News Topic: FinTech

News: Informative Research Enhances Verification Platform through Expanded Integration with The Work Number® from Equifax

Mortgage and Finance News: (GARDEN GROVE, Calif.) Informative Research, a leading technology platform delivering data-driven solutions to the lending community, today announced the expansion of its verification platform through the integration of additional Equifax solutions that leverage The Work Number®, the industry-leading commercial source of consolidated income and employment information.

News: Optimal Blue Launches New Generative AI Assistant Capabilities

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today announced the delivery of generative AI capabilities centered on helping lenders maximize profitability on every loan transaction. Through direct engagement with its thousands of clients, the company has begun delivering generative AI capabilities built for secondary-market-specific use cases and purposefully designed to solve the real-world challenges that mortgage lenders face.

News: Informative Research Adds Brandon Hall as New EVP of Operations

Mortgage and Finance News: (GARDEN GROVE, Calif.) Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, has named Brandon Hall as its new executive vice president (EVP) of operations. Hall brings over 20 years of experience driving operational excellence within the financial services sector and is known for implementing innovative process improvements, fostering cross-functional collaboration and leading through change.

News: Vice Capital Markets Launches Integration with Fannie Mae Mission Score API

Mortgage and Finance News: (NOVI, Mich.) Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today it has integrated the Fannie Mae® Mission Score application programming interface (API) into its trading portal, allowing current clients to take advantage of pricing and best execution decisions to improve gain-on-sale.

News: MCT Integrates with Fannie Mae’s Mission Score API and New Product Grids to Empower Originators to Take Advantage of Market...

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced the launch of new integrations with Fannie Mae's Mission Score application programming interface (API) and Mission Score 2 and 3 product grids that provide better transparency and pricing for mortgages aligned with Fannie Mae's mission objectives.

News: Optimal Blue Launches Competitive Data License to Help Lenders Optimize Margins With Competitive Loan Pricing Data

Mortgage and Finance News: (PLANO, Texas) Optimal Blue announced the release of Competitive Data License, a collection of key national mortgage pricing data that enables lenders to price products competitively, operate more profitably, and react swiftly to changing market conditions. Competitive Data License draws upon direct-source loan data from the Optimal Blue PPE, which is used to price and lock over 35% of loans in the United States.

News: Secured Signing Scales Up with Strategic Leadership and Global Expansion

Mortgage and Finance News: (MOUNTAIN VIEW, Calif.) Secured Signing, a leading provider of secure Digital Signatures and Remote Online Notarization platform, today announced a significant growth, fueled by a visionary leadership change and strategic team expansion.

News: MCT and Lender Price Join Forces to Improve Mortgage Pricing with Loan-Level MSR Values

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading (MCT®), the de facto leader in innovative mortgage capital markets technology, and Lender Price, the first cloud-native provider of mortgage pricing technology, have partnered to provide mortgage lenders using the Lender Price product and pricing engine (PPE) with loan-level MCT MSR values. MCT's industry-leading mortgage servicing rights (MSR) grids allow Lender Price PPE clients to be more granular, profitable, and efficient when generating their front-end borrower pricing and managing their MSR portfolio.

News: Avenu Insights & Analytics Unveils Groundbreaking Short-Term Rental Compliance Solution: Avenu | STR

Mortgage and Finance News: (CENTREVILLE, Va.) Avenu Insights & Analytics, a leading provider of revenue recovery and software solutions for state and local governments, proudly announces the launch of Avenu | STR, an innovative SaaS solution designed to streamline short-term rental (STR) compliance and enhance local government revenue management.

News: ProNotary Enhances Business Efficiency with Advanced Remote Online Notarization Solutions

Mortgage and Finance News: (DALLAS, Texas) ProNotary, a pioneering force in the remote online notarization industry, is proud to announce its continued commitment to transforming the landscape of notary services through cutting-edge remote online notarization (RON) solutions. Founded in 2018, ProNotary has been at the forefront of innovation, providing businesses with a comprehensive suite of notarization software designed to meet the evolving needs of the digital age.

News: American Pacific Mortgage Picks Fee Chaser by LenderLogix to Collect Upfront Borrower Fees

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, recently announced the addition of American Pacific Mortgage to its roster of clients utilizing Fee Chaser. Employing Fee Chaser enables American Pacific Mortgage to efficiently and compliantly collect initial mortgage-related fees from borrowers.

News: Online notarization is streamlined with Secured Signing’s new features

Mortgage and Finance News: (MOUNTAIN VIEW, Calif.) Secured Signing, a leader in remote online notarization (RON) solutions, announces a suite of innovative features designed to streamline the online document signing and notarization process. These enhancements empower both notaries and singers to experience a smoother, more secure, and efficient experience.

News: ACES Quality Management Partners with Digilytics, Provider of AI-Powered Document Indexing, Categorization for QC Reviews

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced a new partnership with Digilytics to provide ACES users access to Revel, an advanced optical character recognition (OCR) technology powered by artificial intelligence (AI) and machine learning (ML).

News: Dark Matter Technologies enhances the Empower LOS with native support for mortgage assumptions

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative leader in mortgage technology backed by time-tested loan origination software and leadership, today announced enhancements to the Loan Assumptions feature in the Empower® loan origination system (LOS) that make it easier for mortgage lenders and servicers to transfer assumable mortgages to new homebuyers. The Empower LOS is the first mortgage loan origination system to announce native support for loan assumptions.

News: Truity Credit Union inks deal to implement the Empower LOS from Dark Matter Technologies

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today welcomed Truity Credit Union (Truity) as the latest financial institution to select the Empower® loan origination system. A member-owned credit union with locations in Oklahoma, Kansas and Texas, Truity will leverage the Empower LOS to provide loan officers and members a modern, mobile-friendly experience.

