News: New workflow in the Empower LOS makes it easier for mortgage lenders to consider rent payments when qualifying first-time homebuyers

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the availability of a new, automated workflow in the Empower® loan origination system (LOS) that makes it easier for lenders to identify and qualify loan applicants who could benefit from evaluation of their positive rent payment history.

News: iEmergent CEO Laird Nossuli to present at Seattle’s inaugural Black Homeownership Symposium on January 26

Mortgage and Finance News: (SEATTLE, Wash.) iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced that its CEO Laird Nossuli will present at Seattle's inaugural Black Homeownership Symposium on January 26. Dr. Courtney Johnson Rose, president of the National Association of Real Estate Brokers (NAREB), one of the oldest minority trade associations in the nation and its foremost network of Black real estate professionals, will unveil the findings of the first-ever Washington state edition of the State of Housing in Black America (SHIBA) report.

News: Realfinity Launches Dual-License Program for Real Estate Agents

Mortgage and Finance News: (MIAMI, Fla.) Real-Finity, Inc. ("Realfinity") is excited to announce the availability of its Dual-License Program enabling the integration of mortgage services for real estate agents. In the dynamic and increasingly challenging environment of real estate, agents are now able to take advantage of this innovative solution to combat pressure on their commissions and enhance their value proposition by offering mortgage services.

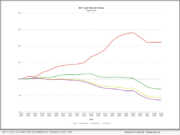

News: Seasonal Lows Contribute to 13.71% Drop In Mortgage Volume

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, revealed today a 13.71% decline in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

News: ACES Audit Volume Increases 24%, Hits Record High in 2023

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that, despite challenging mortgage market conditions, the company maintained a record growth path achieved over the last few years by adding more than a dozen of the leading lenders in the U.S. to its client roster in 2023.

News: Optimal Blue PPE Now Available in Native Mobile App for Android and iOS, Gives Loan Officers ‘Pricing in Their Pocket’...

Mortgage and Finance News: (PLANO, Texas) Today, Optimal Blue announced releases related to its publicly listed, native mobile app for the Optimal Blue PPE - the industry's most widely used product, pricing, and eligibility engine. The releases consist of a new mobile app for Android, as well as enhancements to the company's mobile offering for iOS.

News: Optimal Blue Originations Market Monitor: December Brought Significant Growth in Rate/Term Refinance Volume as Falling Rates Created Favorable Tailwinds

Mortgage and Finance News: (PLANO, Texas) Today, Optimal Blue announced the release of its Originations Market Monitor report, looking at mortgage origination data through December month-end. Leveraging daily rate lock data from the Optimal Blue PPE - the industry's most widely used product, pricing, and eligibility engine - the Originations Market Monitor provides a comprehensive and timely view into origination activity.

News: Down Payment Resource’s Executive Vice President Sean Moss honored in National Mortgage Professional’s 2024 Industry Titans awards program

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting home buyers with homebuyer assistance programs, today announced its Executive Vice President of Product and Operations Sean Moss has been selected as an Industry Titan by National Mortgage Professional (NMP) magazine. The award recognizes experienced professionals who show exceptional dedication, compassion and integrity who are improving the mortgage industry for both industry professionals and the clients they serve.

News: Floify joins ACUMA to help credit unions elevate the member homebuying experience

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that it has joined the American Credit Union Mortgage Association (ACUMA) as an affiliate member. Through its membership, Floify aims to help credit unions engage their members with an elevated home financing experience while supporting streamlined loan production with cost-saving tools.

News: The Mortgage Collaborative closes 2023 with record-breaking ’12 Days of TMC’ in time for holiday congratulations

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, has wrapped up its fourth annual 12 Days of TMC, a virtual conference running from November 30 to December 15, 2023. The online event, spread over three weeks, featured several keynote speakers.

News: Argyle’s investments in innovation spur over 50 lenders to switch to the mortgage industry’s highest-converting VOI/E platform

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, closed a banner year of mortgage growth with 50 new IMB, credit union and bank customers. The payroll connectivity leader more than doubled the annual volume of income and employment verifications conducted on behalf of its customers to 1.5 million with the help of 15 of the top 100 mortgage lenders.

News: Depth 2023 growth drives key hires in strategic marketing and content development as residential mortgage and real estate industries poise...

Mortgage and Finance News: (ATLANTA, Ga.) Depth, a leading provider of consultative B2B marketing, public relations and reputation management services for technology companies in the residential mortgage finance, financial technology (fintech), real estate technology (REtech) and related regulatory technology (regtech) industries, will close 2023 with a significantly larger internal team and client roster in anticipation of continued rebound for mortgage and real estate volume.

News: Monthly Mortgage Volume Decreases 10.7% In Latest MCT Indices Report

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, today announced a 10.7% decrease in mortgage lock volume in November compared to the previous month. This revelation comes as part of MCT's monthly Lock Volume Indices report, offering valuable insights into the dynamic landscape of the residential mortgage industry.

News: Legacy Mutual Selects LenderLogix’s QuickQual to Improve Transparency and Responsiveness During Mortgage Borrowers’ Home Search

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced that Legacy Mutual Mortgage has selected its pre-approval letter generation tool QuickQual to provide borrowers with a white-labeled, digitally-driven entry point into their homebuying experience.

News: Down Payment Resource donates $10,000 to help an Atlantan buy a home this holiday season

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting home buyers with homebuyer assistance programs, today announced a $10,000 donation to the Atlanta Neighborhood Development Partnership to be used as a grant to help an eligible homebuyer working with the local nonprofit housing agency.

