News Topic: Technology

News: FormFree Appoints Housing Finance Authority Faith Schwartz to Board of Directors

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced that housing finance expert Faith Schwartz has been elected to its board of directors. Among the most influential leaders in the mortgage industry, Schwartz has played a firsthand role in shaping current housing finance best practices and public policy.

News: The Mortgage Collaborative Adds Loan Vision to Preferred Partner Network

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative, the nation's only independent mortgage cooperative, today announced the addition of Loan Vision, a mortgage industry-specific financial management and accounting software provider, to its preferred partner network, giving its Lender Members access to the industry's premier accounting software.

News: Cloudvirga Names Stephen DeSantis as Chief Financial Officer

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, developer of intelligent mortgage point-of-sale (POS) platforms, has appointed Steve DeSantis as its new chief financial officer. A seasoned technology finance executive, DeSantis will be responsible for driving Cloudvirga's financial strategies to accelerate its growth. He will report to Cloudvirga's recently appointed CEO Michael Schreck.

News: OpenClose Adds New Hires to its Software Development Team

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, a multi-channel loan origination system (LOS) and mortgage software solutions provider, announced that it hired four senior developers to arm the company with additional resources to architect new products and enhance existing solutions.

News: Five Top-30 Lenders Choose Cloudvirga’s Digital Mortgage Platform in Last 100 Days

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, developer of intelligent mortgage point-of-sale (POS) platforms, has signed five of the nation's top 30 non-bank lenders in the last 100 days. The new customers collectively originate over $100 billion in loans annually. The announcement follows the firm's addition of Michael Schreck as CEO in June and the completion of a $15 million Series B funding round led by Blackstone Group portfolio company Incenter in March.

News: Matic Insurance Services Raises $7 Million in Series A Round Backed by Top Lender, Insurance Carriers and VC Firms

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic Insurance Services (Matic), a digital insurance agency whose technology enables borrowers to purchase homeowner's insurance during the mortgage transaction, announced today it has raised $7 million in a Series A funding round. Investors participating in the round include Mr. Cooper, one of the nation's top 20 mortgage originators and the fourth-largest home loan servicer in the country

News: Mortgage Capital Trading Integrates its MCTlive! Secondary Marketing Software with Fannie Mae’s Pricing & Execution – Whole Loan Application

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced the release of new online functionality that automates the process of product selection and delivery of loan commitments directly to Fannie Mae for MCT's lender clients. The new solution, which was developed as part of MCT's ongoing technology collaboration with Fannie Mae, is called Rapid Commit(TM) and resides within MCT's award-winning secondary marketing platform, MCTlive!(TM).

News: SimpleNexus Adds AccountChek Asset, Employment and Income Verification from FormFree to Its Mobile Mortgage App

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced it has entered a partnership with SimpleNexus, a leader in bringing the home mortgage process to mobile devices. The integration of the two companies' technologies will make FormFree's AccountChek automated verification service for asset, employment and income a seamless part of the loan application experience for borrowers applying for a loan using SimpleNexus' mobile technology.

News: ReverseVision Partners with Premier Reverse Closings (PRC) to Streamline Title Ordering for Home-Equity Conversion Mortgages

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, has forged a partnership with Premier Reverse Closings (PRC), a title and settlement firm specializing in reverse mortgage closings. A new integration between the companies' software allows users of ReverseVision's flagship RV Exchange (RVX) loan origination system (LOS) to order title services from PRC without ever leaving the RVX system.

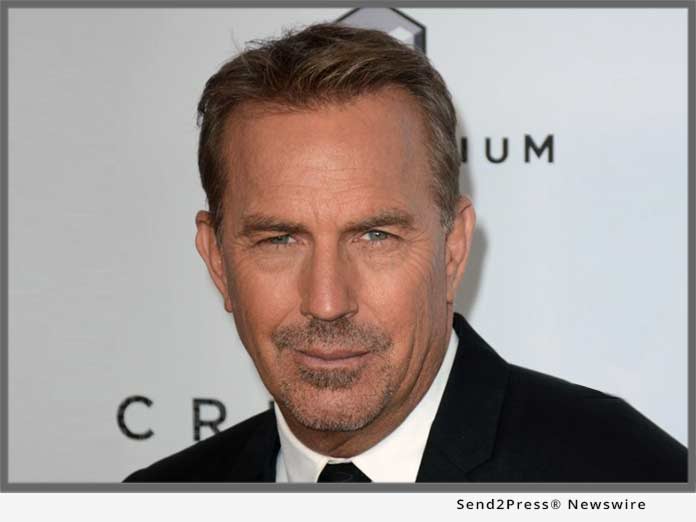

News: Click n’ Close Digital Mortgage Platform Partners with NASCAR, Richard Petty Motorsports

Mortgage and Finance News: (DAYTONA BEACH, Fla.) Click n' Close, a division of Mid America Mortgage, Inc., has entered into official partnership agreements with the sanctioning body, NASCAR, and one of the most iconic race teams in the sport, Richard Petty Motorsports. The collaborations designate Click n' Close as the "Official Mortgage Provider of NASCAR" in addition to becoming a partner of Richard Petty Motorsports.

