Sales Boomerang, the mortgage industry’s top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced the release of Sales Boomerang’s latest Mortgage Market Opportunities Report.

Year-end data finds pockets of opportunity for innovative mortgage advisors in a competitive market

OWINGS MILLS, Md. /Mortgage and Finance News/ — Sales Boomerang, the mortgage industry’s top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced the release of Sales Boomerang’s latest Mortgage Market Opportunities Report. With mortgage volume continuing to decline, the Q4 2022 report highlights pockets of opportunity still available to motivated and innovative loan originators.

Methodology

The Mortgage Market Opportunities Report draws on Sales Boomerang system data to identify market opportunities of relevance to today’s borrowers and lenders. To generate the report, Sales Boomerang reviewed data from more than 150 residential mortgage lenders, a subset of its clients, that use its borrower intelligence and retention tools to monitor millions of customer and prospect records. Sales Boomerang then calculated and compared the aggregate frequency with which those contact records triggered loan-opportunity, prescriptive-scenario and risk-and-retention alerts during the third and fourth quarters of 2022.

Key Findings*

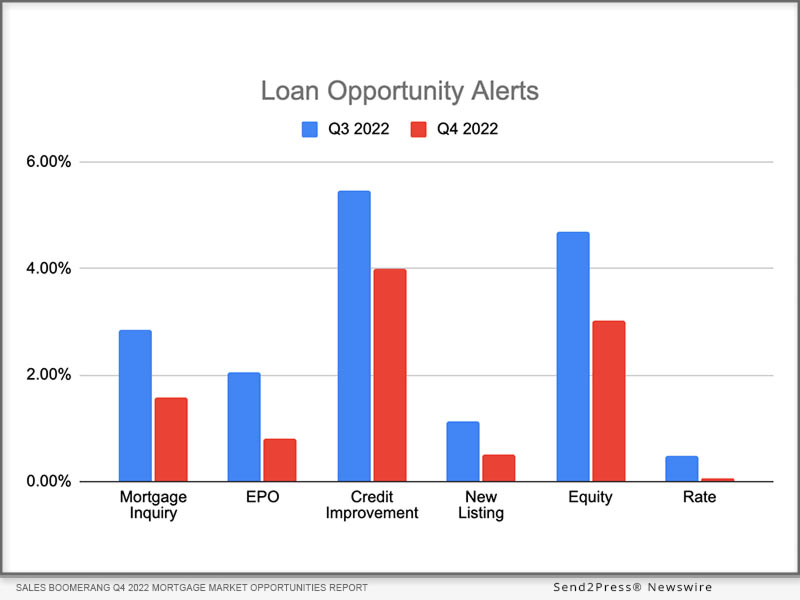

Sales Boomerang’s loan-opportunity alerts identify the contacts inside a lender’s database who are actively shopping for a mortgage loan or who may be able to benefit from a new mortgage loan. Across the sample group, the frequency of each alert type in Q4 2022 was as follows:

* Mortgage Inquiry Alert: 1.58% of monitored contacts (down 44.37% from Q3)

A customer or prospect has shopped with a competitor in the last 24 hours.

* EPO Alert: 0.81% of monitored contacts (down 60.49% from Q3)

A customer or prospect whose loan closed ≤ 6 months ago has shopped with a competitor in the last 24 hours.

* Credit Improvement Alert: 4.00% of monitored contacts (down 26.87% from Q3)

A customer or prospect has improved their FICO score.

* New Listing Alert: 0.52% of monitored contacts (down 53.57% from Q3)

A customer or prospect has listed their home for sale.

* Equity Alert: 3.01% of monitored contacts (down 35.68% from Q3)

A customer or prospect’s home equity has increased.

* Rate Alert: 0.05% of monitored contacts (down 89.80% from Q3)

The interest rate of a customer or prospect’s existing mortgage is significantly higher than current prevailing rates.