News: OneTrust Home Loans Selects LenderLogix’s Fee Chaser to Eliminate Manual Processes

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced OneTrust Home Loans as its newest Fee Chaser client. Using Fee Chaser, OneTrust Home Loans can streamline its operations and compliantly collect upfront fees from its borrowers.

News: Dark Matter Technologies appoints former Ellie Mae executive as deputy chief product officer

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter) today announced the appointment of Vikas Rao as deputy chief product officer. Reporting directly to Chief Product Officer Stephanie Durflinger, Rao is charged with overseeing enhancements to the Empower® loan origination system (LOS) and establishing Dark Matter's developer community, which will help lenders embed automation deeper in their origination workflows and more tightly integrate their systems using open application programming interfaces (APIs) and widgets.

News: Down Payment Resource integration with ICE Mortgage Technology embeds down payment assistance program support into core mortgage origination software

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, today announced a new integration using the latest API framework from Intercontinental Exchange (ICE) for mortgage technology. Available via the Encompass Partner Connect™ API Platform, the integration makes it easier for lenders to support homebuyers with the nation's 2,300-plus down payment assistance (DPA) programs.

News: New Solution Connects API-Driven Back-End Execution to Front-End Pricing with Industry-First Features

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of the Base Rate Generator, an industry-changing solution that allows mortgage lenders to directly inform their front-end rate sheet pricing with their back-end capital markets executions. By combining live agency API connections, co-issue executions, aggregator pricing, and custom TBA indications, the MCT Base Rate Generator allows mortgage lenders to improve margin management and competitive performance.

News: ACES Quality Management Partners with Infrrd to Provide AI-Powered Intelligent Mortgage Document Processing

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced a new partnership with Infrrd to provide ACES users access to intelligent document processing. When used in conjunction with ACES Quality Management & Control software, Infrrd's technology helps lenders improve the efficiency of their quality control (QC) reviews by indexing, categorizing and reviewing the accuracy of loan file documents prior to review.

News: Monterra Credit Union elevates the member experience with the Empower LOS from Dark Matter Technologies

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced that Monterra Credit Union (Monterra CU), a full-service financial institution serving members throughout San Mateo County, California, the City of Palo Alto and the San Francisco Bay Area, has selected the Empower® loan origination system (LOS) for mortgage loan, home-equity loan and home-equity line of credit (HELOC) originations.

News: Down Payment Resource brings its award-winning homebuyer assistance software to The Mortgage Collaborative as a preferred partner

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, today announced that it has joined The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry. As a member of TMC's Preferred Partner Network, DPR will provide its software, which provides operational support for utilizing its database of more than 2,300 down payment assistance (DPA) programs, at a discounted rate to TMC members.

News: Informative Research’s Ryan Kaufman Named HousingWire’s 2024 Rising Star

Mortgage and Finance News: (IRVINE, Calif.) Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced today that Ryan Kaufman, IT Manager - Integrations, has been selected by HousingWire magazine for its annual Rising Stars award.

News: North Dakota Notaries Can Now Ditch the Desk! Secured Signing Brings Streamlined Online Notarization to the Peace Garden State

Mortgage and Finance News: (BISMARK, N.D.) Imagine notarizing documents from the comfort of your couch, or while catching up on emails at your home office. For North Dakota notaries and their clients, that future is now a reality. Secured Signing, a leading innovator in Remote Online Notarization (RON) technology, is proud to announce its RON platform meets and exceeds the requirements as an official RON platform in the state.

News: Agile Introduces Competitive Electronic Bidding on Fourth Month TBA Mortgage-Backed Securities

Mortgage and Finance News: (PHILADELPHIA, Pa.) Agile, a groundbreaking fintech bringing mortgage lenders and broker-dealers onto a single electronic platform, announced today the launch of electronic bidding for the fourth month in the To-Be-Announced mortgage-backed securities (TBA) market. This marks a significant leap forward in the trading landscape of off-screen securities.

News: Argyle recognized as a Financial Services Company of the Year in the 2024 American Business Awards

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, the leading provider of direct-source income and employment data, is a winner of the 22nd annual American Business Awards®. The company received a Silver Stevie® in the mid-sized Financial Services Company of the Year category in recognition of its innovative approach to automating income a

News: Dark Matter and Total Expert partner to boost lender revenue through best-in-class mortgage automation and customer engagement

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter) today announced a new strategic partnership with Total Expert, the customer engagement platform purpose-built for modern financial institutions. A forthcoming bi-directional integration between Total Expert and the Empower® loan origination system (LOS) from Dark Matter will empower mortgage lenders to generate more leads, improve sales productivity and close more loans by intelligently automating and personalizing the homebuyer journey.

News: MCT Launches Complete Best Execution, Now Including Fully Integrated Retain vs. Release MSR Decisioning

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, proudly introduces a game-changing advancement: a Best Ex for Released and Retained all in one platform!

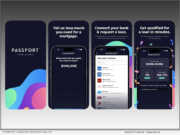

News: FormFree upgrades Passport Wallet with simpler UI, VantageScore integration and streamlined asset validation

Mortgage and Finance News: (ATHENS, Ga.) FormFree®, a leader in financial technology since 2007, today announced significant enhancements to Passport Wallet®, an innovative app that transforms how everyday people access loans. Available now in the Apple App Store and Google Play, the latest version of Passport Wallet is designed to make it easier than ever for consumers to understand their ability to pay and match with lenders.

News: Patelco Credit Union selects the Empower LOS to streamline and bolster home loan and home-equity origination

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the implementation of the Empower® loan origination system (LOS) by Patelco Credit Union (Patelco), a Bay Area-based credit union dedicated to the financial wellness of its team, members and communities.