News Topic: SaaS and Cloud Software

News: Addition of 23 Jurisdictions in the Eastern U.S. Pushes Simplifile E-recording Network Past the 1,700th Mark

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that 23 additional recording jurisdictions throughout the Northeast, Mid-Atlantic, and Southeast have adopted Simplifile's e-recording platform.

News: DocMagic Reaches 300 Million Mortgage eSignings as More Borrowers Opt for eSigning and More Lenders Require Proof of TRID Compliance

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced that it has processed more than 300 million mortgage-related electronic signatures.

News: FormFree Celebrates Its Tenth Year of Operations with Broader Investor Acceptance, New Products and Features for Lenders

Mortgage and Finance News: (ATHENS, Ga.) The last 24 months have seen aggressive growth and milestone achievements for automated verification provider FormFree -- and now the fintech company is setting its sights on achieving even greater market penetration in 2018 thanks to broader investor acceptance and new products and features designed to meet lenders' unique needs.

News: Record Year for Cloudvirga Closes with Customers of Its Digital Mortgage Platform Producing Over $100B in Loan Volume

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga CEO Michael Schreck is on a mission to help mortgage lenders reinvent the mortgage factory. A developer of intelligent mortgage point-of-sale platforms, Cloudvirga gives consumers and loan officers a digital mortgage experience and helps lenders grow market share by automating the mortgage back office, saving them up to $1,500 a loan.

News: Digital Mortgage Point-of-Sale Pioneer Cloudvirga Hires Sean McEvoy as Chief Customer Officer

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga Inc., developer of intelligent mortgage point-of-sale (POS) platforms, has appointed Sean McEvoy as its chief customer officer. As a member of the senior leadership team, McEvoy will be responsible for the firm's customer leadership, implementation and support functions. He has an extensive background in building world-class customer success organizations at FileNET, IBM, Quest and Dell. He will report to Cloudvirga CEO Michael Schreck.

News: AccountChek by FormFree Automated Asset Report Now Accepted for VA Loans

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced that asset reports generated by its AccountChek automated asset verification service meet all underwriting guidelines established by the U.S. Department of Veterans Affairs (VA) for loans guaranteed by its Loan Guaranty Service. The announcement follows the VA's December 29, 2017, release of Circular 26-17-43, which was issued in response to increasing lender interest in automated verification of borrower assets for VA loans.

News: OpenClose Adds AFR’s Flood Services to its LOS via Seamless Interface

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, a multi-channel loan origination system (LOS) and mortgage software solutions provider, announced that it partnered with AFR Services to enable customers to access the company's complete suite of flood services. Using the interface makes it quick and easy to order AFR's various flood services directly from within OpenClose's LenderAssist LOS.

News: ARMCO Announces New Loan Data Validation Tools

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of financial quality control and compliance software ACES Audit Technology(TM), has announced the release of a new technology for mortgage lenders and servicers that improves data validation in the QC process.

News: Docutech and Cloudvirga Partner to Help Loan Officers Work More Efficiently

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, developer of intelligent mortgage point-of-sale (POS) platforms, today announced a partnership with Docutech that will enable Cloudvirga's lender customers to work more efficiently, reduce the cost of document compliance and make the home loan experience more convenient for borrowers.

News: Waterstone Mortgage to Manage QC Audits Using TRK’s Insight RDM

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection, a leading provider of mortgage quality control and origination management solutions, announced today that Wisconsin-based Waterstone Mortgage Corporation has chosen the Insight Risk and Defect Management (RDM) platform to conduct its internal quality control (QC) audits.

News: Maxwell Closes New $3M Funding Round to Accelerate Pace of Mortgage Innovation

Mortgage and Finance News: (DENVER, Colo.) Maxwell Financial Labs, Inc., a leading provider of B2B digital mortgage cloud software, announced today a new funding round of $3 million, led by the investment arm of Anthemis Group, a company committed to cultivating change in financial services, with participation from Route66 Ventures and Assurant Inc., along with its existing investors.

News: FormFree Provides Industry’s Most Complete Analysis of Borrower Ability to Pay with Data from Envestnet | Yodlee Risk Insight Solutions

Mortgage and Finance News: (ATHENS, Ga.) FormFree(R) today announced its expanded partnership with Envestnet | Yodlee (NYSE:ENV), a leading data aggregation and data analytics platform powering dynamic, cloud-based innovation for digital financial services. By leveraging Envestnet | Yodlee Risk Insight Solutions, FormFree will have access to new data points that help to reinforce its position as provider of the most complete and reliable asset, employment and income verification reports in the mortgage industry.

