News: Dovenmuehle receives ISO/IEC 27001 certification, reinforcing commitment to data security and operational excellence

Mortgage and Finance News: (LAKE ZURICH, Ill.) Dovenmuehle Mortgage, Inc. (DMI), a leading mortgage subservicing company, announced today that it has received the ISO/IEC 27001 certification from NSF International Strategic Registrations (NSF-ISR), an NSF company. ISO/IEC 27001 defines global benchmarks for information security management systems (ISMS).

News: The Big Picture opens 2026 with conversations on compliance, leadership and new paths to homeownership

Mortgage and Finance News: (CLEVELAND, Ohio) Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, announced a January slate of guests offering timely perspectives on how to navigate the regulatory landscape ahead, scale mortgage production while developing the next generation of originators, execute with discipline in volatile markets and expand access to homeownership in new ways.

News: The Mortgage Collaborative Appoints Rich Swerbinsky as Strategic Advisor to CEO & President; Names Heidi Belnay Senior Advisor for Business...

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's only independent, wholly-owned mortgage lending cooperative, today announced the appointment of Rich Swerbinsky as Strategic Advisor to the CEO & President and Heidi Belnay as Senior Advisor for Business Development. These strategic additions to the leadership team position TMC for accelerated growth and continued industry impact in 2026 and beyond.

News: IRS Solutions Completes SOC 2® Examination

Mortgage and Finance News: (VALENCIA, Calif.) IRS Solutions® announces today that it has completed the SOC 2® examination. As tax professionals face growing security expectations, technology providers must prove accountability and consistency in how they handle data. A recently completed SOC 2® examination provides independent validation that IRS Solutions systems maintain secure, reliable, and confidential operations.

News: TMC to host inaugural ACT Technology Summit focused on mortgage technology and AI

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's leading independent cooperative network for mortgage lenders, today announced it will host the inaugural ACT Technology Summit, short for Accelerator and Collaborative Transformation, a two-day standalone mortgage technology competition and showcase Aug. 12-13 at The Highlands Hotel in Dallas.

News: LenderLogix expands LiteSpeed POS with native eSignature for borrowers and loan teams

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced LiteSpeed eSign, a fully native eSignature experience built into the LiteSpeed point of sale (POS) platform. Serving both sides of the mortgage process, LiteSpeed eSign enables lenders to tag and request documents for electronic signatures directly in Encompass without the need to switch platforms.

News: TMC launches new individual subscription membership option

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's leading independent cooperative network for mortgage lenders, today announced the launch of an individual subscription membership option that expands access to its network for mortgage professionals seeking connection, insight and peer engagement outside a traditional lender membership.

News: ACES Quality Management Announces General Availability of ACES DATABRIDGE for Enterprise Data Portability

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management#xae; (ACES), the leading provider of enterprise quality management and control software for the financial services industry, today announced the general availability of its latest innovation, ACES DATABRIDGE, which makes ACES customer data fully portable.

News: FirstClose Integrates Stewart Home Equity Solutions into OMS to Streamline Lender Workflows

Mortgage and Finance News: (AUSTIN, Texas) FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, announced today a new partnership with Stewart Lender Services, a division of Stewart Information Services Corporation (NYSE: STC), that enhances FirstClose's Order Management System (OMS) with expanded home equity fulfillment capabilities.

News: Class Valuation names Daniel Allan Busch as chief financial officer

Mortgage and Finance News: (TROY, Mich.) Class Valuation, a leading real estate appraisal management company (AMC), announced today that Daniel A. Busch has joined the company as its chief financial officer (CFO). Busch brings more than two decades of financial leadership experience to the role, including extensive work in private equity environments, business transformation and data-driven operational performance.

News: Optimal Blue report: Lock volume posts strongest November since 2021

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today released its November 2025 Market Advantage mortgage data report, which found that total mortgage rate-lock activity declined with normal late fall seasonality, yet still marked the strongest November in four years. Total lock volume fell 25% month over month (MoM) from October but remained up 17% year over year (YoY), buoyed by historically strong refinance demand and mortgage rates holding near 6%.

