC), an industry-leading organization for mortgage lenders of every variety.

News: The Mortgage Collaborative Welcomes New Lender Members and Preferred Partners to Its Expanding Network

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, proudly announces the addition of several new lender members and preferred partners to its growing community. These organizations join TMC's network of industry leaders committed to collaboration, innovation, and operational excellence.

News: The Mortgage Collaborative Helps Lender Member Resolve VA Loan Issue, Restoring Lender Authority

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC) has once again demonstrated the power of its network by swiftly assisting lenders to resolve a critical VA lending issue that had stalled loan processing nationwide. Through rapid collaboration, direct engagement with the Department of Veterans Affairs (VA), and the persistence of key TMC members, impacted lenders regained their VA underwriting and insurance authority in just one week-ensuring veterans could move forward with their home purchases.

News: CapitalW Collective Collaborates with Citizens to Advance Women in Mortgage Capital Markets

Mortgage and Finance News: (SAN DIEGO, Calif.) CapitalW Collective, a leading non-profit dedicated to increasing the representation of women and their allies in mortgage capital markets, proudly announces Citizens as a Diamond-level corporate sponsor. This partnership reflects a shared commitment to fostering a more inclusive and dynamic mortgage capital markets industry by providing education, mentorship, and leadership opportunities, particularly for underrepresented professionals.

News: Collaboration Between MCT and Fannie Mae Improves Pricing for Mortgage Sellers on Select Loans

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced their integration with Fannie Mae's new Loan Pricing API. By combining various price factors and utilizing a broader set of data found in bid tapes, the new API provides greater price transparency on certain loans. This is the latest in a series of recent collaborations between MCT and Fannie Mae intended to provide additional benefit and value to mortgage secondary market participants.

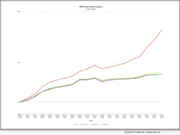

News: MCT Reports 28% Increase in Mortgage Lock Volume Heading into Spring Season

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced a 27.91% increase in mortgage lock volume compared to the previous month. Industry professionals and stakeholders are encouraged to download the full report for a detailed analysis.

News: MCT Introduces Atlas: Generative AI Advisor for Mortgage Capital Markets

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of Atlas, an artificial intelligence (AI) advisor now available within the MCTlive! platform. Atlas serves as a virtual capital markets expert and high-quality educational resource for MCT's mortgage lender clients. With this launch, effective February 10, 2025, MCT continues its tradition of innovation in secondary marketing technology.

News: 2024-2025 Mortgage Industry Insights Released by The Mortgage Collaborative

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), a leading network of mortgage lenders dedicated to innovation and collaboration, has released its latest Pulse of the Network report, offering key insights into the challenges and opportunities shaping the mortgage industry in 2025. The survey, conducted with decision-makers-including CEOs, COOs, and department heads from banks, credit unions, and independent mortgage banks (IMBs)-highlights how lenders are preparing for a shifting market landscape.

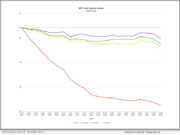

News: Mortgage Lock Volume Stays Flat in Latest MCT February Indices

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 0.12% decrease in mortgage lock volume compared to the previous month. Industry professionals and market enthusiasts are encouraged to download the complete report for a deeper understanding of the latest market trends and dynamics.

News: Optimal Blue Introduces Seven Major Innovations at Its Inaugural User Summit in San Diego

Mortgage and Finance News: (SAN DIEGO, Calif.) Optimal Blue today unveiled a series of new products and features, alongside its major Ask Obi AI assistant announcement, at its Summit user conference in San Diego. These innovation announcements underscore the company's commitment to delivering high-impact solutions, at no additional cost, that tackle real-world challenges and help lenders maximize profitability.

News: Optimal Blue Announces Ask Obi, an AI Assistant to Provide Mortgage Lending Executives With Real-Time Business Insights

Mortgage and Finance News: (SAN DIEGO, Calif.) Optimal Blue today announced Ask Obi, an AI assistant designed to provide mortgage lending executives with instant, actionable insights from their Optimal Blue products and data. Unveiled during Optimal Blue's inaugural Summit user conference in San Diego, Ask Obi gives lenders the power to view their operations holistically with data aggregation across Optimal Blue's comprehensive capital markets platform.

News: Mortgage Capital Trading (MCT) Unveils MSRlive! 4.0 – Offering Ground-Breaking Enhancements to MSR Reporting and Transparency

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading (MCT), the de facto leader in innovative mortgage capital markets technology, today announced the release of MSRlive! 4.0, a groundbreaking enhancement to its mortgage servicing rights (MSR) valuation platform. The latest version offers mortgage servicers an unprecedented level of transparency and business intelligence, equipping portfolio managers with powerful new tools to assess and optimize their

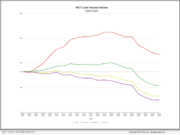

News: MCT Reports 16% Decrease in Mortgage Lock Volume Amid Market Dynamics

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 16.7% decrease in mortgage lock volume compared to the previous month. Industry professionals and market enthusiasts are encouraged to download the complete report to gain comprehensive insights into the evolving market dynamics.

News: Polly and CapitalW Collective Align to Support Women in Mortgage Capital Markets

Mortgage and Finance News: (SAN DIEGO, Calif.) CapitalW Collective, a trailblazing non-profit dedicated to advancing women and their allies in mortgage capital markets, proudly announces Polly as its first product and pricing engine (PPE) Diamond-level corporate sponsor. This alliance underscores CapitalW Collective's mission "to create more inclusive and dynamic mortgage capital markets, one woman and ally at a time."

News: MCT Reports a 15% Decrease in Mortgage Lock Volume Amid Higher Rates

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, has announced a 15.12% decrease in mortgage lock volume compared to the previous month. The data, reflecting current market dynamics, is available in MCT's latest report, which offers in-depth analysis and insights for industry professionals and stakeholders.

News: MCT Announces 2.5% Increase in Mortgage Lock Volume Despite October Market Volatility

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, reported a 2.5% increase in mortgage lock volume compared to the previous month. Mortgage market professionals and industry enthusiasts are invited to download MCT's comprehensive report to gain deeper insights into the current market dynamics.