News: Thread.Legal – the Missing piece of Microsoft Office 365 for Lawyers

Mortgage and Finance News: (CHARLOTTE, N.C.) If you are a law firm using Microsoft Office 365 and need something extra to complete your document and case management, then Thread is for you. Built in Microsoft Office 365, it gives you a practice management solution with software you already know. Thread is the latest case management software from eXpd8 Ltd, harnessing 30 years' legal IT industry experience and specifically designed for lawyers and paralegals.

News: Unalp CPA Group White Paper Comparing Xero, QuickBooks, and Sage Intacct Assists Buyers with Accounting Software Purchase

Mortgage and Finance News: (WALNUT CREEK, Calif.) Unalp CPA Group, Inc. announced today the availability of a white paper comparing popular accounting software solutions Xero, QuickBooks, and Sage Intacct. Unalp's document 'Comparing Xero, QuickBooks, and Sage Intacct' covers pricing, ease of use and more than half a dozen functional areas such as reporting, payroll, and invoicing.

News: Mortgage Coach Platform to Integrate with Tavant’s AI-Powered Digital Lending Platform for an End-To-End Seamless Experience

Mortgage and Finance News: (IRVINE, Calif.) Mortgage Coach, a software as service technology provider of the industry leading Total Cost Analysis, today announced an integration between the Mortgage Coach platform and Tavant FinXperience - Retail platform. This integration creates a seamless connection between the two technologies, enabling the direct, automatic transfer of data and information for mutual customers of FinXperience - Retail and Mortgage Coach.

ARMCO Launches ACES Automated Document Manager, which Uses Robotic Process Automation to Help Lenders Lower Gross Defects

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of financial quality control and compliance software, has announced that it has launched ACES Automated Document Manager (ADM), a new technology that uses robotic process automation to automate the core activities lenders undertake to reduce gross loan defects. ARMCO will be demonstrating ADM, which is available through ARMCO's ACES Audit Technology(TM) and as a stand-alone product, by appointment at MBA's Annual Convention and Expo 2017 in Denver, Colorado.

FormFree Delivers Combined Income, Asset and Employment Report for Fannie Mae’s Single Source Validation Pilot

Mortgage and Finance News: (ATHENS, Ga.) FormFree(R) today announced that it has entered into a pilot with Fannie Mae that could allow mortgage lenders to validate borrower income, asset and employment data through a single report as early as 2018.

31 Jurisdictions Across Eastern U.S. Join Simplifile E-recording Network

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that 31 additional recording jurisdictions throughout the Northeast, Southeast and Mid-Atlantic have signed on to Simplifile's e-recording platform.

Gateway Mortgage Selects TRK Connection’s Insight RDM QC Audit Platform

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection, a leading provider of mortgage quality control and origination management solutions, announced today that Oklahoma-based Gateway Mortgage Group has chosen the Insight Risk & Defect Management (RDM) platform to conduct its internal quality control (QC) audits.

Norcom Mortgage Names ReverseVision Its Provider of Choice for End-to-End HECM Technology

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, today announced that Norwich Commercial Group, Inc. dba Norcom Mortgage (Norcom) has selected ReverseVision as its provider of choice for end-to-end HECM technology.

Mortgage Capital Trading’s Bulk Acquisition Manager™ Technology Achieves 100 Percent Investor Adoption

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that it has gained unprecedented industry-wide technology adoption among the investor aggregator community. MCT officially unveiled the Bulk Acquisition Manager(TM) (BAM) within its capital markets software platform, MCTlive!, in July of this year.

VanDyk Mortgage Encourages Borrowers to Automate Asset Verification Using AccountChek by FormFree

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced that VanDyk Mortgage Corporation has selected its flagship AccountChek(R) service for automated asset verification. Loan officers at VanDyk have already begun offering AccountChek as an alternative to manual, paper-based asset verification. In addition, borrowers can choose AccountChek as a faster alternative to uploading bank statements when using VanDyk's self-service mortgage portal, powered by Ellie Mae's Encompass Consumer Connect.

LBA Ware added to Advanced Technology Development Center’s ATDC Signature Portfolio

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of automated compensation software and systems integration solutions for mortgage lending and retail banking, announced that the Advanced Technology Development Center (ATDC) - Georgia's technology incubator - has accepted LBA Ware to into its ATDC Signature portfolio. As an ATDC Signature company, LBA Ware will have access to ATDC coaching and programming, potential investment capital and additional resources from the Georgia Institute of Technology, including intellectual property and talent.