News: Optimal Blue names Lanny Rogers chief financial officer and Jeremy Moreno chief revenue officer

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today announced the promotion of Lanny Rogers III, CPA, to chief financial officer (CFO) and Jeremy Moreno to chief revenue officer (CRO). Their combined experience and long track records of leadership position the company to advance its next stage of growth and client success with a dedicated financial strategy function and strengthened revenue oversight.

News: Informative Research’s Sriranjini Prabhakara Named to 2025 National Mortgage Professional 40 Under 40 List

Mortgage and Finance News: (GARDEN GROVE, Calif.) Informative Research (IR), a leading technology provider of data-driven credit and verification solutions for the lending industry, today announced that Software Developer Sriranjini "Sri" Prabhakara has been named to National Mortgage Professional Magazine's 2025 40 Under 40 list. The annual recognition highlights emerging professionals whose work is helping shape the future of the mortgage sector.

News: FirstClose appoints Alex Sirpis as vice president of sales

Mortgage and Finance News: (AUSTIN, Texas) FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, today announced the appointment of Alex Sirpis as vice president of sales. In this role, Sirpis will lead the company's sales organization, refine the go-to-market strategy and drive revenue growth as FirstClose continues expanding its presence with mortgage and home equity lenders across the country.

News: Rivermark Community Credit Union Expands Subservicing Relationship with Dovenmuehle

Mortgage and Finance News: (LAKE ZURICH, Ill.) Dovenmuehle Mortgage, Inc. (DMI), a leading mortgage subservicing company, announced today that Rivermark Community Credit Union has expanded its partnership with DMI. Under this expanded relationship, Dovenmuehle will provide subservicing for Rivermark's growing portfolio of mortgage loans, supporting the credit union's expanding membership base and ensuring an exceptional servicing experience for members.

News: The Big Picture’s final lineup of 2025 features mortgage power players in conversation on leadership, tech disruption and the future...

Mortgage and Finance News: (CLEVELAND, Ohio) Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, announced a December lineup of trailblazing figures in loan origination technology, real estate and housing finance advocacy. Co-hosted by mortgage business consultant and executive coach Rich Swerbinsky and capital markets authority Rob Chrisman.

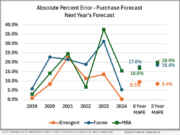

News: iEmergent’s latest U.S. mortgage forecast validation confirms industry-leading accuracy

Mortgage and Finance News: (DES MOINES, Iowa) iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, released a new analysis validating that its U.S. purchase mortgage origination forecasts continue to lead the industry in accuracy, outperforming other publicly available forecasts such as those published by Fannie Mae and the Mortgage Bankers Association (MBA) over the last six years.

News: FirstClose Appoints Adam Nicholson as Director of Professional Services

Mortgage and Finance News: (AUSTIN, Texas) FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, today announced the appointment of Adam Nicholson as director of professional services. Nicholson will lead the company's implementation operations, including project delivery, process optimization and cross-functional coordination to enhance the customer experience.

News: Lake Michigan Credit Union selects FirstClose Equity Order Management for automated home equity settlement workflows

Mortgage and Finance News: (AUSTIN, Texas) FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, announced today that Lake Michigan Credit Union (LMCU) has implemented FirstClose's Equity Order Management to automate settlement workflows for its home equity lending operations.

News: DocMagic enhances Total eClose platform with new IPEN capability for broader digital closing flexibility

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc. announced today the availability of its in-person electronic notarization (IPEN) capability, extending the company's Total eClose™ platform to support more closing scenarios and borrower preferences across the country. IPEN offers lenders, settlement agents, notaries and borrowers an additional digital option for situations where remote online notarization (RON) is not jurisdictionally permitted or simply not the preferred experience.

News: ACES Q2 2025 Mortgage QC Industry Trends Report shows modest rise in critical defect rate as refinance complexity tests loan...

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, today announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the second quarter (Q2) of 2025. The report analyzes post-closing quality control data derived from the ACES Quality Management & Control® software.

