Tag: Reports and Studies

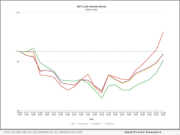

News: MCTlive! Lock Volume Indices: July 2022 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for July 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

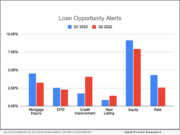

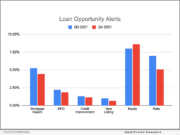

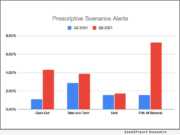

News: Sales Boomerang Q2 2022 Mortgage Market Opportunities Report

Mortgage and Finance News: (OWINGS MILLS, Md.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its latest Mortgage Market Opportunities Report. Sharp quarter-over-quarter increases in equity, credit-improvement and new-listing alerts in Q2 2022 point to areas of opportunity for lenders in a contracting mortgage market

News: Down Payment Resource releases Q2 2022 Homeownership Program Index

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from its latest Homeownership Program Index (HPI). The firm's analysis of 2,273 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 1.6% from Q1 to Q2 2022.

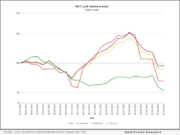

News: MCTlive! Lock Volume Indices: June 2022 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for June 2022.

News: Q4 2021 Critical Defect Rate Rose to 1.95%, Per ACES Quality Management Mortgage QC Industry Trends Report

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) and full calendar year (CY) of 2021. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

News: Down Payment Resource analysis finds that 33% of declined mortgage applications are declined for reasons addressable with homebuyer assistance

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from an analysis showing that a substantial share of mortgage loan applications are both declined for reasons that can be addressed with homebuyer assistance and eligible for homebuyer assistance programs.

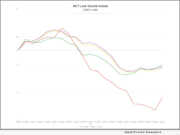

News: MCTlive! Lock Volume Indices: May 2022 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for May 2022.

News: MCTlive! Lock Volume Indices: April 2022 Data

Mortgage and Finance News: (SAN DIEGO, Calif.) MCT®, the leading pipeline hedge advisory in the residential mortgage industry, is pleased to announce the introduction of new MCTlive! Mortgage Lock Volume Indices to help all industry participants better understand key trends in the mortgage industry.

News: Down Payment Resource releases Q1 2022 Homeownership Program Index

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced the release of its latest Homeownership Program Index (HPI). The firm's analysis of 2,238 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 46 from Q4 2021 to Q1 2022.

News: Sales Boomerang releases Q1 2022 Mortgage Market Opportunities Report

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its latest Mortgage Market Opportunities Report. The Q1 2022 report showed an increase in purchase and home-equity loan opportunities that could help lenders offset dwindling refi volume.

News: Critical Defect Rate Drops 18% in Q3 2021, Per ACES Quality Management Mortgage QC Industry Trends Report

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Trends Report covering the third quarter (Q3) of 2021. The latest report provides an analysis of post-closing quality control data derived from ACES Quality Management & Control® software.

News: Sales Boomerang releases Q4 2021 Mortgage Market Opportunities Report

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its latest Mortgage Market Opportunities Report. The Q4 2021 report identified increasing opportunities for mortgage lenders to assist borrowers with tappable home equity, lending credence to analysts' expectations for a surge in home-equity-related mortgage activity in 2022.

News: Down Payment Resource releases Q4 2021 Homeownership Program Index

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced the release of its latest Homeownership Program Index (HPI). The firm's analysis of 2,192 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database showed measurable quarter-over-quarter gains in program funding levels and an increased prevalence of programs aimed at assisting community heroes.

News: Choyce Peterson Publishes Year-End 2021 Lower Fairfield County Office Space Availability Poster

Mortgage and Finance News: (NORWALK, Conn.) Choyce Peterson, Inc., a full service commercial real estate brokerage firm with a specialization in tenant representation, announced the release of its 24th semi-annual Lower Fairfield County Office Space Availability Poster.

News: Critical defect rate increases 13% Q2 2021, according to ACES Quality Management Mortgage QC Industry Trends Report

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Trends Report covering the second quarter (Q2) of 2021.

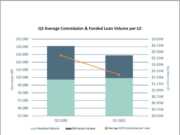

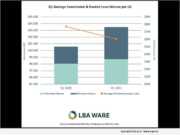

News: SimpleNexus’ Mortgage Loan Compensation Report for Q3 2021 shows year-over-year decline in individual LO commission led by waning refi volume

Mortgage and Finance News: (LEHI, Utah) SimpleNexus, owner of the recently acquired LBA Ware™, a leading provider of incentive compensation management (ICM) and business intelligence (BI) software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry loan compensation in the third quarter of 2021.

News: Sales Boomerang releases Q3 2021 Mortgage Market Opportunities Report

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its Q3 2021 Mortgage Market Opportunities Report. Despite marketwide declines in loan volume, Sales Boomerang's report identified several fertile opportunities for mortgage lenders, including a high frequency of borrowers who are well positioned to refinance for a better rate, remove FHA mortgage insurance or tap into home equity.