News: DocMagic Opens High-Tech Print Fulfillment Supercenter to Support Growth

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced that it has opened a 12,000 square foot print fulfillment center minutes from its Torrance, California headquarters. DocMagic added the high tech "supercenter" to support lenders' growing need for secure, compliant paper documents as the mortgage industry transitions to a 100 percent digital mortgage process.

News: DocMagic’s Jonathan Kearns Appointed to MISMO Residential Standards Governance Committee

Mortgage and Finance News: (TORRANCE, Calif.) DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced that Jonathan Kearns has been appointed to the Mortgage Industry Standards Maintenance Organization (MISMO) Residential Standards Governance Committee.

News: FormFree Appoints Housing Finance Authority Faith Schwartz to Board of Directors

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced that housing finance expert Faith Schwartz has been elected to its board of directors. Among the most influential leaders in the mortgage industry, Schwartz has played a firsthand role in shaping current housing finance best practices and public policy.

News: Cloudvirga Names Stephen DeSantis as Chief Financial Officer

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, developer of intelligent mortgage point-of-sale (POS) platforms, has appointed Steve DeSantis as its new chief financial officer. A seasoned technology finance executive, DeSantis will be responsible for driving Cloudvirga's financial strategies to accelerate its growth. He will report to Cloudvirga's recently appointed CEO Michael Schreck.

News: Five Top-30 Lenders Choose Cloudvirga’s Digital Mortgage Platform in Last 100 Days

Mortgage and Finance News: (IRVINE, Calif.) Cloudvirga, developer of intelligent mortgage point-of-sale (POS) platforms, has signed five of the nation's top 30 non-bank lenders in the last 100 days. The new customers collectively originate over $100 billion in loans annually. The announcement follows the firm's addition of Michael Schreck as CEO in June and the completion of a $15 million Series B funding round led by Blackstone Group portfolio company Incenter in March.

News: Matic Insurance Services Raises $7 Million in Series A Round Backed by Top Lender, Insurance Carriers and VC Firms

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic Insurance Services (Matic), a digital insurance agency whose technology enables borrowers to purchase homeowner's insurance during the mortgage transaction, announced today it has raised $7 million in a Series A funding round. Investors participating in the round include Mr. Cooper, one of the nation's top 20 mortgage originators and the fourth-largest home loan servicer in the country

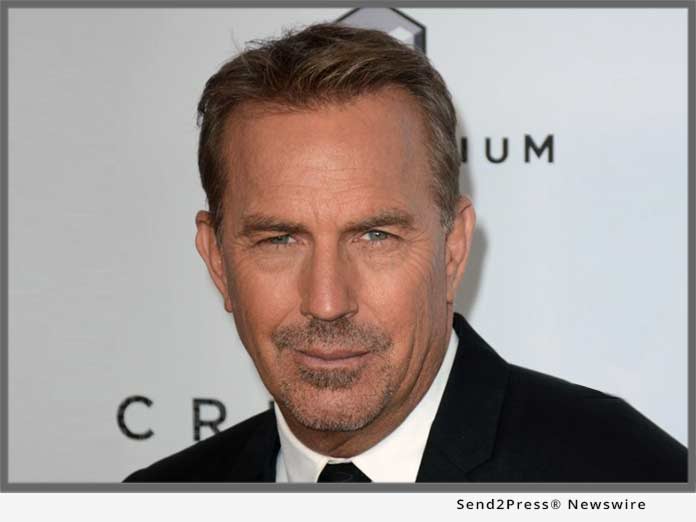

News: Click n’ Close Digital Mortgage Platform Partners with NASCAR, Richard Petty Motorsports

Mortgage and Finance News: (DAYTONA BEACH, Fla.) Click n' Close, a division of Mid America Mortgage, Inc., has entered into official partnership agreements with the sanctioning body, NASCAR, and one of the most iconic race teams in the sport, Richard Petty Motorsports. The collaborations designate Click n' Close as the "Official Mortgage Provider of NASCAR" in addition to becoming a partner of Richard Petty Motorsports.

News: Thread.Legal – the Missing piece of Microsoft Office 365 for Lawyers

Mortgage and Finance News: (CHARLOTTE, N.C.) If you are a law firm using Microsoft Office 365 and need something extra to complete your document and case management, then Thread is for you. Built in Microsoft Office 365, it gives you a practice management solution with software you already know. Thread is the latest case management software from eXpd8 Ltd, harnessing 30 years' legal IT industry experience and specifically designed for lawyers and paralegals.

