Suzee Quanta

News: TRK Connection CEO Teri Sundh Named to MPA’s 2018 List of Elite Women in Mortgage

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection (TRK), a leading provider of mortgage quality control and origination management solutions, announced today that CEO Teri Sundh has been named to Mortgage Professional America (MPA) magazine's 2018 Elite Women in Mortgage.

News: Mid America Mortgage COO Kara Lamphere Repeats as One of MPA Magazine’s Elite Woman in Mortgage

Mortgage and Finance News: (ADDISON, Texas) Mid America Mortgage, Inc. today announced that Chief Operating Officer Kara Lamphere was named by Mortgage Professional America (MPA) magazine to the publication's list of 2018 Elite Women in Mortgage. This is the second consecutive year that Lamphere has received this recognition.

News: MQMR’s Erin Harris Recognized by Mortgage Professional America as One of Its ‘2018 Elite Women in Mortgage’

Mortgage and Finance News: (LOS ANGELES, Calif.) Mortgage Quality Management and Research, LLC (MQMR), a leader in mortgage risk management and compliance services, today announced that Erin Harris, manager of MQMR's vendor management division HQ Vendor Management, has been named by industry trade magazine Mortgage Professional America (MPA) as a 2018 Elite Women in Mortgage honoree.

News: Beckie Santos of IDS Honored with MPA Magazine’s 2018 Elite Women in Mortgage Award

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced today that New Product Development Manager Beckie Santos has been recognized by Mortgage Professional America (MPA) magazine in its list of 2018 Elite Women in Mortgage.

News: Advalent Partners with Novus Healthcare to Close the Gap in Value-Based Care

Mortgage and Finance News: (WESTBOROUGH, Mass.) Advalent Corporation ('Advalent') signed a partnership in early 2018 with Novus Healthcare to identify patients who could benefit from value-based care and implement that approach using Advalent's Value-Based Care Platform and Novus' population health management programs.

News: EPIC adds Lou D’Agostino as a Principal in New York serving the Financial Services Industry

Mortgage and Finance News: (NEW YORK, N.Y.) EPIC Insurance Brokers & Consultants today announced that risk management and insurance brokerage veteran Lou D'Agostino and his Iron Cove Partners team have joined the firm. D'Agostino has over 17 years of insurance brokerage experience with an expertise in serving the Financial Services industry.

News: Thompson Mackey and EPIC Insurance Host Young Risk Professional Event in Atlanta

Mortgage and Finance News: (ATLANTA, Ga.) EPIC Insurance Brokers and Consultants, a retail property & casualty insurance brokerage and employee benefits consultant, announced today that Atlanta-based Risk Management Consultant Thompson Mackey will be hosting an event with the non-profit he leads locally, Young Risk Professionals, at the rooftop of The Ivy in Buckhead on Wednesday, July 25, 2018 from 5:30 - 8:30 p.m.

News: Two Arrested at Civil Disobedience Protest on Rainbow Ridge

Mortgage and Finance News: (SAN FRANCISCO, Calif.) Forests Forever, a non-profit forest protection advocacy group, today announced that five employees of Lear Asset Management, a security contractor for Humboldt Redwood Co. (HRC), swept down on protesters camped near a logging road on Rainbow Ridge in the Mattole River watershed at about 5 a.m. yesterday (July 22).

News: Credit Plus, DocMagic, Home Captain and Snapdocs Lead Fundraiser, Raising $1,500 for Girls Inc. Dallas at NEXT Women’s Mortgage Event

Mortgage and Finance News: (EDMOND, Okla.) NEXT Mortgage Events LLC, a creator of events for women mortgage executives, has announced that mortgage industry technology providers Credit Plus, DocMagic, Home Captain and Snapdocs collaborated as key benefactors in a charity effort that raised $1,500 for Girls Inc. of Metropolitan Dallas.

News: Simplifile Signs 1800th County to Its E-recording Network, Platform Now Utilized by More Than Half of U.S. Recording Jurisdictions

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that Clallam County, Wash., is the 1800th jurisdiction to join Simplifile's e-recording network.

