News Topic: automated Borrower Intelligence System

News: Mortgage Coach integrates with Insellerate to help lenders increase lead conversion with wealth-building mortgage advice

Mortgage and Finance News: (OWINGS MILLS, Md.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced that the Mortgage Coach platform will be integrated with Insellerate, a leading customer experience platform.

News: Rich LaBarca joins Sales Boomerang and Mortgage Coach as Chief Product and Technology Officer

Mortgage and Finance News: (OWINGS MILLS, Md.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced the appointment of Rich LaBarca to the role of Chief Product and Technology Officer.

News: Cheryl Messner joins Sales Boomerang to oversee customer experience department

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced that it has tapped Cheryl Messner to manage its customer experience departments. In her new role, Messner will define strategies to enhance Sales Boomerang's customer experience, engagement, success and operations as well as help the company build upon its growth from a fintech startup to the industry's leading borrower intelligence solution.

News: Sales Boomerang releases Q4 2021 Mortgage Market Opportunities Report

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its latest Mortgage Market Opportunities Report. The Q4 2021 report identified increasing opportunities for mortgage lenders to assist borrowers with tappable home equity, lending credence to analysts' expectations for a surge in home-equity-related mortgage activity in 2022.

News: Sales Boomerang adds ‘Previous Alerts’ to facilitate better-informed conversations between mortgage advisors and prospects

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced the availability of a new feature that lets lenders view a history of Sales Boomerang alerts that have previously triggered for each contact in their monitored database.

News: Sales Boomerang recognized as Baltimore’s second fastest-growing company

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced it has earned the No. 2 spot on the Baltimore Business Journal's (BBJ) 2021 Fast 50, a list of the greater Baltimore region's 50 fastest-growing private companies. Fast 50 rankings were unveiled by the BBJ at a private reception on Thursday, November 4, 2021.

News: Mortgage Coach and Sales Boomerang accelerate lead conversion with personalized Total Cost Analysis loan presentations for every managed borrower

Mortgage and Finance News: (IRVINE, Calif.) Mortgage Coach, the borrower conversion platform empowering mortgage lenders to deliver clear mortgage advice and lending education with the interactive Total Cost Analysis (TCA) loan comparison, today announced an integration with Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system.

News: Sales Boomerang named a top mortgage technology provider by Mortgage Professional America

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the industry's top-rated automated borrower intelligence and retention system, was recognized today as a 5-Star Mortgage Tech provider by Mortgage Professional America (MPA) magazine. The award recognizes the U.S. mortgage industry's top mortgage technology providers as verified by originators and tech specialists across the country.

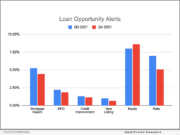

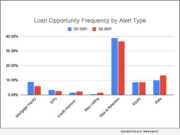

News: Sales Boomerang releases Q2 2021 Mortgage Market Opportunities Report

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the mortgage industry’s top-rated automated borrower intelligence and retention system, today released its inaugural Mortgage Market Opportunities Report. According to the report, refinance opportunities continue to dominate the market, but a promising uptick in new listings was also evident in the Q2 data. Mortgage servicers will need to closely manage their default and foreclosure risk in the coming months, as the second quarter saw nearly two out of five customers trigger a risk-and-retention alert.

News: Sales Boomerang’s Rusty Barnes Honored for Innovative Contributions to Mortgage Customer Retention

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the industry's top-rated automated borrower intelligence and retention system, today announced that Rusty Barnes, senior product manager, has been named a 2021 Rising Star by housing finance trade publication HousingWire as part of its eighth annual Rising Stars awards program recognizing the leaders under the age of 40 who are shaping and driving the mortgage, real estate and fintech industries forward.

News: Sales Boomerang integration with Volly enables lightning-fast lead response for increased mortgage loan volume and customer retention

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the industry's top-rated automated borrower intelligence and retention system, today announced its integration with Volly, an industry-leading provider of SaaS-based fintech and creative marketing services to the financial services industry.

News: Sales Boomerang and Insellerate combine real-time borrower intelligence and marketing automation to supercharge mortgage customer engagement

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the industry's top-rated automated borrower intelligence and retention system, has expanded its integration with leading mortgage customer experience platform Insellerate.