News: MMI launches Refinder mortgage refinance tool to help lenders prepare for expected interest rate decline

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced a new feature, Refinder, to help lenders uncover refinance opportunities in their database of past borrowers.

News: TMC Emerging Technology Fund Announces Newest Corporate Partner: Andromeda Division Constellation Software’s Perseus Operating Group

Mortgage and Finance News: (AUSTIN, Texas) The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP has secured its first corporate partner, Andromeda. Andromeda is a Division of the Perseus Operating Group, of Constellation Software, Inc. (TSX: CSU; "Constellation").

News: MCT Reports a 3% Increase in Mortgage Lock Volume Backed by Increasing Refinance Activity

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 3.33% increase in mortgage lock volume compared to the previous month. Despite a larger increase in rate/term volume, total mortgage volume remains relatively flat.

News: ACES Quality Management Executive Vice President of Compliance, Amanda Phillips, Selected to Speak at 2024 ACUMA Annual Conference

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced its Executive Vice President of Compliance Amanda Phillips will be speaking at the American Credit Union Mortgage Association (ACUMA) Annual Conference taking place September 29 through October 2, 2024 at the Bellagio Hotel & Casino in Las Vegas.

News: LenderLogix’s Patrick O’Brien Recognized as a 2024 HousingWire Vanguard Honoree

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced Co-founder and CEO Patrick O'Brien has been selected by HousingWire as a 2024 Vanguard Award winner.

News: Dovenmuehle’s Ron Malik Named a 2024 Vanguard by HousingWire Magazine

Mortgage and Finance News: (LAKE ZURICH, Ill.) Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading mortgage subservicing company, announced today that HousingWire has selected Ron Malik, Senior Vice President of Default Servicing as a 2024 Vanguard winner. This prestigious award recognizes executives in the housing economy for their outstanding leadership.

News: Dark Matter Technologies’ Chief Risk and Information Security Officer Michael Housch Honored with the 2024 HousingWire Vanguards Award

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative leader in mortgage technology backed by time-tested loan origination software and leadership, today announced that Michael Housch, its chief risk and information security officer (CISO), has been named a 2024 HW Vanguard. The awards program recognizes C-level industry professionals who have become leaders in their respective fields in the housing and mortgage industries.

News: Argyle’s Brian Geary honored with HousingWire’s 2024 Vanguard Award

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, today announced its Chief Operating Officer Brian Geary has been honored with the 2024 HousingWire Vanguard Award. The award recognizes executives and business leaders in housing and mortgage finance whose leadership drives the market forward.

News: The Mortgage Collaborative Participates in FHFA 2024 TechSprint Showcasing Innovative Generative AI Solutions for Housing Challenges

Mortgage and Finance News: (WASHINGTON, D.C.) Represented by its president and COO, Melissa Langdale, The Mortgage Collaborative's (TMC) "Open Angels" team were among the notable solutions recognized for their impact and potential at The Federal Housing Finance Agency (FHFA)-hosted Velocity TechSprint, spotlighting the transformative potential of generative AI in addressing the current housing market's pressing challenges.

News: MMI ranks No. 22 on Utah Fast 50 list of fastest-growing companies

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it ranks No. 22 on the 2024 Utah Business list of fastest-growing companies in the state. This marks MMI's third consecutive appearance on the list.

News: FormFree named TAG ADVANCE Award Winner

Mortgage and Finance News: (ATHENS, Ga.) FormFree®, a leader in financial technology since 2007, has been named a 2024 ADVANCE Award winner by The Technology Association of Georgia (TAG). Part of the Fintech South conference, the ADVANCE Awards program recognizes innovative U.S. fintech companies with a strong connection to Georgia.

News: ACES Quality Management Executives Selected to Speak at 2024 Mortgage Bankers Association Risk Management Conference and Expo

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced its Executive Vice President of Compliance Amanda Phillips and Executive Vice President of Operations, Sharon Reichhardt will speak at the 2024 Mortgage Bankers Association (MBA) Risk Management Conference taking place September 22-24, 2024, at the Grand Hyatt in Washington, DC.

News: iEmergent’s Redlining Roundtable will teach lenders to identify and prevent mortgage redlining while seizing the business opportunity of equitable lending

Mortgage and Finance News: (DES MOINES, Iowa) iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, will host a webinar on mortgage redlining on Thursday, September 19, from 2 p.m. to 4 p.m. ET. "Redlining Roundtable: Don't Just Dodge Risk, Capture Opportunity" will bring together experts from across the housing finance industry to discuss the high price of modern-day mortgage redlining, the strategies lenders can use to identify and prevent unintentional discrimination, and the long-term value mortgage lenders can build through fair and equitable lending practices.

News: Vice Capital Markets Integrates with Digital-First LOS Mortgage Machine

Mortgage and Finance News: (NOVI, Mich.) Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today it has completed its integration with Mortgage Machine™, an out-of-the-box, all-in-one loan origination system (LOS) designed to accelerate lenders' operational velocity and support an end-to-end digital origination process.

News: Informative Research Appoints Industry Leader Steve Schulz as Executive Vice President, Product Management

Mortgage and Finance News: (ST. LOUIS, Mo.) Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced the appointment of Steve Schulz as the new executive vice president of product management. This strategic addition highlights Informative Research's commitment to driving innovation and enhancing its product offerings to better serve its clients.

