Tag: Software

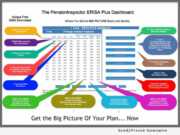

News: The Pension Inspector Launches New SaaS Integrating Prior and Present Form 5500 Filings, to Provide Big Picture of Plan Operations

Mortgage and Finance News: (NEW YORK, N.Y.) National Retirement Programs, Inc. and its wholly owned subsidiary AtPrime Media Services, the creator of PensionInspector.com, introduces "Form 5500 Prestige Vision," an addition to its, super easy to use, replacement for the U.S. Department of Labor's ERISA Form 5500 Download Service "ERISA Plus Dashboard."

News: OpenClose Launches DecisionAssist Mobile for Originators

Mortgage and Finance News: (SAN FRANCISCO, Calif.) OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced at the California Mortgage Bankers Association (CMBA) 46th Annual Western Secondary Marketing Conference that it unveiled DecisionAssist(TM) Mobile, which provides fingertip access to the company's proprietary web-based product and pricing engine (PPE)

News: LBA Ware Recruits Mortgage Process Improvement Specialist Jessica Henke as Solutions Consultant

Mortgage and Finance News: (MACON, Ga.) LBA Ware(TM), a leading provider of automated compensation software and systems integration solutions for mortgage lenders, announced today that it has hired Jessica Henke as a solutions consultant to support the company's implementation consulting and client success efforts. Henke will leverage her two decades of accounting and business process improvement expertise in mortgage lending to bring LBA Ware clients streamlined business workflow solutions and enhanced operational insights.

News: Global DMS Adds Appraisal Pre-Scheduler Functionality to its eTrac Valuation Management Platform

Mortgage and Finance News: (LANSDALE, Pa.) Global DMS, a leading provider of cloud-based valuation management software, announced that it has rolled out eTrac Pre-Scheduler, a newly released tool that that streamlines appraisal appointments, allowing lenders and AMCs that are leveraging eTrac to easily set predetermined appraisal dates, apply specific parameters, and broadcast appraiser communications.

News: C3 Insurance Launches New Technology, a Smartphone Inspection App for Businesses

Mortgage and Finance News: (SAN DIEGO, Calif.) C3 Risk & Insurance Services today announced the launch of its new SaferWorks smartphone technology for businesses to use in documenting inspections. The app is designed to be extremely simple and easy to use by both the company administrator and by the company end users.

News: LBA Ware Celebrates Its 10th Anniversary Serving the Mortgage Industry

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of automated compensation software and systems integration solutions for mortgage lenders, announced it has achieved a decade in business this year. The company celebrated the official anniversary of its founding on June 10, the date of the company's incorporation.

News: Simplifile’s E-recording Platform Utilized by Recording Districts Representing More Than 80-percent of the U.S. Population

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that 31 additional recording jurisdictions located in 16 states throughout the Midwestern, Southwestern, and Western United States have joined Simplifile's e-recording network.

News: OpenClose Recruits LOS Development Expert Joseph Wade to Further Innovate and Enhance Existing Software Solutions

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that it has added senior software LOS and mortgage software development expert Joseph Wade to its growing development team. Joseph was previously at Finastra (formerly D+H) and will play an integral role in software innovation and enhancements at OpenClose.

News: NotaryCam Celebrates 100K Online Notarizations with Live Demo at National Settlement Services Summit (NS3) 2018

Mortgage and Finance News: (NEWPORT BEACH, Calif.) NotaryCam, Inc. today announced that it has completed more than 100,000 online notarizations since introducing the service in 2012. To celebrate this milestone, NotaryCam will offer free demos of its eClose360 platform to attendees of the 2018 National Settlement Services Summit (NS3) being held June 6-8 at the Marriott Renaissance Center in Detroit.

News: DocMagic Integrates eSign Technology with MortgageHippo’s Digital Lending Platform

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, and MortgageHippo, a Fintech-driven digital lending platform, announced a seamless eSign integration between their two platforms.

News: ARMCO Enhances Automation and Analysis in ACES Audit Technology

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk mitigation software solutions, has announced several product enhancements that improve the mortgage quality control (QC) process for lenders and servicers using its auditing platform ACES Audit Technology(TM).

News: DocMagic Employees Join Together to Support Fourth Annual U.S. Red Nose Day Fundraising Campaign

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced that on Thursday, May 24, the entire company participated in Red Nose Day - an effort to help end child poverty both in the U.S. and in some of the poorest communities in the world.

News: Cloudvirga Named a 2018 Benzinga FinTech Award

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga(TM), a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform(R), was honored as one of the world's top fintech firms at last week's Benzinga Global Fintech Awards.

News: Guaranteed Rate Partners with DocMagic to Cut Closing Time

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced that retail mortgage lender Guaranteed Rate can now cut closing time by electronically signing mortgage closing documents in advance.

News: Mortgage QC Executive Jeremy Burcham to Lead Sales Efforts for TRK Connection’s Insight RDM Platform

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection (TRK), a leading provider of mortgage quality control and origination management solutions, announced today that it has hired Jeremy Burcham as Executive Vice President of Sales. Burcham will leverage his 10+ years of experience in mortgage quality control (QC), compliance, credit policy, due diligence and technology to refine TRK's sales and marketing strategy for its suite of solutions, including its flagship mortgage QC audit platform Insight Risk & Defect Management (RDM).

News: Mortgage E-closing Pioneer Mountain America Credit Union Implements Simplifile’s Collaboration and Post Closing Services

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that Mountain America Credit Union has implemented Simplifile Collaboration and Post Closing services to enhance the closing experience for its members.

