Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from its latest Homeownership Program Index (HPI). The firm’s analysis of 2,351 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 1.82% from Q3 to Q4 2022.

HPI report finds an upward trend in new homebuyer assistance programs as the housing industry rounded out a year of difficult homebuying conditions

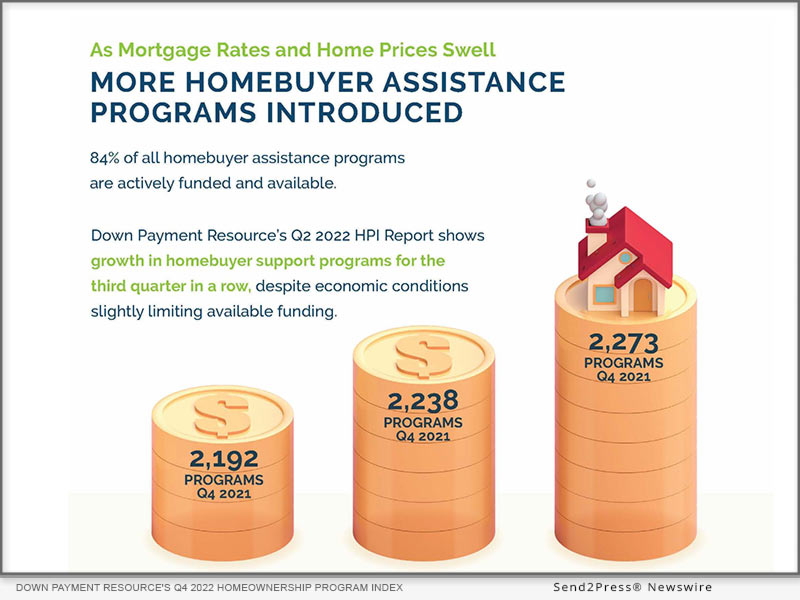

ATLANTA, Ga. /Mortgage and Finance News/ — Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from its latest Homeownership Program Index (HPI). The firm’s analysis of 2,351 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 1.82% from Q3 to Q4 2022. This marks the fifth consecutive quarter the number of homebuyer assistance programs has grown.

Methodology

Published quarterly, DPR’s HPI surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits and other housing organizations. DPR communicates with over 1,200 program providers throughout the year to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates and affordable first mortgages, in the DOWN PAYMENT RESOURCE® database.

Key Findings

The Q4 2022 HPI examined a total of 2,351 homebuyer assistance programs that were active as of January 6, 2023. Key findings are as follows:

* The net number of homebuyer assistance programs is up. The total number of programs increased by 42 in Q4 2022. Among them were five nationwide or multi-state programs and seven statewide programs.

* Support for first-time homebuyers increased. The number of programs dedicated to supporting first-time homebuyers now totals 1,315, up from 1,291 in Q3 2022.

* Support for multifamily homebuyers increased. Programs that support multifamily homeownership saw a 5.5% increase over Q3 2022. These programs now make up 29.3% of all homebuyer assistance offerings.

“While economic roadblocks caused the percentage of programs actively receiving funding to decrease marginally in Q4, homebuyer assistance still saw steady growth in 2022,” said DPR CEO Rob Chrane. “Until home prices and mortgage rates decline and the housing market recovers, down payment assistance will be a crucial source of financial support for homebuyers that lack the savings to cover an inflated down payment.”

A more detailed analysis of the Q4 2022 HPI findings, including infographics and examples of many of the programs described in this release, can be found on DPR’s website at https://downpaymentresource.com/professional-resource/homebuyer-assistance-offerings-increase-for-the-fifth-consecutive-quarter-in-q4-2022/.

For a complete list of homebuyer assistance programs by state, visit https://downpaymentresource.com/wp-content/uploads/2023/01/HPI-state-by-state-data.Q42022.pdf.

About Down Payment Resource:

Down Payment Resource (DPR) is an award-winning technology provider helping the housing industry connect homebuyers with the homebuyer assistance they need. With toolsets tailored for real estate agents, multiple listing services and mortgage lenders, DPR’s technology empowers housing professionals to make affordable home financing opportunities more accessible while growing business and forging referral partnerships. The only organization to track the details of every U.S. homebuyer assistance program, DPR frequently lends its expertise to nonprofits, housing finance agencies, policymakers, government-sponsored enterprises, think tanks and trade organizations seeking to improve housing affordability. Its technology is used by five of the top 10 retail mortgage lenders by volume, three of the four largest real estate listing websites and 500,000 real estate agents. For more information, visit https://downpaymentresource.com/.

Learn More: https://www.downpaymentresource.com/

This version of news story was published on and is Copr. © 2023 Mortgage & Finance News™ (MortgageAndFinanceNews.com) – part of the Neotrope® News Network, USA – all rights reserved.

Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.

STORY ID: 88262