Tag: Reports and Studies

News: Down Payment Resource Issues Q2 2023 Homeownership Program Index Report

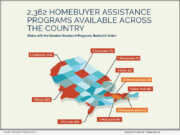

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, issued its Q2 2023 Homeownership Program Index (HPI). The firm's analysis revealed a second consecutive quarterly uptick of 0.5% in the number of homebuyer assistance programs available to help people finance homes, raising the number of programs to 2,373.

News: Down Payment Resource Reports on Homebuyer Assistance Programs for People with Disabilities for Disability Pride Month

Mortgage and Finance News: (ATLANTA, Ga.) In celebration of Disability Pride Month, Down Payment Resource (DPR) has issued a report on the 23 U.S. homebuyer assistance programs that are specifically designed to support people with disabilities and their family caregivers on their journey towards homeownership. While people with disabilities may be eligible for any of the 2,300-plus U.S. homebuyer assistance programs, this report sheds light on programs specially developed to promote accessibility and inclusivity for aspiring homeowners with disabilities.

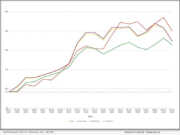

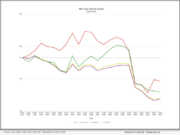

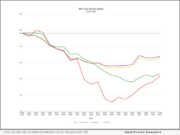

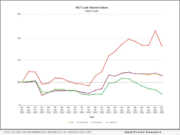

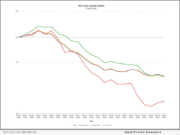

News: Monthly Lock Volume Increases 31% in Latest MCT Indices Report

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a 31% increase in lock volume in June. Visit MCT's website to download the full report. The increase in June's lock volume activity, which is based on actual locked loans, comes after a 15% drop in May's total lock production.

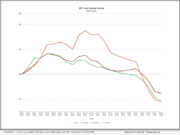

News: Q4 2022 ACES Mortgage QC Industry Trends Report Shows Decline in Critical Defect Rate to 1.84%

Mortgage and Finance News: (The quarterly defect rate declined 25.5% over Q3, though the annual defect rate remained above 2% for 2022) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) of 2022, as well as the full calendar year (CY).

News: Trends in Drug Benefit Design Report Released by Pharmaceutical Strategies Group (PSG)

Mortgage and Finance News: (DALLAS, Texas) Pharmaceutical Strategies Group (PSG), an EPIC company, is pleased to announce the launch of its Trends in Drug Benefit Design Report. The report delivers innovative research on the latest trends in the traditional (non-specialty) drug benefit. Sponsored by Rx Savings Solutions, it outlines the complexities of designing and managing the drug benefit and the cost challenges faced by consumers and plan sponsors alike.

News: MCTlive! Lock Volume Indices: May 2023 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for May 2023. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

News: LenderLogix Announces Quarterly Homebuyer Intelligence Report

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today introduced the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools. The inaugural report covers data collected during the pre-approval and borrower application process during the first quarter (Q1) of 2023.

News: MCTlive! Lock Volume Indices: April 2023 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for April 2023. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

News: Down Payment Resource Issues Q1 2023 Homeownership Program Index Report

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, issued its Q1 2023 Homeownership Program Index (HPI). The firm's analysis revealed a 0.5% uptick in the number of homebuyer assistance programs available to help people finance homes, raising the number of programs to 2,362.

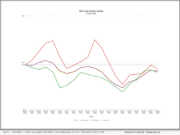

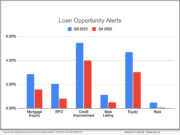

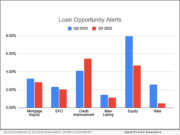

News: Sales Boomerang releases Q1 2023 Mortgage Market Opportunities Report

Mortgage and Finance News: (OWINGS MILLS, Md.) TrustEngine™, a provider of data-driven homebuyer engagement and education solutions for lenders, today announced the release of Sales Boomerang's latest Mortgage Market Opportunities Report. The Q1 2023 report indicates quarter-over-quarter improvements across all indicators of mortgage readiness, representing growth in mortgage lending opportunities.

