Tag: Reports and Studies

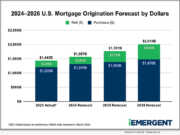

News: iEmergent’s 2024-2026 U.S. Mortgage Origination Forecast is now available in Mortgage MarketSmart

Mortgage and Finance News: (DES MOINES, Iowa) iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the availability of its 2024-2026 U.S. Mortgage Origination Forecast. Updated to reflect preliminary 2023 Home Mortgage Disclosure Act (HMDA) data released by the Federal Financial Institutions Examination Council in March, iEmergent's latest projections call for modest growth in purchase originations and a gradual increase in refinance loan units and dollars as a percentage of total originations.

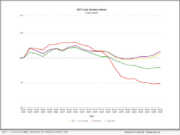

News: Mortgage Purchase Lock Counts See First YoY Gain Since Fed Rate Hikes Began Two Years Ago

Mortgage and Finance News: (PLANO, Texas) Optimal Blue today released its April 2024 Originations Market Monitor report, which reveals the first year-over-year increase in purchase mortgage lock counts since the Federal Reserve initiated rate hikes in March 2022.

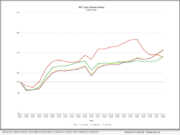

News: MCT Reports A 2% Lock Volume Increase Despite Rising Rates

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today reported a 1.87% increase in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

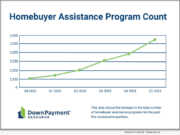

News: Down Payment Resource reports highest annual down payment assistance program count growth on record

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q1 2024 Homeownership Program Index (HPI) report. In a quarter where year-over-year (YoY) home prices jumped 6%, the YoY national down payment assistance count increased by 204, the largest annual jump since DPR began reporting on this data in Q3 2020.

News: LenderLogix Q1 2024 Homebuyer Intelligence Report Data Shows Increase in Home Buying Activity and Fees Collected by Fee Chaser

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the latest release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process during the first quarter (Q1) of 2024.

News: Average Homebuyer Credit Score Hits the Highest Mark in Years

Mortgage and Finance News: (PLANO, Texas) Today, Optimal Blue released its March 2024 Originations Market Monitor report, which reveals the average homebuyer credit score has reached 737 - an all-time high since the company began tracking this data in January 2018. Despite the potential buyer pool being somewhat limited to borrowers with higher credit, rate lock volume showed steady month-over-month growth of 17% in March as the spring buying season got underway.

News: MCT Reports A 15% Lock Volume Increase Heading Into Buying Season

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an increase of 15.36% in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

News: ACES Q3 2023 Mortgage QC Trends Report Finds Critical Defect Rate Declines for Fourth Consecutive Quarter

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the third quarter (Q3) of 2023. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

News: Spring Buying Season Kicks Off With an Uptick in Purchase Applications Despite Climbing Interest Rates

Mortgage and Finance News: (PLANO, Texas) Today, Optimal Blue released its February 2024 Originations Market Monitor report, which reveals that the spring homebuying season has kicked off with a jump in monthly purchase mortgage locks. The seasonal spike in purchase locks propelled a net increase in origination activity, even as higher interest rates led to steep declines in mortgage refinances.

News: MCT Reports a 20.9% Increase In Mortgage Lock Volume Amidst Rising Rates

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, has reported a 20.9% increase in mortgage lock volume in February compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

News: Optimal Blue Originations Market Monitor: Lock Volume Rises 36% Month Over Month in January, Falling Rates and Slowing Decline in...

Mortgage and Finance News: (PLANO, Texas) Today, Optimal Blue announced the release of its Originations Market Monitor report, looking at mortgage origination data through January month-end. Leveraging daily rate lock data from the Optimal Blue PPE - the industry's most widely used product, pricing, and eligibility engine - the Originations Market Monitor provides a comprehensive and timely view into origination activity.

News: Monthly Mortgage Volume Increases 13.96% In Latest MCT Indices Report

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an increase of 13.96% in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

News: LenderLogix Q4 2023 Homebuyer Intelligence Report Data Shows Steady Home Buying Activity

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the latest release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process during the fourth quarter (Q4) of 2023.

News: Down Payment Resource reports 135 homebuyer assistance programs were introduced in 2023 to combat the least affordable housing market in...

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q4 2023 Homeownership Program Index (HPI) report. During a year when home affordability hit a nearly four-decade low, housing agencies introduced 135 homebuyer assistance programs and expanded eligible inventory to make homeownership more accessible.

