Tag: SaaS and Cloud Software

Norcom Mortgage Names ReverseVision Its Provider of Choice for End-to-End HECM Technology

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, today announced that Norwich Commercial Group, Inc. dba Norcom Mortgage (Norcom) has selected ReverseVision as its provider of choice for end-to-end HECM technology.

VanDyk Mortgage Encourages Borrowers to Automate Asset Verification Using AccountChek by FormFree

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced that VanDyk Mortgage Corporation has selected its flagship AccountChek(R) service for automated asset verification. Loan officers at VanDyk have already begun offering AccountChek as an alternative to manual, paper-based asset verification. In addition, borrowers can choose AccountChek as a faster alternative to uploading bank statements when using VanDyk's self-service mortgage portal, powered by Ellie Mae's Encompass Consumer Connect.

Matic Insurance and LendingQB team to Eliminate Stressful Mortgage Delays Related to Homeowner’s Insurance

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic Insurance Services (Matic), a digital insurance agency that enables borrowers to purchase homeowner's insurance during the home-buying transaction, today announced a new partnership with LendingQB, a provider of "lean lending" loan origination technology. Matic announced the news as part of a live demonstration at San Francisco's Digital Mortgage Conference.

TRK Connection enhances Insight RDM Mortgage QC Audit Platform with Data Subscriptions Feature

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection, a leading provider of mortgage quality control and origination management solutions, announced today that it has added a data subscriptions feature to its flagship mortgage quality control (QC) audit platform Insight Risk & Defect Management (RDM).

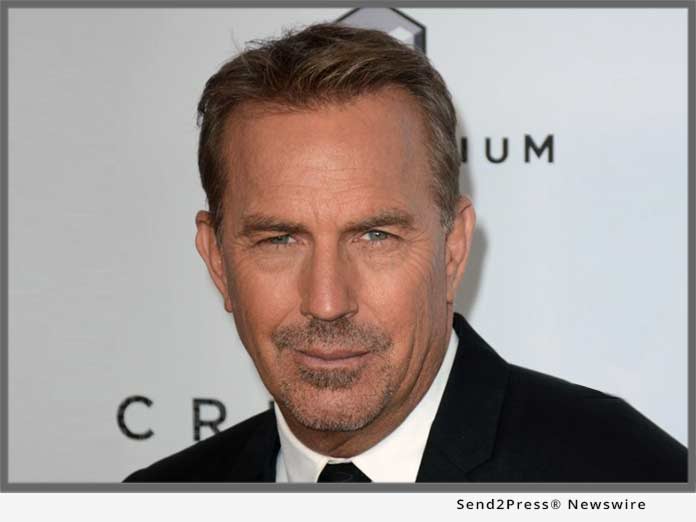

Lender Price Opens New $5 – $10 Million Investment Round and Names Jerry L. Halbrook as CEO

Mortgage and Finance News: (PASADENA, Calif.) Lender Price, the emerging leader in digital mortgage lending technology, announced today that it has named veteran mortgage industry executive Jerry Halbrook as its CEO and has opened a fresh round of equity funding to fuel its growth trajectory.

TechCrunch Disrupt SF 2017: Matic Insurance Services Debuts Integration with Roostify

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic Insurance Services, a digital insurance agency that enables borrowers to purchase homeowner's insurance during the home-buying transaction, has forged a partnership with automated lending technology provider Roostify. The company announced the news Tuesday afternoon from the stage of TechCrunch's Startup Battlefield, part of the TechCrunch Disrupt SF conference held in San Francisco this week. Matic was one of just six elite startups chosen to advance to the final round of the competition.

U.S. Credit Unions Now Successfully Leveraging OpenClose LenderAssist Loan Origination System

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, a multi-channel loan origination system (LOS) and mortgage software solutions provider, announced that multiple credit unions are now using OpenClose's LenderAssist(TM) LOS platform to automate the mortgage side of their businesses.

Xanegy 2017 Nonprofit Executive Series Fall and Winter Schedule Announced

Mortgage and Finance News: (AUSTIN, Texas) The Nonprofit Executive Series webcasts, hosted by Xanegy, will kick off on Tuesday, September 26, 2017, with "Trends in Human Capital Management." The Nonprofit Executive Series is a monthly webcast for nonprofit leaders.

Insight RDM Mortgage QC Audit Platform from TRK Connection selected by JMAC Lending

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection (TRK), a leading provider of mortgage quality control and origination management solutions, announced today that JMAC Lending, a Southern California-based wholesale and correspondent lender, has selected TRK's flagship mortgage quality control (QC) audit platform Insight Risk & Defect Management (RDM).

