Tag: Technology

News: SafeChain to Integrate ALTA Registry into Its Real Estate Wire Fraud Prevention Platform SafeWire

Mortgage and Finance News: (COLUMBUS, Ohio) SafeChain, the industry leader in wire fraud prevention software for land title, announced today that it will integrate the national ALTA Registry into its real estate wire fraud prevention platform SafeWire. Through the integration, mortgage lenders will be able to search the Registry and verify the identity of title insurance agents and settlement companies, providing an enhanced level of efficiency and security to the real estate transaction.

News: SafeChain Honored as 2018 Seed Stage Company of the Year at VentureOhio Awards

Mortgage and Finance News: (COLUMBUS, Ohio) SafeChain, the industry leader in wire fraud prevention software for land title, announced today that it was named 2018 Seed Stage Company of the Year by VentureOhio.

News: Advalent Launches Network 360 to Drive Multi-Dimensional Provider Performance in Value-Based Care Contracting

Mortgage and Finance News: (WESTBOROUGH, Mass.) Advalent, a market-leading healthcare technology company focusing on payer solutions announced today the launch of a new network contracting and analytics product - Network 360(TM). Designed for payers and risk bearing healthcare providers, Network 360 is a breakthrough analytics platform that analyzes network, enables value-based contracting, and manages both upside and downside risk.

News: On Q Financial Selects LBA Ware’s CompenSafe to Improve Accuracy and Efficiency of Mortgage Loan Originator Commission Calculations

Mortgage and Finance News: (MACON, Ga.) LBA Ware(TM), a leading provider of automated compensation software and systems integration solutions for mortgage lenders, today announced that Arizona-based On Q Financial has selected CompenSafe(TM) to manage the numerous compensation plans created for its team of loan originators (LOs) nationwide.

News: Prevail Reinsurance System selected by Tower Insurance as the leading edge technology solution to automate reinsurance administration

Mortgage and Finance News: (STAMFORD, Conn.) Prevail Consulting, Inc., a leading insurance industry technology and professional services provider, today announced a contract with Tower Insurance to license the Prevail Reinsurance System (PRS) to support Tower's reinsurance operations. Under this new contract, Prevail will install PRS and deliver implementation and professional services.

News: PitBullTax Institute Organizes Its Second User Conference – Tax Resolution Expert Program

Mortgage and Finance News: (FORT LAUDERDALE, Fla.) PitBullTax Institute, an educational branch of the well-established IRS Tax Resolution Software, organizes its Second PitBullTax User Conference: "Tax Resolution Expert Program." It will take place on September 20-21-22, 2018 at the Hilton Fort Lauderdale Beach Resort. This conference is designed exclusively for existing and potential users of PitBullTax Software.

News: American Financial Network Deploys Cloudvirga Digital Mortgage Technology Nationwide

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga(TM), a leading provider of digital mortgage software, today announced the deployment of its Cloudvirga Enterprise POS to all 100 branch locations of American Financial Network (AFN), a privately held mortgage company that employs over 750 loan officers and serves tens of thousands of customers nationwide.

News: TRK Connection Add Industry-Leading Reverification Functionality to Insight RDM Mortgage QC Platform

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection, a leading provider of mortgage quality control (QC) and origination management solutions, announced it has added functionality to its flagship QC audit platform Insight Risk & Defect Management (RDM) to help lenders digitally manage the reverification process, including eSign and automated bulk document indexing.

News: SafeChain Completes First Official Real Estate Blockchain Transaction in the U.S.

Mortgage and Finance News: (COLUMBUS, Ohio) SafeChain, the industry leader in wire fraud prevention software for land title, announced today it has successfully facilitated the sale of 36 forfeiture properties via blockchain. The transactions, which were completed on Tuesday in partnership with the auditor's office in Franklin County, Ohio, marks the first instance in the U.S. of a state government using blockchain to legally record the transfer of property deeds.

News: Fairway Independent Mortgage Corporation Partners with Cloudvirga to Support Its Ambitious Operational and Organizational Growth Goals

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform, today announced that Fairway Independent Mortgage Corporation (Fairway) has launched Cloudvirga's digital mortgage platform for consumers and loan officers.

