Tag: Technology

News: MCT Launches InvestorMatic™ Program to Elevate the Whole Loan Trading Experience Between Lenders and Investors

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that it has officially introduced a unique program called InvestorMatic in the lead up to the MBA Annual Convention & Expo in Austin, Texas.

News: FormFree Teams Up with LexisNexis Risk Solutions to Revolutionize Digital Mortgage Loan Applications for Borrowers and Lenders

Mortgage and Finance News: (ATLANTA, Ga.) FormFree has teamed up with LexisNexis Risk Solutions to help lenders intelligently pre-fill the Universal Residential Loan Application (Form 65/1003) for mortgage applicants. The combined solution significantly reduces the amount of information a consumer must manually input.

News: Industry Veteran Chris Olsen Joins OpenClose as Vice President of Sales Engineering

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, an industry-leading multi-channel loan origination system (LOS) and digital mortgage fintech provider, announced that it added technology veteran Chris Olsen to help further expand its sales department. Chris holds the newly created position of vice president of sales engineering.

News: LBA Ware’s CompenSafe™ Enhances the Loan Originator Experience at Guaranteed Rate

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of incentive compensation management (ICM) and business intelligence (BI) software solutions for the mortgage industry, today announced that Guaranteed Rate Companies has improved internal processes and enhanced the loan originator (LO) experience with the implementation of CompenSafe.

News: SimpleNexus Integrates with Reggora, Enabling Loan Originators to View and Manage Appraisals on the Go

Mortgage and Finance News: (LEHI, Utah) SimpleNexus, developer of the leading digital mortgage platform for loan officers, borrowers and real estate agents, today announced it has partnered with Reggora, the leading automated appraisal technology for mortgage lenders and appraisers in delivering a range of origination solutions for the mortgage industry.

News: ReverseVision Unveils New Tech Strategy with Major Platform Updates and Brand Transformation at 2019 MBA Annual Conference

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology, today announced its transformation as an API-enabled flexible reverse lending platform, unveiling a new logo as part of its revised mission and rebranding.

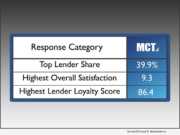

News: STRATMOR Group’s 2019 Technology Insight Study Again Scores MCT Highest for Overall Satisfaction, Lender Loyalty, and Lender Share

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that the study results from STRATMOR Group's 2019 Technology Insight Study show MCT as the industry leader in lender share, overall satisfaction, and Lender Loyalty Score(r) in the Production Pipeline Hedging category.

News: New DocMagic Mobile Application Leverages Backend Technology to Fill Critical Gap in Digital Lending Workflow

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced the launch of its new LoanMagic mobile application. LoanMagic, which is provided free to all DocMagic customers, leverages a powerful backend platform that provides full interoperability with DocMagic solutions, as well as other third-party mortgage software.

News: MCT’s COO Phil Rasori Honored with HousingWire Tech Trendsetters Award

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that its COO, Phil Rasori, has been designated to HousingWire's inaugural Tech Trendsetters award list. Phil is credited with being instrumental in the architecture and launch of multiple innovative capital markets solutions.

News: Polyient Labs Co-sponsoring Blockchain for Good Conference in San Francisco, Oct. 25-27

Mortgage and Finance News: (SAN FRANCISCO, Calif.) Phoenix-based Polyient Labs, an early-stage, blockchain-startup incubator, is co-sponsoring Blockchain for Good, October 25 -27, 2019 in San Francisco. The agenda includes keynote speakers and workshops where participants can pitch ideas.

News: Why Low Balance Letters Are Not Working for Automotive Lenders

Mortgage and Finance News: (MIAMI, Fla.) South Florida-based AI Fintech company Aclaro, whose mission is to deliver data transparency and personalized insights to its auto lending clients, has developed an innovative, technologically advanced method of increasing borrower retention rates. Instead of sending out thousands of low balance letters with the hope that customers will open these letters and follow up with the lender, Aclaro has made the process much simpler and easier.

News: Shardus to Demonstrate First Linearly Scalable Blockchain

Mortgage and Finance News: (DALLAS, Texas) The Shardus Project (Shardus.com) continues to gain momentum with their state sharding solution and will be the first team in the world to demonstrate linear scaling functionality on a decentralized blockchain network at their Q3 update event on Saturday, October 19th in Dallas at the Emerging Technology Summit in Dallas, Texas.

News: ARMCO’s Sharon Reichhardt Wins HW Tech Trendsetters Award

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, today announced that Sharon Reichhardt, the company's vice president of client success, has been named a winner of HousingWire's inaugural Tech Trendsetters award.

News: Capsilon Wins #NEXTSUMMER19’s Best in Show Award

Mortgage and Finance News: (EDMOND, Okla.) NEXT Mortgage Events LLC, creator of events for women mortgage executives, has announced that Capsilon, a provider of mortgage automation software, has been voted Best in Show for its presentation of Capsilon Digital Underwriter at the technology showcase at #NEXTSUMMER19, the women's executive mortgage summit that took place on Aug. 18-19, 2019.

News: ARMCO Names Trevor Gauthier Chief Executive Officer

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, today announced that Trevor Gauthier has been appointed as CEO and board member of ARMCO. Avi Naider, who led ARMCO for the past 10 years as CEO, will transition to the board of directors.