News: ACES Q2 2023 Mortgage QC Trends Report Finds Critical Defect Rate Declines for Third Consecutive Quarter

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the second quarter (Q2) of 2023. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

News: FormFree president Eric Lapin to speak on artificial intelligence at MISMO Winter Summit

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced its President Eric Lapin has been selected to speak at the MISMO Winter Summit taking place January 8-11, 2024, at The Woodlands Resort just outside of Houston, Texas. Lapin will speak on a panel titled "Demystifying Artificial Intelligence, Digital Identity and Blockchain" during a brown-bag lunch session on January 9 from 12:30 pm-1:25 pm CT. He will be joined by fellow panelists Devin Caster, principal, product solutions at CoreLogic; Rishi Godse, principal technical architect at USAA; and Shawn Jobe, vice president and head of business development at Informative Research.

News: Argyle partners with Dark Matter to bring seamless direct-source income and employment verifications to Empower LOS customers

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, announced today its integration with the Exchange, an interconnected network of mortgage-specific service providers available to customers of the Empower® loan origination system (LOS) from Dark Matter Technologies. This collaboration simplifies the income and employment verification process for lenders, further amplifying the cost and time-saving benefits of digital borrower verification.

News: Enhanced integration between the Empower LOS and DocMagic adds support for home equity, wholesale channels

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced significant enhancements to the integration between the comprehensive Empower® loan origination system (LOS) and DocMagic's document generation solution.

News: FormFree appoints Solvent CEO DIVINE as head of culture

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced the appointment of former hip-hop/rap recording artist-turned-techpreneur Victor D. Lombard, professionally known as DIVINE, as head of culture. DIVINE is the CEO and founder of Solvent, a fintech focused on financial empowerment for marginalized groups.

News: Floify launches comprehensive lending platform for mortgage brokers

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS), today announced the launch of Floify Broker Edition, an easy-to-use, one-stop lending platform for mortgage brokers. Built on the foundation of the classic Floify POS platform, Broker Edition has been thoughtfully configured to make managing loans simpler at an accessible price point.

News: Argyle CEO Shmulik Fishman named a 2023 HousingWire Tech Trendsetter

Mortgage and Finance News: (NEW YORK CITY, N.Y.) Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, announced today that CEO Shmulik Fishman has been named to HousingWire's list of 2023 Tech Trendsetters. Now in its fifth year, the Tech Trendsetters award honors the 50 most impactful executives, product leaders and professionals shaping innovation in the mortgage and real estate industries.

News: LenderLogix Co-Founder and Chief Technology Officer Scott Falbo named a 2023 HousingWire Tech Trendsetter

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced Co-founder and Chief Technology Officer Scott Falbo has been selected by HousingWire as a 2023 Tech Trendsetter Award winner. In its fifth year, HousingWire's Tech Trendsetters award recognizes the most impactful and innovative technology leaders serving the housing economy.

News: The Mortgage Collaborative Adds Four Mortgage Industry Luminaries to 2024 Management Board of Directors

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, today announced four additions to its 2024 Management Board of Directors.

News: Encompass Lending Group Adds LiteSpeed and QuickQual from LenderLogix to Its Digital Mortgage Tech Stack

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced that Encompass Lending Group, a wholly owned subsidiary of Fathom Holdings Inc. (Nasdaq: FTHM), has selected its streamlined point-of-sale (POS) platform LiteSpeed and QuickQual, a loan origination system (LOS) add-on that allows prospective borrowers and real estate agents to run payment and closing costs scenarios.

News: Publix Employees Federal Credit Union inks contract with Dark Matter Technologies to modernize mortgage operations

Mortgage and Finance News: (JACKSONVILLE, Fla.) Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced a contract with Lakeland, Florida-based Publix Employees Federal Credit Union (PEFCU). The signing is the first under Dark Matter's new corporate structure and reflects the growing footprint of the company's popular Empower(r) Loan Origination Platform in the credit union sector.

News: FormFree welcomes MX Founder and Executive Chair Ryan Caldwell to its board of directors

Mortgage and Finance News: (ATHENS, Ga.) FormFree® today announced the appointment of MX Technologies, Inc. (MX) Founder and Executive Chair Ryan Caldwell to its board of directors. Caldwell brings more than 20 years of experience in financial services and fintech, helping organizations around the world harness the power of financial data to improve business and consumer outcomes.

News: Floify taps Courtney Dodd as head of marketing to reinvigorate brand presence

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale solution, today announced that Courtney Dodd has joined its team as head of marketing. With 12 years of experience in the mortgage sector, Dodd is set to spearhead Floify's marketing initiatives and reinforce its position as an innovator in the field.

News: Baird Joins Agile’s Growing Broker-Dealer Network

Mortgage and Finance News: (PHILADELPHIA, Pa.) Agile, a groundbreaking fintech bringing mortgage lenders and broker-dealers onto a single electronic platform, is excited to announce that Baird, an international financial services firm, has joined Agile's broker-dealer network.

News: CUSO Home Lending rolls out Dark Matter’s Empower LOS to support mortgage and home equity products

Mortgage and Finance News: (JACKSONVILLE, Fla.) CUSO Home Lending has made Empower LOS, a cloud-based loan origination system from Dark Matter Technologies (Dark Matter), available to its credit union owners. CUSO Home Lending is the first credit union service organization to leverage Empower's newly developed joint-venture feature, which allows credit unions to offer individualized branding, products and pricing while taking advantage of the efficiency and cost savings of their CUSO's shared services model.