OpenClose Integrates with Timios Inc. to Automate Calculation of Title Settlement Fees

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, a multi-channel loan origination system (LOS) and mortgage software solutions provider, announced that it integrated with Timios, Inc., a national provider of title and settlement services to banks, financial institutions and mortgage lenders. The integration allows users to efficiently draw all title and settlement fees directly from within OpenClose's LenderAssist(TM) LOS, eliminating data entry, saving time and ensuring fees are fully accurate and TRID compliant.

Notarize joins The Mortgage Collaborative (TMC) Preferred Partner Network

Mortgage and Finance News: (SAN DIEGO, Calif.) The Mortgage Collaborative, the nation's only independent mortgage cooperative, announced a new partnership with Notarize, the nation's first entirely digital mortgage closing and remote notarization provider, adding them to the preferred partner network.

FormFree hires brand strategist and marketing expert Patricia Ramirez Pinckney as senior director of marketing

Mortgage and Finance News: (ATHENS, Ga.) FormFree has hired brand strategist and marketing expert Patricia "Patty" Ramirez Pinckney as senior director of marketing. In this role, Pinckney will drive planning and implementation of FormFree's marketing campaigns, govern its strategic positioning within the mortgage industry and manage the firm's brand.

Title Guaranty of Hawaii and Simplifile Complete First-Ever E-recording of Hawaii Land Court Document

Mortgage and Finance News: (HONOLULU, Hawai) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that Title Guaranty has completed the first-ever e-recording of a Land Court document in the state of Hawaii using Simplifile's E-recording service. The document, a mortgage, was submitted into the public record on July 26 in a process that took only minutes.

Beckie Santos to Manager of New Product Development at International Document Services Inc.

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has promoted its former Manager of Development Beckie Santos to the newly created position of Manager of New Product Development. In her new role, Santos will leverage her development experience to work closely with the IDS development team as well as operations, quality assurance and compliance to help shape and guide future IDS solutions.

17 Counties Across Midwest, Western United States Join Simplifile E-recording Network for Summer 2017

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, announced today that 17 additional counties throughout the Midwest and Western United States have joined the Simplifile e-recording network.

Pendo Joins Forces with The Mortgage Collaborative to Offer Appraisal Management Services

Mortgage and Finance News: (LEE'S SUMMIT, Mo.) Pendo, a nationwide appraisal management company (AMC), announced a strategic partnership with The Mortgage Collaborative's preferred partner network to provide appraisal management services to the organization's 112 lender members.

International Document Services, Inc. Expands eSign Room Customization Capabilities

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has expanded the settings and capabilities of its eSign room within the idsDoc mortgage doc prep platform. These new features enable lenders to create a more seamless and unified eSign experience for borrowers.

Lender Price, the Leading Mortgage Lending Analytics and Digital Mortgage Provider Announces Integration with Ernst Publishing

Mortgage and Finance News: (PASADENA, Calif.) Lender Price, the emerging leader in digital mortgage interface technology and real-time, competitive mortgage analytics and product pricing & eligibility (PPE) solutions complete with full mobile functionality and advanced business intelligence, announced that it has integrated with Ernst Publishing, the leading provider of mortgage fee data for the real estate and home finance industry.

Lender Price Attending Black Knight Financial Services’ (BKFS) Motivity Solutions User Conference

Mortgage and Finance News: (PASADENA, Calif.) Lender Price, the emerging leader in digital mortgage interface technology and real-time, competitive mortgage analytics and product pricing and eligibility (PPE) solutions complete with full mobile functionality and advanced business intelligence, announced that Black Knight Financial Services' (BKFS) Motivity Solutions will use pricing data from Lender Price's industry-leading PPE to provide pricing analytics to its users.

Ubermortgage Embraces Home-Equity Conversion Mortgage (HECM) with Technology from ReverseVision Inc.

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, Inc., the leading technology provider for the reverse mortgage industry, has formed a partnership with ubermortgage Inc. to support the budding lender's increasing demand for home-equity conversion mortgages (HECMs) with its RV Exchange (RVX) loan origination technology.

Cloudvirga Names Veteran Tech Entrepreneur Michael Schreck as CEO

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga(SM), developer of next-generation loan officer and direct-to-consumer point-of-sale (POS) systems, has named Michael Schreck its chief executive officer. He succeeds cloudvirga co-founder Bill Dallas, who will continue as chairman of cloudvirga's board of directors.

