Tag: FinTech

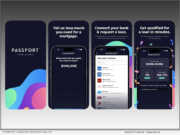

News: FormFree upgrades Passport Wallet with simpler UI, VantageScore integration and streamlined asset validation

Mortgage and Finance News: (ATHENS, Ga.) FormFree®, a leader in financial technology since 2007, today announced significant enhancements to Passport Wallet®, an innovative app that transforms how everyday people access loans. Available now in the Apple App Store and Google Play, the latest version of Passport Wallet is designed to make it easier than ever for consumers to understand their ability to pay and match with lenders.

News: Patelco Credit Union selects the Empower LOS to streamline and bolster home loan and home-equity origination

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the implementation of the Empower® loan origination system (LOS) by Patelco Credit Union (Patelco), a Bay Area-based credit union dedicated to the financial wellness of its team, members and communities.

News: Floify supports Truv’s verification of borrower income and employment service via new integration

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced an integration with Truv, a consumer-permissioned data platform. The integration enables borrowers to electronically verify their income and employment as they apply for a mortgage loan.

News: Click n’ Close Expands DPA Mortgage Product Suite to Include Option for Shared Appreciation

Mortgage and Finance News: (ADDISON, Texas) Click n' Close, a multi-state mortgage lender serving consumers and mortgage originators through its wholesale and correspondent channels, announced it has expanded its suite of down payment assistance (DPA) loan products to include a shared appreciation option to help address the affordability challenges facing homebuyers.

News: Floify prepopulates loan applications for borrowers using data on file in Total Expert

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced an enhanced integration with customer engagement platform Total Expert. This collaboration enables loan originators to effortlessly send pre-populated loan applications to borrowers, leveraging the existing data within Total Expert. This feature is designed to streamline the loan origination process for lenders and enhance the application experience for borrowers by reducing redundant data entry.

News: Average Homebuyer Credit Score Hits the Highest Mark in Years

Mortgage and Finance News: (PLANO, Texas) Today, Optimal Blue released its March 2024 Originations Market Monitor report, which reveals the average homebuyer credit score has reached 737 - an all-time high since the company began tracking this data in January 2018. Despite the potential buyer pool being somewhat limited to borrowers with higher credit, rate lock volume showed steady month-over-month growth of 17% in March as the spring buying season got underway.

News: Informative Research Announces Manual VOI Integration with Veri-Tax to Improve Mortgage Verification Services

Mortgage and Finance News: (GARDEN GROVE, Calif.) Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced the integration of Veri-Tax, the market leader in delivering the industry's fastest verifications, into its proprietary Verification Platform. The integration merges Informative Research's platform with Veri-Tax's verification services so lenders can access advanced validation tools that elevate the accuracy and reliability of borrower information.

News: Blue Sage Solutions and The Mortgage Collaborative Partner to Bring Interim Servicing to their Members

Mortgage and Finance News: (ENGLEWOOD CLIFFS, N.J.) The Mortgage Collaborative, the nation's largest independent mortgage cooperative, announced the addition of Blue Sage Solutions, an industry leader in innovative cloud-based technology providers, to bring interim servicing to the mortgage industry. The partnership makes the Blue Sage Digital Servicing Platform (DSP), a cloud-based system that provides all necessary functions to perform interim servicing, available to TMC members at preferred rates.

News: SmartBuy DPA Now Available to The Mortgage Collaborative’s Lender Members

Mortgage and Finance News: (ADDISON, Texas) Click n' Close, a multi-state mortgage lender, today announced its Preferred Partner status with The Mortgage Collaborative (TMC), a leader in mortgage cooperatives dedicated to providing its members with cutting-edge technology and expert mortgage banking resources.

News: Argyle welcomes former FHFA Chief Fintech Officer Jason Cave to board of advisors

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, today announced the addition of Jason Cave, former chief fintech officer and deputy director of the Federal Housing Finance Agency's Division of Conservatorship Oversight and Readiness, to its board of advisors.

