News Topic: AP

News: Recently Launched LoanMAPS™ LOS Now Integrated with DocMagic Eliminating Need for Disclosure Desk and Closing Department

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance, and comprehensive eMortgage services, is pleased to announce that it has integrated multiple digital lending solutions with Take Three Technologies' ("Take3") cloud-based and fully-integrated loan origination system (LOS), LoanMAPS™.

News: EPIC Private Client Practice Poised for Success with the Appointment of Steve Nelson as Chief Growth Officer

Mortgage and Finance News: (SAN FRANCISCO, Calif.) EPIC Insurance Brokers and Consultants (EPIC), an independent insurance brokerage and consulting firm, announced today that they have appointed Steve Nelson as Chief Growth Officer of their Private Client Practice.

News: Sales Boomerang teams up with OptifiNow to offer lenders an integrated experience for mortgage customer engagement

Mortgage and Finance News: (BALTIMORE, Md.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced its application programming interface (API) integration with OptifiNow, a cloud-based sales, marketing and customer relationship management (CRM) platform. The integration ensures accurate borrower data flows seamlessly and automatically between the two systems, giving lenders more time to focus on nurturing borrower relationships and exceeding sales goals.

News: Reefer Rabble Rouser Ed ‘NJWeedman’ Forchion to Present Oral Arguments in Federal Lawsuit Against New Jersey Governor Phil Murphy

Mortgage and Finance News: (TRENTON, N.J.) Reefer rabble rouser Ed "NJWeedman" Forchion and his longtime attorney, John Vincent Saykanic, Esq. will get another day in court to fight the green fight on Wednesday, February 23, 2022 when oral arguments are presented per his cannabis related lawsuit directed at Governor Phil Murphy (Case 3:20-cv-16582-PGS-TJB FORCHION v. MURPHY).

News: FormFree’s AccountChek joins forces with Freddie Mac for industry-first automated assessment of direct deposit income

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced that its AccountChek® digital asset verification service will support a first-of-its-kind solution from Freddie Mac that allows mortgage lenders to assess a prospective homebuyer's income using direct deposit data. Available to mortgage lenders nationwide, Freddie Mac's Loan Product Advisor® (LPASM) asset and income modeler (AIM) solution fulfills mortgage verification of assets (VOA) and verification of income (VOI) requirements.

News: National Bankers Association Endorses Promontory MortgagePath for Mortgage Fulfillment Services and POS Technology

Mortgage and Finance News: (DANBURY, Conn.) Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC today announced the National Bankers Association (NBA) has endorsed its mortgage fulfillment services and proprietary point-of-sale technology, Borrower Wallet®.

News: Fairport Wealth Announces 2022 Community Beacon Recipient

Mortgage and Finance News: (CLEVELAND, Ohio) Fairport Wealth is pleased to announce Beech Brook, a local behavioral health agency that empowers children and their families, as its 2022 Community Beacon. It is especially important to support the mental health needs of children and adolescents this year, and we are proud to assist Beech Brook's mission.

News: Down Payment Resource welcomes Marcy Ash, AMP, as Director of Strategic Projects

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced it has appointed Marcy Ash, AMP, as director of strategic projects. In her role at DPR, Ash will manage relationships with state Housing Finance Agencies (HFAs) and spearhead industry partnerships and strategies that help DPR deliver greater value to its customers.

News: Blaylock Van Serves as Co-Manager for $1.5 Billion State Street Debt Issuance

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Blaylock Van, LLC, the nation's longest continuously operating Black-owned investment firm, recently announced as co-manager for State Street Corp.'s $1.5 debt issuance. The senior unsecured debt issuance, part of State Street's DE&I focus, involved four black-owned investment firms.

News: #HousingDC22 Announces New Sponsors and Political Commentator Amy Walter

Mortgage and Finance News: (WASHINGTON, D.C.) Housing Finance Strategies President Faith Schwartz made two key announcements today regarding the firm's annual housing policy and technology event on September 26-27, 2022. #HousingDC22 will take place ahead of the critical midterm elections.

News: New Jersey Applebee’s Locations Announce 6th Annual Above and ‘BEE’yond Teacher Essay Contest

Mortgage and Finance News: (ALLENDALE, N.J.) Applebee's Neighborhood Grill & Bar has announced and is accepting nominations for its 6th annual Above and "BEE"yond Teacher Essay Contest, which recognizes top teachers - as nominated by their students - by rewarding them with a sponsorship check and end-of-year class party. The contest is being offered at Applebee's restaurants in New Jersey owned and operated by local franchisee Doherty Enterprises.

News: JV Group, Inc (OTC MARKETS:ASZP) announces Change of Control

Mortgage and Finance News: (FORT LAUDERDALE, Fla.) Publicly-held JV Group, Inc. (OTC MARKETS: ASZP) announces the completion of a change in control effective November 23, 2021. Harthorne Capital, Inc has acquired voting control in a private securities purchase agreement for 98.2% of the issued and outstanding shares of the Company's common stock from Michael A Littman ATTY, Defined Benefit Plan, an affiliate of Michael A Littman, as trustee.

News: Spring EQ Offers Home Equity Loans to Brokers in Lender Price’s Marketplace

Mortgage and Finance News: (PASADENA, Calif.) Lender Price, a provider of mortgage loan pricing and origination technology, announced today that Spring EQ has joined the Lender Price Marketplace as the first home equity loan lender on the platform. Spring EQ, headquartered in Philadelphia, is one of the nation's largest lenders of home equity products.

News: New Jersey Bankers Association endorses Promontory MortgagePath’s mortgage fulfillment services and POS technology

Mortgage and Finance News: (DANBURY, Conn.) Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced today the New Jersey Bankers Association (NJBankers) has officially endorsed its mortgage fulfillment services and proprietary point-of-sale technology Borrower Wallet®.

