Suzee Quanta

News: Floify shares findings from survey of 150 top-producing loan originators

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, commissioned an independent study of 150 high-performing loan originators (LOs) in 2023 to gain recruiting and retention insights. "High-performing" LOs were defined as being in the top 20% of closed loan dollars or volume.

News: Grand Maison: Your New Home in the Heart of the City is Coming Soon to Downtown Manchester NH

Mortgage and Finance News: (MANCHESTER, N.H.) Avatar Construction of Watertown, MA announced today that construction is ready to commence for Grand Maison, a six-story, 223-unit apartment complex and retail space located at 533 Elm Street. This project, set to open in 2026, will transform the current aging commercial space into a modern living destination for both families and individuals.

News: New workflow in the Empower LOS makes it easier for mortgage lenders to consider rent payments when qualifying first-time homebuyers

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the availability of a new, automated workflow in the Empower® loan origination system (LOS) that makes it easier for lenders to identify and qualify loan applicants who could benefit from evaluation of their positive rent payment history.

News: iEmergent CEO Laird Nossuli to present at Seattle’s inaugural Black Homeownership Symposium on January 26

Mortgage and Finance News: (SEATTLE, Wash.) iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced that its CEO Laird Nossuli will present at Seattle's inaugural Black Homeownership Symposium on January 26. Dr. Courtney Johnson Rose, president of the National Association of Real Estate Brokers (NAREB), one of the oldest minority trade associations in the nation and its foremost network of Black real estate professionals, will unveil the findings of the first-ever Washington state edition of the State of Housing in Black America (SHIBA) report.

News: Realfinity Launches Dual-License Program for Real Estate Agents

Mortgage and Finance News: (MIAMI, Fla.) Real-Finity, Inc. ("Realfinity") is excited to announce the availability of its Dual-License Program enabling the integration of mortgage services for real estate agents. In the dynamic and increasingly challenging environment of real estate, agents are now able to take advantage of this innovative solution to combat pressure on their commissions and enhance their value proposition by offering mortgage services.

News: Quadro Acquisition One Corp. to Merge with Group of Greg Lindberg’s Companies with an Estimated Pro Forma Enterprise Value of...

Mortgage and Finance News: (LOS ANGELES, Calif.) Quadro Acquisition One Corp., a NASDAQ-listed Special Purpose Acquisition Company ("Quadro SPAC") has agreed to acquire a group of seven companies in the sports collectibles, software, cloud-based IT and healthcare services segments with an estimated pro-forma enterprise value of $3 billion (referred to as the "Global Growth Companies"). These companies are affiliated with Global Growth, a private equity firm founded by Greg Lindberg. The name and the symbol under which Quadro SPAC will trade upon the completion of its business combination with Global Growth Companies will be determined at a later date.

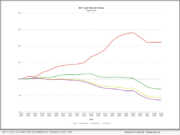

News: Seasonal Lows Contribute to 13.71% Drop In Mortgage Volume

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, revealed today a 13.71% decline in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

News: Avenu Insights & Analytics Announces the Acquisition of Finvi’s State and Local Government Division

Mortgage and Finance News: (CENTREVILLE, Va.) Avenu Insights & Analytics ("Avenu"), the global leader in revenue recovery and administrative solutions for state and local governments, is proud to announce the acquisition of Finvi's State and Local Government ("Finvi SLG") Division. This strategic move marks a significant expansion of Avenu's offerings and capabilities in serving state and local governments.

News: ACES Audit Volume Increases 24%, Hits Record High in 2023

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that, despite challenging mortgage market conditions, the company maintained a record growth path achieved over the last few years by adding more than a dozen of the leading lenders in the U.S. to its client roster in 2023.

News: Optimal Blue PPE Now Available in Native Mobile App for Android and iOS, Gives Loan Officers ‘Pricing in Their Pocket’...

Mortgage and Finance News: (PLANO, Texas) Today, Optimal Blue announced releases related to its publicly listed, native mobile app for the Optimal Blue PPE - the industry's most widely used product, pricing, and eligibility engine. The releases consist of a new mobile app for Android, as well as enhancements to the company's mobile offering for iOS.

