Tag: Software

VanDyk Mortgage Encourages Borrowers to Automate Asset Verification Using AccountChek by FormFree

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced that VanDyk Mortgage Corporation has selected its flagship AccountChek(R) service for automated asset verification. Loan officers at VanDyk have already begun offering AccountChek as an alternative to manual, paper-based asset verification. In addition, borrowers can choose AccountChek as a faster alternative to uploading bank statements when using VanDyk's self-service mortgage portal, powered by Ellie Mae's Encompass Consumer Connect.

LBA Ware added to Advanced Technology Development Center’s ATDC Signature Portfolio

Mortgage and Finance News: (MACON, Ga.) LBA Ware, a leading provider of automated compensation software and systems integration solutions for mortgage lending and retail banking, announced that the Advanced Technology Development Center (ATDC) - Georgia's technology incubator - has accepted LBA Ware to into its ATDC Signature portfolio. As an ATDC Signature company, LBA Ware will have access to ATDC coaching and programming, potential investment capital and additional resources from the Georgia Institute of Technology, including intellectual property and talent.

Pendo Makes Enhancements to Its Appraisal Review Tool with over 100 Automated Checks

Mortgage and Finance News: (LEE'S SUMMIT, Mo.) Pendo, a nationwide appraisal management company (AMC), has made enhancements to their Appraisal Review Tool, which is part of their proprietary technology solutions for appraisal management. Pendo's Appraisal Review Tool assists their quality review team in managing the process of checking each and every appraisal, ensuring reports are accurate, complete and most of all compliant.

Quandis, Inc. Adds New Imaging Functionality to its Military Search Service for DOD SCRA Compliance

Mortgage and Finance News: (RANCHO SANTA MARGARITA, Calif.) Quandis, Inc., a leading default management mortgage technology provider, announced that it has added new functionality that allows servicers and default attorneys to more easily manage images of official certificates from the Department of Defense (DoD) to demonstrate proof of compliance for adherence to the Servicemembers Civil Relief Act (SCRA).

Matic Insurance and LendingQB team to Eliminate Stressful Mortgage Delays Related to Homeowner’s Insurance

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic Insurance Services (Matic), a digital insurance agency that enables borrowers to purchase homeowner's insurance during the home-buying transaction, today announced a new partnership with LendingQB, a provider of "lean lending" loan origination technology. Matic announced the news as part of a live demonstration at San Francisco's Digital Mortgage Conference.

FormFree Expands Alliance with LexisNexis Risk Solutions and impending launch of AccountChek Plus

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced the impending launch of AccountChek Plus, a new tool for lenders that combines the features of AccountChek, the nation's most trusted asset verification app, with liens and civil judgments data from LexisNexis Risk Solutions. By giving lenders a more complete picture of borrower ability-to-pay before loans go to underwriting, AccountChek Plus cuts costs, reduces risk and empowers better lending decisions.

The Mortgage Collaborative welcomes BUILT to Preferred Partner Network

Mortgage and Finance News: (NASHVILLE, Tenn.) Built was named to The Mortgage Collaborative's Preferred Partner Network, providing solutions for digital draw management and collaboration software for the network's lenders active in construction lending. Built is the leading provider of secure, cloud-based construction lending software.

TRK Connection enhances Insight RDM Mortgage QC Audit Platform with Data Subscriptions Feature

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection, a leading provider of mortgage quality control and origination management solutions, announced today that it has added a data subscriptions feature to its flagship mortgage quality control (QC) audit platform Insight Risk & Defect Management (RDM).

