News: Major Update to Cloudvirga’s Enterprise Point-of-Sale Platform Raises the Digital Mortgage Bar

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform(R), today announced a major update to the Cloudvirga Enterprise POS. New features designed to improve lender speed, compliance and productivity will make the platform's 4.0 release the most robust POS solution on the market.

News: PitBullTax Software Launches PitBullTax University and Announces Its First User Conference

Mortgage and Finance News: (CORAL SPRINGS, Fla.) PitBullTax, The Leading IRS Tax Resolution Software provider for CPAs, Enrolled Agents and Tax Attorneys received accreditation to be a Continuing Education Provider for tax professionals who are involved in IRS tax resolution and for those who plan to practice in this lucrative specialty. This is yet another milestone in a long history of accomplishments for PitBullTax, and another example of how this company maintains its dominant position in the tax resolution arena.

News: Attorneys from Shapiro Goldman Babboni Fernandez & Walsh Attended The FJA’s Workhorse Seminar

Mortgage and Finance News: (ORLANDO, Fla.) Several Managing Partners from the personal injury law firm Shapiro Goldman Babboni Fernandez & Walsh participated in the Florida Justice Association's Workhorse CLE Seminar and Networking Event. Held at the Marriott World Center in Orlando, the four day event hosted dozens of seminars on a wide variety of topics including damages from personal injury and wrongful death cases.

News: Mortgage Technology Industry Veteran Tom Rice Joins OpenClose as Vice President Enterprise Account Executive

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that long-time industry veteran Tom Rice has joined its growing sales team. Mr. Rice has experience with multiple LOS platforms as well as other enterprise-class mortgage technology solutions. He will be responsible for covering the West Coast territory.

News: New Mobile App from Cloudvirga Connects Real Estate Agents with Loan Officers on Its Digital Mortgage Platform

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga(TM), a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform(r), today announced the launch of a new mobile app that will enable real estate agents to collaborate with mortgage loan officers in real time. This native mobile app allows instantaneous and secure exchange of loan documents and communication between real estate agents and loan teams for a faster, more efficient mortgage experience.

News: Two MQMR Employees Selected as MBA, California MBA Future Leaders

Mortgage and Finance News: (LOS ANGELES, Calif.) Mortgage Quality Management and Research, LLC (MQMR), a leader in mortgage risk management and compliance services, today announced that two employees from the MQMR family of companies have been selected to participate in executive leadership development programs sponsored by the national Mortgage Bankers Association (MBA) and the California Mortgage Bankers Association.

News: Simplifile Debuts Enhanced Post-Closing Service to Automate Return of Trailing Mortgage Documents

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, announced that it has enhanced its Post Closing service to help lenders automate the return of trailing loan documents. This new service is designed to save lenders time on final Closing Disclosure (CD) reconciliation, eliminate time-consuming post-closing document management tasks, and provide a complete audit trail to reduce regulatory risk.

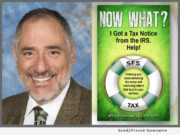

News: Life-preserving tax tips, quips and advice series, book one from Jeffrey Schneider, is now available in a Kindle Edition

Mortgage and Finance News: (STUART, Fla.) SFS Tax Problem Solutions Press announces the release of the eBook and Kindle Edition of "Now What? I Got a Tax Notice from the IRS. Help!" (B079XWL8P9) by Jeffrey Schneider. "Now What?" is also available in paperback (ISBN: 978-0692997154) and will be published in an audiobook version in June 2018.

News: National Mortgage Professional Magazine Designates MCT a 2018 Top Mortgage Employer

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that National Mortgage Professional (NMP) magazine named the company to its 2018 'Top Mortgage Employers' list. MCT was one of only ten companies to be included in the Services Providers category.

News: Bank of Southern California, N.A. Announces Addition of Phillip Mulder and Billy Szeto to Its Commercial Real Estate and SBA...

Mortgage and Finance News: (SAN DIEGO, Calif.) Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, Calif., announces the addition of two tenured Business Development Officers to support the company's continued expansion into the Southern California region.

News: FormFree Returns as Sponsor of Ellie Mae Experience 2018

Mortgage and Finance News: (ATHENS, Ga.) For the second year, automated verification provider FormFree will sponsor Ellie Mae's (NYSE:ELLI) annual user conference. Ellie Mae Experience 2018 takes place March 19-21 at the Wynn hotel in Las Vegas. Each year, Ellie Mae Experience brings together thousands of mortgage leaders to discuss the latest industry strategies, share best practices and receive hands-on training.

