Tag: Software

News: Sustainable Organizations Embrace EnergyCAP’s Complete Suite of Energy and Sustainability ERP Solutions

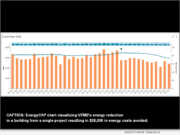

Mortgage and Finance News: (STATE COLLEGE, Pa.) EnergyCAP, a renowned provider of energy and sustainability enterprise resource planning (ERP) solutions, proudly announces The University of Texas Medical Branch (UTMB) and The University of New Mexico (UNM) have adopted EnergyCAP's newest solutions: CarbonHub and Wattics, making them the first customers to embrace EnergyCAP's complete solution suite.

News: Introducing RapidVerify: A Cutting-Edge Solution for Applicant Document Verification

Mortgage and Finance News: (AUSTIN, Texas) In today's business landscape, where companies are facing the disconcerting reality of losing up to 5% of their revenue to fraudulent activities, the urgency for a reliable and efficient solution is critical. RapidVerify is proud to announce the launch of its innovative Software-as-a-Service (SaaS) platform specifically engineered to address the pressing issue of document fraud.

News: Q4 2022 ACES Mortgage QC Industry Trends Report Shows Decline in Critical Defect Rate to 1.84%

Mortgage and Finance News: (The quarterly defect rate declined 25.5% over Q3, though the annual defect rate remained above 2% for 2022) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) of 2022, as well as the full calendar year (CY).

News: Nomis Solutions hires Amy Chase as Senior Vice President of Services

Mortgage and Finance News: (SAN FRANCISCO, Calif.) Nomis Solutions (Nomis), the leading provider of end-to-end pricing lifecycle management technology, announced that client success veteran Amy Chase has been tapped as Senior Vice President of Services. Chase will be responsible for leading implementations of Nomis Solutions and delivering ongoing services to existing clients.

News: Jonathan Nahil joins FormFree as chief technology officer

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that it has brought on Jonathan Nahil as chief technology officer (CTO). Nahil possesses more than 20 years of experience as a software architect and leader of development teams at renowned technology organizations.

News: Vice Capital Markets Releases Integration with Freddie Mac Income Limits API

Mortgage and Finance News: (NOVI, Mich.) Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today it is one of the first Freddie Mac-integrated Secondary Market Advisors (SMAs) to release an integration with Freddie Mac's Income Limits application programming interface (API).

News: LenderLogix enhances LiteSpeed point-of-sale platform to support communication with Spanish-speaking mortgage borrowers

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced its streamlined point-of-sale (POS) LiteSpeed now offers a Spanish version of the residential loan application to support communication with Spanish-speaking borrowers in their native language.

News: ACES Quality Management unveils ACES PROTECT® mortgage compliance testing module

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announces the addition of ACES PROTECT, a suite of automated regulatory compliance tests, to its flagship ACES Quality Management & Control® quality control (QC) auditing platform.

News: Peak Residential Lending Builds Digital-First Mortgage Borrowing Experience Using LenderLogix Product Suite

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced Peak Residential Lending has implemented its complete application suite - LiteSpeed, QuickQual and Fee Chaser - into its existing tech stack to power a digital-first borrower experience.

News: FormFree and Brimma Tech announce partnership to expedite matching of prospective homebuyers with best-fit loan products and lenders

Mortgage and Finance News: (RALEIGH, N.C.) Mortgage software development and solutions firm Brimma Tech (Brimma) today announced a strategic collaboration with ability-to-pay fintech FormFree®. The integration of Brimma's AI-enabled chatbot service into FormFree's Passport® mobile app will make it possible for prospective homebuyers to find their ideal loan product from the convenience of their mobile device, without the need to first complete a detailed loan application.

News: MCT AOT Automation Improves Mortgage Lender Profitability and Investor Efficiency

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that it has automated the process of digital TBA trade assignment during the loan sale process for both mortgage lenders and participating correspondent investors. This automation makes assignment of trade loan sales (AOTs) faster, more convenient, and easier for investors to offer.

News: MMI increases platform’s business intelligence and expands mortgage and real estate data analytics capabilities with its Custom Dashboard Hub

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announced today it has launched its new Custom Dashboard Hub and expanded the business intelligence (BI) tools available on its platform, increasing users' ability and ease in developing strategy, recruiting, nurturing talent and discovering new opportunities.

News: IndiSoft partners with FormFree to streamline the delivery of housing counseling services to underserved consumers

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that developer of collaborative solutions for the housing finance industry, IndiSoft, is leveraging FormFree's Passport® to enable HUD-approved housing counseling agencies (HCAs) to provide more effective and expeditious consumer counseling.

News: The Mortgage Firm selects LiteSpeed from LenderLogix as its POS Platform

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced The Mortgage Firm, a Florida-based independent retail mortgage lender with branches located throughout the U.S., has selected its streamlined point-of-sale (POS) platform LiteSpeed to power its application process and deliver a superior borrower experience at the initial point of contact.

News: LenderLogix increased organic growth by 150% amongst its client base of independent mortgage lenders, banks and credit unions in 2022

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced significant growth within its client base in 2022, increasing its number of partnered lending institutions by 150%. The company also maintained a net promoter score (NPS) of 86 based on feedback from the thousands of lenders and real estate agents that interact with LenderLogix and its suite of mortgage technology.

News: GreenLyne adopts FormFree’s Residual Income Knowledge Index to unlock greater inclusivity in mortgage lending

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that Inclusive-Finance-as-a-Service platform GreenLyne has enhanced its ability to help lenders identify home financing opportunities for underserved consumers with its adoption of FormFree's Residual Income Knowledge Index™ (RIKI™).