News: ReverseVision Expands Support for Proprietary Reverse Mortgage Products

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, today announced that it is offering a combination of enhanced software functionality and professional services to help mortgage lenders launch proprietary reverse mortgage products.

News: Pendo Once Again Named as Top 100 Fastest Growing Companies in Kansas City and Top 5000 Nationally

Mortgage and Finance News: (LEE'S SUMMIT, Mo.) Pendo, a nationwide appraisal management company (AMC), has been named to the Ingram's Corporate 100 list for fastest growing companies in Kansas City and the Inc. 5000 list for fastest growing companies nationally. Both lists recognize companies who have achieved significant revenue growth over a three-year period. This marks Pendo's fifth consecutive year on both lists.

News: Finance of America Mortgage Gives Advisors and Borrowers a Cutting-Edge Experience with Digital Mortgage Technology from Cloudvirga

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga(TM), a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform(R), today announced that Finance of America Mortgage (FAM) will deploy the Cloudvirga Enterprise POS as its digital mortgage platform.

News: MCT Integrates its MCTlive! Secondary Marketing Software with Freddie Mac for Automated Loan Sale Pricing and Commitment

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced new functionality that delivers real-time pricing and automates loan committing for Freddie Mac clients. MCT's lender clients receive the pricing information seamlessly via its integrated capital markets technology platform, MCTlive!

News: FinKube Publishes New Digital Lending White Paper, ‘Simplifying the Digital Mortgage Process’

Mortgage and Finance News: (DALLAS, Texas) FinKube, a company that provides AI-powered Platform-as-a-Service solutions for a range of industries, announced today that it has published a new whitepaper entitled "Simplifying the Digital Mortgage Process." The new paper outlines some of the risks lenders face when making choices about the technologies they employ on the front ends of their mortgage origination processes.

News: MCT’s Bid Auction Manager (BAM) Technology Automates Tri-Party Agreement for Investors’ Bid Tape AOT Loan Sale Executions

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced automation of the Tri-Party Agreement required between lenders, investors, and broker dealers during Assignment Of Trade (AOT) transactions in the secondary market. The functionality is built into MCT's Bid Auction Manager(TM) (BAM) bid tape management and best execution platform.

News: NotaryCam Applauds Treasury Recommendations to Remove Barriers to Remote Online Notarization and ‘Fully Digital Mortgage’

Mortgage and Finance News: (NEWPORT BEACH, Calif.) Rick Triola, founder and CEO of the industry's most popular remote online notarization solution, NotaryCam, calls the Department of Treasury's recommendations in its July 31 report to the President: A Financial System That Creates Economic Opportunities: Nonbank Financials, Fintech, and Innovation "a cure to the persistent drags on real estate transactions that have prevented the consumer from experiencing the benefits now possible with digital technologies."

News: Advalent Partners with Novus Healthcare to Close the Gap in Value-Based Care

Mortgage and Finance News: (WESTBOROUGH, Mass.) Advalent Corporation ('Advalent') signed a partnership in early 2018 with Novus Healthcare to identify patients who could benefit from value-based care and implement that approach using Advalent's Value-Based Care Platform and Novus' population health management programs.

News: Simplifile Signs 1800th County to Its E-recording Network, Platform Now Utilized by More Than Half of U.S. Recording Jurisdictions

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that Clallam County, Wash., is the 1800th jurisdiction to join Simplifile's e-recording network.

News: Maxwell Announces New Partnership with HomeServices Lending

Mortgage and Finance News: (DENVER, Colo.) Digital mortgage software provider, Maxwell, today announced a new partnership with HomeServices Lending of Des Moines, Iowa. Maxwell empowers mortgage lenders across the nation with a modern digital workspace that digitizes and automates the home-buying experience.