News: ReverseVision’s Sold-Out Third Annual User Conference Equips New and Experienced HECM Lenders with Data-Driven Insights

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, attracted a record crowd of industry newcomers to its third annual user conference February 6-8 at the Kona Kai Resort and Spa in San Diego.

News: Gallo LLP Files first 10 Consumer Claims Against Google Following Injunction and Revision of Gmail Architecture

Mortgage and Finance News: (SAN RAFAEL, Calif.) San Francisco Bay Area law firm Gallo LLP has filed the first of what it predicts could be thousands of individual damages cases against Google based on the same misconduct alleged in Matera v. Google, Case No. 15-CV-04062-LHK. Acting for a class of consumers who never signed up for Gmail (but nevertheless had their email scanned by Google), the Matera plaintiffs sought injunctive relief under the federal Electronic Communications Privacy Act (the "Wiretap Act") and California Invasion of Privacy Act ("CIPA").

News: AccountChek by FormFree Will Integrate with Black Knight’s LoanSphere Exchange Digital Solution

Mortgage and Finance News: (ATHENS, Ga.) Automated verification provider FormFree today announced that its award-winning AccountChek asset verification service will integrate with LoanSphere Exchange Digital, a centralized application programming interface (API) marketplace for the mortgage industry. LoanSphere Exchange Digital is offered by Black Knight, Inc., a leading provider of integrated software, data and analytics to the mortgage and real estate industries.

News: Renee Crow of EPIC to Present on Litigation Impact Awareness at CLM Annual Conference in Houston

Mortgage and Finance News: (SAN FRANCISCO, Calif.) EPIC Insurance Brokers and Consultants, a retail property, casualty insurance brokerage and employee benefits consultant, announced today that Vice President, Hospitality Practice Leader Renee Crow will present at the CLM Annual Conference on Thurs., March 15 at 10:10 a.m. at the Marriott Marquis in Houston, Texas.

News: Bank of Southern California N.A. Recognized as Top Small Business Lender

Mortgage and Finance News: (SAN DIEGO, Calif.) Bank of Southern California, N.A. (OTC Pink: BCAL / OTCMKTS:BCAL) announced it was awarded two top small business lending partner awards in the medium sized bank category by the San Diego District Office of the U.S. Small Business Administration based on the largest quantity and dollar volume of SBA 7(a) loans originated. The rankings reflect the SBA's fiscal year-end results as of September 30, 2017. These accolades follow the bank's recognition by the SBA as the top performing small business lending partner for medium sized banks in 2016.

News: Paragon Insurance Holdings Invests in Cloud Business Intelligence (BI) to Enhance Analytics Capabilities

Mortgage and Finance News: (AVON, Conn.) Paragon Insurance Holdings, LLC, a national multi-line specialty MGA, has selected LeapFrogBI, LLC, an agile business intelligence provider, and Sisense, Inc., to develop an advanced data warehouse and enable enhanced reporting capabilities.

News: Chuck Simpson of EPIC to Present on Hazard Recognition at Arklatex ASSE Chapter Meeting

Mortgage and Finance News: (BIRMINGHAM, Ala.) EPIC Insurance Brokers and Consultants, a retail property, casualty insurance brokerage and employee benefits consultant, announced today that Senior Risk Control Consultant Chuck Simpson will present at the Arklatex American Society of Safety Engineers (ASSE) Bi-Monthly Chapter Meeting on Thurs., March 15 at 11:30 a.m. at Shane's Seafood and BBQ in Bossier City, La.

News: ReverseVision Partners with DataVerify to Help HECM Lenders Improve Loan Quality, Reduce Repurchase Risk

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, today announced the availability of DataVerify's DRIVE verification platform within ReverseVision's flagship RV Exchange (RVX) loan origination system (LOS). DRIVE helps lenders improve efficiency and reduce repurchase risk by monitoring changes to borrower identity, loan application, and property data throughout the origination process.

News: National Mortgage Professional Magazine Names OpenClose a 2018 Top Mortgage Employer for the Second Year in a Row

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that was it was again honored as a Top Mortgage Employer by National Mortgage Professional magazine (NMP) for 2018. OpenClose was one of only ten companies to be included in the Services Providers category.