News: Mortgage Coach Platform to Integrate with Tavant’s AI-Powered Digital Lending Platform for an End-To-End Seamless Experience

Mortgage and Finance News: (IRVINE, Calif.) Mortgage Coach, a software as service technology provider of the industry leading Total Cost Analysis, today announced an integration between the Mortgage Coach platform and Tavant FinXperience - Retail platform. This integration creates a seamless connection between the two technologies, enabling the direct, automatic transfer of data and information for mutual customers of FinXperience - Retail and Mortgage Coach.

ARMCO Launches ACES Automated Document Manager, which Uses Robotic Process Automation to Help Lenders Lower Gross Defects

Mortgage and Finance News: (POMPANO BEACH, Fla.) ACES Risk Management (ARMCO), the leading provider of financial quality control and compliance software, has announced that it has launched ACES Automated Document Manager (ADM), a new technology that uses robotic process automation to automate the core activities lenders undertake to reduce gross loan defects. ARMCO will be demonstrating ADM, which is available through ARMCO's ACES Audit Technology(TM) and as a stand-alone product, by appointment at MBA's Annual Convention and Expo 2017 in Denver, Colorado.

31 Jurisdictions Across Eastern U.S. Join Simplifile E-recording Network

Mortgage and Finance News: (PROVO, Utah) Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that 31 additional recording jurisdictions throughout the Northeast, Southeast and Mid-Atlantic have signed on to Simplifile's e-recording platform.

Norcom Mortgage Names ReverseVision Its Provider of Choice for End-to-End HECM Technology

Mortgage and Finance News: (SAN DIEGO, Calif.) ReverseVision, the leading provider of technology and training for the Home Equity Conversion Mortgage (HECM) industry, today announced that Norwich Commercial Group, Inc. dba Norcom Mortgage (Norcom) has selected ReverseVision as its provider of choice for end-to-end HECM technology.

VanDyk Mortgage Encourages Borrowers to Automate Asset Verification Using AccountChek by FormFree

Mortgage and Finance News: (ATHENS, Ga.) FormFree today announced that VanDyk Mortgage Corporation has selected its flagship AccountChek(R) service for automated asset verification. Loan officers at VanDyk have already begun offering AccountChek as an alternative to manual, paper-based asset verification. In addition, borrowers can choose AccountChek as a faster alternative to uploading bank statements when using VanDyk's self-service mortgage portal, powered by Ellie Mae's Encompass Consumer Connect.

Matic Insurance and LendingQB team to Eliminate Stressful Mortgage Delays Related to Homeowner’s Insurance

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic Insurance Services (Matic), a digital insurance agency that enables borrowers to purchase homeowner's insurance during the home-buying transaction, today announced a new partnership with LendingQB, a provider of "lean lending" loan origination technology. Matic announced the news as part of a live demonstration at San Francisco's Digital Mortgage Conference.

TRK Connection enhances Insight RDM Mortgage QC Audit Platform with Data Subscriptions Feature

Mortgage and Finance News: (SALT LAKE CITY, Utah) TRK Connection, a leading provider of mortgage quality control and origination management solutions, announced today that it has added a data subscriptions feature to its flagship mortgage quality control (QC) audit platform Insight Risk & Defect Management (RDM).

Lender Price Opens New $5 – $10 Million Investment Round and Names Jerry L. Halbrook as CEO

Mortgage and Finance News: (PASADENA, Calif.) Lender Price, the emerging leader in digital mortgage lending technology, announced today that it has named veteran mortgage industry executive Jerry Halbrook as its CEO and has opened a fresh round of equity funding to fuel its growth trajectory.

TechCrunch Disrupt SF 2017: Matic Insurance Services Debuts Integration with Roostify

Mortgage and Finance News: (SHERMAN OAKS, Calif.) Matic Insurance Services, a digital insurance agency that enables borrowers to purchase homeowner's insurance during the home-buying transaction, has forged a partnership with automated lending technology provider Roostify. The company announced the news Tuesday afternoon from the stage of TechCrunch's Startup Battlefield, part of the TechCrunch Disrupt SF conference held in San Francisco this week. Matic was one of just six elite startups chosen to advance to the final round of the competition.

U.S. Credit Unions Now Successfully Leveraging OpenClose LenderAssist Loan Origination System

Mortgage and Finance News: (WEST PALM BEACH, Fla.) OpenClose, a multi-channel loan origination system (LOS) and mortgage software solutions provider, announced that multiple credit unions are now using OpenClose's LenderAssist(TM) LOS platform to automate the mortgage side of their businesses.