News: EnHelix Unveils the First Blockchain-Based Commodity Trading Software at Houston Gastech Event

Mortgage and Finance News: (HOUSTON, Texas,) EnHelix an award-winning oil and gas commodity trading and logistics management software with artificial intelligence and blockchain, today announced the launch of its new Marketplace Blockchain software for commodity trading companies.

News: Goodbye checks and wires! Ablii now offers payments to businesses in the U.S. and Canada

Mortgage and Finance News: (TORONTO, Ontario) Ablii by nanopay, a self-service online payments platform for businesses, is proud to announce its expansion into the U.S. market. Now businesses can send domestic payments in the U.S. and Canada, and cross-border payments between the two countries.

News: LBA Ware to Debut LimeGear Live from the Digital Mortgage Conference Main Stage

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of incentive compensation management (ICM) and performance management software and solutions for the mortgage industry, will debut LimeGear, a turnkey business intelligence (BI) platform at Source Media's Digital Mortgage Conference on Tuesday, September 24, live from the event's main stage during demo session #4, which begins at 8:55 a.m.

News: SimpleNexus Debuts Mortgage Disclosures Auto-Fulfillment Service at Digital Mortgage Conference

Mortgage and Finance News: (LEHI, Utah) SimpleNexus, developer of the leading digital mortgage platform for loan officers, borrowers and real estate agents, debuted its integrated auto-fulfillment service for mortgage disclosures at Source Media's Digital Mortgage conference in Las Vegas.

News: New MCTlive! Mobile App Puts Secondary Marketing at Lenders’ Fingertips

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, debuted a new MCTlive! mobile application at its MCT Exchange client conference last Friday. The app enables secondary marketing managers to review reporting, manage loan pipelines, and conduct whole loan trading from the convenience of their mobile phone.

News: Elizabeth Karwowski, CEO, Get Credit Healthy, Selected Woman With Vision Award Winner

Mortgage and Finance News: (SUNRISE, Fla.) Fintech company, Get Credit Healthy, Inc., (a subsidiary of Beta Music Group Inc. OTC PINK: BEMG) announces CEO Elizabeth Karwowski, has been selected as a winner of the Women With Vision Award, to be presented live, during the Vision Summit on September 25 in Tampa, Florida.

News: FormFree’s Brent Chandler to Discuss the Transformative Impact of APIs on Mortgage Lending Technology as Digital Mortgage Conference Panelist

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced that company Founder and CEO Brent Chandler will be a featured panelist at Source Media's fourth annual Digital Mortgage Conference, which will take place September 23-24, 2019, at the Wynn Las Vegas.

News: Mid America Mortgage Selects ReverseVision as Technology Partner to Debut HECM and Reverse Products

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, today announced that Mid America Mortgage, Inc. (Mid America) has selected its flagship reverse loan origination system (LOS), ReverseVision Exchange (RVX) to support the introduction of HECM and private reverse mortgage products.

News: ARMCO Expands Client Base by Adding KWIK Mortgage, The KLR Group and Several Top 25 Mortgage Lenders

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk mitigation solutions, has announced that it has achieved significant growth during the first two quarters of 2019, the result of acquiring new clients, including KWIK Mortgage, The KLR Group and several top 25 mortgage lenders.

News: Aclaro Announces New Board Member and the Release of Aclaro EcoSystem 3.0

Mortgage and Finance News: (CHICAGO, Ill.) Aclaro Inc., the game-changing Artificial Intelligence software company that provides disruptive technologies to the automotive, financial, and government sectors, announces a new Board Member and the release of Aclaro EcoSystem 3.0 (ES 3.0). With these announcements, Aclaro continues rapid advancement toward its overarching mission of helping lenders, dealers and consumers develop and nurture longer mutually beneficial relationships.

News: Simplifile Adds 31 Western U.S. Jurisdictions to E-recording Network

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents and counties, today announced that 31 additional recording jurisdictions located in 13 states throughout the Midwest, Southwest and Western U.S. have joined Simplifile's e-recording network.

News: VLP Law Group Announces the Addition of Mike Morrissey as a Partner in its Technology Transactions Practice Group

Mortgage and Finance News: (PALO ALTO, Calif.) VLP Law Group LLP is pleased to announce that Mike Morrissey has joined the firm as a partner in its Technology Transactions Practice Group. Mr. Morrissey comes to VLP from MobileIron (NASDAQ: MOBL), #1 on Deloitte's Technology Fast 500 in 2014 (for revenue growth from 2009-2013) and a VLP client.

News: SafeChain Partners with RamQuest to Provide Fraud-Free Closings

Mortgage and Finance News: (COLUMBUS, Ohio) SafeChain, the industry leader in wire fraud prevention technology and blockchain applications for land title, announced today its SafeWire application has been fully integrated into RamQuest's Closing Market application - making SafeWire available as a seamless experience to title offices nationwide.

News: New Tools from SimpleNexus Help Mortgage Lenders Build Stronger Relationships with Borrowers’ Real Estate Agents

Mortgage and Finance News: (LEHI, Utah) SimpleNexus, developer of the leading digital mortgage platform for loan originators and borrowers, today announced the availability of a suite of tools designed to help originators build stronger relationships with their borrowers' real estate agents and convert more prospects into mutual customers.

News: Westerly Becomes First Municipality in Rhode Island to Adopt E-recording

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that the Town of Westerly has joined Simplifile's e-recording network following the July 1 passage of a law authorizing e-recording statewide in Rhode Island.