News: Grand Central Suites: The Ultimate Modern Living Experience is Coming Soon to Downtown Manchester NH

Mortgage and Finance News: (MANCHESTER, N.H.) Avatar Construction of Watertown, MA announced today that construction is underway for Grand Central Suites, the newest apartment complex in downtown Manchester, New Hampshire. Located at 21 Central Street, this 77-unit complex is set to transform the current aging commercial space into the premier living destination for families and individuals.

News: Optimal Blue Originations Market Monitor: December Brought Significant Growth in Rate/Term Refinance Volume as Falling Rates Created Favorable Tailwinds

Mortgage and Finance News: (PLANO, Texas) Today, Optimal Blue announced the release of its Originations Market Monitor report, looking at mortgage origination data through December month-end. Leveraging daily rate lock data from the Optimal Blue PPE - the industry's most widely used product, pricing, and eligibility engine - the Originations Market Monitor provides a comprehensive and timely view into origination activity.

News: Murray Homes Wins At The NARI CotY 2023 Awards!

Mortgage and Finance News: (SARASOTA, Fla.) Each year, NARI of Tampa Bay presents Contractor of the Year Awards to members who have demonstrated outstanding work through the submission of their remodeling projects. The CotY Awards are the highest form of recognition by industry leaders and peers and celebrate members committed to design, best practices, integrity, high standards, and professionalism.

News: Matrix Advises on the Sale of Bobby Taylor Oil Company, Inc. & T&S Transport, Inc. to Parker Oil Company

Mortgage and Finance News: (RICHMOND, Va.) Matrix Capital Markets Group, Inc. ("Matrix"), a leading, independent investment bank, announces the successful closing on the sale of Bobby Taylor Oil Company, Inc. and T&S Transport, Inc. ("BTOC" or the "Company") to Parker Oil Company Incorporated. Based in Fayetteville, North Carolina, BTOC is a leading supplier of retail propane, commercial refined fuels, and racing gas to a diverse customer base of residential and commercial accounts throughout the state of North Carolina.

News: ImpactAZ 2025 documents economic strides of statewide supplier-diversity accelerator

Mortgage and Finance News: (PHOENIX, Ariz.) Thinkzilla Consulting Group today announced that ImpactAZ 2025, a statewide supplier-diversity accelerator serving black and other minority business owners, has announced the results from its inaugural cohort. Thirty-five participants selected for the accelerator completed the program, with 75% attending all technical assistance programming.

News: Legacy Wealth Advisors has been named to the 2nd annual Forbes 2024 Best-in-State Wealth Management Teams list

Mortgage and Finance News: (WARRENVILLE, Ill.) Raymond James Financial Services is proud to announce that Legacy Wealth Advisors has been named to the 2nd annual Forbes Best-in-State Wealth Management Teams list* for 2024! Legacy Wealth is a diverse team that includes Financial Advisors Fernando Ereneta, Justin Ancona, and Jennifer Secola.

News: Leading Travel Insurance Comparison Site TravelInsurance.com Has Surpassed 100,000 Customer Reviews on Shopper Approved

Mortgage and Finance News: (NEW YORK, N.Y.) TravelInsurance.com today announced surpassing 100,000 customer reviews on Shopper Approved, a rapidly growing review platform in the United States. The verified reviews led to a 4.9 out of 5 stars rating, with over 96,000 perfect 5-star ratings. TravelInsurance.com has the highest third-party reviews in the travel insurance industry.

News: A PAGA Victory to Bring in the New Year: Trial Court Holds LWDA Responsible for Prevailing Employer’s Costs

Mortgage and Finance News: (SAN FRANCISCO, Calif.) Last week a trial court in Alameda County entered an order permitting Hobby Lobby Stores, Inc. to recover nearly $125,000 in costs from the California Labor and Workforce Development Agency (LWDA). Hobby Lobby incurred these costs during six years of hard-fought litigation involving claims brought under California's Private Attorneys General Act (PAGA), CDF Labor Law LLP announced today.

News: Down Payment Resource’s Executive Vice President Sean Moss honored in National Mortgage Professional’s 2024 Industry Titans awards program

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting home buyers with homebuyer assistance programs, today announced its Executive Vice President of Product and Operations Sean Moss has been selected as an Industry Titan by National Mortgage Professional (NMP) magazine. The award recognizes experienced professionals who show exceptional dedication, compassion and integrity who are improving the mortgage industry for both industry professionals and the clients they serve.