News: MCTlive! Lock Volume Indices: March 2023 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for March 2023. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

News: National Buyers Agents Association Announces Surprising Survey Results for 2023 Homebuyer Concerns

Mortgage and Finance News: (EVERGREEN, Colo.) A National Buyers Agents Association (NBAA) survey of its members reveals surprising homebuyer concerns. Detailed results of the national survey are included in the association's blog section of its website. Some agents responded in the survey that their markets are not declining.

News: Critical Defect Rate Reaches Report-High in Q3 2022, Per ACES Quality Management Mortgage QC Industry Trends Report

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the third quarter (Q3) of 2022. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

News: 78.9% of metro Atlanta residential housing inventory is eligible for down payment assistance – offsetting price and interest rate impact...

Mortgage and Finance News: (ATLANTA, Ga.) As metro Atlanta homebuyers encounter the challenging trifecta of sharply rising home prices, elevated interest rates and institutional investor depletion of starter home inventory, Down Payment Resource (DPR), the housing industry's leading technology for connecting home buyers with homebuyer assistance programs, released a comprehensive report on the 46 active metro Atlanta homebuyer assistance programs.

News: MMI Announces Launch of ‘Mortgage Industry Benchmarks’ Report

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announced the launch of the "Mortgage Industry Benchmarks" report, a monthly newsletter compiling lender and loan officer (LO) production data and trends to facilitate peer-to-peer comparison.

News: MCTlive! Lock Volume Indices: February 2023 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for February 2023. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

News: MCTlive! Lock Volume Indices: January 2023 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for January 2023. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

News: Down Payment Resource’s Q4 2022 Homeownership Program Index shows homebuyer assistance programs have increased in number for fifth consecutive quarter

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from its latest Homeownership Program Index (HPI). The firm's analysis of 2,351 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 1.82% from Q3 to Q4 2022.

News: Sales Boomerang releases Q4 2022 Mortgage Market Opportunities Report

Mortgage and Finance News: (OWINGS MILLS, Md.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced the release of Sales Boomerang's latest Mortgage Market Opportunities Report.

News: MCTlive! Lock Volume Indices: December 2022 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for December 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

News: Critical Defect Rates Rose 6% in Q2 2022 Per ACES Quality Management Mortgage QC Industry Trends Report

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the second quarter (Q2) of 2022. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control software.

News: MCTlive! Lock Volume Indices: November 2022 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for November 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

News: New Energy Risk Publishes Sustainability Report, Adds Two Key Hires

Mortgage and Finance News: (AVON, Conn.) New Energy Risk (NER), a wholly-owned division of Paragon Insurance Group, today announces the release of its annual Sustainability Report and two key hires to support its goal of "Underwriting a Greener Future." The report details the climate, sustainability, and environmental impacts of NER's client portfolio.

News: MCTlive! Lock Volume Indices: October 2022 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for October 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

News: Sales Boomerang releases Q3 2022 Mortgage Market Opportunities Report

Mortgage and Finance News: (OWINGS MILLS, Md.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced the release of Sales Boomerang's latest Mortgage Market Opportunities Report.

News: Down Payment Resource releases Q3 2022 Homeownership Program Index

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), a technology provider helping the housing industry connect homebuyers with homebuyer assistance programs, today announced findings from its latest Homeownership Program Index (HPI). The firm's analysis of 2,309 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 1.6% from Q2 to Q3 2022.

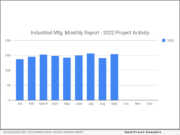

News: 154 New Industrial Manufacturing Development Projects Showed Improved Performance in September 2022

Mortgage and Finance News: (JACKSONVILLE BEACH, Fla.) IMI SalesLeads announced today the September 2022 results for the new planned capital project spending report for the Industrial Manufacturing industry. The 154 new projects increased from August 2022 140 manufacturing projects, however, down from 162 in September 2021.

News: MCTlive! Lock Volume Indices: September 2022 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for September 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

News: Critical Defect Rate Declined in Q1 2022 Per ACES Quality Management Mortgage QC Industry Trends Report

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management(r) (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the first quarter (Q1) of 2022. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control(r) software.

News: MCTlive! Lock Volume Indices: August 2022 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for August 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.