News: Beth A. Wilson Named New President of Excelas, LLC

Mortgage and Finance News: (CLEVELAND, Ohio) Beth A. Wilson has been named President of Excelas, LLC, a national provider of medical record organization, retrieval, and analysis, helping healthcare organizations respond to claims - and litigation - brought against them. Excelas, LLC's announcement today says Ms. Wilson's tenure begins April 17, 2023.

News: FormFree sharpens focus on decentralizing and democratizing consumer access to credit with strategic divestiture of AccountChek

Mortgage and Finance News: (ATHENS, Ga.,) Founder and CEO Brent Chandler today heralded a new era for FormFree® following its strategic divestiture of asset-verification service AccountChek®. Moving forward, the fintech will focus on products that advance its mission to decentralize and democratize the way consumers understand their financial data and access credit opportunities. Eric Lapin, who joined FormFree in 2022 as chief strategy officer, will guide the company's next chapter as president.

News: HomeScout partners with Down Payment Resource to capture consumer demand for homebuyer assistance program information

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting home buyers with homebuyer assistance programs, today announced that it has partnered with HomeScout LLC to help mortgage lenders generate and convert more leads by meeting heightened consumer demand for information about affordable pathways to homeownership.

News: ACES Quality Management Taps Mortgage and Financial Services QC/Risk Experts to Headline 2023 ACES ENGAGE

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced its speaker lineup for the upcoming ACES ENGAGE conference, taking place at the historic Broadmoor Hotel in Colorado Springs, May 17 - 19, 2023.

News: TrustEngine launches lending’s most comprehensive borrower intelligence platform (BIP)

Mortgage and Finance News: (OWINGS MILLS, Md.) Sales Boomerang and Mortgage Coach today announced their union under the new name TrustEngine™, an identity that embodies the merged organization's vision to help lenders drive undeniable value as clients' trusted financial advisors. The name also reflects the brand's heritage as a trusted service provider to mortgage lenders for more than a quarter-century.

News: Barr Group Mortgage Closes First eNote Transaction through Click n’ Close’s non-delegated correspondent eNote program

Mortgage and Finance News: (ADDISON, Texas) Click n' Close, a multi-state mortgage lender serving consumers and mortgage originators through its wholesale and correspondent channels, announced that Alabama-based mortgage banker Barr Group Mortgage has completed the first eNote transaction through Click n' Close's non-delegated correspondent eNote program. Entities participating in the transaction include the registration of the eNote on the MERS® eRegistry (the mortgage industry's approved eNote system of record), Ameris Bank as Barr Group Mortgage's warehouse lender and DocMagic as the eClosing and eVault tech provider.

News: After, Inc. Partners with ENVE to Offer a Seamless Registration Process to its Dealers and Customers

Mortgage and Finance News: (NORWALK, Conn.) After, Inc. announced today that ENVE (enve.com) will utilize QuickReg® to provide a seamless post-sale registration experience to its dealers and customers. ENVE Composites designs, manufactures, and markets handmade carbon fiber bicycle rims and components, and custom bikes (through its premium dealer network) and is highly respected amongst professional riders and biking enthusiasts for its engineering, innovation and customer service and support.

News: MonitorBase Launches Instant Inquiry Alerts to Help Lenders Capture More Opportunities

Mortgage and Finance News: (MURRAY, Utah) MonitorBase, a mortgage fintech company that monitors prescreened credit information and real-time behavioral data to alert lenders when one of their contacts is in the market to purchase or refinance a home, today announced the launch of instant credit inquiry alerts for their mortgage lender clients.

News: MCT First to Integrate with Freddie Mac’s Income Limits API

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, is pleased to announce it is the first secondary marketing platform to integrate with Freddie Mac's Income Limits application programming interface (API) created for the first-time home buyer area median income (AMI) limits. Income Limits allows for the accurate pricing of Credit Fee in Price (Exhibit 19, or "Credit Fees") waivers.

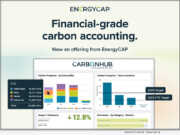

News: EnergyCAP expands offering to include financial-grade carbon accounting

Mortgage and Finance News: (BOALSBURG, Pa.,) EnergyCAP, a leading provider of energy and sustainability enterprise resource planning (ERP) software, today announced the launch of CarbonHub, a new solution that offers financial-grade carbon accounting and sustainability reporting.

News: After, Inc. among 1,000 + exhibitors at the 2023 National Hardware Show (NHS) in Las Vegas

Mortgage and Finance News: (NORWALK, Conn.) After, Inc., a global leader in warranty solutions and post-sale customer experience technology, will be joining an awesome list of exhibitors at the 2023 National Hardware Show, January 30 - February 2 at the Las Vegas Convention Center in Las Vegas, NV. Come meet our team during the show at Booth SL4279!

News: Nomis Solutions Elevates Johnathan Bant to Head of Client Relations for Financial Services Market in Canada

Mortgage and Finance News: (TORONTO, Ontario) Nomis Solutions (Nomis), the leading provider of end-to-end pricing lifecycle management technology, announced industry veteran Johnathan Bant will serve as Head of Client Relations for Canada. In this role, Bant is responsible for leading Canadian engagements across Nomis' client portfolio as well as non-customer financial institutions (FIs) across the country.

News: ACES Quality Management expands client base by 22% in 2022

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the company had record growth increasing its client base by 22% amidst significant market volatility. The company also made numerous updates to its ACES Quality Management & Control® software and its free Compliance NewsHub resource, in addition to launching its inaugural ACES ENGAGE conference.

News: MMI named 2022 Inc Power Partner in Real Estate and Proptech

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announced today that it has been named a 2022 Inc. Power Partner in Real Estate and Proptech. The inaugural list recognizes more than 250 business-to-business companies in 22 categories.