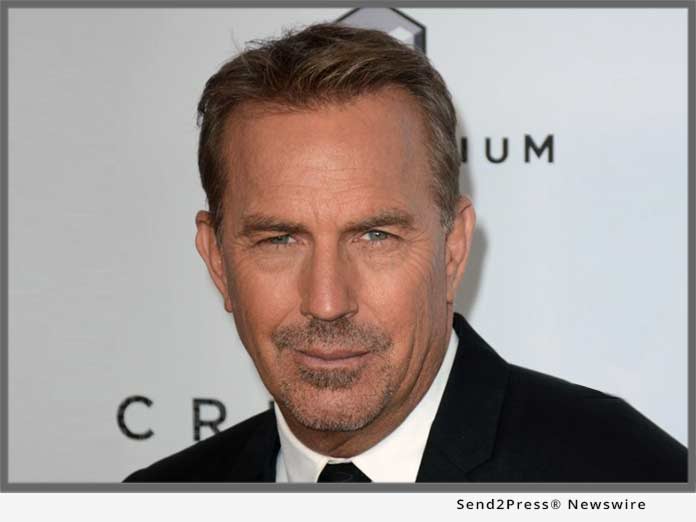

Lender Price Opens New $5 – $10 Million Investment Round and Names Jerry L. Halbrook as CEO

Mortgage and Finance News: (PASADENA, Calif.) Lender Price, the emerging leader in digital mortgage lending technology, announced today that it has named veteran mortgage industry executive Jerry Halbrook as its CEO and has opened a fresh round of equity funding to fuel its growth trajectory.

TechCrunch Disrupt SF 2017: Matic Insurance Services Debuts Integration with Roostify

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic Insurance Services, a digital insurance agency that enables borrowers to purchase homeowner's insurance during the home-buying transaction, has forged a partnership with automated lending technology provider Roostify. The company announced the news Tuesday afternoon from the stage of TechCrunch's Startup Battlefield, part of the TechCrunch Disrupt SF conference held in San Francisco this week. Matic was one of just six elite startups chosen to advance to the final round of the competition.

U.S. Credit Unions Now Successfully Leveraging OpenClose LenderAssist Loan Origination System

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, a multi-channel loan origination system (LOS) and mortgage software solutions provider, announced that multiple credit unions are now using OpenClose's LenderAssist(TM) LOS platform to automate the mortgage side of their businesses.

Xanegy 2017 Nonprofit Executive Series Fall and Winter Schedule Announced

Mortgage and Finance News: (AUSTIN, Texas) The Nonprofit Executive Series webcasts, hosted by Xanegy, will kick off on Tuesday, September 26, 2017, with "Trends in Human Capital Management." The Nonprofit Executive Series is a monthly webcast for nonprofit leaders.

ACES Risk Management (ARMCO) Releases ACES Automated Document Manager

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of financial quality control and compliance software, today announced the release of ACES Automated Document Manager. ADM can parse hundreds of PDF files, identify each document in the file, and categorize them by document type or name.

ReverseVision announces UserCon 2018 – Third Annual User Conference for its LOS Mortgage Technologies

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, Inc., the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, will host its third annual user conference February 6-8, 2018, at the Kona Kai Resort and Spa on San Diego's Shelter Island.

Insight RDM Mortgage QC Audit Platform from TRK Connection selected by JMAC Lending

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection (TRK), a leading provider of mortgage quality control and origination management solutions, announced today that JMAC Lending, a Southern California-based wholesale and correspondent lender, has selected TRK's flagship mortgage quality control (QC) audit platform Insight Risk & Defect Management (RDM).

OpenClose Integrates with Timios Inc. to Automate Calculation of Title Settlement Fees

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, a multi-channel loan origination system (LOS) and mortgage software solutions provider, announced that it integrated with Timios, Inc., a national provider of title and settlement services to banks, financial institutions and mortgage lenders. The integration allows users to efficiently draw all title and settlement fees directly from within OpenClose's LenderAssist(TM) LOS, eliminating data entry, saving time and ensuring fees are fully accurate and TRID compliant.

Title Guaranty of Hawaii and Simplifile Complete First-Ever E-recording of Hawaii Land Court Document

Mortgage and Finance News: (HONOLULU, Hawai) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that Title Guaranty has completed the first-ever e-recording of a Land Court document in the state of Hawaii using Simplifile's E-recording service. The document, a mortgage, was submitted into the public record on July 26 in a process that took only minutes.

Beckie Santos to Manager of New Product Development at International Document Services Inc.

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has promoted its former Manager of Development Beckie Santos to the newly created position of Manager of New Product Development. In her new role, Santos will leverage her development experience to work closely with the IDS development team as well as operations, quality assurance and compliance to help shape and guide future IDS solutions.