News: Argyle brings the mortgage industry’s highest-converting VOIE platform to The Mortgage Collaborative

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, has joined The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, as a preferred partner. As a member of TMC's Preferred Partner Network, Argyle will provide the cooperative's lender members discounted access to its exemplary customer service and award-winning income and employment verification (VOIE) services, which outperform legacy verification services for a fraction of their cost.

News: Floify introduces flexible pricing with the introduction of Lender Edition

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS), today announced the launch of Lender Edition, a newly badged version of the popular mortgage point-of-sale that introduces a flexible per-loan pricing option for mortgage lenders. Floify Lender Edition is the counterpart to Broker Edition, a one-stop lending platform configured for the needs of mortgage brokers that was introduced in December 2023.

News: Informative Research Announces Mortgage Lenders Using Fannie Mae’s Desktop Underwriter Can Now Validate Income and Employment with AccountChek

Mortgage and Finance News: (GARDEN GROVE, Calif.) GARDEN GROVE, Calif., March 7, 2024 (SEND2PRESS NEWSWIRE) -- Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced that lenders using Fannie Mae's Desktop Underwriter® (DU®) can now leverage a 12-month asset verification report to validate income and employment in addition to assets with a single asset report. By using direct deposit banking data to evaluate income and employment, lenders can streamline processes and improve the borrower experience.

News: LenderLogix Announces POS Integration with Informative Research’s AccountChek to Enhance the Mortgage Borrower Experience

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, announced the integration of AccountChek by Informative Research into its point-of-sale system LiteSpeed. This integration blends AccountChek's pioneering verification technology into LiteSpeed to seamlessly enhance the borrower experience and optimize the loan origination process to ensure a smooth experience for borrowers and users alike.

News: MCT Releases Custom TBA Indications to Provide Price Discovery for Illiquid Coupons

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of pricing indications for the to-be-announced mortgage-backed securities (TBAs) used by mortgage lenders to hedge their open mortgage pipelines. TBA indications improve transparency in illiquid market segments and act as a key reference point on lenders' unique executions - critical data for generating accurate front-end borrower pricing.

News: Dark Matter Technologies unveils Horizon User Conference agenda

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the agenda for its Horizon User Conference. Open to Dark Matter clients and partners, the conference will take place at the Fontainebleau Miami Beach Hotel on April 24-25, 2024.

News: ACES Quality Management Releases Call Monitoring Audit Pack to Enhance Mortgage Quality Control and Compliance Programs

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced its newest product offering, ACES Call Monitoring Audit Pack. The pre-built, configurable Call Monitoring Audit Pack enables lenders and servicers to establish an additional layer of protection quickly and seamlessly within their QC program. ACES Call Monitoring Audit Pack includes custom data fields, ACES managed questionnaires and custom reports configurable to the individual organizations' business needs.

News: Agile Selected as 2024 HousingWire Tech100 Winner for the Third Consecutive Year

Mortgage and Finance News: (PHILADELPHIA, Pa.) Agile, a groundbreaking fintech bringing mortgage lenders and broker-dealers onto a single electronic platform, is excited to announce Agile Trading Technologies was selected for the 3rd consecutive year as a winner of the HousingWire Tech100 Award. The list is comprised of the most innovative technology companies in the housing market and provides housing professionals a look into the most impactful organizations that can be leveraged to identify partners and solutions.

News: Optimal Blue Clinches 2024 HousingWire Tech100 Mortgage Award

Mortgage and Finance News: (PLANO, Texas) Today, Optimal Blue announced its selection by HousingWire as a Tech100 Mortgage award winner. Now in its 12th year, HousingWire's Tech100 award program spotlights the most innovative and impactful tech organizations in housing.

News: Floify named a 2024 HW Tech100 Mortgage honoree

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, announced that it has been named a HW Tech100 Mortgage award honoree. Floify was recognized as an exceedingly user-friendly point-of-sale (POS) whose easy-to-configure platform and rule-based automations have made it beloved among small and midsize lenders and mortgage brokers.