News: Maxwell Announces New Partnership with HomeServices Lending

Mortgage and Finance News: (DENVER, Colo.) Digital mortgage software provider, Maxwell, today announced a new partnership with HomeServices Lending of Des Moines, Iowa. Maxwell empowers mortgage lenders across the nation with a modern digital workspace that digitizes and automates the home-buying experience.

News: Bank of Southern California NA Names Catherine Puckett VP, Business Development Manager

Mortgage and Finance News: (SAN DIEGO, Calif.) Bank of Southern California, N.A. (OTC Pink: BCAL), a community business bank headquartered in San Diego, is pleased to announce that Catherine Puckett has joined the company as Vice President, Business Development Manager. She will be responsible for expanding Bank of Southern California's business banking client base by actively seeking new business opportunities in the San Diego region.

News: Mortgage Risk Management Firm MQMR Continues Corporate Philanthropy Efforts through Volunteer Day at Camp Impact

Mortgage and Finance News: (LOS ANGELES, Calif.) Mortgage Quality Management and Research, LLC (MQMR), a leader in mortgage risk management and compliance services, recently completed a volunteer day at Camp Impact as part of its on-going corporate commitment to community service. Camp Impact offers free summer camps to homeless and underprivileged youth in the Arlington and Grand Prairie, Texas, communities.

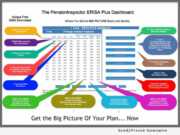

News: The Pension Inspector Launches New SaaS Integrating Prior and Present Form 5500 Filings, to Provide Big Picture of Plan Operations

Mortgage and Finance News: (NEW YORK, N.Y.) National Retirement Programs, Inc. and its wholly owned subsidiary AtPrime Media Services, the creator of PensionInspector.com, introduces "Form 5500 Prestige Vision," an addition to its, super easy to use, replacement for the U.S. Department of Labor's ERISA Form 5500 Download Service "ERISA Plus Dashboard."

News: Express Information Systems Named to Software Industry Guru Bob Scott’s 2018 List of Top 100 VARs

Mortgage and Finance News: (SAN ANTONIO, Texas) Express Information Systems, a leading provider of business software and consulting for growing businesses in Texas and beyond, has announced its inclusion on Bob Scott's Top 100 VARs 2018 published by Progressive Media Group.

News: EPIC Insurance Brokers add Josh Close in Birmingham, Alabama

Mortgage and Finance News: (BIRMINGHAM, Ala.) EPIC Insurance Brokers and Consultants ("EPIC") announced today that Josh Close has joined the firm's Birmingham-based national energy construction practice as a client services coordinator, reporting to EPIC Principal Brian Tanner.

News: Paragon Insurance Holdings Expands Operations in San Diego with addition of Robert Etzler and opening of new offices

Mortgage and Finance News: (SAN DIEGO, Calif.) Paragon Insurance Holdings LLC ("Paragon"), a national multi-line specialty MGA (Managing General Agency) based in Avon, Conn., today announced its expansion in San Diego, Calif. with the opening of new offices at 401 B Street in downtown San Diego and the hiring of top local insurance professional Robert Etzler, under the leadership of Paragon regional president, Andrew Petersen.

News: MorVest Capital Hires Ruth Lee as Executive Vice President for Expansion of Mortgage Liquidity and MSR Advisory Services

Mortgage and Finance News: (SUGAR LAND, Texas) David Fleig, CEO of MorVest Capital, LLC, a financial services advisory firm specializing in mortgage banking liquidity and capital solutions, today announced its addition of Executive Vice President Ruth Lee.

News: OpenClose Launches DecisionAssist Mobile for Originators

Mortgage and Finance News: (SAN FRANCISCO, Calif.) OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced at the California Mortgage Bankers Association (CMBA) 46th Annual Western Secondary Marketing Conference that it unveiled DecisionAssist(TM) Mobile, which provides fingertip access to the company's proprietary web-based product and pricing engine (PPE)

News: ARMCO Releases Fourth Quarter / Calendar Year 2017 Trends Report

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report provides loan quality findings for mortgages reviewed by ACES Audit Technology(TM) during the fourth quarter (Q4) of 2017 as well as the 2017 calendar year (CY).