News: ACES Mortgage QC Industry Trends Report Shows Decline in Critical Defect Rate for Second Consecutive Quarter

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Trends Report covering the first quarter (Q1) of 2021. The latest report provides an analysis of post-closing quality control data derived from ACES Quality Management & Control® software.

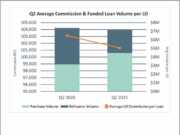

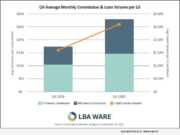

News: LBA Ware’s Q2 2021 Mortgage Loan Compensation Report shows decline in individual LO commission and volume

Mortgage and Finance News: (MACON, Ga.) LBA Ware™, a leading provider of incentive compensation management (ICM) and business intelligence (BI) software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry loan compensation in the second quarter of 2021. The firm's analysis of data from its CompenSafe™ ICM platform showed that despite a marginal increase in loan volume from Q2 2020 to Q2 2021, quarterly commissions per LO were down.

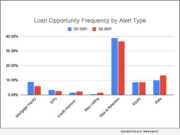

News: Sales Boomerang releases Q2 2021 Mortgage Market Opportunities Report

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the mortgage industry’s top-rated automated borrower intelligence and retention system, today released its inaugural Mortgage Market Opportunities Report. According to the report, refinance opportunities continue to dominate the market, but a promising uptick in new listings was also evident in the Q2 data. Mortgage servicers will need to closely manage their default and foreclosure risk in the coming months, as the second quarter saw nearly two out of five customers trigger a risk-and-retention alert.

News: Critical Defect Rate Moderates in Q4 but CY 2020 Defect Rate Remains High, Per ACES Mortgage QC Industry Trends Report

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management™ (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Trends Report covering both the fourth quarter (Q4) and the 2020 calendar year (CY).

News: Report: Over One Quarter of All Mileage Reimbursement Claims Are Overreported

Mortgage and Finance News: (ISSAQUAH, Wash.) According to internal data gathered by TripLog, a leading enterprise mileage and expense tracking solution, over 1/4 (nearly 30%) of all mileage is overreported, which could potentially cost businesses millions of dollars per year in fraudulent reimbursements.

News: Staff Retention Tops List of Lender Concerns in 2021, Inaugural Survey from The Mortgage Collaborative Finds

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's largest independent mortgage industry cooperative network, has announced the results of its inaugural The Pulse of the Mortgage Industry survey ranking mortgage lenders' top concerns based on 598 executive responses from the co-op's 234 lender members.

News: After, Inc. publishes a ‘Risk Management 101’ guide that gives Warranty Leaders a first-hand look at this complex discipline

Mortgage and Finance News: (NORWALK, Conn.) After, Inc. a pioneer in the Warranty Services industry, has provided innovative warranty marketing, analytics, and program management solutions to top-tier manufacturing clients since 2005. In delivering program management solutions, After, Inc. found that few manufacturers understand Risk Management.

News: Shoplifting and Dishonest Employee Average Case Values Increased in 2020, According to Jack L. Hayes International’s 33rd Annual Retail Theft...

Mortgage and Finance News: (WESLEY CHAPEL, Fla.) Jack L. Hayes International, Inc. released today the results of their 33rd Annual Retail Theft Survey which reports on over 184,000 shoplifters and dishonest employee apprehensions in 2020 by just 22 large retailers, who recovered over $81 million from these thieves.

News: LBA Ware’s Q1 2021 Mortgage Loan Compensation Report shows slight decrease in basis points paid

Mortgage and Finance News: (MACON, Ga.) LBA Ware™, a leading provider of incentive compensation management (ICM) and business intelligence (BI) software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry loan compensation in the first quarter of 2021.

News: Q3 2020 Critical Defect Rate Hits Five-Year High, According to ACES Mortgage QC Industry Trends Report

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management™ (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Trends Report covering the third quarter (Q3) of 2020. The latest report provides an analysis of post-closing quality control data derived from ACES Quality Management & Control Software™.

News: LBA Ware Issues Q4 2020 Loan Compensation Report, Includes Summary of 2020 Loan Originator Commission Trends

Mortgage and Finance News: (MACON, Ga.) LBA Ware™, a leading provider of incentive compensation management (ICM) and business intelligence software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry incentive compensation in the fourth quarter of 2020 and loan originator (LO) commissions for the year as a whole.

News: Tubbergen reports Recently Passed COVID Relief Bill May Threaten Your Retirement

Mortgage and Finance News: (GRAND RAPIDS, Mich.) Does the Recently Passed COVID Relief Bill Threaten Your Retirement? According to Dennis Tubbergen, a partner with Retirement Lifestyle Advocates, that question is not as crazy as you may be thinking it is.

News: Critical Defect Rate Highest Since 2018, Per ACES Quality Management Q2 2020 Mortgage QC Trends Report

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Trends Report covering the second quarter (Q2) of 2020.