News: Dark Matter Technologies adds mortgage technology veteran Tony Fox as chief of client engagement

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced industry veteran Tony Fox as its chief of client engagement.

News: New workflow in the Empower LOS makes it easier for mortgage lenders to consider rent payments when qualifying first-time homebuyers

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the availability of a new, automated workflow in the Empower® loan origination system (LOS) that makes it easier for lenders to identify and qualify loan applicants who could benefit from evaluation of their positive rent payment history.

News: Realfinity Launches Dual-License Program for Real Estate Agents

Mortgage and Finance News: (MIAMI, Fla.) Real-Finity, Inc. ("Realfinity") is excited to announce the availability of its Dual-License Program enabling the integration of mortgage services for real estate agents. In the dynamic and increasingly challenging environment of real estate, agents are now able to take advantage of this innovative solution to combat pressure on their commissions and enhance their value proposition by offering mortgage services.

News: ACES Audit Volume Increases 24%, Hits Record High in 2023

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that, despite challenging mortgage market conditions, the company maintained a record growth path achieved over the last few years by adding more than a dozen of the leading lenders in the U.S. to its client roster in 2023.

News: Optimal Blue PPE Now Available in Native Mobile App for Android and iOS, Gives Loan Officers ‘Pricing in Their Pocket’...

Mortgage and Finance News: (PLANO, Texas) Today, Optimal Blue announced releases related to its publicly listed, native mobile app for the Optimal Blue PPE - the industry's most widely used product, pricing, and eligibility engine. The releases consist of a new mobile app for Android, as well as enhancements to the company's mobile offering for iOS.

News: Argyle’s investments in innovation spur over 50 lenders to switch to the mortgage industry’s highest-converting VOI/E platform

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, closed a banner year of mortgage growth with 50 new IMB, credit union and bank customers. The payroll connectivity leader more than doubled the annual volume of income and employment verifications conducted on behalf of its customers to 1.5 million with the help of 15 of the top 100 mortgage lenders.

News: NotaryCam Authorized to Provide Remote Online Notarization Services for California Transactions in 2024

Mortgage and Finance News: (NEWPORT BEACH, Calif.) NotaryCam®, a Stewart-owned company and leading remote online notarization (RON) provider for real estate and legal transactions, announced today it will support remote online notarial acts in California beginning in 2024 following the passage of CA Senate Bill 696, which was signed into law by California Governor Gavin Newsom on September 30, 2023. Stage 1 of the bill takes effect on January 1, 2024.

News: Legacy Mutual Selects LenderLogix’s QuickQual to Improve Transparency and Responsiveness During Mortgage Borrowers’ Home Search

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced that Legacy Mutual Mortgage has selected its pre-approval letter generation tool QuickQual to provide borrowers with a white-labeled, digitally-driven entry point into their homebuying experience.

News: FormFree president Eric Lapin to speak on artificial intelligence at MISMO Winter Summit

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced its President Eric Lapin has been selected to speak at the MISMO Winter Summit taking place January 8-11, 2024, at The Woodlands Resort just outside of Houston, Texas. Lapin will speak on a panel titled "Demystifying Artificial Intelligence, Digital Identity and Blockchain" during a brown-bag lunch session on January 9 from 12:30 pm-1:25 pm CT. He will be joined by fellow panelists Devin Caster, principal, product solutions at CoreLogic; Rishi Godse, principal technical architect at USAA; and Shawn Jobe, vice president and head of business development at Informative Research.

News: Argyle partners with Dark Matter to bring seamless direct-source income and employment verifications to Empower LOS customers

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, announced today its integration with the Exchange, an interconnected network of mortgage-specific service providers available to customers of the Empower® loan origination system (LOS) from Dark Matter Technologies. This collaboration simplifies the income and employment verification process for lenders, further amplifying the cost and time-saving benefits of digital borrower verification.