17 Counties Across Midwest, Western United States Join Simplifile E-recording Network for Summer 2017

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, announced today that 17 additional counties throughout the Midwest and Western United States have joined the Simplifile e-recording network.

Randy Abbey promoted to Chief Technology Officer at TRK Connection

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection, a leading provider of mortgage quality control and origination management solutions, announced it has promoted former Senior Systems Architect Randy Abbey to Chief Technology Officer (CTO). In this new role, Abbey will bring to bear his two decades of SaaS, cloud security and diverse solution development expertise.

Bulk Acquisition Manager Secondary Marketing Tape Transfer Technology announced by MCT Trading

Mortgage and Finance News: (SAN FRANSISCO, Calif.) Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing technology firm, announced at the California Mortgage Bankers Association's (CMBA) annual Western Secondary Market Conference held in San Francisco, that it has released new secondary marketing technology to improve the industry's existing loan sale practices. Dubbed Bulk Acquisition Manager(TM) (BAM), the solution automates the process of packaging and transferring bulk loan bids, which benefits investors, lenders and MCT's team of mortgage loan traders.

International Document Services, Inc. Expands eSign Room Customization Capabilities

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has expanded the settings and capabilities of its eSign room within the idsDoc mortgage doc prep platform. These new features enable lenders to create a more seamless and unified eSign experience for borrowers.

Guaranteed Rate Inc. Adopts Automated Asset Verification from AccountChek by FormFree

Mortgage and Finance News: (ATLANTA, Ga.) FormFree(R) today announced that Guaranteed Rate, Inc. ("Guaranteed Rate"), one of the nation's largest independent retail mortgage companies, has selected AccountChek(R) by FormFree for automated asset verification.

OpenClose Launches Corporate Website to Reflect New Positioning of its Enterprise-class, Multi-channel Loan Origination System

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, a multi-channel loan origination system (LOS) and mortgage software solutions provider, announced it unveiled a new corporate website to better position the company's expanded enterprise-class solution set, customer profile focus and long-term value proposition.

Real Estate Industry Veteran Jake Seid Joins Qualia Labs Advisory Board

Mortgage and Finance News: (SAN FRANCISCO, Calif.) Qualia today announced that Jake Seid will join the company's board of advisors. In addition to his time as president of Ten-X (formerly known as Auction.com) and Managing Director at Lightspeed Venture Partners, Seid is an investor and advisor to a myriad of companies touching the real estate sector.

DocMagic UCD Mortgage Tech Solution Now Supports Both Phases of Upcoming UCD Requirements

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the mortgage industry's leading provider of document production, automated compliance and comprehensive eMortgage services, announced that its technologies are now capable of supporting both phases of the upcoming UCD (Uniform Closing Dataset) requirement.

IDS Inc. Adds Pushback Notifications to Interface with Byte Software’s BytePro Enterprise LOS

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has added pushback notifications to its existing interface with BytePro Enterprise, the flagship loan origination software (LOS) platform from Byte Software. Through this enhancement, BytePro users will receive mortgage documents and fulfillment status notifications within the LOS platform.

Kiel Mortgage HECM Division Selects ReverseVision RVX Loan Origination Software

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of software and technology for the reverse mortgage industry, today announced that Kiel Mortgage has chosen RV Exchange (RVX) loan origination software (LOS) to power its home-equity conversion mortgage (HECM) division.

Industry Veteran Finn Klemann Joins Mortgage Technology Vendor, LBA Ware

Mortgage and Finance News: (MACON, Ga.) LBA Ware(TM), a leading provider of automated compensation software and systems integration solutions for mortgage lending and retail banking, announced it has hired Finn Klemann as director of business development. In this role, Klemann will bring his more than 20 years of business development and sales experience in forging new relationships for LBA Ware in the financial services industry, with a specific focus on targeting growth in the mortgage industry.

Simplifile eRecording Network Now Available in 15 Midwestern, Western U.S. Jurisdictions

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, has expanded its industry-leading e-recording network to include 15 additional recording jurisdictions across the Western and Midwestern United States.