News: Mortgage Risk Management and Compliance Vendor MQMR Grows Sixth Consecutive Year Serving Lenders and Servicers

Mortgage and Finance News: (LOS ANGELES, Calif.) Mortgage Quality Management and Research, LLC (MQMR), a leader in mortgage risk management and compliance services, today announced that 2017 was a banner year for the company, marked by the launch of two new auditing programs and the addition of senior-level staff members.

News: Andrea Racanelli of EPIC to Present on Social Media Marketing in the Transportation Industry at International LCT Show

Mortgage and Finance News: (LAS VEGAS, Nev.) EPIC Insurance Brokers and Consultants, a retail property, casualty insurance brokerage and employee benefits consultant, announced today that Marketing Communications Manager Andrea Racanelli of The Capacity Group - an EPIC Company will present at the International Luxury Coach and Transportation (LCT) Show on March 13 at the Mandalay Bay Resort and Casino in Las VegaS.

News: Suzanne McGarey, Matias Ormaza and Louis Hefter of EPIC Honored as Risk & Insurance Magazine 2018 Power Brokers

Mortgage and Finance News: (SAN FRANCISCO, Calif.) EPIC Insurance Brokers and Consultants ('EPIC'), a retail property, casualty insurance brokerage and employee benefits consultant, announced today that Managing Principal Suzanne McGarey and Senior Vice President Matias Ormaza have been recognized as 2018 Power Brokers by Risk & Insurance Magazine. Principal Louis Hefter was named a finalist.

News: Lion’s Heart Receives $10,000 from Shulman Hodges & Bastian LLP in Support of Teen Volunteers and Leaders

Mortgage and Finance News: (IRVINE, Calif.) Lion's Heart is thrilled to announce it has received a $10,000 corporate partner sponsorship from the esteemed Orange County law firm, Shulman Hodges & Bastian LLP. These funds will support the cultivation of age-appropriate service projects for over 10,000 empowered teen Members across the country as well as support general law and business counsel for the organization.

News: Bank of Southern California N.A. Announces Amanda Conover as Vice President, Director of Marketing

Mortgage and Finance News: (SAN DIEGO, Calif.) Bank of Southern California, N.A. (OTC Pink:BCAL / OTCMKTS:BCAL), a community business bank headquartered in San Diego, Calif., has named Amanda Conover as Vice President, Director of Marketing. She will be responsible for developing and executing a strategic marketing plan that strengthens brand awareness and drives growth, further supporting the Bank's efforts to increase its presence as it continues its expansion in the Southern California region.

News: Simplifile Approved by Arkansas Secretary of State as E-Notary Vendor

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, announced that it has been approved by the Arkansas Secretary of State as an electronic notary (e-notary) service provider. As a result, Simplifile users in the 23 Arkansas recording jurisdictions in Simplifile's e-recording network will now have the ability to electronically notarize documents, thus streamlining their processes and allowing them to keep as much of the real estate transaction electronic as possible.

News: Quest Advisors Picks TRK’s Insight RDM Mortgage QC Audit Platform

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection , a leading provider of mortgage quality control and origination management solutions, announced today that outsourced mortgage quality assurance firm Quest Advisors has selected Insight Risk & Defect Management to power its third-party mortgage QC reviews.

News: Inlanta Mortgage Integrates CompenSafe with LendingQB

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of automated compensation software and systems integration solutions for mortgage lending and retail banking, announced that Wisconsin-based Inlanta Mortgage has completed integration between LBA Ware's CompenSafe automated compensation calculation platform and LendingQB's cloud-based loan origination solution (LOS). Through the integration, Inlanta is able to leverage real-time loan production data to automatically calculate compensation for each of its 100+ loan originators.

News: IDS Gains Market Share in 2017 Despite Industry Downturn

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it increased its share of the mortgage document preparation market in 2017, even though the industry overall experienced a decline in volume. In February, idsDoc introduced new borrower data collection fields that support compliance with the 2018 changes to Home Mortgage Disclosure Act (HMDA) reporting.

News: RoundPoint and Matic Automate Homeowner’s Insurance for Homebuyers, Mortgage Servicing Customers and RoundPoint Employees

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic, a digital insurance agency whose technology enables borrowers to purchase homeowner's insurance during the mortgage transaction, today announced a wide-ranging integration with RoundPoint Mortgage Servicing Corporation, a mortgage loan originator and one of the nation's largest non-bank mortgage servicing companies. The integration will make Matic's one-click "get quote" button available to both customers and employees of RoundPoint.