Pendo Makes Enhancements to Its Appraisal Review Tool with over 100 Automated Checks

Mortgage and Finance News: (LEE'S SUMMIT, Mo.) Pendo, a nationwide appraisal management company (AMC), has made enhancements to their Appraisal Review Tool, which is part of their proprietary technology solutions for appraisal management. Pendo's Appraisal Review Tool assists their quality review team in managing the process of checking each and every appraisal, ensuring reports are accurate, complete and most of all compliant.

Quandis, Inc. Adds New Imaging Functionality to its Military Search Service for DOD SCRA Compliance

Mortgage and Finance News: (RANCHO SANTA MARGARITA, Calif.) Quandis, Inc., a leading default management mortgage technology provider, announced that it has added new functionality that allows servicers and default attorneys to more easily manage images of official certificates from the Department of Defense (DoD) to demonstrate proof of compliance for adherence to the Servicemembers Civil Relief Act (SCRA).

Matic Insurance and LendingQB team to Eliminate Stressful Mortgage Delays Related to Homeowner’s Insurance

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic Insurance Services (Matic), a digital insurance agency that enables borrowers to purchase homeowner's insurance during the home-buying transaction, today announced a new partnership with LendingQB, a provider of "lean lending" loan origination technology. Matic announced the news as part of a live demonstration at San Francisco's Digital Mortgage Conference.

FormFree Expands Alliance with LexisNexis Risk Solutions and impending launch of AccountChek Plus

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced the impending launch of AccountChek Plus, a new tool for lenders that combines the features of AccountChek, the nation's most trusted asset verification app, with liens and civil judgments data from LexisNexis Risk Solutions. By giving lenders a more complete picture of borrower ability-to-pay before loans go to underwriting, AccountChek Plus cuts costs, reduces risk and empowers better lending decisions.

TRK Connection enhances Insight RDM Mortgage QC Audit Platform with Data Subscriptions Feature

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection, a leading provider of mortgage quality control and origination management solutions, announced today that it has added a data subscriptions feature to its flagship mortgage quality control (QC) audit platform Insight Risk & Defect Management (RDM).

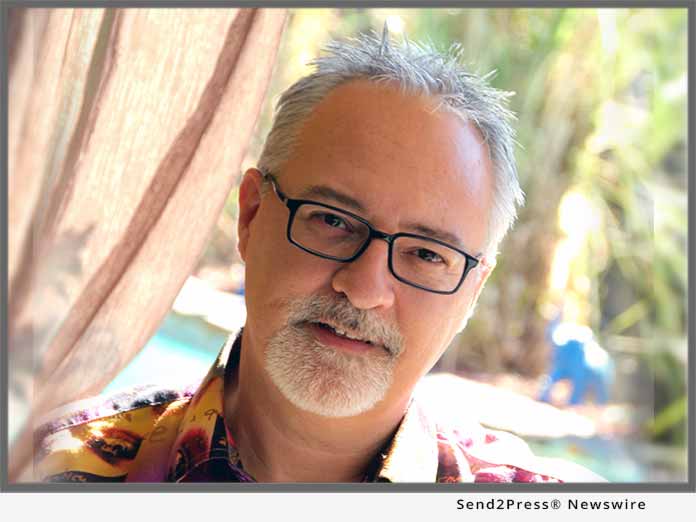

Lender Price Opens New $5 – $10 Million Investment Round and Names Jerry L. Halbrook as CEO

Mortgage and Finance News: (PASADENA, Calif.) Lender Price, the emerging leader in digital mortgage lending technology, announced today that it has named veteran mortgage industry executive Jerry Halbrook as its CEO and has opened a fresh round of equity funding to fuel its growth trajectory.

TechCrunch Disrupt SF 2017: Matic Insurance Services Debuts Integration with Roostify

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic Insurance Services, a digital insurance agency that enables borrowers to purchase homeowner's insurance during the home-buying transaction, has forged a partnership with automated lending technology provider Roostify. The company announced the news Tuesday afternoon from the stage of TechCrunch's Startup Battlefield, part of the TechCrunch Disrupt SF conference held in San Francisco this week. Matic was one of just six elite startups chosen to advance to the final round of the competition.

U.S. Credit Unions Now Successfully Leveraging OpenClose LenderAssist Loan Origination System

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, a multi-channel loan origination system (LOS) and mortgage software solutions provider, announced that multiple credit unions are now using OpenClose's LenderAssist(TM) LOS platform to automate the mortgage side of their businesses.

Xanegy 2017 Nonprofit Executive Series Fall and Winter Schedule Announced

Mortgage and Finance News: (AUSTIN, Texas) The Nonprofit Executive Series webcasts, hosted by Xanegy, will kick off on Tuesday, September 26, 2017, with "Trends in Human Capital Management." The Nonprofit Executive Series is a monthly webcast for nonprofit leaders.