News: MMI Honored with 2025 AI Pioneer Award for Innovative Use of Artificial Intelligence in Mortgage Technology

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mobility Market Intelligence (MMI), the leader in mortgage technology, has been recognized with the 2025 AI Pioneer Award by PROGRESS in Lending Association for leveraging artificial intelligence like ChatMMI cross its platform to deliver to deliver real, measurable outcomes for lenders-from opportunity discovery and timely outreach to borrower retention and lifetime loyalty.

News: Rice Park Acquires Rosegate Mortgage, Enhancing End-to-End Mortgage Capabilities and MSR Investment Platform

Mortgage and Finance News: (CHARLOTTE, N.C. and PLYMOUTH, Minn.) Rice Park Capital Management LP ("Rice Park"), a Minneapolis-based private investment firm specializing in mortgage servicing rights (MSRs), announced today that it has acquired Rosegate Mortgage, LLC ("Rosegate Mortgage"), NMLS #2020757, a retail and consumer-direct mortgage lender headquartered in Charlotte, NC.

News: Velocity Credit Union Introduces ‘Buy Now, Pay Later’ to Give Members Greater Financial Flexibility

Mortgage and Finance News: (AUSTIN, Texas) Velocity Credit Union (Velocity) has announced the launch of a new Buy Now, Pay Later (BNPL) program designed to give members greater financial flexibility and control over their everyday spending. A financial institution with over $1 billion in assets and serving over 80,000 members, Velocity is introducing this program to further its commitment to offering comprehensive financial services to its members for every stage of their life.

News: The Mortgage Collaborative Charts 2026 Strategy Focused on Connection, Growth and Industry Resilience

Mortgage and Finance News: (SAN DIEGO, Calif.) As lenders continue to navigate a shifting housing market marked by volatility, margin pressure and rapid technological change, The Mortgage Collaborative (TMC) is doubling down on what it believes is the industry's greatest strength: connection.

News: Cloudvirga’s Loan Hub equips loan teams with modern tools for managing pipelines, tasks and borrower communication

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, a Stewart-owned provider of digital point-of-sale platforms for lenders, today announced the launch of its new Loan Hub for lenders seeking an optimized loan team experience. The Loan Hub gives loan officers, LO assistants and processors a modern, intuitive workspace to manage their pipelines, collaborate with borrowers and complete key tasks without toggling between systems.

News: Optimal Blue report: October lock volume holds second-highest level in three years

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today released its October 2025 Market Advantage mortgage data report, showing that rate-lock activity remained strong despite seasonal cooling and continued to outpace last year's levels. Total lock volume fell 4.2% month over month (MoM) from September's peak but was still up 18% year over year (YoY) as borrowers responded to improving affordability and narrower rate spreads.

News: MMI’s Chief Technology Officer Dan Jones Named 2025 HousingWire Tech Trendsetter

Mortgage and Finance News: (SALT LAKE CITY, Utah) HousingWire has recognized Dan Jones, Chief Technology Officer at Mobility Market Intelligence (MMI), as one of its 2025 Tech Trendsetters - an annual honor celebrating 75 technology leaders who are shaping the future of housing through innovation.

News: LenderLogix expands LiteSpeed POS with built-in AI-powered agent for mortgage loan officers

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced it has launched AI Sidekick, an artificial intelligence (AI) feature built into the LiteSpeed point-of-sale (POS) platform. AI Sidekick supports loan officers (LOs) with simple tools to instantly review loan files, efficiently update document needs lists and rapidly identify missing data, reducing loan processing times by up to 40%.

News: Secured Signing and Reality Defender Partner to End Deepfake Fraud

Mortgage and Finance News: (MOUNTAIN VIEW, Calif.) Secured Signing, a global leader in Digital Signature and Remote Online Notarization (RON) solutions, announces a major step forward in fighting digital fraud. We've partnered with Reality Defender, the leader in real-time deepfake detection, to integrate a powerful new security layer into our services.