News: Cloudvirga Raises $50M to Deliver a Truly Digital Mortgage Experience

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform, today announced the closing of a $50-million Series C funding round led by private-equity firm Riverwood Capital (Riverwood) with ongoing participation from Upfront Ventures.

News: TeamSnap Appoints New Chief Financial Officer

Mortgage and Finance News: (BOULDER, Colo.) TeamSnap, the household name in integrated sports management, announced today that Todd Stockard has been appointed the company's new Chief Financial Officer. Stockard will oversee TeamSnap's financial strategy as the company continues its rapid expansion with the introduction of new products, platforms and partnerships.

News: PitBullTax Software Expands its Power with Release of New Version 4.0

Mortgage and Finance News: (CORAL SPRINGS, Fla.) PitBullTax Software, the leading IRS Tax Resolution Software for CPAs, EAs and Tax Attorneys, just released its new and more feature rich Version 4.0. For nine years PitBullTax Software has transformed the tax resolution business by making it more efficient and intuitive for tax professionals to solve their clients' IRS problems.

News: Prevail Consulting, Inc. announces contract with Medical Assurance Society New Zealand Limited to license Prevail Reinsurance System

Mortgage and Finance News: (STAMFORD, Conn.) Prevail Consulting, Inc., a leading insurance industry technology and professional services provider, today announced a contract with Medical Assurance Society New Zealand Limited (MAS) to license the Prevail Reinsurance System (PRS) to support MAS's reinsurance operations. Under this new contract, Prevail will install PRS and deliver implementation, application and data migration services.

News: LBA Ware Appoints Mortgage Technology Specialist Diana Sheffer as Solutions Consultant

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of automated compensation software and systems integration solutions for mortgage lenders, announced it has hired Diana Sheffer as a solutions consultant to support the company's sales and product implementation efforts. In this role, Sheffer will apply her 18 years' experience in mortgage lending and technology consulting to connect LBA Ware's clients with best-fit systems integration and process automation solutions to enhance performance-driven organizational growth.

News: ReverseVision and Allegiant Reverse Services Partner to Simplify Title Ordering for HECM Loans

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, today announced a partnership with Allegiant Reverse Services (ARS), a full-service title and settlement company with an exclusive focus on reverse mortgage closings.

News: Ascend Federal Credit Union Automates its Residential Mortgage Lending Business with OpenClose’s LenderAssist LOS and DecisionAssist PPE

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that Ascend Federal Credit Union (Ascend) is leveraging its LenderAssist(TM) LOS platform and DecisionAssist(TM) product and pricing engine (PPE). OpenClose's completely browser-based solution has delivered additional efficiencies and heightened service levels for the credit union's growing mortgage lending division.

News: Ready for Next Tax Season? New TaxBird App Designed for People with Homes in More than One State

Mortgage and Finance News: (NAPLES, Fla.) With this year's tax season in the rear-view mirror, there's no better time to start prepping for the next round. TaxBird - a new tax app developed by ware2now, LLC - helps people with homes in more than one state ensure they don't exceed their residency threshold. It's useful to tax professionals and estate planners too.

News: Cloudvirga Adds Award-Winning Appraisal Order Management from Mercury Network to Its Digital Mortgage Point-of-Sale Platform

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the Intelligent Mortgage Platform, today announced its completion of a fully automated, lights-out integration with Mercury Network, part of CoreLogic (NYSE:CLGX) and one of the industry's largest appraisal order management platforms.

News: MCT Wins PROGRESS in Lending Association’s 2018 Innovation Award for its New Bid Auction Manager (BAM) Whole Loan Trading Technology

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that PROGRESS in Lending Association, the industry's premier mortgage technology focused organization, presented the company with its annual Innovation Award for the rapid adoption and impact of its Bid Auction Manager(TM) (BAM) within the whole loan trading market.

News: Matic Marks Commitment to Compliance with Appointment of Shaz Kojouri to Senior Management Team

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic, a digital insurance agency whose technology enables borrowers to purchase homeowner's insurance during the mortgage transaction, today announced it has tapped Shahrzad "Shaz" Kojouri as VP of legal and compliance. Prior to joining Matic, Kojouri was assistant general counsel for nonprofit student loan provider AccessLex Institute.

News: Veros and IDS Partner on Integrated Solution for Fannie Mae and Freddie Mac UCD Data Submissions

Mortgage and Finance News: (SANTA ANA, Calif.) Veros Real Estate Solutions (Veros), a leading developer of enterprise risk management, collateral valuation, and predictive analytics services, and mortgage document preparation vendor International Document Services, Inc. (IDS) announced today that they have partnered to provide lenders with a fully integrated automated delivery solution for submitting the Uniform Closing Dataset (UCD) to the Government Sponsored Enterprises (GSEs).

News: IDS Adds Hybrid eClosing Capabilities to Its Mortgage Doc Prep Platform

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced that its clients now have the capabilities to conduct hybrid electronic mortgage closings through its flagship mortgage document preparation platform, idsDoc. Hybrid eClosings allow for faster, more seamless mortgage real estate closing transactions, which can help lenders meet the Consumer Financial Protection Bureau's (CFPB) "Know Before You Owe" mandate to improve the borrower experience for consumers.

News: Cloudvirga and Freddie Mac Team Up to Deliver a Better Borrower Experience, Maximize Fungibility

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform, today launched single-click submission of loan data to both GSEs' automated underwriting systems (AUS) in a collaborative effort with Freddie Mac (OTCMKTS: FMCC), delivering on the industry need for greater transactional ease.