Paul Clifford of Simplifile Receives 2017 Award for Innovation from October Research LLC

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, announced that Paul Clifford, president, was recognized with the 2017 October Research Award for Innovation for his leadership in establishing Simplifile's e-recording network, along with other achievements in support of the title industry.

OpenClose and QuestSoft to Hold Webinar on the New CFPB HMDA Rules

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, a multi-channel loan origination system (LOS) provider, and QuestSoft, a provider of automated mortgage compliance software, announced that they will host a joint webinar covering the new CFPB HMDA regulations, how they will impact organizations, and outline specific plans to make compliance with the new HMDA rules the most efficient and time-saving process in the mortgage industry.

IDS Inc. Builds Mortgage Document Preview Feature for LendingQB LOS Integration

Mortgage and Finance News: (SALT LAKE CITY, Utah) Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has incorporated a new document preview feature into its integration with LendingQB's cloud-based loan origination solution (LOS). The feature allows LendingQB users to preview mortgage documents, such as the Loan Estimate or Closing Disclosure, before they are submitted to fulfillment.

DocMagic eMortgage Solutions Receive 2017 ALTA ‘Elite Provider’ Designation

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the mortgage industry's leading provider of document production, automated compliance and comprehensive eMortgage services, announced that it has been accepted into the Elite Provider Program for American Land Home Title Association (ALTA).

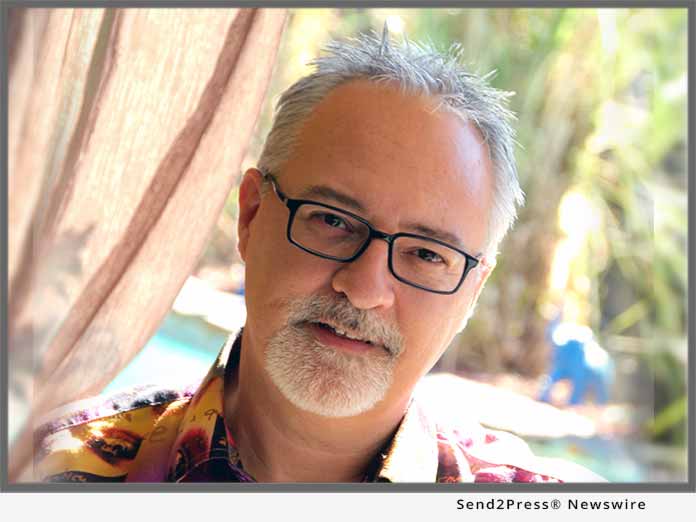

Douglas Brewer Named Director of Enterprise Architecture at FormFree Holdings Corp.

Mortgage and Finance News: (ATLANTA, Ga.) FormFree today announced the appointment of senior software developer Douglas Brewer to the role of director of enterprise architecture. Brewer, who first joined FormFree in 2014, will be responsible for managing the retention and growth of FormFree's software development team, overseeing enterprise software design and ensuring the quality and timely delivery of software updates.

Skyline Financial Corp preps New Reverse Mortgage Division with ReverseVision’s Tech and Training

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of software and technology for the reverse mortgage industry, has forged a partnership with Skyline Financial Corp. (Skyline Home Loans and NewLeaf Lending) to support the lender's growing reverse mortgage division with RV Exchange (RVX) loan origination technology and RV University (RVU) training programs.

Mid America Mortgage Inc. Purchases eNote from First eClosing Transaction in North Carolina

Mortgage and Finance News: (ADDISON, Texas) Mid America Mortgage, Inc. (Mid America) announced today it has purchased the eNote from North Carolina's first eMortgage transaction. The transaction, which was completed entirely electronically on May 5, was a refinance for a property in Winston-Salem and was executed by Hickory-based North State Bank. Upon completion of the closing, Mid America was able to purchase the resulting eNote within one business day after receiving the final loan package.

Simplifile Adds 14 Counties in American Northeast to Its E-Recording Network for Q2-2017

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, has added more than a dozen new recording jurisdictions in five states across the American Northeast to its e-recording network, the nation's largest.

FormFree welcomes Ann Fulmer as its Chief Strategy and Industry Relations Officer

Mortgage and Finance News: (ATLANTA, Ga.) FormFree(R) today announced that it has hired mortgage loan quality subject matter expert and analyst Ann Fulmer as its chief strategy and industry relations officer. FormFree's flagship product, AccountChek(R), is an asset verification app that streamlines the loan underwriting process for both borrowers and lenders, resulting in higher borrower satisfaction and shaving more than a week off the time it takes to close a loan.