News: Floify joins ACUMA to help credit unions elevate the member homebuying experience

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that it has joined the American Credit Union Mortgage Association (ACUMA) as an affiliate member. Through its membership, Floify aims to help credit unions engage their members with an elevated home financing experience while supporting streamlined loan production with cost-saving tools.

News: The Mortgage Collaborative closes 2023 with record-breaking ’12 Days of TMC’ in time for holiday congratulations

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, has wrapped up its fourth annual 12 Days of TMC, a virtual conference running from November 30 to December 15, 2023. The online event, spread over three weeks, featured several keynote speakers.

News: Alliance Group and Four-Time Olympian Chaunté Lowe Join Forces for 2024 Living Benefits Awareness Month, National Life Group Joins as...

Mortgage and Finance News: (LAWRENCEVILLE, Ga.) Alliance Group, a leading IMO in the insurance industry, is thrilled to announce an exciting partnership with four-time Olympian and American high jump record holder, Chaunté Lowe, for Living Benefits Awareness Month (LBAM) in January 2024. In a demonstration of their shared commitment to spreading consumer awareness about Living Benefits, National Life Group has also stepped in as a co-sponsor of this pivotal event.

News: Argyle’s investments in innovation spur over 50 lenders to switch to the mortgage industry’s highest-converting VOI/E platform

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, closed a banner year of mortgage growth with 50 new IMB, credit union and bank customers. The payroll connectivity leader more than doubled the annual volume of income and employment verifications conducted on behalf of its customers to 1.5 million with the help of 15 of the top 100 mortgage lenders.

News: Depth 2023 growth drives key hires in strategic marketing and content development as residential mortgage and real estate industries poise...

Mortgage and Finance News: (ATLANTA, Ga.) Depth, a leading provider of consultative B2B marketing, public relations and reputation management services for technology companies in the residential mortgage finance, financial technology (fintech), real estate technology (REtech) and related regulatory technology (regtech) industries, will close 2023 with a significantly larger internal team and client roster in anticipation of continued rebound for mortgage and real estate volume.

News: NotaryCam Authorized to Provide Remote Online Notarization Services for California Transactions in 2024

Mortgage and Finance News: (NEWPORT BEACH, Calif.) NotaryCam®, a Stewart-owned company and leading remote online notarization (RON) provider for real estate and legal transactions, announced today it will support remote online notarial acts in California beginning in 2024 following the passage of CA Senate Bill 696, which was signed into law by California Governor Gavin Newsom on September 30, 2023. Stage 1 of the bill takes effect on January 1, 2024.

News: Monthly Mortgage Volume Decreases 10.7% In Latest MCT Indices Report

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, today announced a 10.7% decrease in mortgage lock volume in November compared to the previous month. This revelation comes as part of MCT's monthly Lock Volume Indices report, offering valuable insights into the dynamic landscape of the residential mortgage industry.

News: Matrix Announces the Sale of Santmyer Companies, Inc.’s Convenience Retail and Branded Dealer Wholesale Businesses

Mortgage and Finance News: (RICHMOND, Va.) Matrix Capital Markets Group, Inc. ("Matrix"), a leading, independent investment bank, announces that it has advised Santmyer Companies, Inc. ("Santmyer" or the "Company") on the sale of its Red Rover convenience retail stores to Par Mar Oil Company and its branded dealer wholesale business to Countywide Petroleum Company (subsidiaries of Croton Holdings Co.). Santmyer is a leading privately-owned and family operated full-service distributor whose primary offerings include diesel, gasoline, propane, lubricants, diesel exhaust fluid and logistics services.

News: Legacy Mutual Selects LenderLogix’s QuickQual to Improve Transparency and Responsiveness During Mortgage Borrowers’ Home Search

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced that Legacy Mutual Mortgage has selected its pre-approval letter generation tool QuickQual to provide borrowers with a white-labeled, digitally-driven entry point into their homebuying experience.

News: Down Payment Resource donates $10,000 to help an Atlantan buy a home this holiday season

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting home buyers with homebuyer assistance programs, today announced a $10,000 donation to the Atlanta Neighborhood Development Partnership to be used as a grant to help an eligible homebuyer working with the local nonprofit housing agency.

News: ACES Q2 2023 Mortgage QC Trends Report Finds Critical Defect Rate Declines for Third Consecutive Quarter

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the second quarter (Q2) of 2023. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.