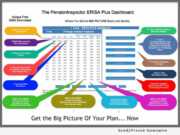

News: The Pension Inspector Launches New SaaS Integrating Prior and Present Form 5500 Filings, to Provide Big Picture of Plan Operations

Mortgage and Finance News: (NEW YORK, N.Y.) National Retirement Programs, Inc. and its wholly owned subsidiary AtPrime Media Services, the creator of PensionInspector.com, introduces "Form 5500 Prestige Vision," an addition to its, super easy to use, replacement for the U.S. Department of Labor's ERISA Form 5500 Download Service "ERISA Plus Dashboard."

News: Express Information Systems Named to Software Industry Guru Bob Scott’s 2018 List of Top 100 VARs

Mortgage and Finance News: (SAN ANTONIO, Texas) Express Information Systems, a leading provider of business software and consulting for growing businesses in Texas and beyond, has announced its inclusion on Bob Scott's Top 100 VARs 2018 published by Progressive Media Group.

News: OpenClose Launches DecisionAssist Mobile for Originators

Mortgage and Finance News: (SAN FRANCISCO, Calif.) OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced at the California Mortgage Bankers Association (CMBA) 46th Annual Western Secondary Marketing Conference that it unveiled DecisionAssist(TM) Mobile, which provides fingertip access to the company's proprietary web-based product and pricing engine (PPE)

News: LBA Ware Recruits Mortgage Process Improvement Specialist Jessica Henke as Solutions Consultant

Mortgage and Finance News: (MACON, Ga.) LBA Ware(TM), a leading provider of automated compensation software and systems integration solutions for mortgage lenders, announced today that it has hired Jessica Henke as a solutions consultant to support the company's implementation consulting and client success efforts. Henke will leverage her two decades of accounting and business process improvement expertise in mortgage lending to bring LBA Ware clients streamlined business workflow solutions and enhanced operational insights.

News: Aclaro to Bring the Power of Predictive Analytics to Lending Sector, Expands Operations in the US

Mortgage and Finance News: (MIAMI, Fla.) Aclaro, the leading provider of blockchain based open data platforms and solutions, has announced that it has launched a new Fintech Artificial Intelligence (AI) solution focused on the lending industry. The new solution is Aclaro TrueView(TM). Aclaro aims to equip lenders with the innovative tools needed for competitive advantage with its tech savvy, blockchain based predictive analytics platform that can be utilized without incurring heavy costs.

News: Accurate Group Enhances Its NotaryWorks Complete Notary Solution with Remote Online Notarization from NotaryCam

Mortgage and Finance News: (NEWPORT BEACH, Calif.) NotaryCam today announced that it has partnered with Accurate Group, a leading provider of technology-driven real estate appraisal, title and compliance services, to provide remote online notarization services for NotaryWorks(TM), Accurate Group's complete notary solution.

News: Global DMS Adds Appraisal Pre-Scheduler Functionality to its eTrac Valuation Management Platform

Mortgage and Finance News: (LANSDALE, Pa.) Global DMS, a leading provider of cloud-based valuation management software, announced that it has rolled out eTrac Pre-Scheduler, a newly released tool that that streamlines appraisal appointments, allowing lenders and AMCs that are leveraging eTrac to easily set predetermined appraisal dates, apply specific parameters, and broadcast appraiser communications.

News: C3 Insurance Launches New Technology, a Smartphone Inspection App for Businesses

Mortgage and Finance News: (SAN DIEGO, Calif.) C3 Risk & Insurance Services today announced the launch of its new SaferWorks smartphone technology for businesses to use in documenting inspections. The app is designed to be extremely simple and easy to use by both the company administrator and by the company end users.

News: LBA Ware Celebrates Its 10th Anniversary Serving the Mortgage Industry

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of automated compensation software and systems integration solutions for mortgage lenders, announced it has achieved a decade in business this year. The company celebrated the official anniversary of its founding on June 10, the date of the company's incorporation.

News: Simplifile’s E-recording Platform Utilized by Recording Districts Representing More Than 80-percent of the U.S. Population

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that 31 additional recording jurisdictions located in 16 states throughout the Midwestern, Southwestern, and Western United States have joined Simplifile's e-recording network.