News: Business Development and Relationship Management Specialist Julia Moore Joins EPIC in Sacramento CA

Mortgage and Finance News: (SACRAMENTO, Calif.) EPIC Insurance Brokers & Consultants ('EPIC') announced today that new business sales and relationship management professional Julia Moore has joined the firm's operations in Sacramento as Vice President, New Business Development.

News: LBA Ware Recruits Mortgage Process Improvement Specialist Jessica Henke as Solutions Consultant

Mortgage and Finance News: (MACON, Ga.) LBA Ware(TM), a leading provider of automated compensation software and systems integration solutions for mortgage lenders, announced today that it has hired Jessica Henke as a solutions consultant to support the company's implementation consulting and client success efforts. Henke will leverage her two decades of accounting and business process improvement expertise in mortgage lending to bring LBA Ware clients streamlined business workflow solutions and enhanced operational insights.

News: Aclaro to Bring the Power of Predictive Analytics to Lending Sector, Expands Operations in the US

Mortgage and Finance News: (MIAMI, Fla.) Aclaro, the leading provider of blockchain based open data platforms and solutions, has announced that it has launched a new Fintech Artificial Intelligence (AI) solution focused on the lending industry. The new solution is Aclaro TrueView(TM). Aclaro aims to equip lenders with the innovative tools needed for competitive advantage with its tech savvy, blockchain based predictive analytics platform that can be utilized without incurring heavy costs.

News: Accurate Group Enhances Its NotaryWorks Complete Notary Solution with Remote Online Notarization from NotaryCam

Mortgage and Finance News: (NEWPORT BEACH, Calif.) NotaryCam today announced that it has partnered with Accurate Group, a leading provider of technology-driven real estate appraisal, title and compliance services, to provide remote online notarization services for NotaryWorks(TM), Accurate Group's complete notary solution.

News: EPIC adds Sarmad Naqvi to its Private Client Practice in Northern California

Mortgage and Finance News: (SAN FRANCISCO, Calif.) EPIC Insurance Brokers and Consultants ('EPIC') today announced that risk management and insurance professional Sarmad Naqvi has joined the firm's Private Client Insurance operations in Northern California, specializing in providing comprehensive, cost effective risk management and insurance protection to high net worth individuals and their families.

News: EPIC Insurance adds Eric Kitei as a Principal in Southern California

Mortgage and Finance News: (LOS ANGELES, Calif.) EPIC Insurance Brokers and Consultants ('EPIC') announced today that risk management and insurance professional Eric Kitei has joined the firm's operations in Southern California as a Principal, focusing on the unique needs of auto dealers and others in the automotive industry.

News: EPIC Adds John Check in Pittsburgh, Pa.

Mortgage and Finance News: (PITTSBURGH, Pa.) EPIC Insurance Brokers and Consultants ('EPIC'), a retail property and casualty insurance brokerage and employee benefits consultant, today announced the addition of benefits consulting professional John Check as a Senior Consultant in the firm's Employee Benefits Consulting Division.

News: Klingenstein Fields Wealth Advisors Ranked in Financial Times 2018 Top 300 Registered Investment Advisers

Mortgage and Finance News: (NEW YORK, N.Y.) KFWA (Klingenstein Fields Wealth Advisors) is pleased to announce it has been named to the 2018 edition of the FT 300 Top Registered Investment Advisers. The list recognizes top independent RIA firms from across the U.S. This is the fifth annual FT 300 list, produced independently by the FT in collaboration with Ignites Research.

News: Lykken on Lending June 25 Podcast Features Black Knight EVP Shelley Leonard on Mortgage Servicing in the Digital Age

Mortgage and Finance News: (AUSTIN, Texas) Lykken on Lending, the mortgage industry podcast created by mortgage lenders for mortgage lenders, is pleased to announce that its June 25 episode welcomes Shelley Leonard, EVP and Chief Product Officer for Black Knight, Inc. (NYSE:BKI).

News: Cloudvirga Named One of North America’s Top 100 Tech Firms by Red Herring

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga(TM), a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform(r), was honored today with Red Herring's Top 100 North America award.