Sales Boomerang’s prescriptive-scenario alerts analyze not only whether a consumer could benefit from a given loan type, but also whether the consumer is credit-qualified to apply for financing. This additional layer of intelligence makes prescriptive-scenario alerts among the highest-converting available to mortgage lenders today. The frequency of each alert during Q4 2022 was as follows:

* Cash-Out Alert: 2.07% of monitored contacts (down 20.38% from Q3)

A borrower is credit qualified and has built sufficient equity to tap into the cash in their home.

* Rate-and-Term Alert: 0.05% of monitored contacts (down 95.93% from Q3)

A borrower is credit qualified and can benefit from the current interest rates for a refinance.

* FHA MI Removal Alert: 2.07% of monitored contacts (down 80.08% from Q3)

An FHA borrower has exceeded 20% equity and can remove mortgage insurance (MI).

For a subset of lenders that maintain servicing portfolios, the frequency of risk-and-retention alerts was as follows:

* Risk & Retention Alert: 43.46% of monitored contacts (up 43.53% from Q3)

A customer is engaging in one or more of 15 credit activities that may put their serviced loan at risk.

Analysis*

* Although Credit Improvement, Equity and FHA MI Removal alerts were down from Q3, they outperformed other alert types, signaling that opportunities remain for lenders to reconnect with previously denied loan applicants and help homeowners with untapped equity improve their financial situation.

* New Listing alerts fell for a second consecutive quarter, reflecting a decrease in U.S. housing inventory between October and November of 2022. The shortage of supply, which is especially pronounced for entry-level homes, has left first-time buyers on the sidelines and homeowners afraid to trade up. Strategies like down payment assistance and seller buy-downs are becoming increasingly important tools for lenders looking to serve more purchase customers.

* Risk & Retention alerts were up more than 40% for the second quarter in a row amid reports that inflation has consumers dipping into savings and racking up credit card debt. With retail store credit cards now carrying APRs of more than 30%, home equity remains an attractive alternative, even in the current mortgage interest rate environment.

* Mortgage Inquiry and EPO alerts decreased for the third consecutive quarter. With fewer consumers actively putting themselves in the market for a mortgage, originators must proactively engage with consumers to understand their financial goals and demonstrate how the right mortgage loan can help.

“As the trends from Q3 continued, and in some cases intensified, in Q4, lenders need to remain proactive and creative in order to keep their pipelines from drying up,” said Sales Boomerang and Mortgage Coach Chief Visionary Officer Alex Kutsishin. “By pairing Sales Boomerang’s borrower intelligence with Mortgage Coach’s Total Cost Analysis, lenders can find opportunities hidden in their own databases and present borrowers with innovative loan strategies for purchasing a home, building wealth or paying off debts. In this market, it’s becoming more important each day for lenders to think creatively and build consumer trust.”

*Key findings and analysis provided for informational purposes only. The data represented in the Mortgage Market Opportunities report is historical. Past performance is not a reliable indicator of future results. Sales Boomerang accepts no responsibility or liability for readers’ use of the key findings or analysis included in this report.

About Sales Boomerang and Mortgage Coach:

Sales Boomerang and Mortgage Coach are trusted by more than 300 lenders, including brokers, independent mortgage companies, credit unions and banks, to connect borrowers with the right loan at the right time.

Sales Boomerang transformed the relationship between mortgage lenders and borrowers with the introduction of the first automated borrower intelligence system in 2017. Intelligent alerts notify lenders as soon as a past customer or prospect is ready and credit-qualified for a loan. As the mortgage industry’s #1 borrower retention tool, Sales Boomerang helps lenders build lasting borrower relationships that maximize lifetime customer value. To learn more, visit https://www.salesboomerang.com.

Mortgage Coach is an award-winning platform that empowers mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time. Side-by-side loan comparisons allow borrowers to make faster, more informed mortgage decisions while enabling lenders to consistently deliver an on-brand, consultative home financing experience that increases borrower pull-through, repeat business and referrals. To learn more, visit https://www.mortgagecoach.com.

Learn More: https://www.salesboomerang.com/

This version of news story was published on and is Copr. © 2023 Mortgage & Finance News™ (MortgageAndFinanceNews.com) – part of the Neotrope® News Network, USA – all rights reserved.

Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.

STORY ID: 88042