News: Floify shares findings from survey of 150 top-producing loan originators

Mortgage and Finance News: (BOULDER, Colo.) Floify, the mortgage industry's leading point-of-sale (POS) solution, commissioned an independent study of 150 high-performing loan originators (LOs) in 2023 to gain recruiting and retention insights. "High-performing" LOs were defined as being in the top 20% of closed loan dollars or volume.

News: Seasonal Lows Contribute to 13.71% Drop In Mortgage Volume

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, revealed today a 13.71% decline in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

News: Optimal Blue Originations Market Monitor: December Brought Significant Growth in Rate/Term Refinance Volume as Falling Rates Created Favorable Tailwinds

Mortgage and Finance News: (PLANO, Texas) Today, Optimal Blue announced the release of its Originations Market Monitor report, looking at mortgage origination data through December month-end. Leveraging daily rate lock data from the Optimal Blue PPE - the industry's most widely used product, pricing, and eligibility engine - the Originations Market Monitor provides a comprehensive and timely view into origination activity.

News: Monthly Mortgage Volume Decreases 10.7% In Latest MCT Indices Report

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, today announced a 10.7% decrease in mortgage lock volume in November compared to the previous month. This revelation comes as part of MCT's monthly Lock Volume Indices report, offering valuable insights into the dynamic landscape of the residential mortgage industry.

News: ACES Q2 2023 Mortgage QC Trends Report Finds Critical Defect Rate Declines for Third Consecutive Quarter

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the second quarter (Q2) of 2023. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

News: 3D Chess Media Unveils the Latest Analysis of the Evolving Car Extended Warranty Landscape in the Age of Electric and...

Mortgage and Finance News: (LAS VEGAS, Nev.) In a comprehensive industry analysis, 3D Chess Media has released a detailed report on the significant shifts occurring in the car extended warranty market, driven by the rapid evolution of electric and autonomous vehicles. This in-depth exploration sheds light on the changing dynamics of automotive warranties in response to new technological advancements.

News: Down Payment Resource reports housing authorities rolled out 54 homebuyer assistance programs in Q3 and are funding buydowns to offset...

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, reports that homebuyer assistance program administrators are responding to the mounting home affordability crisis by rapidly rolling out new homebuyer assistance programs and funding buydowns.

News: Mortgage Volume Continues Downward Trend in Latest MCT November 2023 Indices Report

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a drop of 17.76% in mortgage lock volume over the prior month.

News: LenderLogix Q3 2023 Homebuyer Intelligence Report Data Shows Slight Decline in Home Buying Activity

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the latest release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools.

News: Down Payment Resource highlights 42 Native American homebuyer assistance programs in honor of Native American Heritage Month

Mortgage and Finance News: (ATLANTA, Ga.) Down Payment Resource (DPR), the housing industry's leading technology for connecting home buyers with homebuyer assistance programs, is highlighting 42 U.S. homebuyer assistance programs in 14 states that are specifically designed to support Native Americans (American Indians and Alaska Natives) in conjunction with Native American Heritage month.

News: High Rates and Low Supply Drag Down Mortgage Volume in MCT October Indices Report

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a significant dip of 13.29% in mortgage lock volume over the prior month.

News: ACES Q1 2023 Mortgage QC Trends Report Finds Critical Defect Rate Declines for Second Consecutive Quarter

Mortgage and Finance News: (DENVER, Colo.) ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the first quarter (Q1) of 2023. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

News: Mortgage Lock Volume Dips Slightly in Response to Rising Rates in September MCT Indices Report

Mortgage and Finance News: (SAN DIEGO, Calif.) SAN DIEGO, Calif., Sept. 5, 2023 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a slight 4.76% decline in mortgage lock volume over the prior month. The slight dip in mortgage lock volume is likely attributed to an increase in mortgage rates through the last month.

News: July’s Mortgage Lock Volume Flat Amongst Rising Rates in Latest MCT Indices Report

Mortgage and Finance News: (SAN DIEGO, Calif.) Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a relatively flat .44% increase in mortgage lock volume over the prior month. Visit MCT's site to download the full report.

News: LenderLogix Q2 2023 Homebuyer Intelligence Report Data Shows Slight Increase in Homebuying Activity Despite Affordability and Inventory Challenges

Mortgage and Finance News: (BUFFALO, N.Y.) LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the latest release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools.

News: TrustEngine releases Q2 2023 Mortgage Market Opportunities Report

Mortgage and Finance News: (ELLICOTT CITY, Md.) TrustEngine™, a provider of data-driven homebuyer engagement and education solutions for lenders, today announced the release of its latest Mortgage Market Opportunities Report analyzing trends in the frequency of different types of mortgage opportunity alerts through June 2023.