News: ACES Quality Management adds Mortgage Bankers Association Economist Dr. Edward Seiler to ACES ENGAGE agenda

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced it has added Dr. Edward Seiler, housing economist at the Mortgage Bankers Association (MBA) and executive director of the MBA's think tank Research Institute for Housing America, to its speaker line-up for the upcoming ACES ENGAGE conference.

News: RMA Hired by Wilton Manors for Real Estate / Market Analysis and Branding Strategy

Mortgage and Finance News: (POMPANO BEACH, Fla.) The award-winning economic development firm, RMA (rma.us.com) is proud to announce they have been hired by the City of Wilton Manors for the WiltonNext project, a real estate / market analysis and branding strategy for the commercial corridors in the city.

News: Down Payment Resource Presents 2021 Beverly Faull Affordable Housing Leadership Award to Ruth Johnson

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced that Ruth Johnson, founder and CEO of Homes for Heroes, has been selected the winner of its fourth annual 2021 Beverly Faull Affordable Housing Leadership Award.

News: Mortgage Coach expands partnership with NAMMBA to grow diversity, equity and inclusion in housing finance

Mortgage and Finance News: (IRVINE, Calif.) Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, has expanded its relationship with the National Association of Minority Mortgage Bankers of America (NAMMBA).

News: EPIC Adds Joseph Freeman – Will Lead West Region Loss Control Team

Mortgage and Finance News: (SAN FRANCISCO, Calif.) EPIC Insurance Brokers and Consultants, a retail property and casualty insurance brokerage and employee benefits consultant, announced today that Joseph Freeman has joined the firm as Managing Principal. He will be based in Los Angeles.

News: Sales Boomerang’s Reverse Mortgage Alert helps lenders bring timely home-equity opportunities to more homeowners

Mortgage and Finance News: (BALTIMORE, Md.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced the launch of Reverse Mortgage Alert, a new addition to its pantheon of automated borrower intelligence products, as well as significant enhancements to the company's existing Rate Alert product.

News: ReverseVision Recruits Marketing Maven Scott Shepherd to Elevate Brand and Support Growth

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision®, the leading national provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology, announced that seasoned marketing executive Scott Shepherd has joined the company to head its marketing efforts. As head of marketing, he oversees ReverseVision's marketing department and is responsible for the design and implementation of its new marketing strategy.

News: Mortgage Coach unveils redesigned website

Mortgage and Finance News: (IRVINE, Calif.) Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, has announced the launch of a newly designed website. The website redesign offers visitors an enhanced user experience featuring immersive brand exploration opportunities and an enriched library of lender resources.

News: Paragon Hires Industry Vet for East Coast Expansion

Mortgage and Finance News: (AVON, Conn.) Paragon Insurance Holdings LLC, a nationwide multiline specialty managing general agent (MGA), is pleased to announce the hire of Patrick Carroll as senior vice president - Eastern Region, effective January 31, 2022. Carroll brings more than 38 years of property and casualty and workers' compensation experience to his role at Paragon.

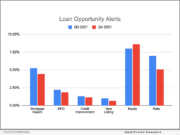

News: Sales Boomerang releases Q4 2021 Mortgage Market Opportunities Report

Mortgage and Finance News: (WASHINGTON, D.C.) Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its latest Mortgage Market Opportunities Report. The Q4 2021 report identified increasing opportunities for mortgage lenders to assist borrowers with tappable home equity, lending credence to analysts' expectations for a surge in home-equity-related mortgage activity in 2022.

News: Alliance Group, a leading national insurance marketing organization, announces a series of promotions for 2022

Mortgage and Finance News: (ATLANTA, Ga.) Alliance Group, a leading national insurance marketing organization (IMO), announced a series of promotions within their ranks, effective immediately. Mark Powell was promoted from Systems Engineer to Chief Strategy Officer,

News: Down Payment Resource releases Q4 2021 Homeownership Program Index

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced the release of its latest Homeownership Program Index (HPI). The firm's analysis of 2,192 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database showed measurable quarter-over-quarter gains in program funding levels and an increased prevalence of programs aimed at assisting community heroes.

News: IDS expands mortgage eClosing platform with addition of eVault

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced today that it has released its eVault, expanding the capabilities of its eClosing platform, Solitude Solution. With the addition of the eVault to Solitude Solution, lenders now have the ability to deliver documents, including eNotes, to partners though Mortgage Electronic Registration Systems, Inc. (MERS) eRegistry.

News: TMC Emerging Technology Fund LP Invests in Capacity

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP (the "Fund") recently participated in a $38M Series C investment round for AI Software, LLC dba Capacity. Capacity is an AI-powered support automation platform.

News: KROST Posts Record Year of M&A Advisory in 2021, Expects Trend to Continue in 2022

Mortgage and Finance News: (LOS ANGELES, Calif.) KROST CPAs and Consultants reported a record year of M&A advisory work in 2021 and expects to remain equally busy in 2022. "We were involved in 21 buy-side and sell-side transactions in 2021," said Paren Knadjian, Head of M&A and Capital Markets at KROST.

News: Nomis Solutions Appoints Fintech Veteran George Neal as Chief Product Officer, Promotes Prashant Balepur to SVP, Corporate Strategy and Partnerships

Mortgage and Finance News: (SAN FRANCISCO, Calif.) Nomis Solutions (Nomis), a global, industry-leading pricing and profitability management solutions provider, recently announced the appointment of George Neal as chief product officer. In this role, Neal will oversee strategy and development for new and existing products across all Nomis industry verticals.