News: Argyle is now an approved service provider supporting Freddie Mac’s AIM

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing real-time income and employment verifications for some of the largest lenders in the United States, is now an approved third-party service provider supporting Freddie Mac's Loan Product Advisor® (LPA℠) asset and income modeler (AIM), a solution that simplifies the mortgage underwriting process for lenders. Argyle's verification of income and employment (VOIE) solution, which includes reports, pay stubs and W-2s, saves lenders 5-7 days per loan and 60-80% in costs compared to legacy VOIE providers.

News: Mortgage Machine Services Enhances AI-Powered Document Management System to Accelerate Loan Processing Speed

Mortgage and Finance News: (ADDISON, Texas) Mortgage Machine Services, an industry leader in digital origination technology to residential mortgage lenders, announced the launch of Auto Split, an enhancement to the Click n' File document management system embedded into the Mortgage Machine™ loan origination system (LOS).

News: Informative Research Unveils Enhancements to Its Suite of Mortgage Portfolio Monitoring Alerts

Mortgage and Finance News: (GARDEN GROVE, Calif.) Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced the launch of new alert types to enhance the portfolio monitoring service offered by Informative Research Data Solutions. These advanced alerts offer sophisticated monitoring capabilities, enrich lenders' portfolio monitoring and borrower engagement strategies and solidify Informative Research as a data solutions leader in the mortgage industry.

News: Teal Makes the Inc. 5000, at No. 2093, for the 6th Time

Mortgage and Finance News: (WASHINGTON, D.C.) Inc. revealed today that Teal ranks No. 2093 with a three-year revenue growth of 251% on the 2024 Inc. 5000, its annual list of the fastest-growing private companies in America. The prestigious ranking provides a data-driven look at the most successful companies within the economy's most dynamic segment-its independent, entrepreneurial businesses.

News: Accountable CRM Launches First Activity-Based Platform for Mortgage Teams

Mortgage and Finance News: (AUSTIN, Texas) 90-Day Sales Manager proudly launches the first activity-based CRM with built-in coaching and accountability for mortgage teams at credit unions and community banks. The 3-in-1 platform provides mortgage departments an affordable solution to help loan officers stay productive during challenging times.

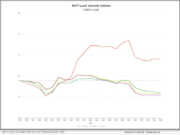

News: July Refinance Activity Hits Highest Levels Since September 2022

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today released its July 2024 Market Advantage mortgage data report, which revealed that mortgage refinance demand surged to levels not seen since September 2022 amid softening interest rates. The lower interest rates seen in July also coaxed increased purchase activity, which, combined with greater refi activity, drove a 3.5% month-over-month (MoM) increase in mortgage rate lock volumes.

News: Patented Technology Allows Mortgage Buyers to Transact with Any Seller on MCT Marketplace

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced that the company has been awarded a patent for the security spread commitment used in the industry's largest mortgage asset exchange: MCT Marketplace. The security spread commitment transforms loan auctions, turning shadow bids into executable prices.

News: ACES Quality Management EVP of Compliance Amanda Phillips Selected as a 2024 Insider by HousingWire Magazine

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced its Executive Vice President (EVP) of Compliance Amanda Phillips has been named a 2024 Insider in HousingWire Magazine's annual award program.

News: MCT Reports a 6% Mortgage Lock Volume Decrease in Latest Report

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a decrease of 5.67% in mortgage lock volume compared to the previous month. Industry professionals and enthusiasts are invited to download the complete report for comprehensive insights into the market dynamics.

News: Dovenmuehle’s Patricia McCarthy named a 2024 Insider in HousingWire Magazine’s annual award program

Mortgage and Finance News: (LAKE ZURICH, Ill.) Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading mortgage subservicing company, announced today that Vice President of the Escrow Department Patricia McCarthy was selected by HousingWire magazine for its annual Insiders awards program.

News: Informative Research’s Penny Gonzalez Named 2024 HousingWire Insider

Mortgage and Finance News: (IRVINE, Calif.) Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced today that Penny Gonzalez, Vice President of Business Process, has been selected by HousingWire magazine for its annual Insiders awards program.

News: Dark Matter Technologies’ Product Evangelist Craig Rebmann honored with 2024 HW Insiders Award

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative leader in mortgage technology backed by time-tested loan origination software and leadership, today announced that Craig Rebmann, its product evangelist, has been named a 2024 HW Insider. Now in its ninth year, the HW Insiders program recognizes talented operations professionals laying the foundation of success for their organizations.

News: Argyle’s Rowdy Harris honored as HousingWire Insider

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, today announced its principal mortgage customer success manager Rowdy Harris has been honored as a 2024 HousingWire Insider. Now in its ninth year, the Insiders Award recognizes operational all-stars working behind the scenes in companies across the housing industry to drive innovation and underpin business growth.

News: LenderLogix Integrates Income, Employment Verification Services from Truv into LiteSpeed Mortgage Point-of-Sale

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced its integration with automated employment and income technology provider Truv. Through the integration, lenders can now access Truv's consumer-permissioned data platform through LenderLogix's point-of-sale (POS) LiteSpeed to obtain direct-to-source income and employment verification for mortgage applicants.

News: LenderLogix Integrates Income, Employment Verification Services from Truv into LiteSpeed Mortgage Point-of-Sale

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced its integration with automated employment and income technology provider Truv. Through the integration, lenders can now access Truv's consumer-permissioned data platform through LenderLogix's point-of-sale (POS) LiteSpeed to obtain direct-to-source income and employment verification for mortgage applicants.